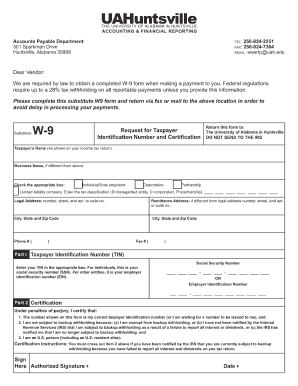

Free W9 Form Alabama Download: A Comprehensive Guide

Navigating the world of taxes can be daunting, but understanding and utilizing the W9 form is crucial for both individuals and businesses. This guide provides a comprehensive overview of the Free W9 Form Alabama Download, empowering you with the knowledge and resources to complete the form accurately and efficiently.

The W9 form, also known as the Request for Taxpayer Identification Number and Certification, is an essential document used to collect vital information from individuals or entities receiving payments for services rendered. It plays a pivotal role in ensuring compliance with tax regulations and streamlining the tax reporting process.

Common Errors to Avoid When Completing the W9 Form

Filling out the W9 form correctly is crucial to ensure accurate tax reporting and avoid delays in payments. Here are some common mistakes to watch out for and how to steer clear of them:

Incorrect Taxpayer Identification Number (TIN)

- Mistyping or transposing numbers in the TIN field can lead to incorrect tax reporting.

- Double-check the TIN against official documents like the Social Security card or the IRS website.

Incomplete or Inaccurate Name and Address

- Leaving out or misspelling the legal name or business name can cause confusion and payment delays.

- Ensure the name and address match those on the official records and correspondence from the IRS.

Missing or Incorrect Certification

- Failing to sign and date the form or providing incorrect information in the certification section can invalidate the W9.

- Review the certification requirements carefully and provide accurate information.

Incorrect Exemptions or Backup Withholding

- Claiming incorrect exemptions or failing to indicate backup withholding can result in underpayment or overpayment of taxes.

- Consult the IRS guidelines or seek professional advice to determine the appropriate exemptions and withholding.

Additional Resources and Support

There are a few additional resources and support available for individuals seeking assistance with the W9 form.

Contact Information

* Internal Revenue Service (IRS): 1-800-829-1040

* Alabama Department of Revenue: 1-800-232-7213

Helpful Websites

* IRS website: https://www.irs.gov/forms-pubs/about-form-w-9

* Alabama Department of Revenue website: https://revenue.alabama.gov/income-tax/individual/

Online Forums

* IRS Tax Professionals Forum: https://www.irs.gov/businesses/small-businesses-self-employed/irs-tax-professionals-forum

* Alabama Society of Certified Public Accountants (ASCPA): https://www.ascpa.org/

Questions and Answers

What is the purpose of the W9 form?

The W9 form is used to collect taxpayer identification information, such as name, address, and Taxpayer Identification Number (TIN), from individuals or entities receiving payments for services rendered. This information is essential for accurate tax reporting and compliance.

Where can I find a free W9 form download in Alabama?

The Alabama Department of Revenue provides a free W9 form download on its official website. You can access the form directly from the link provided in this guide.

What are some common errors to avoid when completing the W9 form?

Common errors include incorrect taxpayer name or TIN, missing or incomplete information, and failing to sign and date the form. To avoid these errors, carefully review the instructions and ensure all fields are filled out accurately and completely.