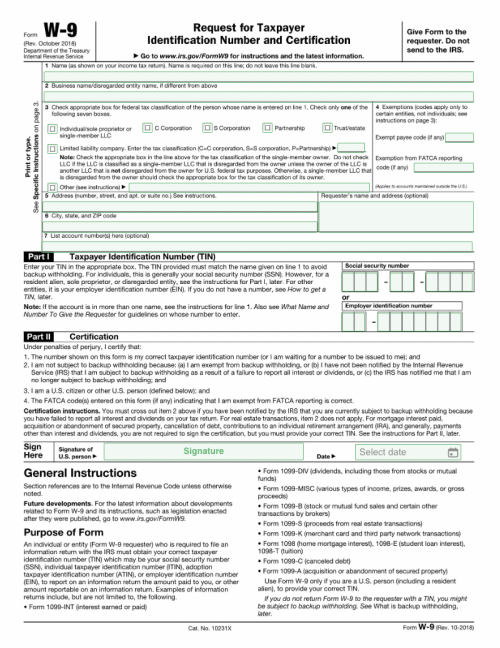

Free W9 2018 Form Download: A Comprehensive Guide

Navigating the complexities of tax forms can be daunting, especially when dealing with essential documents like the W-9. This comprehensive guide will provide you with all the necessary information to effortlessly download, complete, and utilize the free 2018 W-9 form. Whether you’re a seasoned taxpayer or a first-timer, this guide will empower you with the knowledge and resources to tackle this task with confidence.

The W-9 form, officially known as the Request for Taxpayer Identification Number and Certification, plays a crucial role in ensuring accurate tax reporting and compliance. Understanding its purpose, who needs to complete it, and its various sections will lay the foundation for a seamless form-filling experience.

Downloading the Free 2018 W-9 Form

The W-9 form is a crucial document for independent contractors and self-employed individuals. It allows you to provide your tax information to the person or business that’s paying you, ensuring that the correct amount of tax is withheld from your payments. If you’re looking to download the free 2018 W-9 form, here’s a step-by-step guide to help you out.

Downloading the W-9 form is a straightforward process. There are several online resources where you can find the form, including the official IRS website and various tax software providers. Once you’ve found a reputable source, you can download the form in a variety of file formats, including PDF, DOC, and TXT.

File Formats and Compatibility

The W-9 form is available in several file formats, each with its own advantages and disadvantages.

- PDF: PDF is a popular file format that can be opened on most computers and devices. It’s a good choice if you want to print the form or share it with others.

- DOC: DOC is a Microsoft Word document format. It’s a good choice if you want to edit the form before printing it or saving it as a PDF.

- TXT: TXT is a plain text file format. It’s a good choice if you want to save the form in a simple, text-only format.

The file format you choose will depend on your needs. If you’re not sure which format to choose, PDF is a good all-around option.

Using and Completing the W-9 Form

The W-9 form is a crucial document for independent contractors and self-employed individuals. Completing it accurately ensures proper tax reporting and avoids potential issues.

To fill out the W-9 form correctly, follow these steps:

- Provide your full name and business name (if applicable).

- Enter your address and contact information.

- Select the appropriate taxpayer classification (individual, sole proprietor, etc.).

- Indicate if you are exempt from backup withholding.

- Sign and date the form.

Common Mistakes to Avoid

- Using incorrect information or providing incomplete details.

- Mixing personal and business information.

- Leaving sections blank or incomplete.

- Not signing and dating the form.

Consequences of Incomplete or Inaccurate Forms

Submitting an incomplete or inaccurate W-9 form can result in:

- Delayed payments or processing issues.

- Penalties or fines for incorrect tax reporting.

- Difficulty obtaining accurate tax refunds.

Additional Resources and Support

If you need additional help completing your W-9 form, there are several resources available online and through the IRS.

The IRS website has a dedicated page for the W-9 form, which includes instructions, frequently asked questions, and a fillable PDF version of the form. You can also call the IRS at 1-800-829-1040 for assistance.

Online Resources

- IRS W-9 Form Page: https://www.irs.gov/forms-pubs/about-form-w-9

- W-9 Form Instructions: https://www.irs.gov/pub/irs-pdf/iw9.pdf

- Fillable W-9 Form: https://www.irs.gov/pub/irs-pdf/fw9.pdf

Contact Information

- IRS Phone Number: 1-800-829-1040

- IRS Website: https://www.irs.gov

Software Tools and Templates

There are a number of software tools and templates available that can make it easier to complete your W-9 form. Some of these tools include:

- TurboTax

- H&R Block

- TaxSlayer

Answers to Common Questions

What is the purpose of the W-9 form?

The W-9 form is used to collect essential taxpayer information, including their name, address, Taxpayer Identification Number (TIN), and certification status. This information is crucial for accurate tax reporting and compliance.

Who needs to complete a W-9 form?

Individuals or businesses that receive payments for services or goods from another business or individual are required to complete a W-9 form. This includes independent contractors, freelancers, and sole proprietors.

Where can I download the free 2018 W-9 form?

You can download the free 2018 W-9 form from the IRS website or various other online resources. Ensure you download the most up-to-date version to avoid any discrepancies.

What are some common mistakes to avoid when completing the W-9 form?

Common mistakes include providing an incorrect TIN, leaving fields blank, or signing the form before it’s fully completed. Carefully review the form and ensure all fields are filled out accurately and completely.

What are the consequences of submitting an incomplete or inaccurate W-9 form?

Submitting an incomplete or inaccurate W-9 form can lead to delays in payment, penalties, or even legal issues. It’s crucial to complete the form accurately and submit it on time to avoid any potential complications.