Free W8 Form 2024 Download: A Comprehensive Guide to Downloading and Completing the W8 Form

Navigating the complexities of tax forms can be a daunting task, but with the right resources, it doesn’t have to be. This guide will provide you with all the essential information you need to download and complete the W8 Form 2024, ensuring accuracy and compliance.

The W8 Form is a crucial document used to certify that a non-U.S. person is eligible for a reduced rate of withholding on their U.S. income. By understanding the purpose and benefits of the W8 Form, you can make informed decisions about your tax obligations.

Yo, listen up! If you’re a UK taxpayer who’s gotta file your taxes, you need to get your hands on the W8 Form 2024, blud. It’s like the golden ticket to making sure your tax affairs are sorted, innit.

The W8 Form, fam, is basically a document that tells the taxman how much tax you should be paying on your US income. It’s a way to avoid getting taxed twice, which would be a right pain in the proverbials.

Benefits of the Free W8 Form 2024 Download

- It’s free: No need to splash out any dough. Just click and download, easy peasy.

- It’s up-to-date: You’ll always have the latest version, so you can be sure you’re using the right form.

- It’s convenient: No need to faff about with paper forms. Just fill it in online and submit it electronically.

2.

Downloading the W8 Form 2024 for free is a doddle. You can bag it online from the IRS website or other reputable sources.

IRS Website

Head to the IRS website, search for “W8 Form 2024”, and click on the first result. On the form’s page, scroll down and click “Download” under the “Forms and Instructions” section.

Other Sources

You can also find the W8 Form 2024 on other websites like Tax Forms Central and Nolo. Just make sure the source is reliable before you download anything.

Pros and Cons

Downloading from the IRS website is the most straightforward option, but it can be a bit slow. Other websites may offer faster downloads, but you need to be careful about viruses.

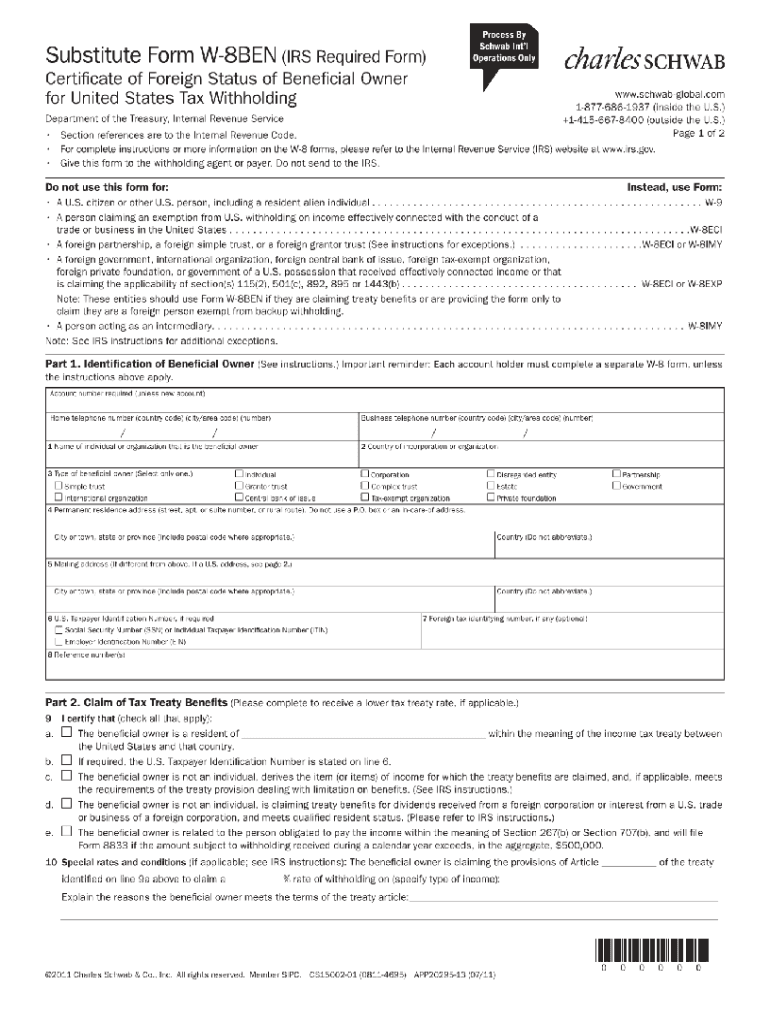

Section-by-Section Overview of W8 Form 2024

The W8 Form 2024 is a tax form used by non-US citizens to claim certain tax treaty benefits. It is divided into several sections, each with its own specific purpose. Let’s break down each section and its fields in detail:

Part I: Identifying Information

This section collects basic information about the individual or entity claiming treaty benefits, including their name, address, and tax identification number. It also includes a section for the withholding agent to provide their information.

Part II: Certification

This section is where the individual or entity certifies that they meet the requirements for claiming treaty benefits. They must provide information about their country of residence, the relevant tax treaty, and the type of income they are claiming benefits for.

Part III: Beneficial Owner Information

This section is only required if the individual or entity claiming treaty benefits is not the beneficial owner of the income. It collects information about the beneficial owner, including their name, address, and tax identification number.

Part IV: Additional Information

This section provides space for the individual or entity to provide any additional information that may be relevant to their claim for treaty benefits. This could include information about their residency status, the source of their income, or any other factors that may affect their eligibility for treaty benefits.

Part V: Declaration

This section is where the individual or entity signs and dates the form, certifying that the information provided is true and correct. It also includes a space for the withholding agent to sign and date the form.

Eligibility Criteria for Using W8 Form 2024

The W8 Form 2024 is specifically designed for certain types of taxpayers who meet specific eligibility criteria. These criteria ensure that the form is used appropriately and that the taxpayer is entitled to the benefits it provides.

- Individuals: Individuals who are non-US citizens or residents and who receive income from US sources are eligible to use the W8 Form 2024. This includes individuals who are students, researchers, or employees working in the US on a temporary basis.

- Entities: Non-US entities, such as corporations, partnerships, and trusts, can also use the W8 Form 2024 if they receive income from US sources. This includes entities that are engaged in business activities in the US or that have investments in US assets.

- Exempt Organizations: Certain exempt organizations, such as charities and religious organizations, may also be eligible to use the W8 Form 2024. These organizations must meet specific requirements to qualify for exemption from US withholding tax.

Case Study

A UK citizen named Emily is working in the US on a temporary work visa. She receives a salary from her US employer. Emily is eligible to use the W8 Form 2024 to claim a reduced withholding rate on her US income, as she is a non-US citizen who is receiving income from US sources.

5. Tips for Completing the W8 Form 2024 Accurately

Completing the W8 Form 2024 can be a bit daunting, but it doesn’t have to be. Here are a few tips to help you do it right the first time:

Read the instructions carefully. This may seem like a no-brainer, but it’s important to take the time to read the instructions before you start filling out the form. This will help you understand what information is required and where it should go.

Use a black or blue pen. This is the IRS’s preferred method for filling out tax forms.

Print clearly. Make sure your handwriting is legible so that the IRS can easily read your answers.

Be complete. Answer all of the questions on the form, even if you think they don’t apply to you.

Sign and date the form. This is required for the form to be valid.

Common Mistakes to Avoid

Here are a few common mistakes to avoid when filling out the W8 Form 2024:

- Using a pencil. The IRS prefers that you use a black or blue pen to fill out tax forms.

- Writing in the margins. The IRS uses the margins of the form to process it, so don’t write anything in them.

- Making erasures. If you make a mistake, cross out the incorrect information and write the correct information next to it. Do not use white-out or correction fluid.

- Leaving questions unanswered. Answer all of the questions on the form, even if you think they don’t apply to you.

- Forgetting to sign and date the form. This is required for the form to be valid.

Checklist for Completing the W8 Form 2024

Here is a checklist to help you complete the W8 Form 2024:

- Read the instructions carefully.

- Use a black or blue pen.

- Print clearly.

- Be complete.

- Sign and date the form.

Retain a Copy of W8 Form 2024

Keeping a copy of the completed W8 Form 2024 is crucial. It serves as proof of compliance with tax regulations and can protect you in case of audits or inquiries. Proper record-keeping is essential for both legal and tax purposes.

Secure Storage and Organization

Store your tax documents securely, either physically or digitally. Physical storage options include filing cabinets, safes, or bank safety deposit boxes. Digital storage options include cloud-based platforms or encrypted hard drives. Organize your documents systematically to ensure easy retrieval when needed.

FAQ Section

Can I download the W8 Form 2024 for free?

Yes, the W8 Form 2024 is available for free download from the IRS website.

What is the purpose of the W8 Form?

The W8 Form is used to certify that a non-U.S. person is eligible for a reduced rate of withholding on their U.S. income.

Who can use the W8 Form?

The W8 Form can be used by non-U.S. persons who receive income from U.S. sources, such as dividends, interest, and royalties.

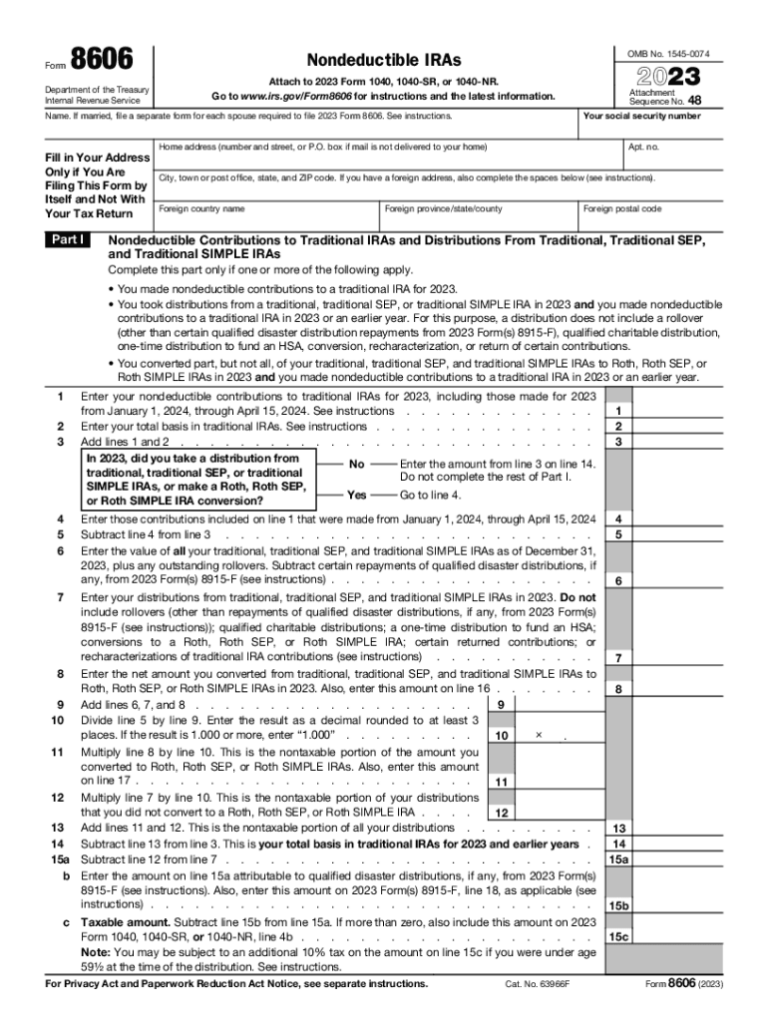

What are the different types of W8 Forms?

There are three main types of W8 Forms: W8-BEN, W8-BEN-E, and W8-IMY. Each form is designed for a specific purpose and should be used accordingly.

Where can I get help completing the W8 Form?

You can find helpful resources on the IRS website, including instructions, FAQs, and a fillable form. You can also consult with a tax professional for personalized guidance.