Free W7 Form Download: A Comprehensive Guide to Access and Utilize

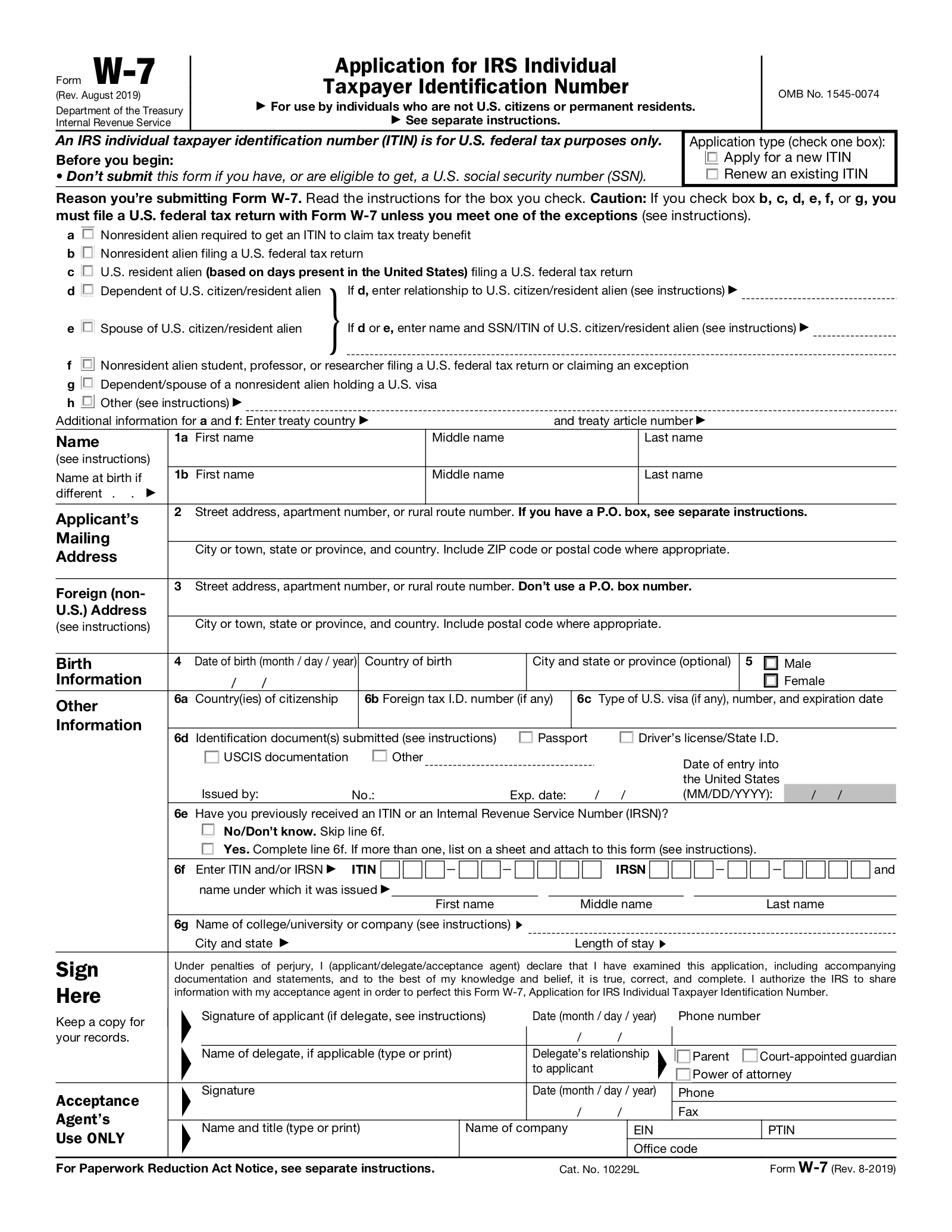

Navigating the complexities of tax forms can be daunting, but understanding and utilizing the W7 form is essential for individuals seeking to claim foreign tax credits or avoid double taxation. This guide provides a comprehensive overview of the W7 form, its significance, and step-by-step instructions for downloading and completing it.

The W7 form, officially known as the Certificate of Foreign Tax Withheld, plays a crucial role in international tax compliance. It enables taxpayers to claim foreign tax credits on their U.S. tax returns, reducing their overall tax liability. By understanding the purpose and process of the W7 form, individuals can maximize their tax savings and ensure compliance with tax regulations.

Steps to Download a Free W7 Form

Getting your hands on a free W7 form is a breeze, mate. Here’s a step-by-step guide to help you out:

GOV.UK Website

1. Head over to the GOV.UK website: https://www.gov.uk/government/publications/w7-application-for-registration-as-a-civil-partner

2. Scroll down to the “Documents” section and click on the “Download the W7 form” link.

3. The W7 form will be downloaded as a PDF file.

Marriage Care Website

Alternatively, you can grab the W7 form from the Marriage Care website: https://www.marriagecare.org.uk/information/ceremonies/civil-partnerships/civil-partnership-form-w7/

1. Click on the “Download the W7 form” button.

2. The W7 form will be downloaded as a PDF file.

Using the W7 Form

Blag the W7 form like a pro, innit? Here’s the lowdown on filling it out the right way.

The W7 form is split into a bunch of sections, each with its own bits and bobs. Let’s break it down, yeah?

Your Personal Details

- Chuck your name and address in the boxes, no brainer.

- Don’t forget your date of birth and National Insurance number, or the taxman will be on your case.

- Tick the box if you’re a student, ‘cos that might affect your tax.

Your Income

- Whack in all your income from the past year, whether it’s from a job, benefits, or investments.

- Use the handy tables to work out how much tax you’ve already paid.

- If you’ve got any other income, like from a side hustle or rental property, don’t be shy about declaring it.

Your Allowances and Deductions

- Check the boxes for any allowances you’re entitled to, like the personal allowance or the marriage allowance.

- List any deductions you can claim, like pension contributions or charitable donations.

- Make sure you’ve got all the paperwork to back up your claims, or HMRC might come knocking.

Your Tax Calculation

- The form will do the maths for you and work out how much tax you owe.

- If you’ve already paid too much tax, you’ll get a refund.

- If you owe more tax, you’ll have to pay up, so don’t skimp on the details.

Submitting the W7 Form

Once you’ve filled out your W7 form, you have a couple of options for submitting it. You can either mail it in or submit it online.

If you’re mailing it in, you’ll need to send it to the Internal Revenue Service at the address listed on the form. Make sure to include a copy of your passport or other valid identification document.

If you’re submitting it online, you can do so through the IRS website. You’ll need to create an account and then follow the instructions on the website.

Contact Information

If you have any questions about submitting your W7 form, you can contact the IRS at 1-800-829-1040.

Benefits of Using a Free W7 Form

There are several advantages to using a free W7 form instead of paid or proprietary options.

Firstly, it saves you money. Paid W7 forms can cost anywhere from £10 to £50, while free W7 forms are available online at no cost.

Secondly, free W7 forms are widely accessible. You can download them from a variety of websites, including the HMRC website.

Finally, using a free W7 form can help you save money on your taxes. By completing a W7 form, you can claim a refund of any tax that has been overpaid on your foreign income.

Cost Savings

- Paid W7 forms can cost anywhere from £10 to £50, while free W7 forms are available online at no cost.

- Using a free W7 form can save you a significant amount of money, especially if you are filing multiple W7 forms.

Accessibility

- Free W7 forms are widely accessible. You can download them from a variety of websites, including the HMRC website.

- This makes it easy to get the W7 form you need, regardless of your location or financial situation.

Tax Savings

- By completing a W7 form, you can claim a refund of any tax that has been overpaid on your foreign income.

- This can result in a significant tax savings, especially if you have a lot of foreign income.

Alternatives to Free W7 Form Download

Obtaining a W7 form doesn’t have to be limited to downloading it for free. Let’s explore some alternative methods that may offer advantages or cater to specific needs.

Each alternative has its own pros and cons, so it’s essential to consider the circumstances and choose the one that aligns best with your situation.

Requesting a Form by Mail

You can request a W7 form by mail by contacting the IRS at their official address. While this method is reliable, it may take longer to receive the form compared to downloading it online.

Visiting an IRS Office

If you prefer in-person assistance, you can visit your local IRS office and request a W7 form. This method allows for immediate access to the form, but you may need to factor in travel time and potential wait times.

Using a Tax Software

Tax software often includes the option to generate and print a W7 form as part of their services. This method can be convenient if you’re already using tax software for your tax preparation.

Hiring a Tax Preparer

Hiring a tax preparer can take the hassle out of obtaining and completing a W7 form. They can assist with the process and ensure accuracy, but their services typically come with a fee.

FAQs

What is the purpose of the W7 form?

The W7 form is used to claim foreign tax credits on U.S. tax returns, reducing the overall tax liability for individuals with foreign income or tax obligations.

Where can I download a free W7 form?

The W7 form can be downloaded for free from the Internal Revenue Service (IRS) website: https://www.irs.gov/forms-pubs/about-form-w-7.

How do I complete the W7 form?

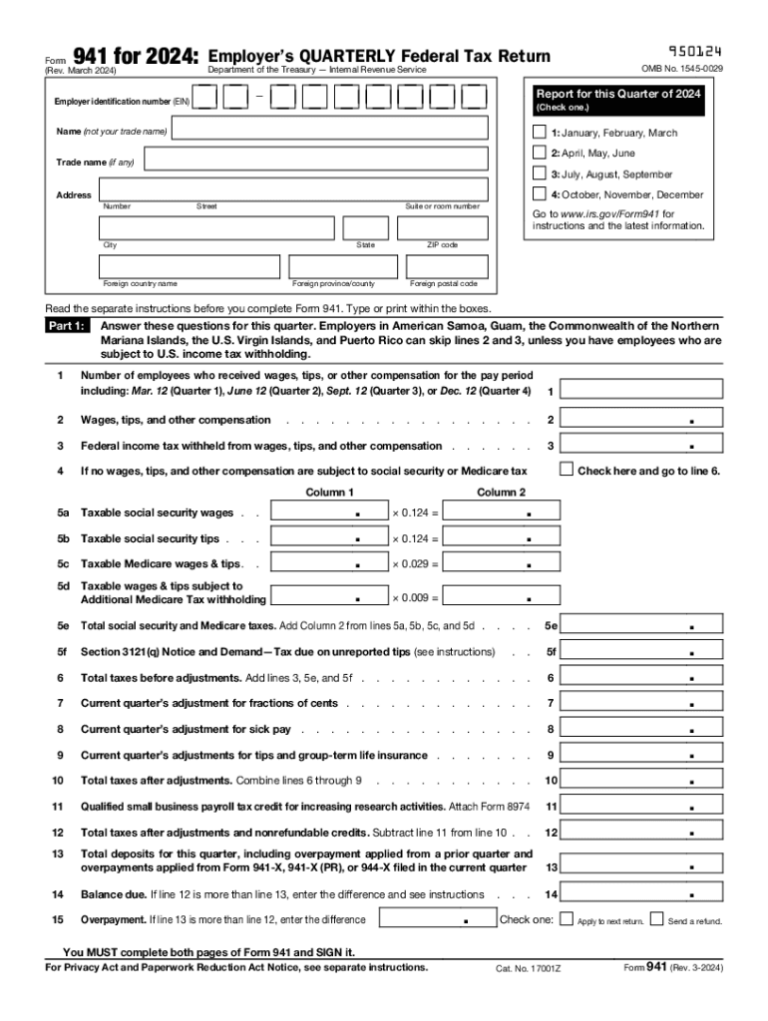

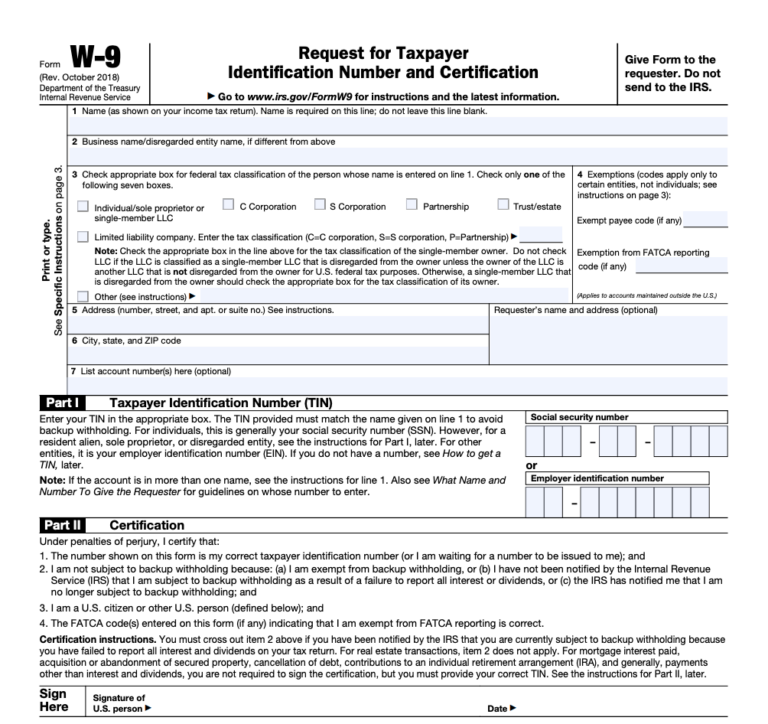

The W7 form consists of several sections, including personal information, foreign tax information, and certification. It is important to provide accurate and complete information in each section to ensure proper processing.

How do I submit the W7 form?

The completed W7 form can be mailed to the IRS or submitted electronically through the IRS website. The specific mailing address and online submission instructions are provided on the form.