Free W4 Form PDF Download: A Comprehensive Guide

Navigating the complexities of tax withholding can be daunting, but understanding and utilizing the W4 form is crucial for ensuring accurate tax payments. This comprehensive guide provides an overview of the W4 form, its advantages, and step-by-step instructions for filling it out. By optimizing your W4 information, you can minimize tax-related surprises and optimize your financial planning.

In this guide, we’ll delve into the benefits of using a PDF version of the W4 form, explore strategies for optimizing tax withholding, and provide valuable resources for additional support. Whether you’re a seasoned taxpayer or new to the process, this guide will empower you with the knowledge and tools to confidently manage your tax obligations.

Free W4 Form PDF

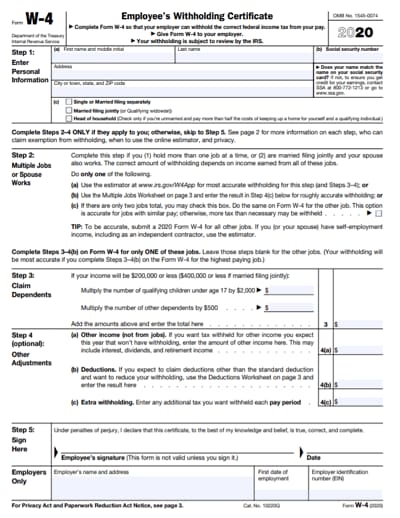

The W4 form, also known as the Employee’s Withholding Allowance Certificate, is a crucial document that helps determine the amount of federal income tax withheld from your paycheck. Completing this form accurately is essential to ensure that you’re paying the correct amount of taxes and not overpaying or underpaying.

Using a PDF version of the W4 form offers several advantages. It’s easy to download, print, and fill out at your convenience. You can also save a copy for your records or share it with your employer electronically. The official W4 form PDF can be found on the Internal Revenue Service (IRS) website.

Where to Find and Download the Official W4 Form PDF

To download the official W4 form PDF, visit the IRS website at https://www.irs.gov/forms-pubs/about-form-w-4. Click on the “Download Form W-4 (PDF)” link and save the file to your computer.

Benefits of Using a PDF W4 Form

Blud, if you’re tired of the hassle of filling out tax forms on paper, then you need to get with the times and start using a PDF W4 form. Not only is it way easier to access and fill out, but it’s also more secure and convenient.

Ease of Access and Completion

With a PDF W4 form, you can fill it out on your computer, tablet, or even your phone. This means you can do it anywhere, anytime, without having to worry about finding a printer or a pen.

Convenience of Storage

Once you’ve filled out your W4 form, you can save it digitally and store it anywhere you want. This makes it easy to keep track of your tax documents and ensures that you’ll always have a copy on hand.

Security and Privacy

PDF W4 forms are more secure than paper forms because they’re encrypted, which means that your personal information is protected from prying eyes.

How to Fill Out a W4 Form

Filling out a W4 form is a crucial step in ensuring accurate tax withholding. It helps determine the amount of federal income tax withheld from your paycheck. Here’s a step-by-step guide to filling out the form correctly:

Personal Information

Start by providing your personal information, including your name, address, and Social Security number. Make sure the information matches what’s on your official records.

Filing Status

Select your filing status from the options provided. Your filing status affects the standard deduction and tax brackets you qualify for.

Allowances

Allowances are a way to reduce the amount of tax withheld from your paycheck. Each allowance you claim reduces the amount of taxable income by a specific amount. The more allowances you claim, the less tax will be withheld.

Determine the number of allowances you’re entitled to based on your personal circumstances, such as dependents, marital status, and itemized deductions.

Deductions

Deductions are expenses that can be subtracted from your income before taxes are calculated. Common deductions include mortgage interest, charitable contributions, and student loan interest.

If you expect to have significant deductions, you may want to claim additional allowances to ensure enough tax is withheld.

Sign and Date

Once you’ve completed the form, sign and date it. By signing, you’re certifying that the information provided is accurate and true.

Tips for Optimizing Tax Withholding

Optimizing tax withholding using the W4 form is crucial to avoid underpayments or overpayments, ensuring you meet your tax obligations while minimizing unnecessary refunds or penalties. By understanding the impact of allowances and deductions, you can effectively manage your tax withholding and maximize your financial well-being.

Impact of Allowances and Deductions

Allowances and deductions significantly influence your tax withholding. Allowances represent personal exemptions that reduce your taxable income, resulting in lower tax liability. Deductions are expenses that can be subtracted from your income before calculating taxes, further reducing your tax burden. The number of allowances you claim on your W4 form determines the amount of income that is not subject to withholding.

Consequences of Incorrect W4 Information

Incorrect W4 information can lead to significant consequences. Underpaying taxes due to claiming too many allowances or failing to account for deductions can result in penalties and interest charges. Conversely, overpaying taxes by claiming too few allowances or not utilizing deductions means you’re essentially giving the government an interest-free loan. It’s crucial to ensure your W4 information is accurate to avoid these potential pitfalls.

Additional Resources and Support

The W4 form is a crucial document for managing your tax withholding. For further assistance, we recommend exploring the following resources:

The Internal Revenue Service (IRS) provides a wealth of information and guidance on the W4 form. Their website offers detailed instructions, FAQs, and online tools to help you complete the form accurately. Additionally, you can contact the IRS directly for support.

Official IRS Resources

- IRS website: https://www.irs.gov/forms-pubs/about-form-w-4

- IRS Publication 15-T (Circular E): https://www.irs.gov/pub/irs-pdf/p15t.pdf

- IRS Interactive Tax Assistant: https://www.irs.gov/help/ita

Professional Assistance

If you need additional support, you can consider seeking professional assistance from a tax advisor or accountant. They can provide personalized guidance based on your financial situation and help you optimize your tax withholding.

Tax Software and Online Tools

Various tax software and online tools are available to assist with W4 form preparation. These tools can automate calculations, provide step-by-step instructions, and ensure accuracy.

- TurboTax: https://turbotax.intuit.com/personal-taxes/online/w4-calculator

- H&R Block: https://www.hrblock.com/tax-center/filing/tax-forms/w-4-withholding-calculator

- ADP W4 Calculator: https://www.adp.com/tools-and-resources/calculators-and-tools/w4-withholding-calculator.aspx

Questions and Answers

Can I use a PDF W4 form for both federal and state taxes?

Yes, the PDF W4 form is suitable for both federal and state tax purposes. However, you may need to complete additional state-specific forms depending on your residency.

How often should I review and update my W4 form?

It’s recommended to review and update your W4 form annually, especially after major life events such as marriage, divorce, or a change in income or dependents.

What are the consequences of providing incorrect information on my W4 form?

Providing incorrect information on your W4 form can result in underpayment or overpayment of taxes. This may lead to penalties, interest charges, or a refund delay.

Can I file my W4 form electronically?

Yes, you can file your W4 form electronically through the IRS website or through tax software. However, your employer may require a physical copy for their records.

Where can I find additional resources and support for completing my W4 form?

The IRS website provides comprehensive guidance, FAQs, and interactive tools to assist you in completing your W4 form. You can also seek professional assistance from a tax preparer or use tax software for a more personalized approach.