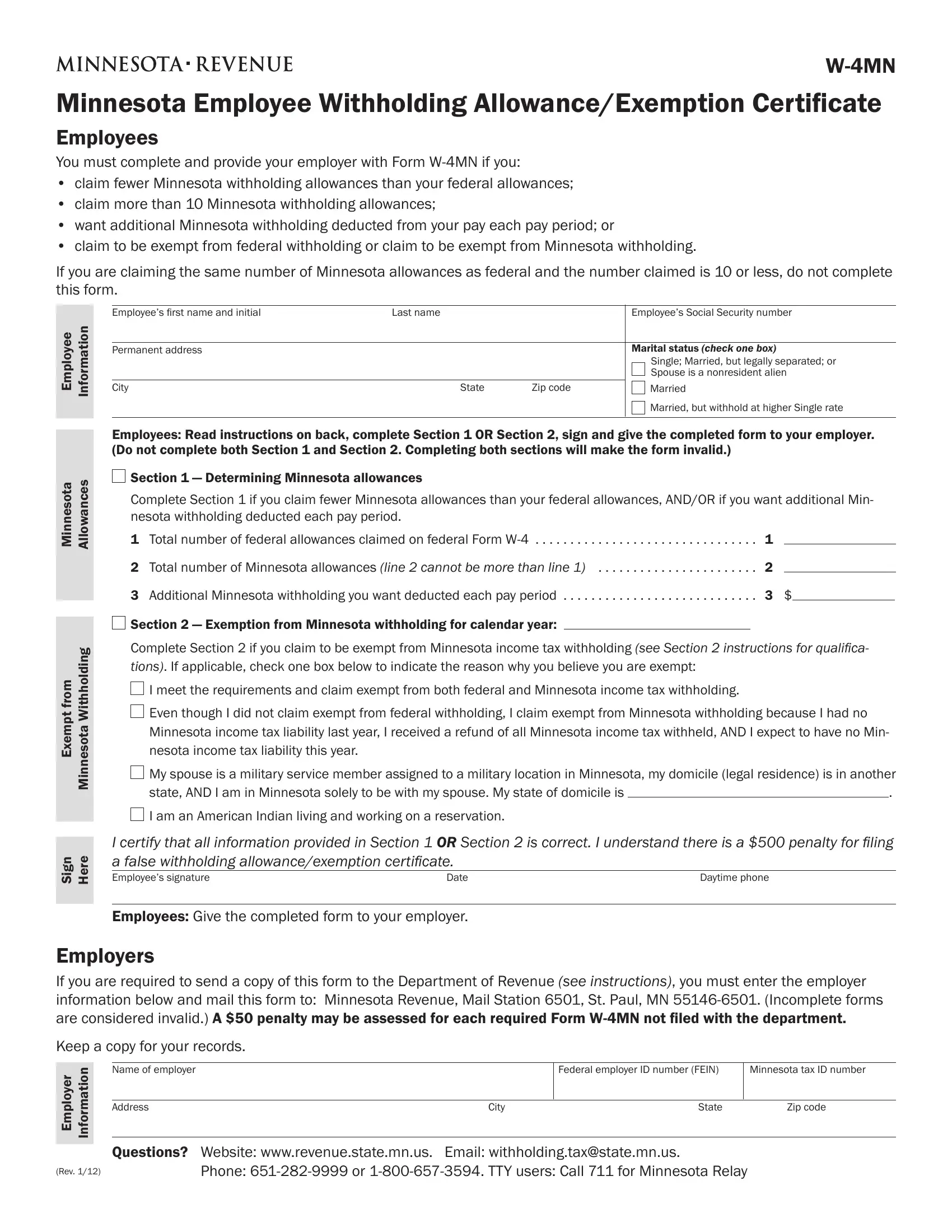

Free W4 Form Minnesota Download: A Comprehensive Guide

Filing taxes can be a daunting task, but it doesn’t have to be. This guide will provide you with everything you need to know about downloading, understanding, and filing the Minnesota W4 form, ensuring accurate tax withholding and hassle-free tax filing.

The Minnesota Department of Revenue has made the W4 form easily accessible online, offering various file formats to suit your needs. Whether you prefer a printable PDF or a fillable online form, this guide will walk you through the process step-by-step.

Filing the W4 Form in Minnesota

Filing the W4 form in Minnesota is essential for ensuring that the correct amount of state income tax is withheld from your paycheck. There are several methods for submitting the form to the Minnesota Department of Revenue, including mail, online, and through a tax professional.

Deadlines for Filing

The deadline for filing the W4 form in Minnesota is April 15th for both paper and electronic submissions. If you file your taxes late, you may be subject to penalties and interest charges.

Making Changes to the Form

If your circumstances change, such as your income or withholding allowances, you should make changes to your W4 form as soon as possible. You can do this by submitting a new W4 form to your employer or by using the Minnesota Department of Revenue’s online portal.

Submitting the Form Online

The Minnesota Department of Revenue offers an online portal where you can submit your W4 form electronically. This is a convenient and secure way to file your form, and it allows you to track the status of your submission.

Submitting the Form by Mail

You can also submit your W4 form by mail to the Minnesota Department of Revenue. The address for mailing your form is:

Minnesota Department of RevenuePO Box 64448

Saint Paul, MN 55164-0448

Using a Tax Professional

If you are not comfortable filing your W4 form yourself, you can hire a tax professional to do it for you. Tax professionals can help you ensure that your form is filled out correctly and that you are withholding the correct amount of taxes.

Additional Resources for Minnesota Residents

The Minnesota Department of Revenue offers a range of resources to assist taxpayers with their tax-related queries and obligations. These resources include comprehensive FAQs, user-friendly tax calculators, and direct contact information for further inquiries.

In addition, the department provides various tax-related assistance programs and initiatives tailored to the specific needs of Minnesota residents. These programs aim to simplify the tax filing process, provide financial relief, and enhance overall tax literacy.

Upcoming Tax-Related Events and Workshops

The Minnesota Department of Revenue hosts regular tax-related events and workshops throughout the state. These events provide taxpayers with the opportunity to interact with tax professionals, receive personalized guidance, and stay updated on the latest tax laws and regulations.

- Tax Preparation Assistance: Free tax preparation assistance is available to low- and moderate-income taxpayers through the Volunteer Income Tax Assistance (VITA) program.

- Taxpayer Education Workshops: The department offers free taxpayer education workshops covering a wide range of tax topics, including income tax, property tax, and sales tax.

- Online Tax Resources: The department’s website provides a wealth of online resources, including tax forms, instructions, and publications.

Helpful Answers

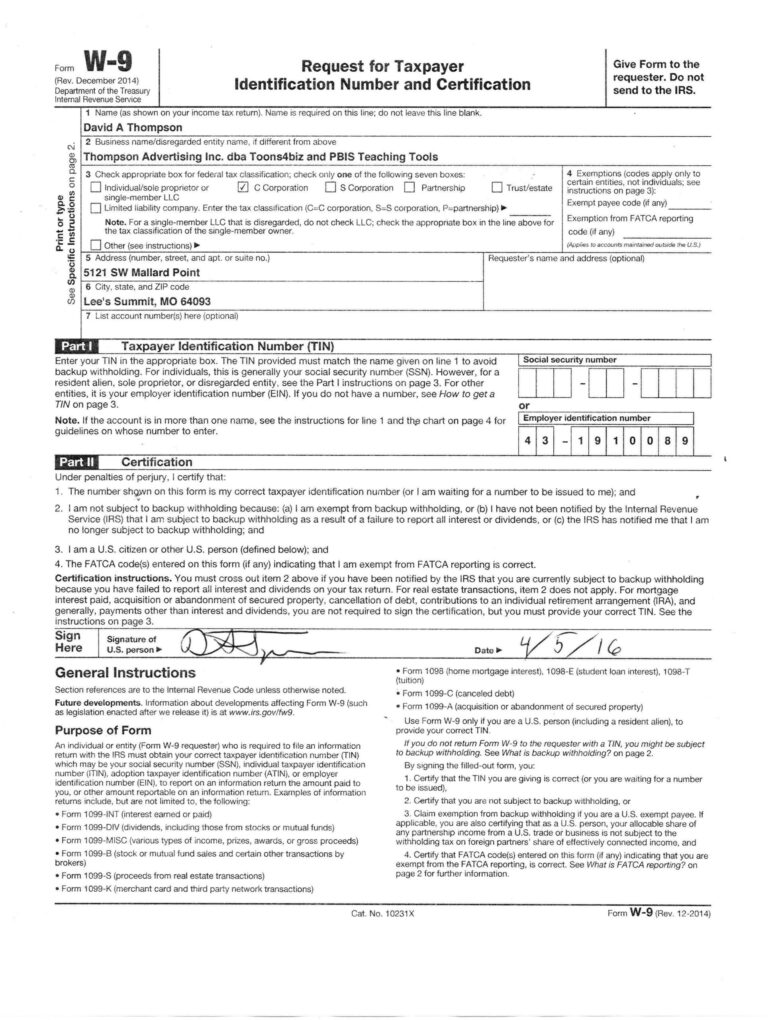

Where can I find the Minnesota W4 form?

The Minnesota W4 form can be downloaded from the Minnesota Department of Revenue website: https://www.revenue.state.mn.us/w4.

What file formats are available for the Minnesota W4 form?

The Minnesota W4 form is available in PDF and fillable online form formats.

What system requirements are needed to open and fill out the Minnesota W4 form?

To open and fill out the PDF version of the Minnesota W4 form, you will need a PDF reader such as Adobe Acrobat Reader. To fill out the online version of the form, you will need an internet connection and a web browser.

What is the purpose of the Minnesota W4 form?

The Minnesota W4 form is used to calculate the amount of Minnesota income tax that should be withheld from your paycheck. It is important to complete the form accurately to avoid overpaying or underpaying your taxes.

What are the deadlines for filing the Minnesota W4 form?

The Minnesota W4 form must be filed with your employer by the end of the year. However, it is recommended that you file the form as soon as possible to ensure that the correct amount of tax is withheld from your paycheck.