Free W4 Form Michigan Download: A Comprehensive Guide

Filing your taxes can be a daunting task, but it doesn’t have to be. Understanding and accurately completing your W4 form is crucial for ensuring you withhold the correct amount of taxes from your paycheck. If you’re a Michigan resident, this guide will provide you with all the essential information you need to download and complete your W4 form with confidence.

In this comprehensive guide, we’ll walk you through the purpose and significance of the W4 form, provide detailed instructions on how to complete it accurately, and highlight common mistakes to avoid. We’ll also discuss the consequences of submitting an incorrect W4 form and provide additional resources available to Michigan taxpayers.

Additional Resources for Michigan Taxpayers

In addition to the Free W4 Form Michigan Download, there are several other resources available to Michigan taxpayers to assist with accurate tax preparation.

These resources include online tax calculators and professional tax assistance. Online tax calculators can help taxpayers estimate their tax liability and withholding amounts, while professional tax assistance can provide personalized guidance and ensure that all tax obligations are met.

Online Tax Calculators

- The Michigan Department of Treasury offers an online tax calculator that can be used to estimate state income tax liability.

- The Internal Revenue Service (IRS) offers an online tax calculator that can be used to estimate federal income tax liability.

- Several commercial tax software providers offer online tax calculators that can be used to estimate both state and federal income tax liability.

Professional Tax Assistance

- Certified Public Accountants (CPAs) are licensed professionals who can provide tax preparation and planning services.

- Enrolled Agents (EAs) are licensed by the IRS to represent taxpayers before the IRS.

- Tax attorneys can provide legal advice on tax matters.

Utilizing these resources can help Michigan taxpayers ensure that their tax returns are accurate and complete, minimizing the risk of errors and penalties.

Common Queries

Where can I download the free W4 form for Michigan?

You can download the free W4 form for Michigan from the Internal Revenue Service (IRS) website or the Michigan Department of Treasury website.

What information do I need to complete the W4 form?

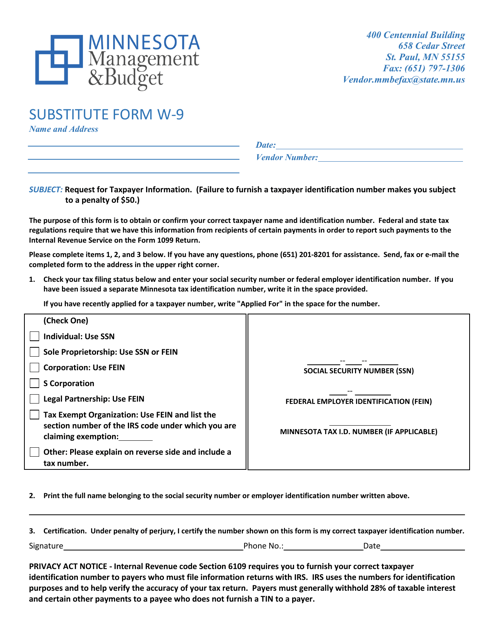

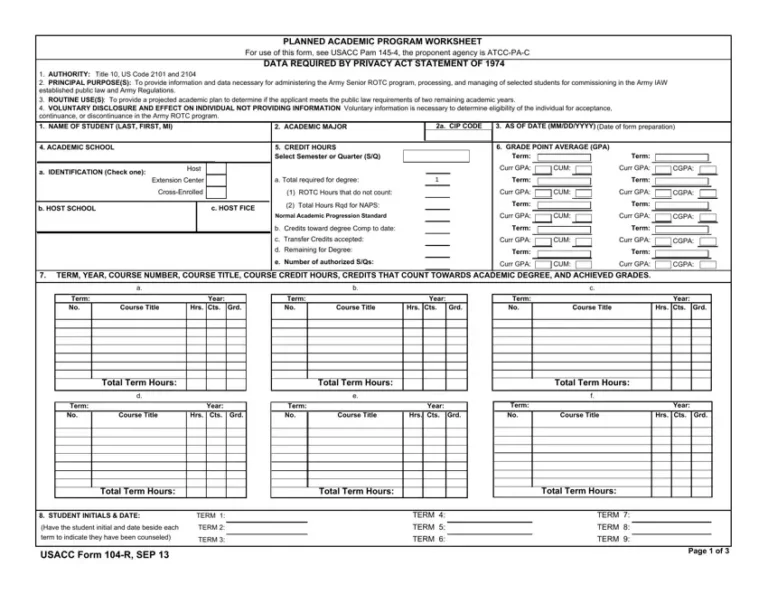

To complete the W4 form, you will need your personal information, such as your name, address, and Social Security number, as well as information about your income and dependents.

What are some common mistakes to avoid when completing the W4 form?

Some common mistakes to avoid when completing the W4 form include not claiming the correct number of allowances, not taking into account other sources of income, and not updating your W4 form when your circumstances change.

What are the consequences of submitting an incorrect W4 form?

Submitting an incorrect W4 form can result in overpaying or underpaying your taxes. If you overpay, you will receive a refund when you file your tax return. If you underpay, you may owe additional taxes and penalties.

What additional resources are available to Michigan taxpayers?

Michigan taxpayers have access to a variety of resources, including online tax calculators, tax preparation software, and professional tax assistance. These resources can help you ensure that your taxes are prepared accurately and on time.