Free W4 Form Arizona Download: A Comprehensive Guide

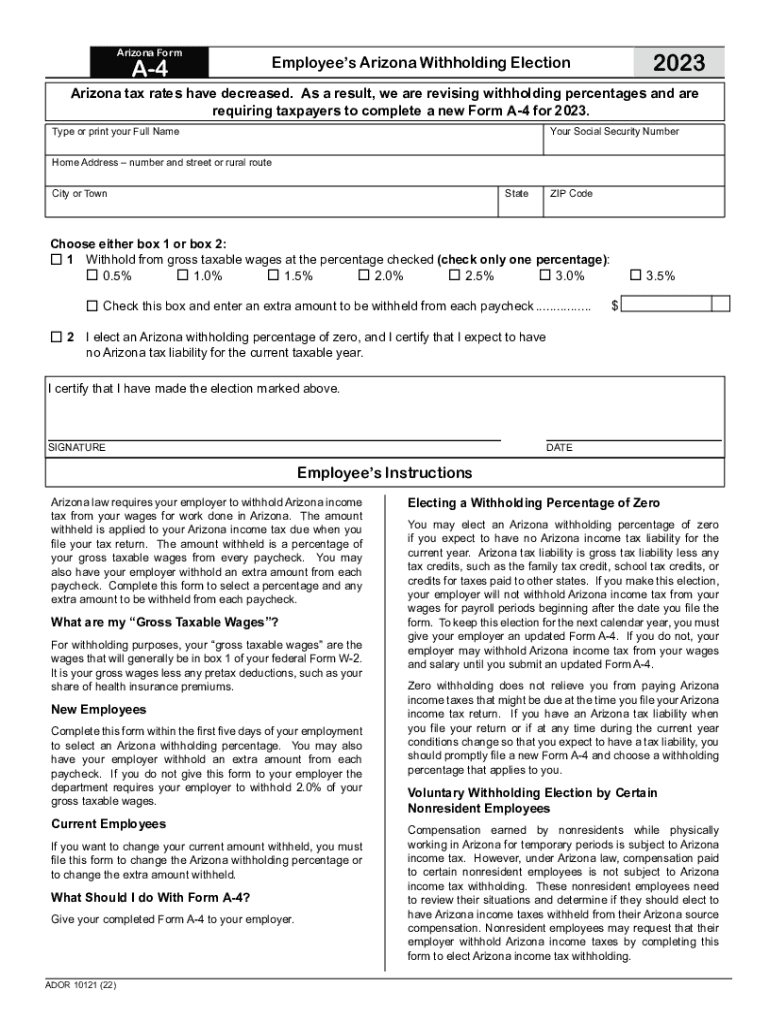

Navigating the complexities of tax forms can be a daunting task, but it’s crucial to ensure accuracy to avoid potential pitfalls. The W4 form, a cornerstone of the tax filing process, plays a vital role in determining your income tax withholding. If you reside in Arizona, accessing a free W4 form is a convenient and accessible option.

In this comprehensive guide, we’ll delve into the purpose, importance, and benefits of downloading a free W4 form from Arizona. We’ll provide a step-by-step guide to ensure a seamless download process, highlight common mistakes to avoid, and share additional resources for your convenience.

Introduction

Yo, listen up! If you’re in Arizona and gotta file your taxes, you need to fill out a W4 form. It’s like the key to unlocking your tax destiny, innit? It tells the taxman how much cheddar you’re gonna owe, so they can take it out of your paycheck before you even get your hands on it. Having a bang-on W4 form is like having a secret weapon – it can save you from getting stung with a hefty tax bill at the end of the year. Plus, downloading a free W4 form from Arizona is as easy as pie, bruv.

So, why bother downloading a free W4 form from Arizona? Well, for starters, it’s free. No need to fork out any dough. Secondly, it’s accurate. The Arizona Department of Revenue has got your back, making sure that the form is up to date and in line with all the latest tax laws. And lastly, it’s convenient. You can download it in a jiffy, fill it out on your laptop or phone, and submit it without breaking a sweat.

Filling out a W4 form might seem like a bit of a drag, but trust me, it’s worth it. Getting it right can save you a lot of hassle and headaches down the line. So, grab a free W4 form from Arizona today and make sure you’re sorted for tax time.

Additional Resources

Innit, bruv? We gotchu covered with more resources on the Arizona Department of Revenue’s gaff. Plus, we’ll hook you up with peeps who can lend a hand with filling out that W4 form.

Not feeling the online vibe? No stress, mate. We’ll show you other ways to bag a W4 form.

Arizona Department of Revenue Resources

- Website: https://azdor.gov/

- Phone: (602) 255-3381

- Email: [email protected]

Help with W4 Form

- IRS website: https://www.irs.gov/forms-pubs/about-form-w-4

- Tax preparation software: Check out options like TurboTax, H&R Block, and Jackson Hewitt.

- Tax preparers: Find a local tax preparer who can assist you.

Other Options for Obtaining a W4 Form

- Download from IRS website: https://www.irs.gov/pub/irs-pdf/fw4.pdf

- Order by phone: Call the IRS at (800) 829-3676.

- Visit an IRS office: Find the nearest IRS office in your area.

FAQ Summary

Is it mandatory to download the W4 form from the Arizona Department of Revenue website?

No, it is not mandatory. You can obtain a W4 form from various sources, including the IRS website, tax preparation software, or your employer.

Can I fill out the W4 form online and submit it electronically?

Yes, the Arizona Department of Revenue provides an online fillable W4 form that can be submitted electronically.

What are the consequences of making errors on a W4 form?

Errors on a W4 form can result in incorrect tax withholding, leading to underpayment or overpayment of taxes. This may necessitate filing an amended return or facing penalties.