Free W4 Form 2024 Download: A Comprehensive Guide to Accurate Tax Withholding

Navigating the complexities of tax withholding can be a daunting task, but understanding and completing the W4 form is crucial for ensuring accurate deductions and avoiding tax penalties. This guide provides a comprehensive overview of the Free W4 Form 2024 Download, empowering you with the knowledge to optimize your tax withholding and streamline your tax filing process.

The W4 form, also known as the Employee’s Withholding Allowance Certificate, is a vital document that determines the amount of federal income tax withheld from your paychecks. By providing accurate information on this form, you can ensure that the appropriate amount of taxes is withheld, minimizing the risk of underpayment or overpayment.

Introduction

Free W4 Form 2024 Download

The Free W4 Form 2024 Download is an official form provided by the Internal Revenue Service (IRS) to assist individuals in accurately calculating their federal income tax withholding for the year 2024.

Completing and submitting the W4 form to your employer is crucial as it determines the amount of federal income tax withheld from your paychecks throughout the year. This ensures that the appropriate amount of tax is withheld, minimizing the chances of underpayment or overpayment of taxes.

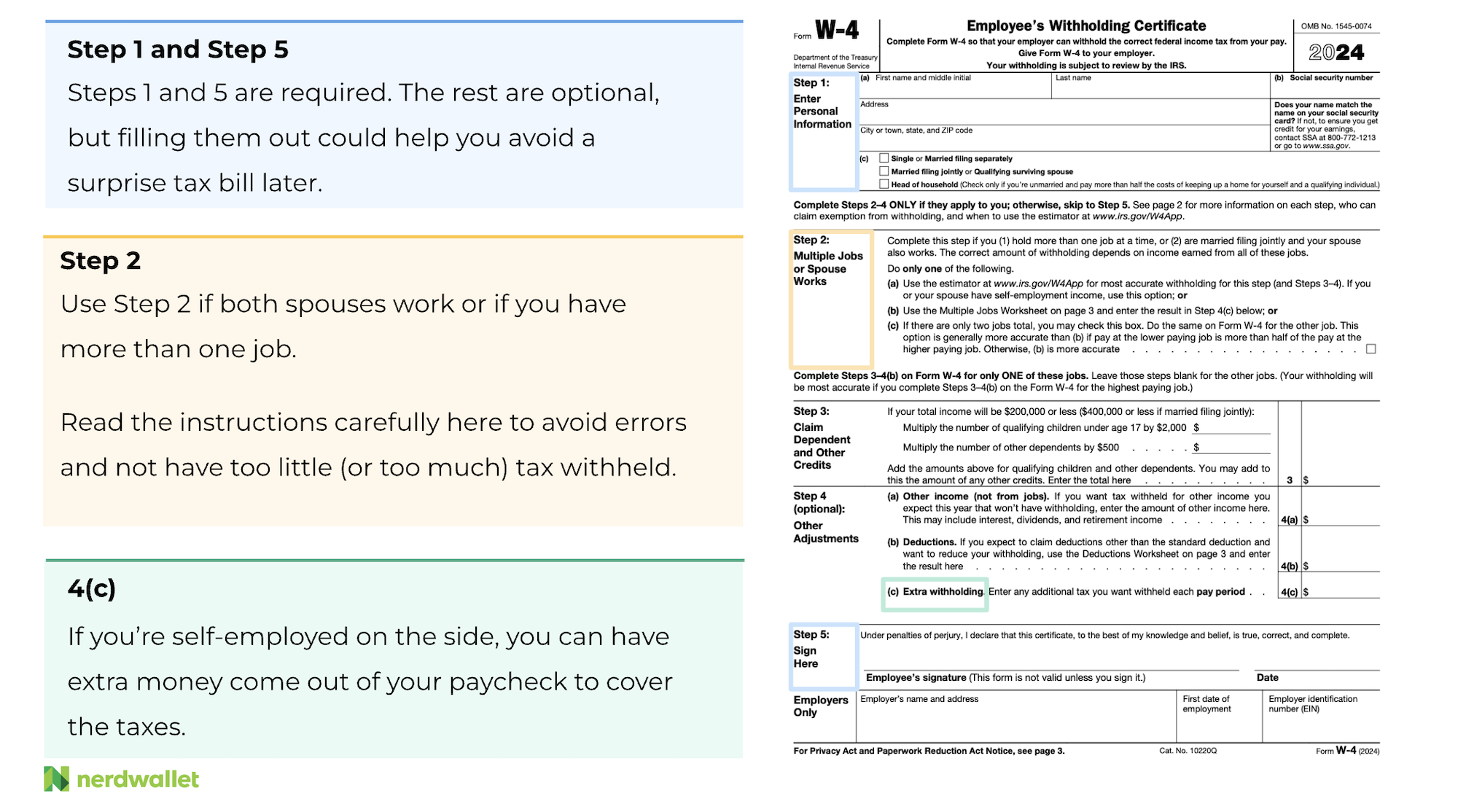

Structure and Content of the W4 Form

The W4 form consists of five sections:

- Personal Information: Includes your name, address, and Social Security number.

- Multiple Jobs or Spouse Works: Indicates if you have multiple jobs or if your spouse also works.

- Claim Dependents: Allows you to claim dependents, which can reduce the amount of tax withheld.

- Other Income: Used to report any additional income sources, such as dividends or interest.

- Deductions and Adjustments: Provides space to list deductions and adjustments that can further reduce your taxable income.

Methods for Downloading the W4 Form

Baggin’ a W4 form is a breeze, and there are a bunch of ways to do it. You can grab it straight from the IRS website, use tax software, or even send a letter in the post.

Downloading from the IRS Website

To download the W4 form from the IRS website, follow these sick steps:

- Cruise on over to the IRS website at www.irs.gov.

- In the search bar, type “W4 form” and hit enter.

- Click on the “Forms and Publications” tab.

- Find the W4 form and click on the “Download” button.

Alternative Methods

If you’re not feeling the IRS website, here are some other ways to get your hands on a W4 form:

- Tax Software: Tax software like TurboTax and H&R Block usually have the W4 form built in, so you can download it while you’re filing your taxes.

- By Mail: You can also request a W4 form by mail by sending a letter to the IRS at the following address:

Internal Revenue Service

P.O. Box 25866

Richmond, VA 23289

Comparison Table

To help you choose the best method for you, here’s a comparison table:

| Method | Advantages | Disadvantages |

|---|---|---|

| IRS Website |

|

|

| Tax Software |

|

|

| By Mail |

|

|

Completing the W4 Form

Filling out the W4 form is straightforward, but there are a few things you need to know to do it accurately. The form is divided into several sections, each of which collects specific information. Let’s go through each section and see what it’s all about.

Personal Information

The first section of the W4 form collects your personal information, such as your name, address, and Social Security number. Make sure to fill out this section carefully and accurately, as any errors could delay your tax refund.

Filing Status

The next section asks you to indicate your filing status. Your filing status determines the standard deduction and tax rates that you are eligible for. The most common filing statuses are single, married filing jointly, married filing separately, and head of household.

Dependents

If you have any dependents, you will need to list them in this section. Dependents can include children, spouses, or other relatives who meet certain criteria. For each dependent, you will need to provide their name, Social Security number, and relationship to you.

Other Income

If you have any other income besides wages, such as self-employment income or investment income, you will need to report it in this section. This information will help the IRS determine how much tax you owe.

Deductions and Credits

The final section of the W4 form allows you to claim any deductions or credits that you are eligible for. Deductions reduce your taxable income, while credits reduce the amount of tax you owe. Some common deductions and credits include the standard deduction, the child tax credit, and the earned income tax credit.

Common Mistakes to Avoid

Here are some common mistakes to avoid when completing the W4 form:

- Not filling out the form completely

- Making errors in your personal information

- Selecting the wrong filing status

- Not claiming all of your dependents

- Not reporting all of your income

- Claiming deductions or credits that you are not eligible for

By avoiding these mistakes, you can ensure that your W4 form is accurate and that you are paying the correct amount of taxes.

Additional Considerations

Bruv, listen up. There are some bits you need to be clued up on if you’re a bit of a geezer with multiple gaffs or your dough’s a right mess.

Not filling in a W4 form is a bit of a fail, init. You could end up paying too much or too little tax, which is a right pain in the backside.

Special Considerations

- Multiple Jobs: If you’re a bit of a hustler with more than one job, you need to fill in a W4 form for each one. This will make sure you’re paying the right amount of tax.

- Complex Financial Situations: If your bread’s a bit complicated, like you have investments or own a business, you might need to fill in a more detailed W4 form. You can get help with this from a tax advisor.

Consequences of Not Filing a W4 Form

Not filling in a W4 form can lead to:

- Overpaying tax, which means you’ll have less dough in your pocket.

- Underpaying tax, which could lead to fines and penalties.

- Getting a right earful from the taxman.

Resources for Help

If you need a bit of a hand with your W4 form, there are plenty of resources available:

- IRS website: https://www.irs.gov/forms-pubs/about-form-w-4

- Tax advisors: You can find a tax advisor in your area by searching online or asking for recommendations.

- Tax software: There are several tax software programs that can help you fill in your W4 form.

FAQ Summary

What is the purpose of the W4 form?

The W4 form is used to inform your employer of your withholding allowances, which determine the amount of federal income tax withheld from your paychecks.

How often should I update my W4 form?

You should update your W4 form whenever there is a change in your personal or financial circumstances, such as a change in income, dependents, or filing status.

What are the consequences of not filing a W4 form?

If you do not file a W4 form, your employer will withhold taxes as if you are single with no dependents, which could result in underpayment of taxes and penalties.

Where can I find the Free W4 Form 2024 Download?

You can download the Free W4 Form 2024 from the IRS website at https://www.irs.gov/forms-pubs/about-form-w4.

How can I get help completing my W4 form?

You can seek assistance from a tax professional, use tax software, or refer to the IRS website for guidance on completing the W4 form.