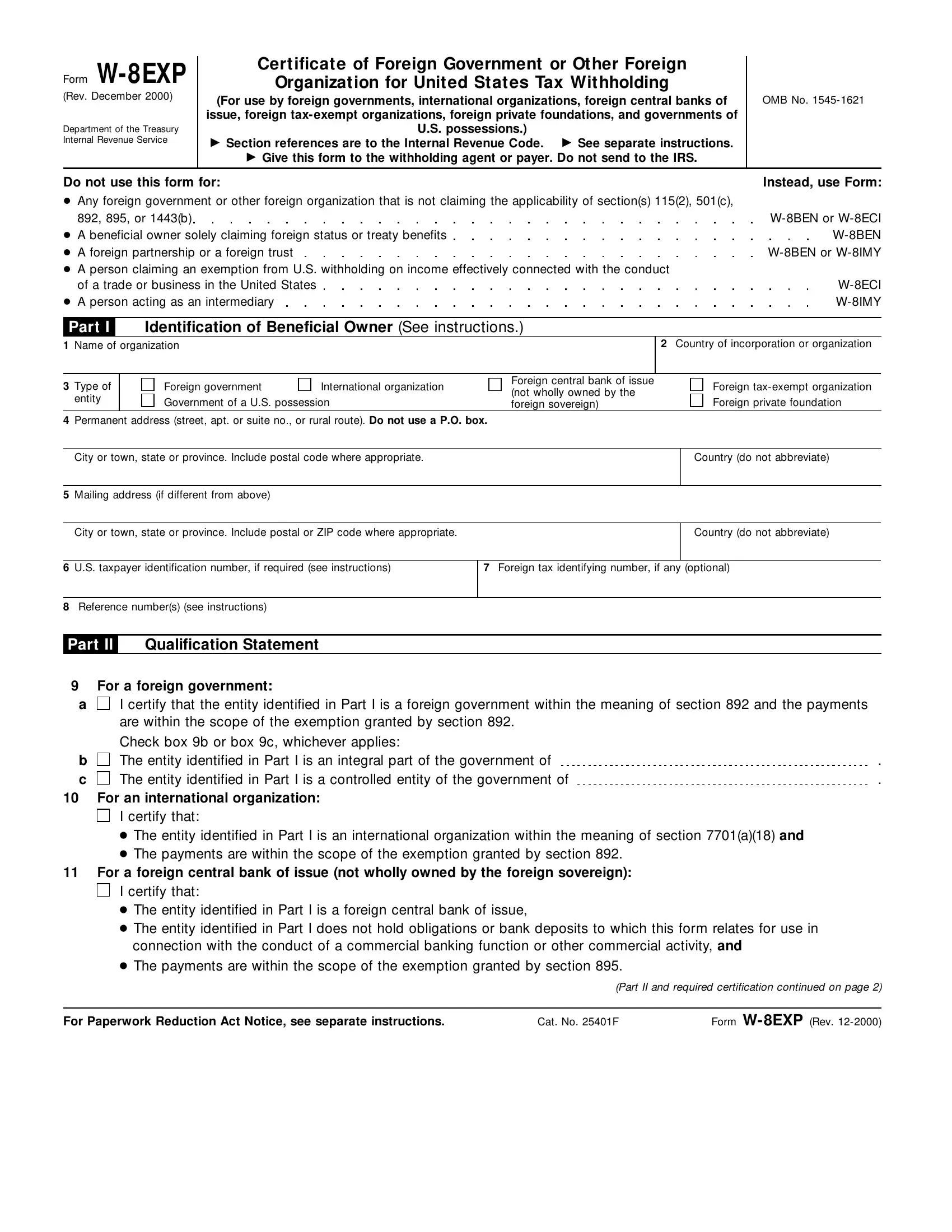

Free W 8exp Form Download: A Comprehensive Guide for Individuals and Businesses

Navigating the complexities of tax reporting can be a daunting task, especially when dealing with international transactions. The W-8 EXP form plays a crucial role in simplifying this process for individuals and businesses. In this comprehensive guide, we will delve into the purpose, benefits, and step-by-step instructions for completing the W-8 EXP form. We will also explore common mistakes to avoid and provide additional resources for support.

The W-8 EXP form, also known as the Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding, is an essential document for foreign individuals and entities to claim reduced or exempt withholding rates on certain types of U.S. income. Understanding the eligibility requirements and proper completion of this form can lead to significant cost savings and ensure compliance with tax regulations.

Where to Download the W-8 EXP Form

The W-8 EXP form is an essential document for foreign individuals and entities to claim tax treaty benefits. To ensure you’re using the most up-to-date version, it’s crucial to download it from official sources.

Official Sources

- Internal Revenue Service (IRS):

https://www.irs.gov/forms-pubs/about-form-w-8-ben-certificate-of-foreign-status-of-beneficial-owner-for-united-states-tax-withholding - Her Majesty’s Revenue and Customs (HMRC):

https://www.gov.uk/government/publications/form-w-8-ben-certificate-of-foreign-status-of-beneficial-owner-for-united-states-tax-withholding

These official sources provide the most up-to-date versions of the W-8 EXP form, ensuring you’re using the correct version and avoiding potential issues with tax authorities.

Additional Resources and Support

Innit, bruv? If you’re lost in the W-8 EXP maze, fear not! Here’s the 411 on where to get extra help.

Helpful Articles and FAQs

Need a quick fix? Check out these articles that’ll sort you out:

– [W-8 EXP Form Guide](https://www.irs.gov/forms-pubs/about-form-w-8-exp)

– [FAQs about W-8 EXP Form](https://www.irs.gov/businesses/international-businesses/frequently-asked-questions-about-form-w-8-exp)

Contact Information for Assistance

If you’re still stumped, don’t be a mug! Reach out to the IRS for a helping hand:

– Phone: 1-800-829-1040

– Email: [email protected]

Professional Guidance

If it’s all too much, don’t sweat it. Seeking professional guidance from an accountant or tax advisor can be a wise move. They’ll help you navigate the W-8 EXP form and ensure you’re doing it right.

FAQ Section

What is the purpose of the W-8 EXP form?

The W-8 EXP form is used to certify that a foreign individual or entity is eligible for a reduced or exempt withholding rate on certain types of U.S. income, such as dividends, interest, and royalties.

Who is eligible to use the W-8 EXP form?

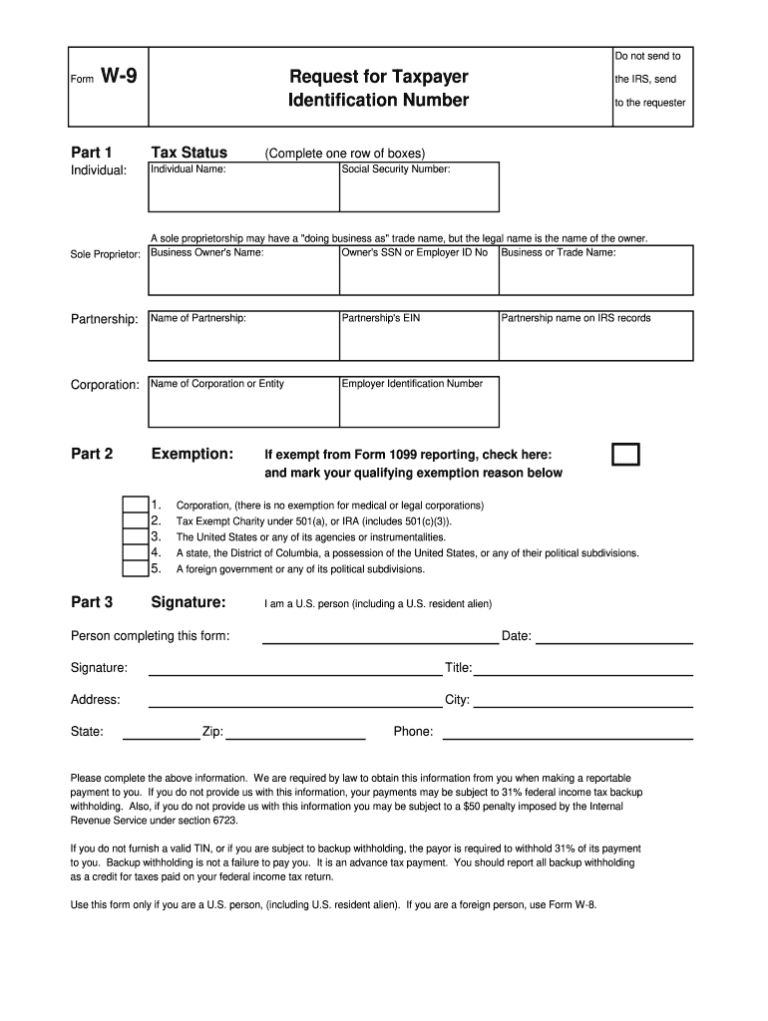

To be eligible to use the W-8 EXP form, the individual or entity must be a non-U.S. citizen or resident and must meet specific requirements related to their country of residence and tax status.

What are the benefits of using the W-8 EXP form?

Using the W-8 EXP form can reduce or eliminate withholding taxes on U.S. income, simplify tax reporting, and potentially save money on tax payments.

Where can I download the W-8 EXP form?

The W-8 EXP form can be downloaded from the Internal Revenue Service (IRS) website.

What are some common mistakes to avoid when completing the W-8 EXP form?

Common mistakes to avoid include providing incorrect or incomplete information, failing to sign and date the form, and not attaching the required documentation.