Free W-6 Form Download: A Comprehensive Guide to Understanding and Utilizing W-6 Forms

Navigating the intricacies of tax withholding can be a daunting task, but the W-6 form is an essential tool that can help you optimize your tax savings. Whether you’re a seasoned taxpayer or just starting to explore the world of tax deductions, this comprehensive guide will provide you with everything you need to know about the Free W-6 Form Download.

In this guide, we will delve into the purpose, significance, and tax implications of W-6 forms. We will also provide step-by-step instructions on how to fill out the form, discuss legal considerations, and share best practices for using W-6 forms effectively. By the end of this guide, you will have a thorough understanding of W-6 forms and the confidence to use them to your advantage.

Understanding W-6 Forms

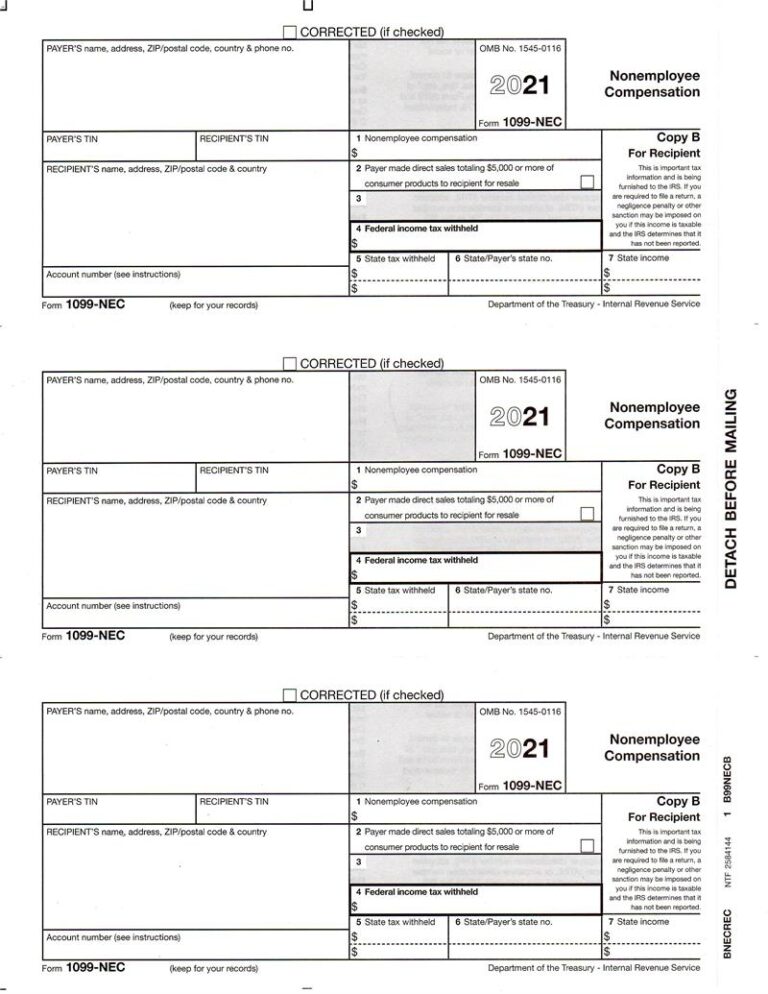

W-6 forms, also known as Employee’s Withholding Allowance Certificate, are crucial documents that help determine how much federal income tax is withheld from your paycheck. By accurately filling out this form, you can ensure that the right amount of tax is deducted, minimizing the risk of overpaying or underpaying taxes.

Key Sections of the W-6 Form

The W-6 form consists of several key sections, each serving a specific purpose:

- Personal Information: This section includes your name, address, and Social Security number.

- Exemptions: Here, you indicate the number of withholding allowances you claim. This number reduces the amount of tax withheld from your paycheck.

- Additional Income: If you have additional sources of income, such as self-employment or investments, you can report them here.

- Adjustments: Use this section to adjust your withholding based on deductions, credits, or other factors that may affect your tax liability.

- Signature: Finally, you must sign and date the form to make it valid.

Filling Out the W-6 Form

To fill out the W-6 form accurately, follow these steps:

- Gather Your Information: Collect your personal information, income details, and any relevant adjustments.

- Determine Your Allowances: Use the IRS Withholding Calculator or consult a tax professional to determine the appropriate number of allowances to claim.

- Complete the Form: Fill out the form carefully, providing accurate information in each section.

- Sign and Date: Remember to sign and date the form before submitting it to your employer.

Tax Implications of W-6 Forms

Filling out a W-6 form can have a significant impact on your tax withholding. It helps the taxman work out how much income tax to take out of your pay each month. If you fill in the W-6 form, you can claim more personal allowances, which means you’ll pay less tax each month. But be careful, if you claim too many allowances, you could end up owing money when you file your tax return.

The number of allowances you can claim depends on your personal circumstances. For example, you can claim an allowance for yourself, your spouse, and each of your dependents. You can also claim an allowance for certain deductions, such as mortgage interest or charitable contributions.

Adjusting Withholding

If you need to adjust your withholding, you can do so by completing a new W-4 form. You can get a W-4 form from your employer or from the IRS website. When you complete the W-4 form, you will need to provide information about your income, deductions, and dependents. The IRS will use this information to calculate how much tax should be withheld from your pay each month.

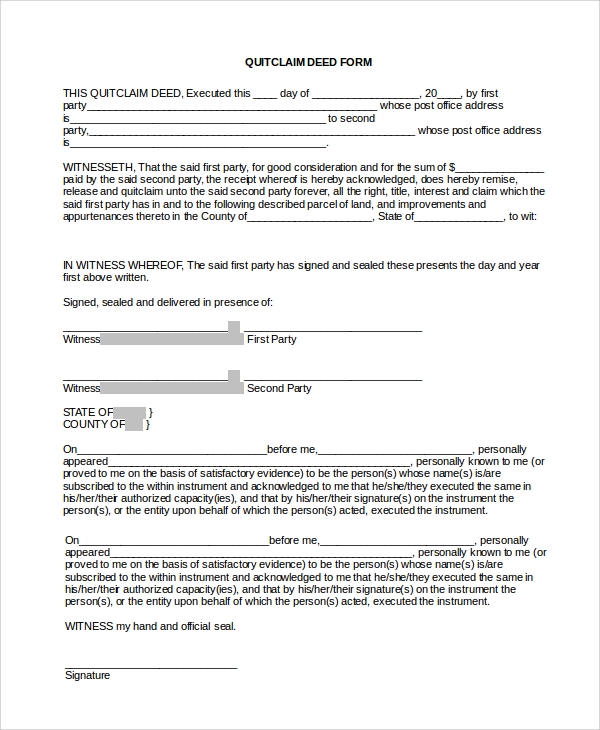

Legal Considerations for W-6 Forms

Filling out a W-6 form comes with legal responsibilities and potential consequences for misrepresentation. Understanding these legal aspects is crucial to avoid any complications or penalties.

Penalties for Misrepresenting Information

Intentionally or unintentionally providing false or misleading information on a W-6 form can result in severe penalties. These penalties may include:

- Civil penalties: Fines and other financial sanctions imposed by the IRS for incorrect withholding claims.

- Criminal charges: In extreme cases, individuals may face criminal prosecution for knowingly falsifying information on a W-6 form.

Avoiding Legal Pitfalls

To steer clear of legal troubles when completing a W-6 form, follow these guidelines:

- Be honest and accurate: Provide truthful and precise information to the best of your knowledge.

- Seek professional advice: If you’re unsure about any aspect of the form, consult with a tax professional for guidance.

- Keep a copy: Retain a copy of your completed W-6 form for your records and as proof of accuracy.

- Review and update: Regularly review your W-6 form and make adjustments as your financial situation changes to ensure accurate withholding.

Best Practices for Using W-6 Forms

Navigating the complexities of W-6 forms can be a daunting task. To ensure effective usage and optimize tax savings, consider the following best practices:

First and foremost, it’s crucial to determine your eligibility for using a W-6 form. If you anticipate substantial itemized deductions, such as mortgage interest, charitable contributions, or state and local taxes, filing a W-6 form can help reduce your tax withholding and avoid overpaying.

When to Use W-6 Forms

The ideal time to use a W-6 form is when you expect to have itemized deductions that exceed the standard deduction. For 2023, the standard deduction is £12,950 for single filers and £25,900 for married couples filing jointly.

If your anticipated itemized deductions are less than the standard deduction, filing a W-6 form may not provide significant benefits. In such cases, it’s generally recommended to stick with the standard deduction.

How to Use W-6 Forms

Completing a W-6 form involves accurately estimating your itemized deductions. While it’s important to be realistic, it’s also essential to avoid underestimating your deductions, as this could lead to under withholding and potential penalties.

If you have complex financial situations, consider consulting with a tax professional for guidance on completing the W-6 form. They can help you assess your eligibility, estimate your deductions, and ensure your form is filled out correctly.

Common Mistakes to Avoid

To avoid common pitfalls when using W-6 forms, keep the following in mind:

- Overestimating deductions: Inflating your deductions to reduce withholding can lead to an underpayment of taxes and potential penalties.

- Underestimating deductions: Conversely, underestimating your deductions could result in over withholding and a larger tax refund, which ties up your money unnecessarily.

- Inconsistent withholding: Ensure that your W-6 form withholding instructions are consistent with your actual deductions. Significant discrepancies can trigger an IRS audit.

- Not updating W-6 forms: Life circumstances and financial situations can change, so it’s essential to review and update your W-6 forms as needed. Failure to do so could lead to over withholding or under withholding.

FAQ Corner

What is the purpose of a W-6 form?

A W-6 form is used to certify that you are exempt from federal income tax withholding. This means that your employer will not withhold any taxes from your paycheck.

Who should use a W-6 form?

You should use a W-6 form if you meet certain criteria, such as having no tax liability for the current year or expecting a large refund.

How do I fill out a W-6 form?

Follow the instructions on the form carefully. You will need to provide your personal information, as well as information about your income and withholding allowances.

What are the legal considerations for using a W-6 form?

It is important to be truthful and accurate when completing a W-6 form. Misrepresenting information on the form can result in penalties.

Where can I find a free W-6 form?

You can download a free W-6 form from the IRS website or from your employer’s website.