Free Virginia State Tax Form 2024 Download: Your Comprehensive Guide to Filing State Taxes

Navigating the complexities of state tax filing can be daunting, but with the Free Virginia State Tax Form 2024 Download, you can simplify the process and ensure accurate and timely submissions. This comprehensive guide will provide you with a step-by-step walkthrough of downloading, filling out, and submitting the form, empowering you to confidently manage your state tax obligations.

Filing state taxes is an essential civic duty, and the Free Virginia State Tax Form 2024 Download makes it easier than ever to fulfill this responsibility. By utilizing this free resource, you can save time, minimize errors, and ensure that your tax payments are handled efficiently and accurately.

Benefits of Using the Free Virginia State Tax Form 2024

Blud, if you’re after a sweet deal on your Virginia state taxes, then you need to cop the free 2024 form, fam. This sick form is a total game-changer, innit? It’ll save you a bomb and take the hassle out of doing your taxes, bruv.

First off, it’s free as a bird, so you don’t have to fork out any dough. Plus, it’s easy peasy to use. You don’t need to be a tax wizard or anything; just follow the simple instructions, and you’ll be sorted.

Time-Saving

This free form is like a magic wand when it comes to saving you time. You can fill it out in a jiffy, unlike those complicated paid forms that take forever.

Money-Saving

Not only does this form save you time, but it can also save you a pretty penny. How, you ask? Well, if you make a mistake on a paid form, you might have to pay a fine. But with this free form, you can avoid that drama altogether.

s for Downloading the Free Virginia State Tax Form 2024

Innit, getting your mitts on the Free Virginia State Tax Form 2024 is a doddle. Here’s the lowdown on how to bag it in a jiffy:

Get your phone or laptop ready, ’cause we’re gonna hit the Virginia Tax website.

Step 1: Navigate to the Virginia Tax Website

- Smash this link: https://tax.virginia.gov/forms

- Keep your peepers peeled for the “Forms” tab. Give it a click, mate.

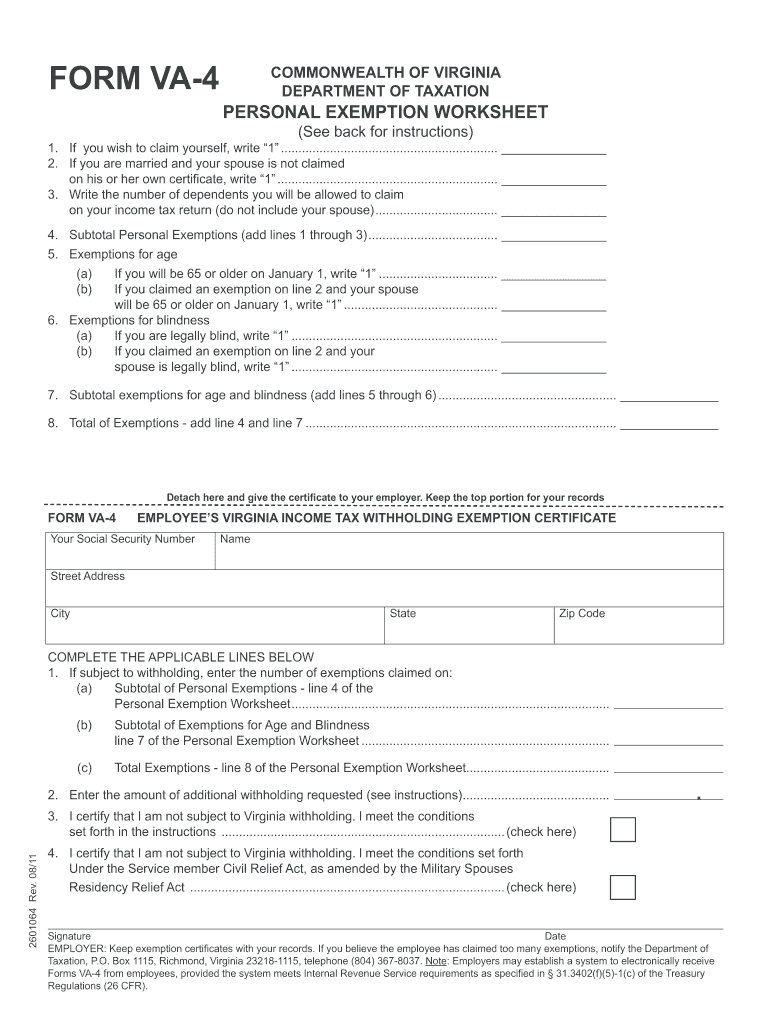

Step 2: Find the 2024 Individual Income Tax Forms

- Scroll down until you see the “2024 Individual Income Tax Forms” section.

- Your target is Form 760, the Virginia Individual Income Tax Return.

Step 3: Download the Form

- Click the link to download Form 760. It’s usually a PDF file.

- Save the file to your computer or phone. That’s it, bruv. You’ve got the form!

Filling Out the Free Virginia State Tax Form 2024

Filling out the Free Virginia State Tax Form 2024 can be a breeze, innit? But to make sure your form is spick and span, there are a few bits to watch out for. Let’s dive right in, shall we?

Tips for Completing the Form

– Read the instructions carefully, bruv. It might sound boring, but it’ll save you from any right royal cock-ups.

– Use black or blue ink, not your dodgy biro. It makes it easier for the taxman to read, and you don’t want to give them any excuses to reject your form, do you?

– Write clearly and legibly. Don’t make them squint or guess what you’ve written.

– Answer all the questions, even if they don’t apply to you. If it’s not relevant, just write “N/A” or “Not Applicable.”

– Double-check your calculations before you sign on the dotted line. You don’t want to end up owing more dosh than you should.

Common Mistakes to Avoid

– Don’t forget to sign and date the form. It’s like the icing on the cake, and without it, your form is as good as bog roll.

– Don’t leave any questions blank. Even if you don’t know the answer, write “Unknown” or “N/A.”

– Don’t use abbreviations or slang. Keep it formal and easy to understand.

– Don’t attach any unnecessary documents. Only include what’s specifically asked for on the form.

– Don’t be late! Make sure you file your form by the deadline. If you’re late, you could face penalties or interest charges.

Submitting the Free Virginia State Tax Form 2024

There be several ways to submit your Free Virginia State Tax Form 2024, blud. You can do it online, by mail, or in person.

Online

If you’re a right geezer, you can submit your form online through the Virginia Department of Taxation website. You’ll need to create an account and then follow the instructions to upload your form. The deadline for online submissions is April 18, 2024.

By Mail

You can also submit your form by mail. The address to send it to is:

Virginia Department of Taxation

P.O. Box 1164

Richmond, VA 23218

The deadline for mailing your form is April 18, 2024. Make sure to allow enough time for your form to arrive before the deadline.

In Person

You can also submit your form in person at any Virginia Department of Taxation office. The deadline for in-person submissions is April 18, 2024. You can find the address of your nearest office on the Virginia Department of Taxation website.

No matter which method you choose, make sure to submit your form by the deadline. If you miss the deadline, you may have to pay penalties and interest.

Additional Resources

Yo, need more info on Virginia taxes, bruv? Check out these sick links:

Virginia Department of Taxation Contact Info

- Website: https://www.tax.virginia.gov/

- Phone: 804-367-8031

- Email: [email protected]

Helpful Answers

Q: What are the benefits of using the Free Virginia State Tax Form 2024 Download?

A: The Free Virginia State Tax Form 2024 Download offers numerous benefits, including saving time and money by eliminating the need for paid tax preparation services. It also ensures accuracy by providing clear instructions and eliminating the potential for errors associated with manual calculations.

Q: How do I download the Free Virginia State Tax Form 2024?

A: Downloading the Free Virginia State Tax Form 2024 is simple. Visit the Virginia Department of Taxation website, navigate to the ‘Forms’ section, and select ‘Individual Income Tax Forms.’ From there, you can download the PDF version of the form.

Q: Where can I find additional resources related to Virginia state taxes?

A: The Virginia Department of Taxation website provides a wealth of resources, including frequently asked questions, contact information, and helpful guides. You can also contact the department directly for personalized assistance.