Free Va W2 Form Download: A Comprehensive Guide to Easy Tax Filing

The tax season can be a daunting time, but it doesn’t have to be. With the advent of online resources, it’s now easier than ever to file your taxes accurately and on time. One of the essential documents you’ll need for tax filing is Form W-2, which reports your wages and other compensation for the year. If you’re unable to obtain a physical W-2 form from your employer, downloading a free W-2 form online is a convenient and reliable option.

This guide will provide you with all the information you need to download and complete a free Va W2 Form. We’ll cover where to find reputable sources for free W-2 form downloads, how to navigate these websites to locate the form, and step-by-step instructions on completing the form accurately. We’ll also discuss the different methods for submitting the completed W-2 form and troubleshooting common issues you may encounter.

Understanding the Need for Free Va W2 Form Downloads

The Form W-2, Wage and Tax Statement, is a crucial document for tax filing in the United States. It provides essential information about an employee’s income and taxes withheld during the previous tax year. Obtaining a physical copy of the W-2 form can be challenging, especially for those who have lost or misplaced their original. Fortunately, there are numerous websites that offer free W-2 form downloads, making it convenient and accessible for individuals to file their taxes accurately and on time.

Benefits of Downloading a Free W-2 Form Online

Downloading a free W-2 form online offers several advantages:

- Convenience: Online W-2 forms are readily available 24/7, allowing individuals to access and download the form at their convenience, without the need to visit a physical office or wait for a mailed copy.

- Accuracy: The W-2 forms provided by reputable websites are typically up-to-date and accurate, ensuring that individuals have the correct information for their tax filings.

- Cost-effective: Downloading a W-2 form online is free of charge, eliminating the need for individuals to spend money on postage or other related expenses.

- Environmental friendliness: By downloading a W-2 form online, individuals can reduce their environmental impact by eliminating the need for paper and mailing, contributing to a greener planet.

Finding Reputable Sources for Free Va W2 Form Downloads

Innit, finding a safe and reliable source for free W-2 form downloads is a piece of cake. Just keep your eyes peeled for these tips:

Criteria for a Reputable Source:

- Government websites: The IRS website is the ultimate hook-up for official W-2 forms, bruv.

- Reputable accounting firms: These guys know their stuff and often offer free downloads as a cheeky bonus.

- Tax software providers: TurboTax and H&R Block are your go-to lads for tax-related goodies, including W-2 forms.

- Nonprofit organizations: Some non-profits, like the United Way, provide free tax assistance and may offer W-2 downloads.

- Trusted websites: Check out websites like IRS.gov and PaycheckCity.com for reliable W-2 downloads.

Navigating the Websites:

- IRS website: Head to IRS.gov and click on “Forms & Publications” > “Individual Income Tax Forms” > “W-2, Wage and Tax Statement”.

- Accounting firms: Visit the website of your chosen firm and look for a section on “Tax Forms” or “Resources”.

- Tax software providers: Log in to your account or visit their website and search for “W-2 form download”.

- Nonprofit organizations: Contact the organization directly or check their website for tax assistance resources.

- Trusted websites: Simply type “free W-2 form download” into Google and select a reputable website from the search results.

Remember, it’s all about finding a source that’s legit and won’t leave you with a dodgy W-2. Stay safe and tax smart, fam!

Downloading and Completing the Free Va W2 Form

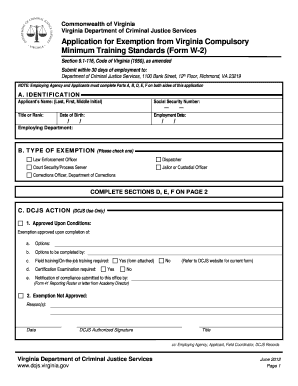

Bagsy you get the free W-2 form from the Virginia Tax website, blud. It’s a doddle to download, innit? Just follow these easy peasy steps:

Step 1: Downloading the Form

- Navigate to the Virginia Tax website, fam.

- Click on the “Forms” tab.

- Scroll down to “Individual Income Tax Forms” and click on “W-2, Wage and Tax Statement.”

- Select the year you need the form for and click “Download.”

Step 2: Completing the Form

Now that you’ve got the form, it’s time to fill it in, my bredrin. Here’s the lowdown:

- Make sure you’ve got all the necessary info, like your name, address, and Social Security number.

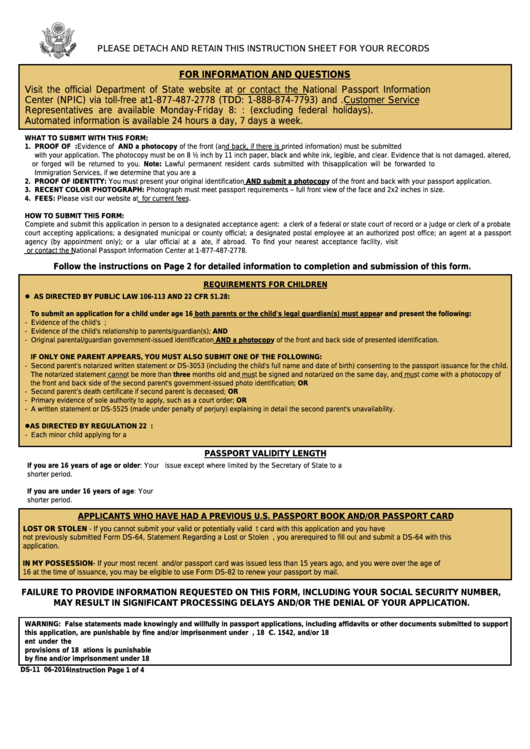

- Follow the instructions on the form carefully.

- Don’t leave any blanks. If you don’t have the info, write “N/A.”

- Double-check your work before you submit the form.

Tips for Error-Free Form

Wanna make sure your form is squeaky clean? Here are some tips:

- Use a black or blue pen.

- Write clearly and legibly.

- Don’t use white-out or correction fluid.

- If you make a mistake, cross it out neatly and write the correct info next to it.

- Keep a copy of the completed form for your records.

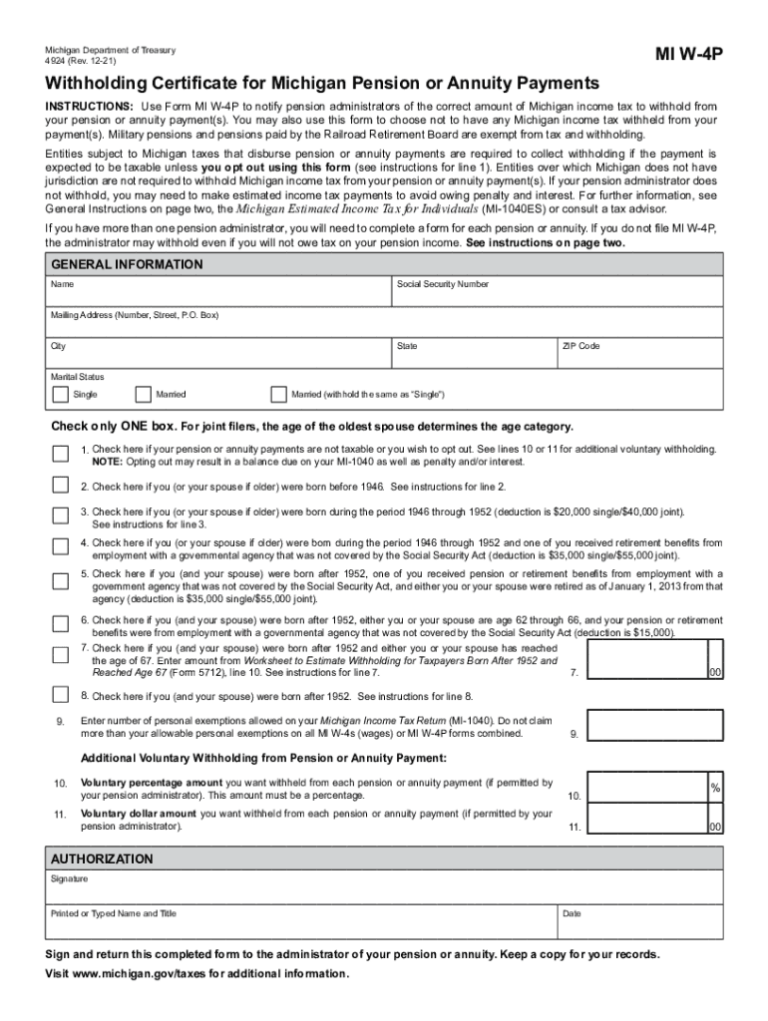

Submitting the Completed Free Va W2 Form

Once you’ve completed your Free Va W2 Form, you need to submit it to the Virginia Department of Taxation (VDT). There are a few different ways to do this:

Online Submission

You can submit your W-2 form online through the VDT’s website. This is the quickest and easiest way to submit your form, and you’ll receive confirmation that your form has been received.

To submit your W-2 form online, you’ll need to create an account on the VDT’s website. Once you’ve created an account, you can log in and click on the “File a Return” link. From there, you’ll be able to upload your W-2 form and submit it.

Mailing

You can also mail your completed W-2 form to the VDT. The address is:

Virginia Department of Taxation

P.O. Box 1104

Richmond, VA 23218

Make sure to include a copy of your W-2 form with your tax return.

Importance of Timely Submission

It’s important to submit your W-2 form on time. If you file your form late, you may be subject to penalties and interest. The deadline for filing your W-2 form is April 15th.

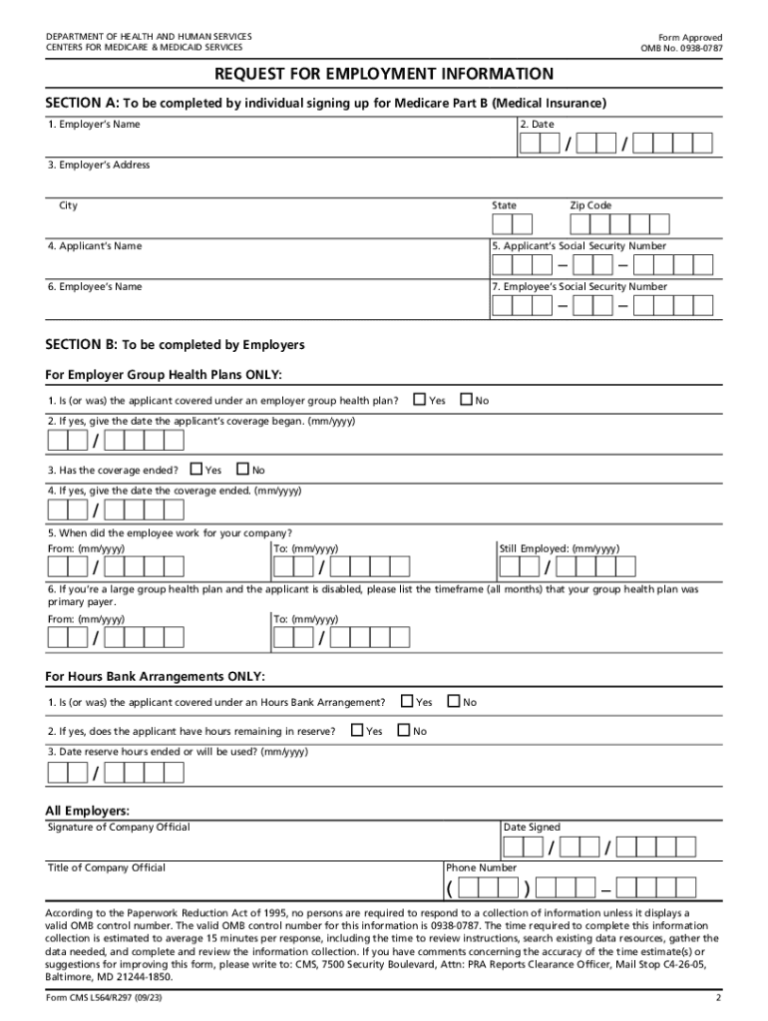

Troubleshooting Common Issues with Free Va W2 Form Downloads

Downloading and completing the free Va W2 form is generally straightforward, but some common issues can arise. These issues can range from technical difficulties to problems with the form itself. If you encounter any problems, there are several steps you can take to troubleshoot and resolve them.

Downloading Issues

- Problem: Unable to download the form from the website.

Solution: Check your internet connection and ensure that the website is accessible. Try using a different browser or downloading the form at a different time. - Problem: The downloaded file is corrupted or damaged.

Solution: Delete the downloaded file and try downloading it again. If the problem persists, contact the website administrator for assistance.

Form Completion Issues

- Problem: Missing or incomplete information on the form.

Solution: Double-check the form to ensure that all required fields are filled out. Refer to the form instructions for guidance. - Problem: Difficulty understanding the form instructions.

Solution: Read the form instructions carefully and refer to online resources or seek professional assistance if needed. - Problem: Errors when submitting the form.

Solution: Review the form for any errors, such as incorrect formatting or missing information. If the errors persist, contact the relevant tax authority for assistance.

Contact Information for Assistance

If you encounter any unresolved issues, you can contact the Virginia Department of Taxation for assistance.

- Phone: (804) 367-8031

- Email: [email protected]

FAQs

Where can I find a reputable source to download a free Va W2 Form?

There are several reputable websites that offer free W-2 form downloads, including the Internal Revenue Service (IRS) website, the Virginia Department of Taxation website, and ADP’s website.

How do I know if a website is a credible source for downloading a W-2 form?

When evaluating the credibility of a website for downloading a W-2 form, consider factors such as the website’s affiliation with government agencies or reputable organizations, the presence of secure encryption protocols (HTTPS), and positive user reviews.

What are some common issues I may encounter while downloading or completing a W-2 form?

Some common issues you may encounter include difficulty accessing the website, problems downloading the form, or errors while completing the form. If you encounter any issues, try refreshing the website, using a different browser, or contacting the website’s customer support for assistance.