Free Upwork Tax Forms Download: A Comprehensive Guide for Freelancers

Navigating the complexities of freelance taxation can be a daunting task, but with the right resources, you can simplify the process. Upwork, one of the leading freelance platforms, offers a range of tax forms to assist freelancers in managing their tax obligations. This comprehensive guide will provide you with all the essential information you need to download and utilize Upwork’s tax forms.

Understanding the purpose and importance of each tax form is crucial. From Form 1099-NEC to Schedule SE, we will delve into the details of these forms and guide you through the process of downloading them in various formats, including PDF and Excel. Additionally, we will address common issues and provide troubleshooting tips to ensure a seamless download experience.

Tax Forms for Upwork

Upwork provides a comprehensive suite of tax forms to assist freelancers in managing their tax obligations. These forms cover various tax-related aspects and are essential for accurate tax reporting and compliance.

Understanding the purpose and importance of each form is crucial for proper tax management. Upwork offers these forms in multiple formats, including PDF and Excel, for convenience and accessibility.

List of Tax Forms Available on Upwork

Upwork provides the following tax forms:

- Form 1099-NEC: Reports nonemployee compensation and is used for self-employed individuals.

- Form 1099-K: Reports payment transactions for goods and services and is relevant for freelancers using payment processors like PayPal.

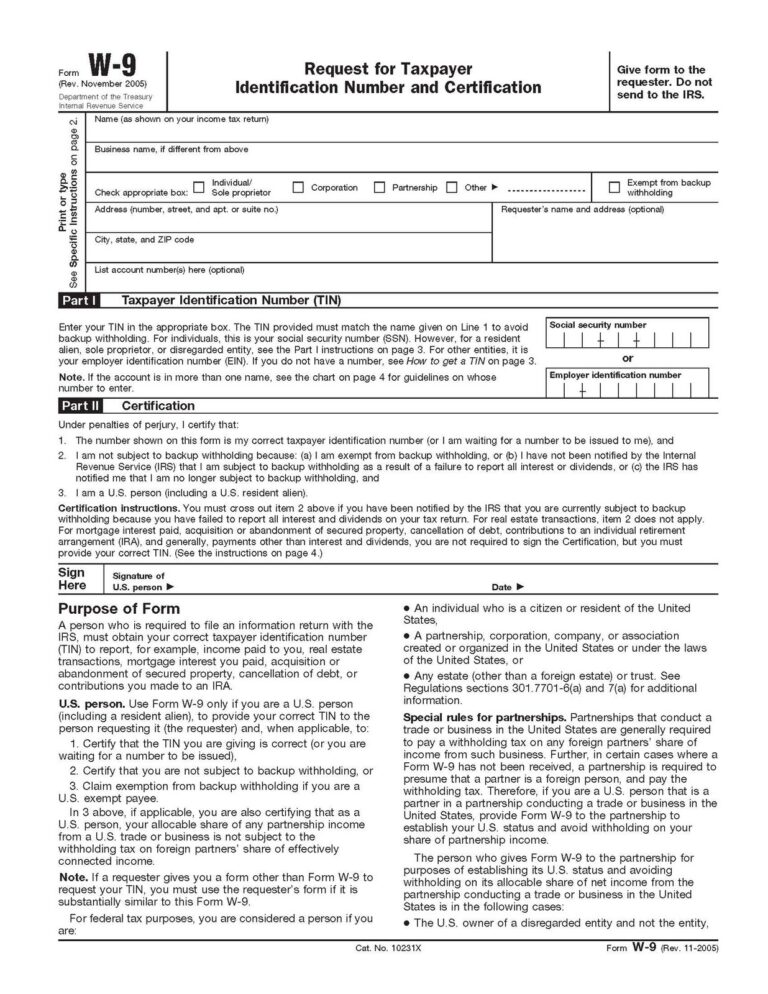

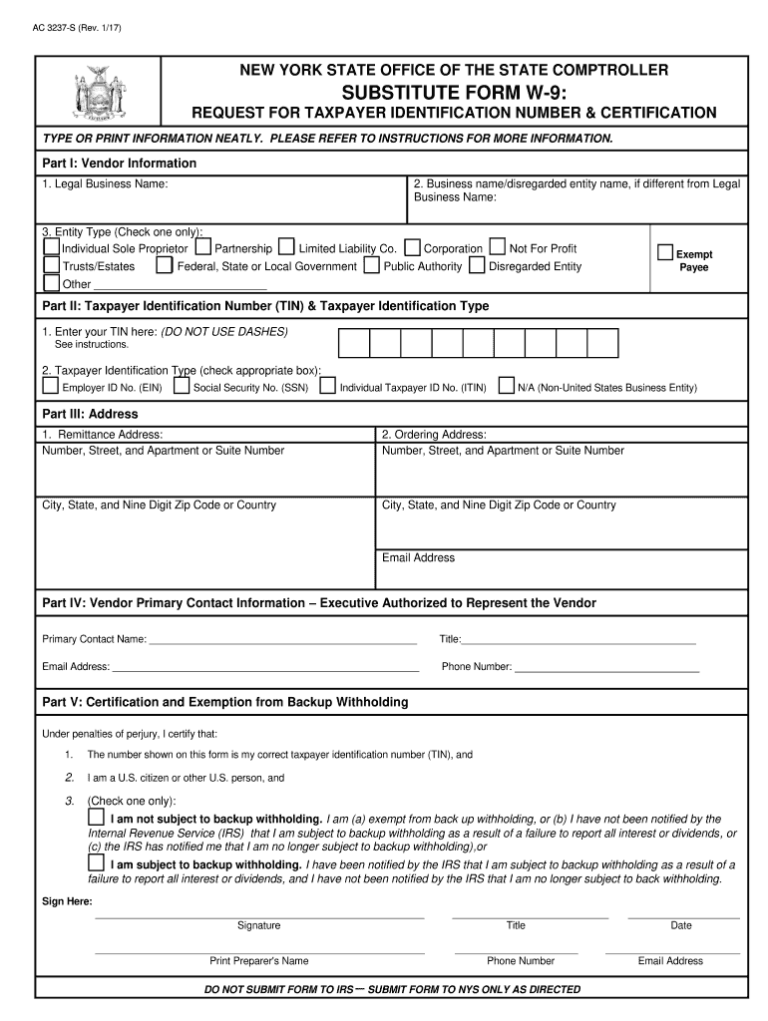

- Form W-9: Collects taxpayer information for individuals and businesses receiving payments from Upwork.

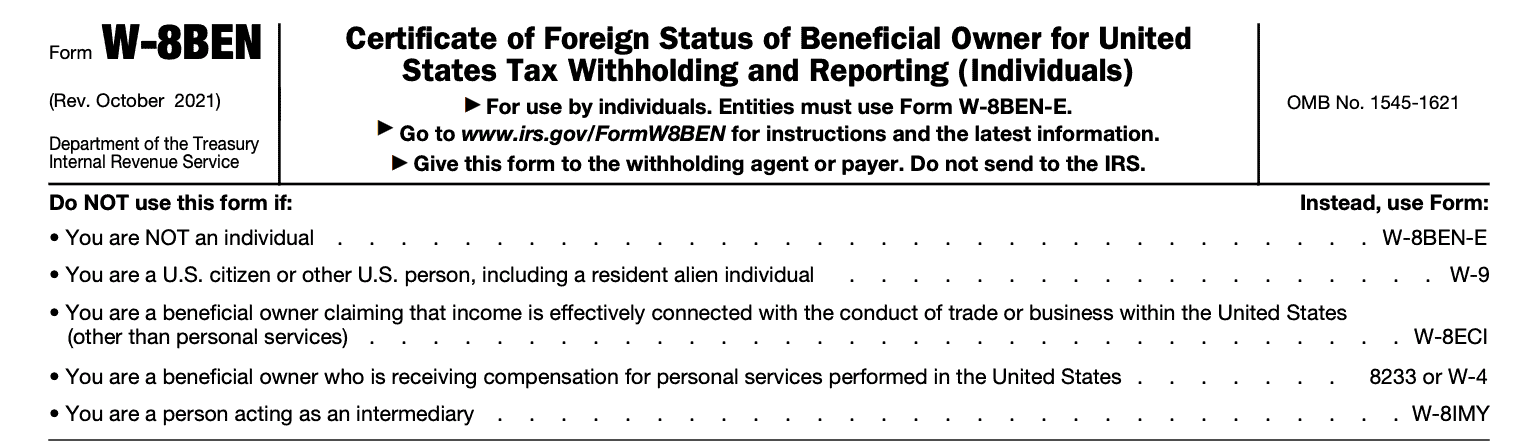

- Form W-8BEN: Collects taxpayer information for non-US citizens or residents receiving payments from Upwork.

Importance of Tax Forms

Tax forms play a vital role in tax compliance and management. They provide accurate documentation of income and expenses, ensuring proper tax calculations and reporting. By utilizing these forms, freelancers can avoid potential tax-related issues and penalties.

Formats for Downloading Tax Forms

Upwork offers tax forms in multiple formats to cater to different user preferences and needs. These formats include:

- PDF: A portable and widely accepted format that can be easily viewed, printed, and shared.

- Excel: A spreadsheet format that allows for easy editing, customization, and data analysis.

s for Downloading Tax Forms

Grabbing your tax forms from Upwork is a doddle. Just follow these cheeky steps:

Navigating Upwork

1. Sign in to your Upwork account and click on the ‘Settings’ icon in the top right corner.

2. Select ‘Tax Settings’ from the menu on the left.

Locating Tax Forms

3. Scroll down to the ‘Tax Forms’ section and click on the ‘Download’ button next to the tax form you need.

4. Your tax form will be downloaded as a PDF file.

Screenshots

Here’s a couple of cheeky screenshots to help you out:

- Step 1: [Image of Upwork ‘Settings’ page with ‘Tax Settings’ highlighted]

- Step 2: [Image of Upwork ‘Tax Settings’ page with ‘Tax Forms’ section]

- Step 3: [Image of Upwork ‘Tax Forms’ section with ‘Download’ button]

Common Issues and Troubleshooting

Downloading tax forms from Upwork is generally straightforward, but there are a few common issues that users may encounter.

Here are some tips for troubleshooting these issues:

Missing Forms

If you are unable to find the tax form you need, it may be because it is not yet available. Upwork typically releases tax forms in January of each year. If you are trying to download a form for a previous year, you may need to contact Upwork support.

Incorrect Formats

If you download a tax form and it is in the wrong format, you may need to convert it to the correct format. You can use a free online converter to do this.

Technical Difficulties

If you are experiencing technical difficulties when downloading tax forms from Upwork, you may need to try the following:

- Refresh your browser.

- Clear your browser’s cache and cookies.

- Try downloading the form from a different browser.

- Contact Upwork support.

Additional Resources

Explore external resources for comprehensive guidance and support related to Upwork tax forms. These resources provide in-depth information, official guidelines, and assistance to ensure accurate tax reporting and compliance.

Refer to the following table for a curated list of valuable resources:

External Resources

| Resource | Description |

|---|---|

| Upwork Tax Forms Documentation | Official Upwork documentation providing detailed instructions and explanations on obtaining and understanding tax forms. |

| IRS Form W-9 | Request for Taxpayer Identification Number and Certification form required for independent contractors. |

| IRS Form 1099-NEC | Nonemployee Compensation form used to report payments to independent contractors. |

| TaxAct 1099-MISC Guide | Comprehensive guide to understanding and completing Form 1099-MISC, which is commonly used for reporting miscellaneous income. |

Helpful Answers

Can I download tax forms from Upwork if I’m not a US citizen?

Yes, Upwork allows freelancers from all countries to download tax forms. However, the specific forms available may vary depending on your country of residence.

What if I can’t find the tax form I need on Upwork?

If you’re unable to locate a specific tax form on Upwork, you can contact Upwork’s support team for assistance. They can guide you to the correct form or provide alternative options.

Can I use Upwork’s tax forms for my taxes outside of the US?

While Upwork’s tax forms are primarily designed for US freelancers, they may also be useful for freelancers in other countries. However, it’s important to consult with a local tax professional to ensure compliance with your country’s tax regulations.