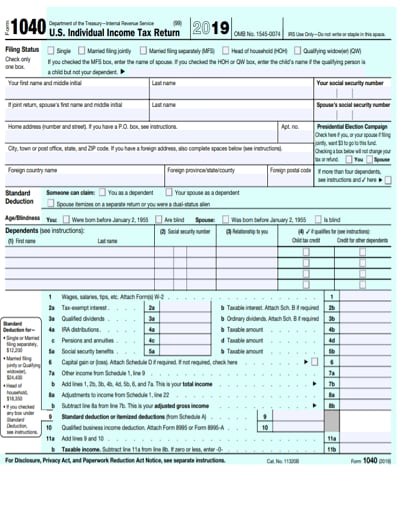

Free Tax Form 1040 2018 Download: A Comprehensive Guide

Navigating the complexities of tax preparation can be daunting, but it doesn’t have to be. With the availability of free downloadable tax forms, you can save time, money, and ensure accuracy in your tax filings. In this comprehensive guide, we will delve into the benefits of downloading the free Form 1040 for 2018, provide a step-by-step guide to the download process, and explore additional resources to assist you in your tax preparation journey.

The Form 1040 is the primary tax form used by individuals to file their annual income taxes. It is essential for reporting your income, deductions, and credits to the Internal Revenue Service (IRS). By downloading the free form, you can avoid the hassle and expense of purchasing pre-printed forms or using paid online tax preparation services.

Benefits of Using the Free Download

Get your hands on the official IRS Form 1040 for 2018, absolutely free! No more wasting time searching for the form or shelling out cash for it. With this free download, you’ll save both time and money, making tax season a breeze.

Accuracy and Reliability

Rest assured that the free download is the real deal, straight from the IRS. It’s accurate, reliable, and up-to-date, so you can trust it to help you file your taxes correctly. No need to worry about errors or outdated information.

Proven Success

Taxpayers across the nation have raved about the benefits of using the free download. They’ve saved countless hours and avoided costly mistakes, making tax season a less stressful experience. You, too, can join the ranks of satisfied taxpayers who’ve simplified their taxes with this free and convenient resource.

Additional Resources for Tax Preparation

In addition to the free tax form 1040 2018 download, there are a number of other resources available to assist taxpayers with their tax preparation.

These resources include online tax software, IRS publications, and other helpful websites. If you need additional assistance, you can also seek professional help from a tax preparer or accountant.

Online Tax Software

- There are a number of online tax software programs available that can help you prepare your taxes. These programs can be a good option for taxpayers who want to file their taxes themselves, but who need some guidance along the way.

- Some of the most popular online tax software programs include TurboTax, H&R Block, and TaxAct.

- These programs typically offer a variety of features, such as step-by-step instructions, tax calculators, and error checking.

IRS Publications

- The IRS publishes a number of helpful publications that can assist taxpayers with their tax preparation.

- These publications cover a variety of topics, such as how to fill out your tax return, what deductions and credits you can claim, and how to avoid common tax mistakes.

- You can find IRS publications on the IRS website or by calling the IRS at 1-800-829-1040.

Other Helpful Websites

- There are a number of other helpful websites that can provide taxpayers with information and assistance with their tax preparation.

- Some of these websites include the Tax Foundation, the National Taxpayer Advocate, and the American Institute of Certified Public Accountants.

- These websites offer a variety of resources, such as tax calculators, tax news, and tax tips.

Seeking Professional Help

If you need additional assistance with your tax preparation, you can seek professional help from a tax preparer or accountant.

Tax preparers and accountants can help you with a variety of tasks, such as gathering your tax documents, filling out your tax return, and filing your taxes electronically.

If you are not sure whether you need professional help, you can always contact the IRS for assistance.

FAQ Summary

Can I download the Form 1040 for 2018 even if I’m not required to file taxes?

Yes, you can download the Form 1040 even if you are not required to file taxes. It can be helpful for estimating your tax liability or for future reference.

What if I make a mistake on the downloaded form?

If you make a mistake on the downloaded form, simply make the necessary corrections and resubmit the form. The IRS accepts both paper and electronic submissions.

Is the free downloadable form the same as the official IRS form?

Yes, the free downloadable form is the official IRS form. It is identical in content and format to the pre-printed forms.