Free New Jersey 1099 Form Download: A Comprehensive Guide

Filing 1099 forms can be a daunting task, especially if you’re unfamiliar with the process. But don’t worry, we’ve got you covered! In this comprehensive guide, we’ll provide you with everything you need to know about downloading and completing New Jersey 1099 forms.

We’ll walk you through the different types of 1099 forms available, show you where to find free downloads, and give you step-by-step instructions on how to fill them out. We’ll also cover any state-specific requirements you need to be aware of.

Free New Jersey 1099 Form Options

Finding free New Jersey 1099 forms online is a breeze, innit? Whether you’re a freelancer, contractor, or self-employed, there’s a plethora of websites and platforms where you can grab these forms without breaking the bank.

From government agencies to tax preparation software providers and non-profit organizations, there’s no shortage of reputable sources offering free New Jersey 1099 forms. Here’s a rundown of some of the top options:

Government Agencies

- New Jersey Division of Taxation: The official website of the New Jersey Division of Taxation provides free downloadable 1099 forms in PDF format. These forms are updated annually to reflect the latest tax laws and regulations.

- Internal Revenue Service (IRS): The IRS website offers a comprehensive library of tax forms, including 1099 forms for all states, including New Jersey. These forms are available in both PDF and fillable formats.

Tax Preparation Software Providers

- TurboTax: TurboTax, a popular tax preparation software provider, offers free downloadable 1099 forms for New Jersey residents. These forms are easy to fill out and can be filed electronically or by mail.

- H&R Block: H&R Block, another well-known tax preparation software provider, also offers free downloadable 1099 forms for New Jersey. These forms are available in both English and Spanish.

Non-Profit Organizations

- National Association for the Self-Employed (NASE): NASE, a non-profit organization dedicated to supporting self-employed individuals, provides free downloadable 1099 forms for New Jersey residents. These forms are available in PDF format.

- Freelancers Union: The Freelancers Union, a non-profit organization representing freelance workers, offers free downloadable 1099 forms for New Jersey residents. These forms are available in both English and Spanish.

Form Types and Compatibility

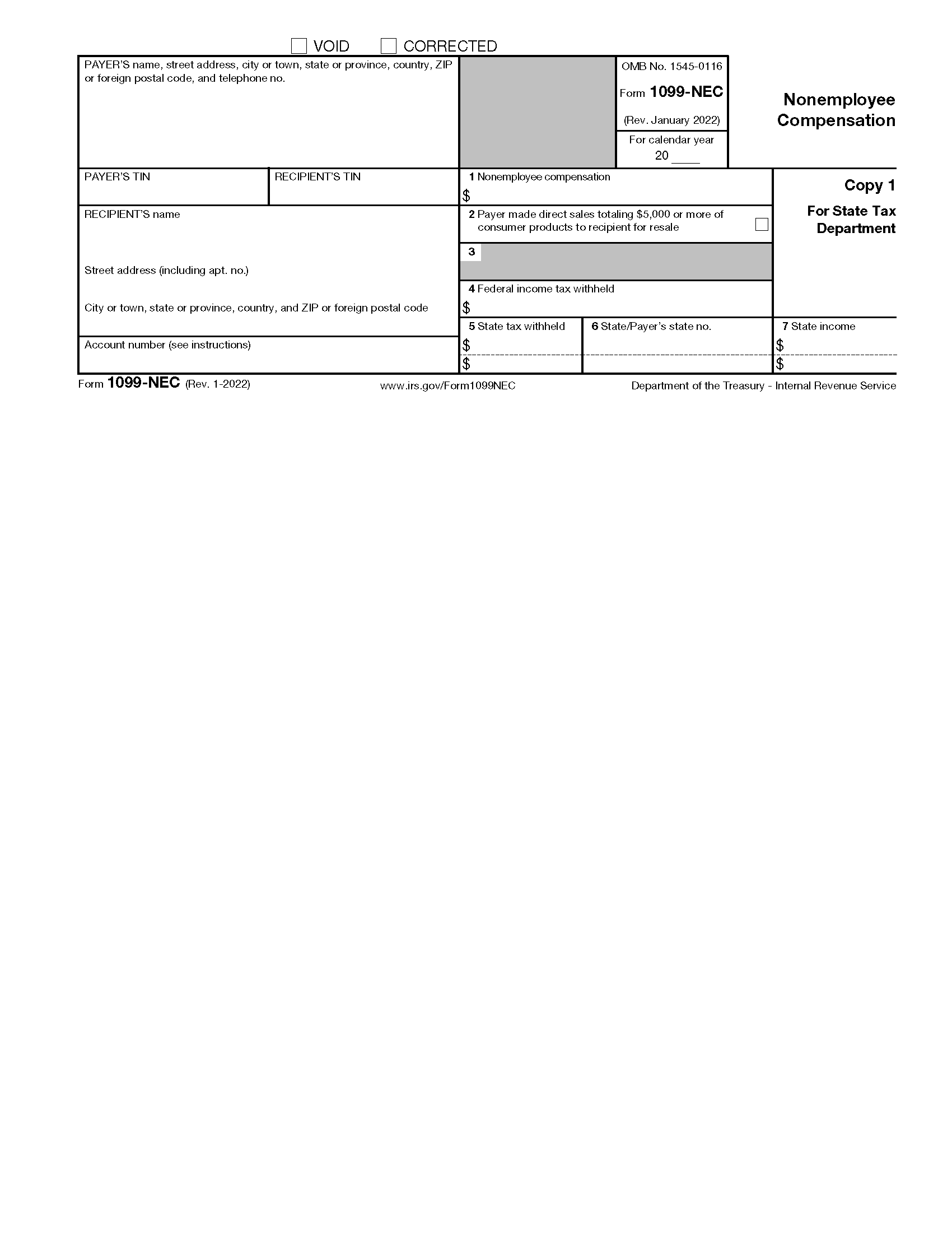

Blud, let’s chat about the diff types of 1099 forms you can nick for free. There’s the 1099-NEC, 1099-MISC, and 1099-INT.

Now, let’s talk about how they roll with different tax software and e-filing systems. It’s like a buncha different crews, innit? Some forms are tight with certain software, while others are more chilled with a wider range. We’ll break it down for ya.

1099-NEC Form

- This form is for payments to independent contractors and freelancers who you’ve shelled out more than $600 to.

- It shows the amount you’ve paid them, as well as any federal income tax, Social Security tax, and Medicare tax that’s been taken out.

1099-MISC Form

- This form is for all sorts of other income that doesn’t fit into the other 1099 forms.

- Things like rent, prizes, awards, and payments to attorneys are all fair game for the 1099-MISC.

1099-INT Form

- This form is for interest payments, like the ones you get from your bank account or investments.

- It shows the amount of interest you’ve earned, as well as any federal income tax that’s been taken out.

s and Guidance

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg?w=700)

Filing 1099 forms can be a bit daunting, but it doesn’t have to be. Here’s a quick and easy guide to help you get it done right.

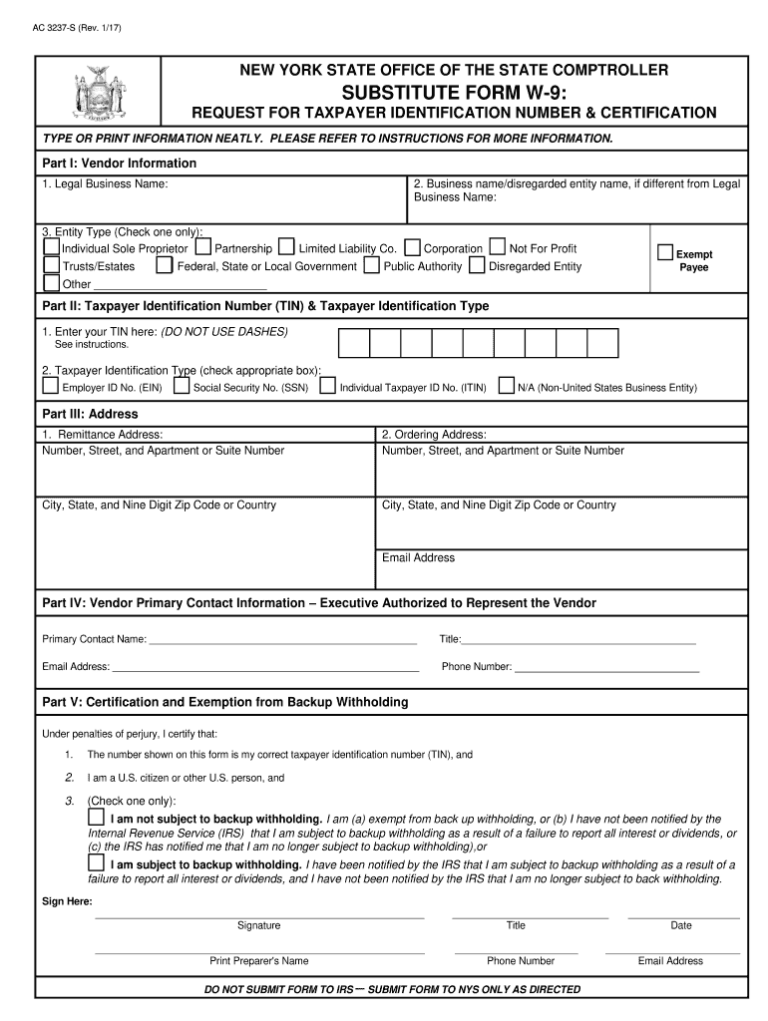

Whether you’re filing by paper or electronically, it’s important to make sure you have all the information you need. This includes your recipient’s name, address, and tax ID number, as well as the amount of income you paid them during the year.

Paper Submissions

To file by paper, simply download the appropriate form from the IRS website and fill it out. Once you’ve completed the form, mail it to the IRS at the address provided on the form.

Electronic Submissions

If you’re filing electronically, you’ll need to use an IRS-approved e-file provider. Once you’ve chosen a provider, you’ll need to create an account and follow their instructions for submitting your 1099 forms.

No matter which method you choose, it’s important to file your 1099 forms on time. The deadline for filing paper forms is January 31st, and the deadline for filing electronically is March 31st.

State-Specific Requirements

New Jersey imposes specific requirements for filing 1099 forms, including deadlines, penalties, and other considerations. Understanding these regulations is crucial for businesses and individuals to ensure compliance and avoid potential legal consequences.

In New Jersey, businesses are required to file 1099 forms for payments made to non-employees, such as independent contractors and freelancers. The forms must be filed with the New Jersey Division of Taxation by January 31st of the following year.

Penalties

Failure to file 1099 forms on time or provide accurate information can result in penalties. The penalties for late filing range from $50 to $500 per form, depending on the number of days late. Additionally, there may be interest charges on any unpaid taxes.

Other Considerations

Businesses are also required to provide copies of 1099 forms to the recipients by January 31st. This helps ensure that the recipients can accurately report their income and avoid any tax-related issues.

It’s important to note that these requirements are subject to change, so it’s always a good idea to consult with the New Jersey Division of Taxation for the most up-to-date information.

Additional Resources and Support

Individuals may seek assistance with 1099 form filing through various resources and support channels.

For guidance, individuals can access:

Tax Preparation Assistance Programs

- Free File Alliance: Provides free tax preparation software for eligible individuals.

- Volunteer Income Tax Assistance (VITA): Offers free tax preparation services to low- and moderate-income individuals.

Online Forums and Resources

- IRS website: Comprehensive information and guidance on 1099 forms and tax filing.

- Tax forums: Online communities where individuals can connect with tax professionals and seek advice.

Professional Tax Services

- Certified Public Accountants (CPAs): Provide professional tax preparation and advisory services.

- Enrolled Agents (EAs): Licensed tax professionals authorized to represent taxpayers before the IRS.

Additionally, individuals can contact the New Jersey Division of Taxation at (609) 292-6400 or visit their website for further guidance and support.

Frequently Asked Questions

Where can I find free New Jersey 1099 forms?

You can find free New Jersey 1099 forms on the websites of the New Jersey Division of Taxation and the Internal Revenue Service.

What are the different types of 1099 forms?

There are several different types of 1099 forms, including Form 1099-NEC (Nonemployee Compensation), Form 1099-MISC (Miscellaneous Income), and Form 1099-INT (Interest Income).

How do I fill out a 1099 form?

The specific instructions for filling out a 1099 form will vary depending on the type of form you’re using. However, in general, you’ll need to provide the recipient’s name, address, and taxpayer identification number, as well as the amount of income you paid them.

What are the deadlines for filing 1099 forms?

The deadline for filing 1099 forms is January 31st of the year following the year in which the income was paid.

What are the penalties for filing 1099 forms late?

The penalties for filing 1099 forms late can vary depending on the number of forms you file late and how late you file them. However, the maximum penalty is $250 per form.