Free Nc4 Form 2024 Download: A Comprehensive Guide

Navigating the complexities of tax filing can be a daunting task, especially when dealing with specialized forms like Form NC4. This guide will provide you with a comprehensive overview of Form NC4, its significance, and where to find the free download for the latest version. We’ll also explore key features, offer tips for effective usage, and discuss alternatives to Form NC4. Let’s dive in and simplify your tax filing process.

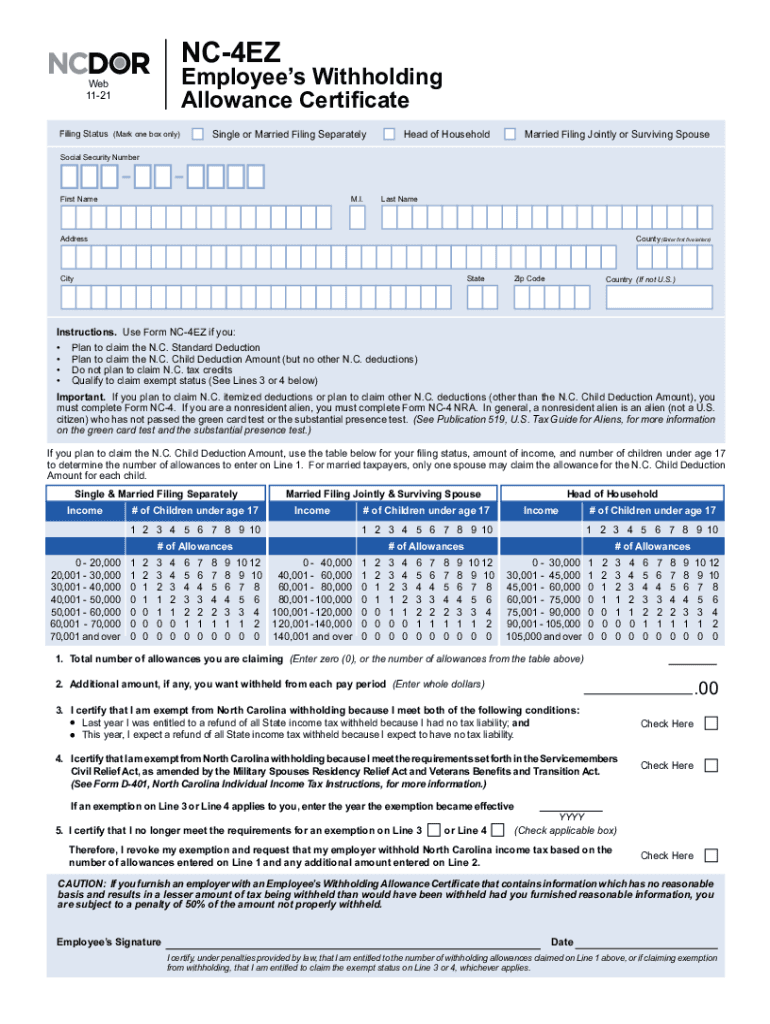

Form NC4 is an essential document for individuals and businesses in North Carolina. It serves as a tax return form for reporting income, deductions, and credits. Understanding its purpose and requirements is crucial to ensure accurate and timely filing. This guide will empower you with the knowledge and resources to confidently handle Form NC4 and fulfill your tax obligations.

Overview of Form NC4

Form NC4 is a legal document used in North Carolina to initiate a civil action in court. It is the first step in filing a lawsuit and is required for all civil cases, except for small claims cases.

The purpose of Form NC4 is to provide the court with basic information about the case, including the names of the parties involved, the nature of the claim, and the relief sought. The form must be completed and filed with the clerk of court in the county where the defendant resides or where the incident giving rise to the claim occurred.

Target Audience

Form NC4 is intended for use by individuals or businesses who are seeking to file a civil lawsuit in North Carolina. It is not necessary to have an attorney to complete the form, but it is recommended that you seek legal advice before filing a lawsuit.

Filing Requirements

To file a civil lawsuit in North Carolina, you must complete and file Form NC4 with the clerk of court. The form must be accompanied by a filing fee, which varies depending on the county in which the case is filed. You may also need to file additional documents, such as a summons and complaint.

Alternatives to Form NC4

In addition to Form NC4, there are a number of other methods or forms that can be used to achieve similar purposes. Each alternative has its own advantages and disadvantages, so it’s important to consider the specific needs of your situation before making a decision.

One alternative to Form NC4 is to use a written contract. A written contract is a legally binding agreement that Artikels the terms of a transaction or agreement. Written contracts can be used for a variety of purposes, including the sale of goods or services, the lease of property, or the employment of an individual. The main advantage of using a written contract is that it provides a clear and concise record of the agreement between the parties. This can help to avoid misunderstandings and disputes down the road. However, written contracts can also be time-consuming and expensive to prepare.

Another alternative to Form NC4 is to use an oral agreement. An oral agreement is a legally binding agreement that is not written down. Oral agreements can be used for a variety of purposes, but they are generally not as reliable as written contracts. This is because it can be difficult to prove the terms of an oral agreement if there is a dispute between the parties. However, oral agreements can be less time-consuming and expensive to create than written contracts.

Finally, you may also consider using a combination of written and oral agreements. This can be a good option if you want to have a legally binding agreement but also want to avoid the time and expense of a formal written contract.

Factors to Consider

When choosing an alternative to Form NC4, there are a number of factors to consider. These factors include:

- The purpose of the agreement.

- The parties involved.

- The amount of money involved.

- The level of risk involved.

Once you have considered these factors, you can make an informed decision about which alternative is right for you.

Common Questions and Answers

Got questions about Form NC4? We’ve got answers.

Below, you’ll find some of the most commonly asked questions about Form NC4, along with clear and concise answers.

What is Form NC4 used for?

Form NC4 is used to apply for a North Carolina driver’s license or identification card.

Who needs to fill out Form NC4?

Anyone who wants to apply for a North Carolina driver’s license or identification card needs to fill out Form NC4.

Where can I get Form NC4?

You can get Form NC4 online from the North Carolina Division of Motor Vehicles (DMV) website or at any DMV office.

How do I fill out Form NC4?

The instructions for filling out Form NC4 are available on the DMV website. You can also get help filling out the form at any DMV office.

What documents do I need to submit with Form NC4?

The documents you need to submit with Form NC4 vary depending on your circumstances. For a complete list of required documents, please visit the DMV website.

How long does it take to process Form NC4?

The processing time for Form NC4 varies depending on the volume of applications. However, you can expect to receive your driver’s license or identification card within 30 days of submitting your application.

Questions and Answers

What is the purpose of Form NC4?

Form NC4 is a North Carolina Individual Income Tax Return form used to report income, deductions, and credits for tax purposes.

Who needs to file Form NC4?

Individuals and businesses with income or tax liability in North Carolina are required to file Form NC4.

Where can I find the free download for Form NC4?

You can download the latest version of Form NC4 from the North Carolina Department of Revenue website.

What are some tips for completing Form NC4 accurately?

Gather all necessary documents, read the instructions carefully, and double-check your calculations before submitting the form.

Are there any alternatives to filing Form NC4?

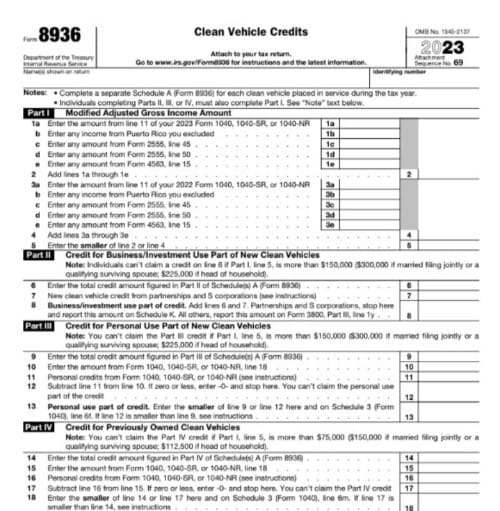

In certain cases, you may be able to use Form 1040 or other tax software to file your North Carolina taxes.