Free Mo W4 Form Download: A Comprehensive Guide for Employers and Employees

Navigating the complexities of tax forms can be a daunting task, especially when it comes to the Mo W4 form. This essential document plays a crucial role in determining the amount of federal income tax withheld from your paycheck. In this comprehensive guide, we will delve into the world of the Mo W4 form, providing you with all the information you need to download, complete, and utilize it effectively.

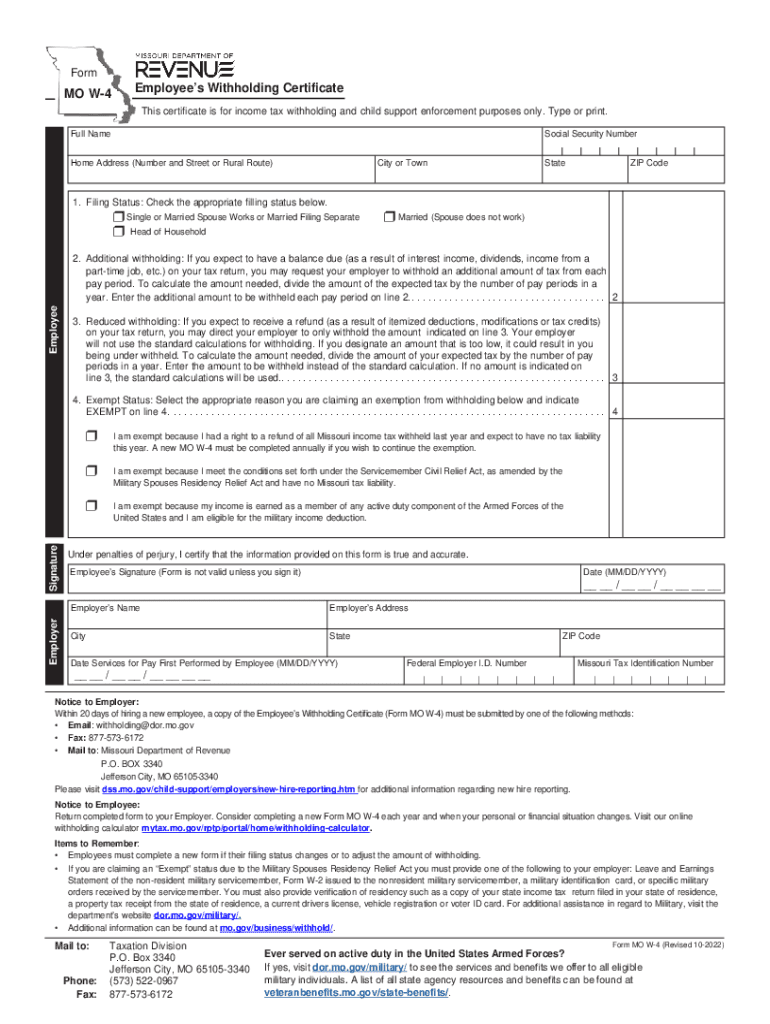

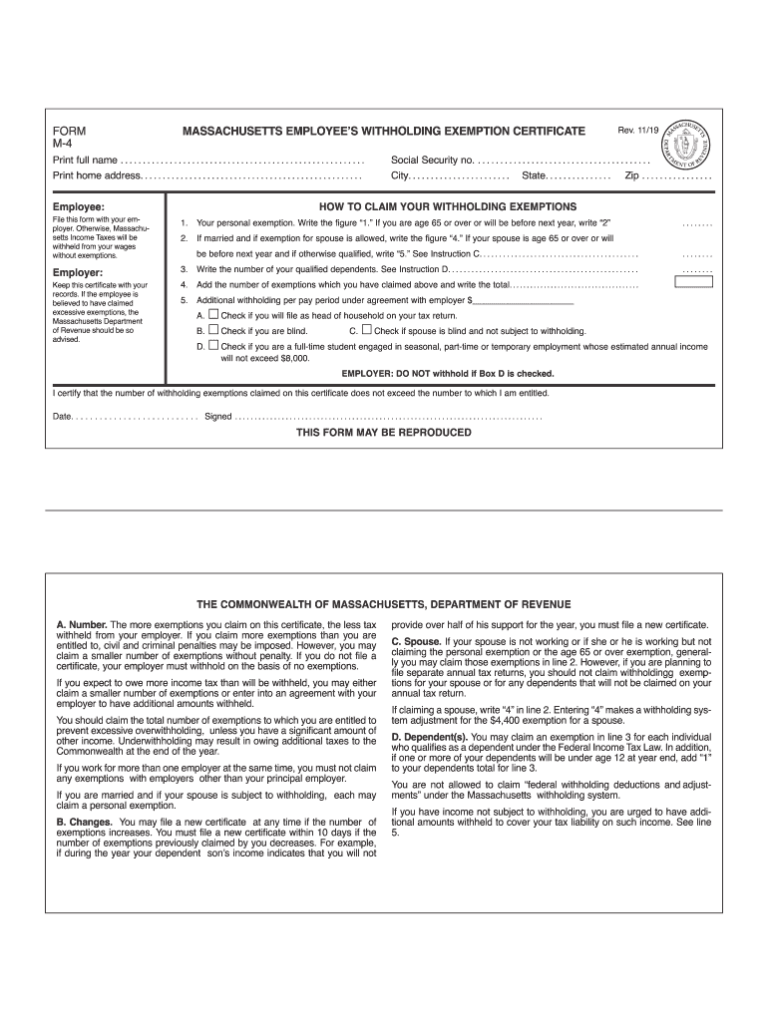

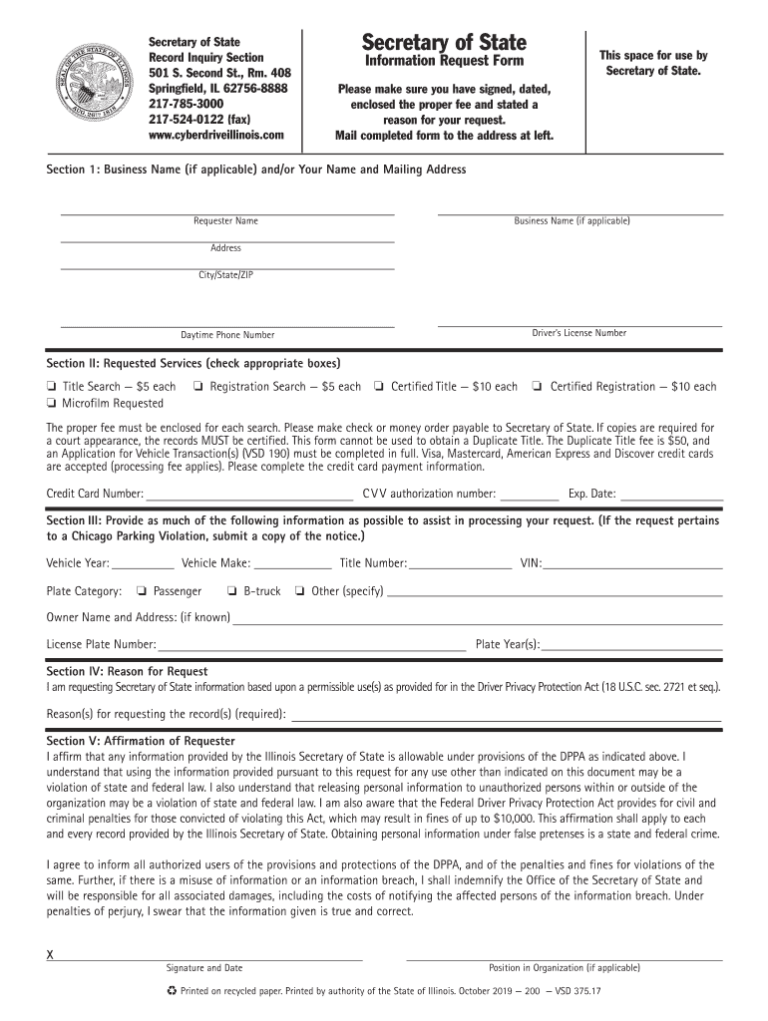

The Mo W4 form, also known as the Employee’s Withholding Certificate, is a legal document that you must complete and submit to your employer. It serves as a communication tool between you and the Internal Revenue Service (IRS), informing them of your withholding allowances and other relevant information. By understanding the significance and benefits of the Mo W4 form, you can ensure accurate tax withholding, avoid penalties, and optimize your financial situation.

Overview of Free Mo W4 Form

The Mo W4 form is an official document used by employers and employees to determine the amount of federal income tax that should be withheld from an employee’s paycheck. It is a crucial document that ensures the correct calculation of tax deductions, minimizing the risk of overpaying or underpaying taxes.

For employers, the Mo W4 form provides essential information about the employee’s tax withholding preferences. This information guides the employer in calculating the correct amount of tax to withhold from the employee’s wages, ensuring compliance with tax regulations.

For employees, the Mo W4 form empowers them to manage their tax obligations. By completing the form accurately, employees can indicate their desired withholding amount, allowing them to adjust their tax deductions and avoid potential tax penalties or refunds.

Examples of Scenarios Where a Mo W4 Form is Required

- When starting a new job, employees are required to complete a Mo W4 form to provide their employer with their tax withholding preferences.

- If an employee experiences a significant life event, such as marriage, divorce, or the birth of a child, they should review and update their Mo W4 form to ensure their withholding accurately reflects their current circumstances.

- Employees who have multiple jobs or receive income from various sources may need to adjust their Mo W4 forms to prevent over-withholding or under-withholding of taxes.

Tips for Completing a Mo W4 Form

Completing a Mo W4 form is essential for ensuring that you pay the correct amount of taxes throughout the year. Here are some essential tips to help you fill out the form accurately and avoid any potential issues:

When filling out your personal information, make sure that it matches the information on your Social Security card. This includes your name, address, and Social Security number.

Withholding allowances are used to calculate how much federal income tax is withheld from your paycheck. The more allowances you claim, the less tax will be withheld. However, if you claim too many allowances, you may end up owing taxes when you file your tax return.

To determine the correct number of withholding allowances to claim, you can use the IRS’s withholding calculator. This calculator will ask you a series of questions about your income, dependents, and other factors to help you determine the correct number of allowances to claim.

If you are unsure about how to fill out any part of the Mo W4 form, you can contact the IRS for assistance. They can provide you with guidance on how to complete the form and answer any questions you may have.

Common Mistakes to Avoid

- Claiming too many withholding allowances. This can result in you owing taxes when you file your tax return.

- Not claiming enough withholding allowances. This can result in you having too much tax withheld from your paycheck.

- Making mistakes on your personal information. This can delay the processing of your W4 form and could result in errors on your tax return.

- Not signing and dating the form. This can make the form invalid.

Additional Resources and Support

If you need further assistance with your Mo W4 form, there are several resources available to you.

Official Websites

The official websites of the IRS and the state tax authority in your area provide a wealth of information on Mo W4 forms, including instructions, FAQs, and online tools.

Tax Professionals

If you have complex tax situations or need personalized advice, you may want to consult with a tax professional, such as a certified public accountant (CPA) or an enrolled agent (EA).

Online Forums

There are numerous online forums where you can connect with other taxpayers and tax professionals to ask questions and share information about Mo W4 forms.

Personalized Assistance

If you need personalized assistance, you can contact the IRS by phone or mail. You can also make an appointment at a local IRS office.

FAQ Corner

What is the purpose of the Mo W4 form?

The Mo W4 form is used to determine the amount of federal income tax withheld from your paycheck. It helps ensure that the correct amount of tax is withheld, minimizing the risk of overpaying or underpaying taxes.

Who needs to complete a Mo W4 form?

All employees in the United States are required to complete a Mo W4 form when they start a new job or experience a change in their tax situation.

Where can I download a free Mo W4 form?

You can download a free Mo W4 form from the IRS website or through reputable online resources that provide tax-related documents.

What are the benefits of downloading a free Mo W4 form?

Downloading a free Mo W4 form saves you money compared to purchasing a paid or subscription-based form. It also provides convenience and flexibility, allowing you to access and complete the form at your own pace.

What are some common mistakes to avoid when completing a Mo W4 form?

Common mistakes include providing incorrect personal information, claiming too many or too few withholding allowances, and failing to sign and date the form. Carefully review the instructions and consult with a tax professional if needed to avoid errors.