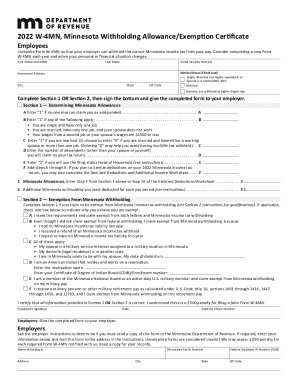

Free Mn W-4 Form 2024 Download: A Comprehensive Guide

Navigating the complexities of tax withholding can be a daunting task, but understanding and utilizing the Minnesota W-4 form is crucial for ensuring accurate tax deductions from your paychecks. This guide will provide a comprehensive overview of the Free Mn W-4 Form 2024, empowering you to complete it confidently and optimize your tax withholding strategy.

The Minnesota W-4 form is an essential document used by employers to determine the amount of federal and state income tax withheld from your earnings. By providing accurate information on this form, you can avoid overpaying or underpaying taxes, ensuring financial stability and peace of mind throughout the year.

Free Mn W-4 Form 2024 Overview

The Minnesota W-4 form is a tax document used by employees to provide their employers with information about their tax withholding. The 2024 W-4 form covers the tax year 2024, which runs from January 1, 2024, to December 31, 2024. All employees who are required to file a federal income tax return must also file a Minnesota W-4 form.

Who Should Use the Minnesota W-4 Form?

The Minnesota W-4 form should be used by all employees who:

- Are required to file a federal income tax return

- Have income from employment in Minnesota

- Are not claimed as a dependent on someone else’s tax return

Downloading the Free Mn W-4 Form 2024

The Minnesota Department of Revenue provides a free online resource for downloading the W-4 form for the 2024 tax year. The form is available in both PDF and fillable formats, making it convenient for taxpayers to complete and submit.

Accessing the Download Page

To download the free Mn W-4 Form 2024, follow these steps:

1. Visit the official website of the Minnesota Department of Revenue: https://www.revenue.state.mn.us/

2. In the search bar, type “W-4 form” and press enter.

3. Click on the first search result, titled “2024 Minnesota Individual Income Tax Forms and Instructions.”

4. Scroll down the page and locate the “Forms” section.

5. Under the “Forms” section, click on the link for “Form W-4, Minnesota Individual Income Tax Withholding Certificate.”

6. This will take you to the download page for the Mn W-4 Form 2024.

Additional Resources

On the download page, taxpayers can also find additional resources and information, including:

* Instructions for completing the W-4 form

* A withholding calculator to estimate tax liability

* Contact information for the Minnesota Department of Revenue

Completing the Mn W-4 Form 2024

Filling out your W-4 form accurately is crucial to ensure the correct amount of Minnesota income tax is withheld from your paychecks. Here’s a breakdown of each section:

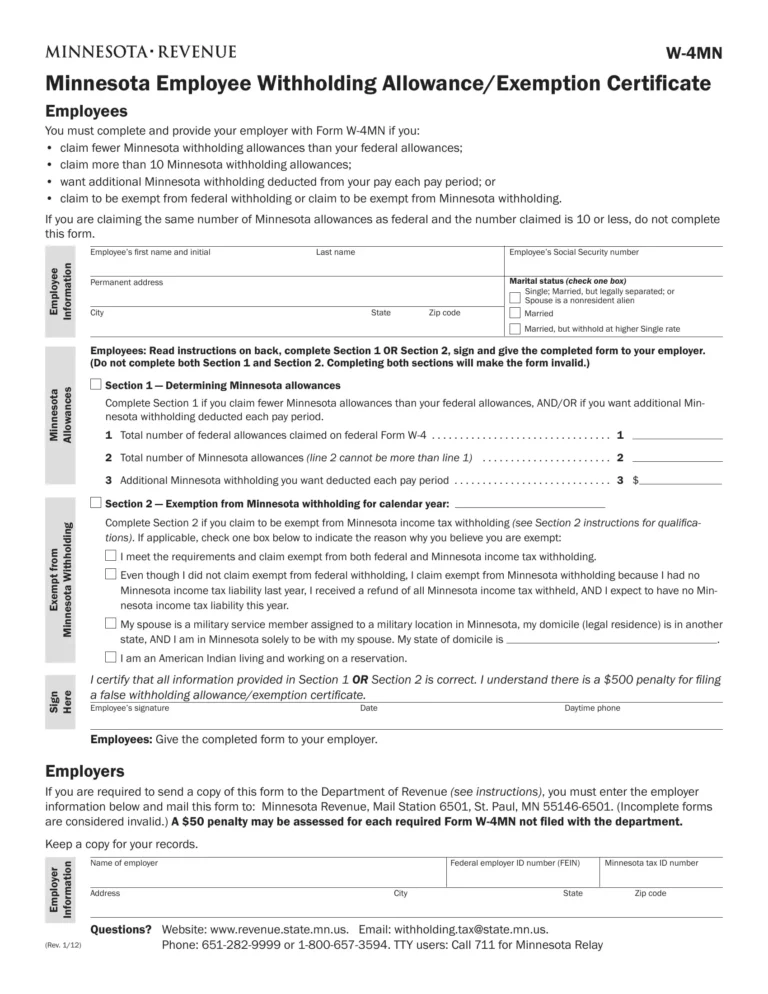

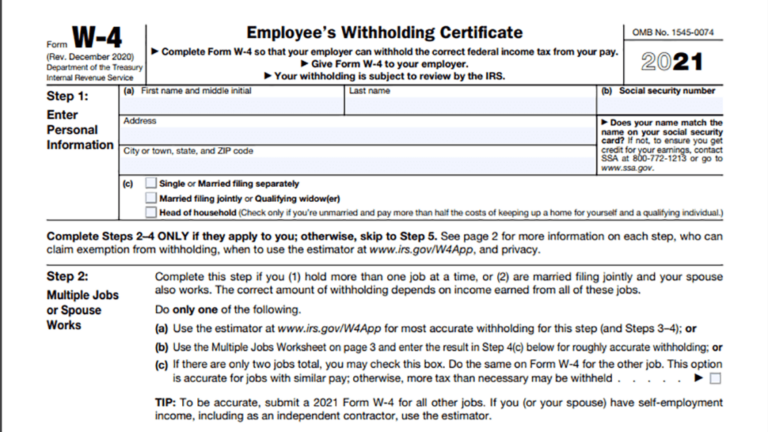

Personal Information

Start by filling in your personal details, including your name, address, and Social Security number. Double-check everything to avoid any errors.

Withholding Allowances

Withholding allowances represent the number of dependents you have, and they affect how much tax is taken out of your paycheck. Use the Personal Allowances Worksheet provided on the form to determine your allowances.

Additional Withholding

If you want extra tax withheld from each paycheck, fill in the “Additional Amount” box. This is useful if you anticipate owing taxes at the end of the year.

Minnesota Specifics

In Minnesota, you can also choose to have your state income tax withheld at a different rate than your federal income tax. If you prefer this, check the “Different Minnesota Withholding” box and enter the percentage you want withheld.

Using the Mn W-4 Form 2024

The W-4 form is used by employers to calculate how much tax to withhold from your paycheck. The information you provide on the form tells your employer how many allowances you claim, which affects the amount of tax that is withheld. The more allowances you claim, the less tax will be withheld from your paycheck.

It’s important to make sure that the information on your W-4 form is accurate, as it can have a big impact on the amount of taxes you owe. If you claim too few allowances, you may end up owing taxes when you file your tax return. If you claim too many allowances, you may end up getting a refund when you file your tax return, but you will have to pay interest on the taxes that you should have paid during the year.

Adjusting the W-4 Form

You can adjust your W-4 form at any time if your withholding needs to be changed. For example, you may need to adjust your W-4 form if you get a new job, get married, or have a child. You can also adjust your W-4 form if you expect to have a large refund or owe taxes when you file your tax return.

To adjust your W-4 form, simply complete a new form and give it to your employer. Your employer will then use the information on the new form to calculate your withholding.

Additional Resources and Considerations

To complement your understanding of Minnesota withholding, we’ve compiled a list of useful resources and additional considerations to assist you.

Remember that special circumstances may apply to your situation. Explore the resources below to gain a comprehensive understanding of your withholding responsibilities.

Relevant Resources

- Minnesota Department of Revenue: https://www.revenue.state.mn.us/withholding-tax

- Minnesota Withholding Tax Tables: https://www.revenue.state.mn.us/withholding-tax-tables

- Minnesota Withholding Calculator: https://www.revenue.state.mn.us/withholding-calculator

Special Considerations

- Non-resident withholding: Different rules apply if you’re not a Minnesota resident.

- Multiple jobs: If you have more than one job, you may need to adjust your withholding to avoid overpaying or underpaying taxes.

- Itemized deductions: If you itemize deductions on your tax return, you may be able to claim additional withholding allowances.

Contact Information

For further assistance with Minnesota withholding or tax-related questions, contact the Minnesota Department of Revenue:

- Phone: 651-296-3781

- Email: [email protected]

Common Queries

What is the purpose of the Minnesota W-4 form?

The Minnesota W-4 form is used by employers to determine the amount of federal and state income tax withheld from your paychecks. It helps ensure that the appropriate amount of taxes is withheld throughout the year, minimizing the risk of overpayment or underpayment.

How do I download the Free Mn W-4 Form 2024?

You can download the Free Mn W-4 Form 2024 from the official Minnesota Department of Revenue website. The form is available in both PDF and fillable online formats for your convenience.

What information do I need to complete the Mn W-4 Form 2024?

To complete the Mn W-4 Form 2024, you will need to provide personal information such as your name, address, and Social Security number. You will also need to indicate your filing status, number of dependents, and any additional withholding you wish to have deducted from your paychecks.

How do I use the Mn W-4 Form 2024?

Once you have completed the Mn W-4 Form 2024, you will need to submit it to your employer. Your employer will use the information provided on the form to calculate the amount of federal and state income tax withheld from your paychecks.

What should I do if my withholding needs to be changed?

If your withholding needs to be changed, you can complete a new Mn W-4 Form 2024 and submit it to your employer. Your employer will adjust your withholding accordingly.