Free Mi W-4p Form 2024 Download: A Comprehensive Guide

Navigating the complexities of tax withholding can be daunting, but the Mi W-4p form is here to simplify the process for 2024. As you embark on your tax planning journey, this free and user-friendly form empowers you to optimize your tax withholdings, ensuring accuracy and minimizing surprises come tax time. Dive into this comprehensive guide to unlock the benefits of the Mi W-4p form and gain control over your tax obligations.

The Mi W-4p form is an essential tool for employees to communicate their withholding preferences to their employers. By accurately completing this form, you can avoid overpaying or underpaying taxes, ensuring that the right amount is withheld from your paycheck throughout the year. Whether you’re a seasoned tax pro or a first-time filer, this guide will provide you with the knowledge and resources you need to navigate the Mi W-4p form with confidence.

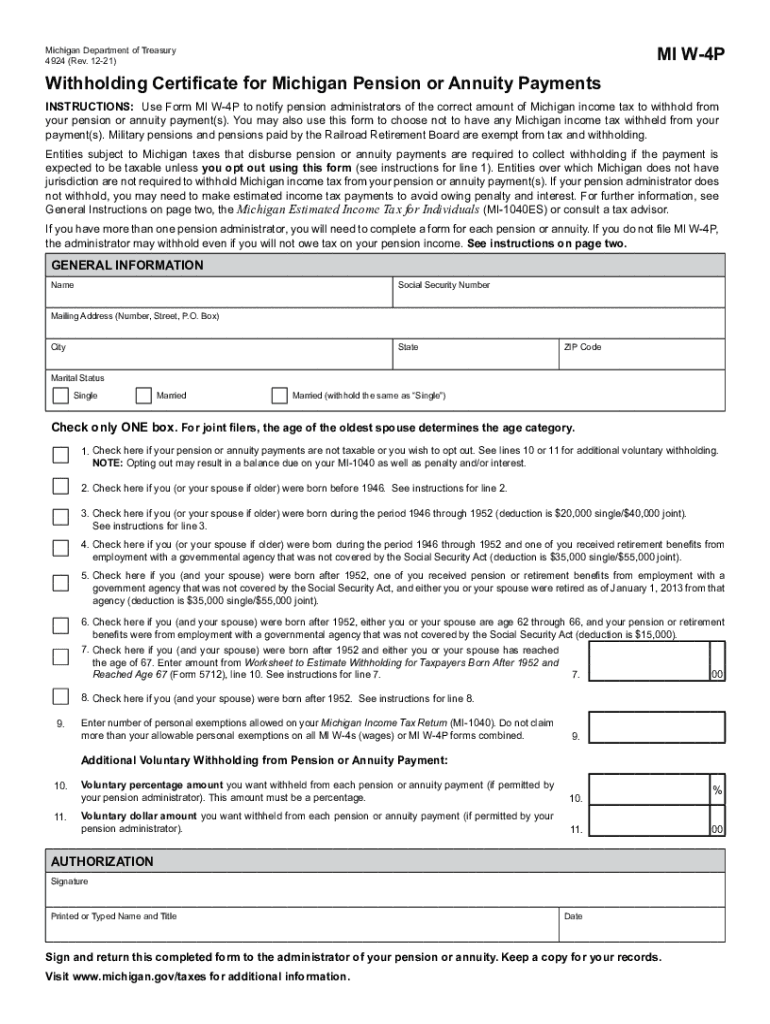

Understanding the Mi W-4p Form and its Implications

The Mi W-4p form is an essential tool for employees in Michigan to accurately calculate their state income tax withholdings. By understanding the different sections and fields of the form, individuals can ensure they are withholding the correct amount of taxes, potentially saving money or avoiding penalties.

Sections and Fields of the Mi W-4p Form

- Personal Information: Includes your name, address, and Social Security number.

- Exemptions: Indicates the number of withholding allowances you claim, which reduces the amount of tax withheld from your paycheck.

- Additional Withholding: Allows you to specify an additional amount to be withheld from each paycheck.

- Signature and Date: Your signature and the date you complete the form are required.

Implications of Completing the Mi W-4p Form

Completing the Mi W-4p form has significant implications for your tax withholdings. If you claim too many allowances, you may end up underpaying your taxes and face penalties when you file your tax return. Conversely, if you claim too few allowances, you may overpay your taxes and receive a refund when you file.

Optimizing Tax Withholdings

The Mi W-4p form provides flexibility in optimizing your tax withholdings. By considering your income, deductions, and tax credits, you can determine the appropriate number of allowances to claim. This can help you avoid over- or underpaying taxes throughout the year.

Example

For instance, if you earn $50,000 annually and have a standard deduction of $12,950, you may be eligible to claim 3 allowances. This would reduce your monthly tax withholding by approximately $100, resulting in a larger take-home pay.

Alternatives to the Mi W-4p Form

The Mi W-4p Form is not the only option for managing tax withholdings. There are several alternative methods that may be more suitable for certain circumstances.

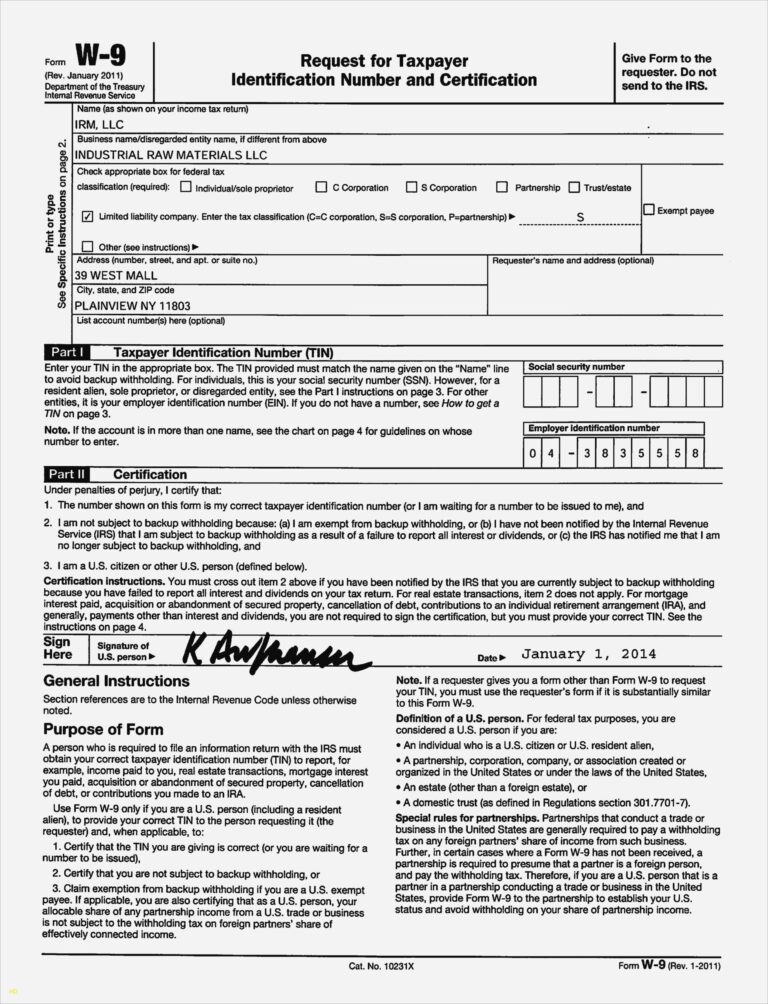

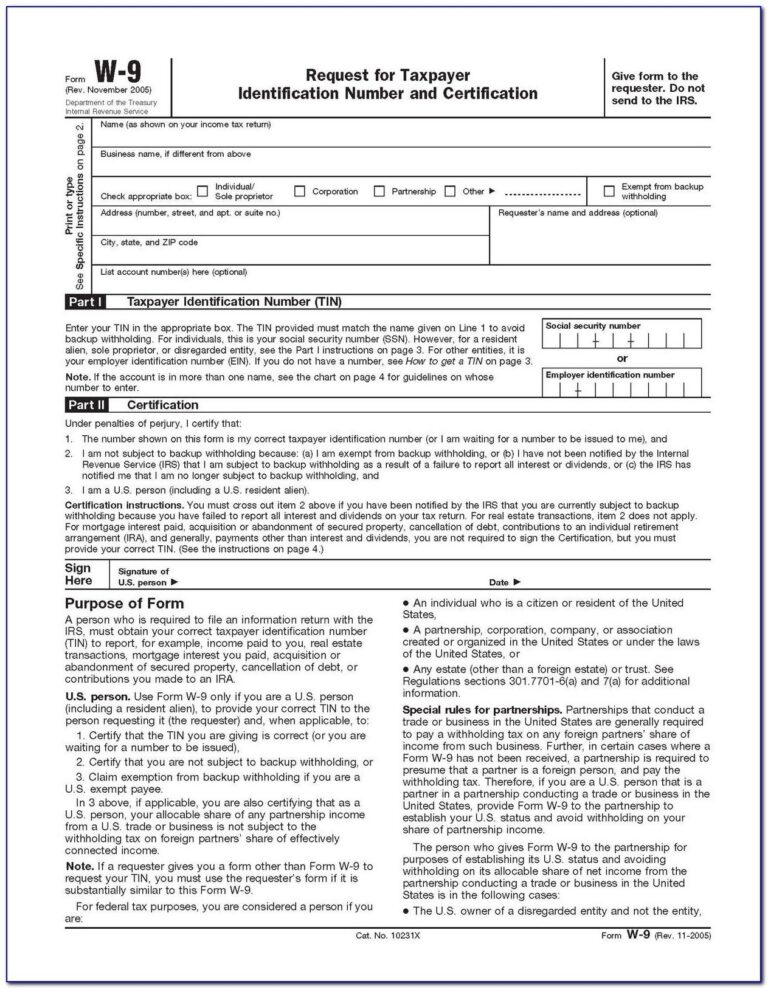

One alternative is to use the traditional W-4 Form. The W-4 Form is a federal tax form that is used to calculate the amount of income tax that should be withheld from an employee’s paycheck. The W-4 Form is less complex than the Mi W-4p Form and may be easier to understand for some employees. However, the W-4 Form does not take into account state income taxes, so it may not be the best option for employees who live in states with high income taxes.

Another alternative to the Mi W-4p Form is to use a payroll withholding calculator. Payroll withholding calculators are available online and can be used to estimate the amount of income tax that should be withheld from an employee’s paycheck. Payroll withholding calculators are easy to use and can be a good option for employees who want to get a quick estimate of their tax liability. However, payroll withholding calculators are not as accurate as the Mi W-4p Form or the W-4 Form, so they should not be used as a substitute for these forms.

Finally, employees can also choose to have no income tax withheld from their paychecks. This option is known as “claiming zero allowances.” Claiming zero allowances can result in a larger refund at the end of the year, but it can also lead to owing taxes if the employee does not have enough other income to cover their tax liability.

Additional Resources and Support

Official IRS Resources

- IRS website: https://www.irs.gov/forms-pubs/about-form-w-4p

- Mi W-4p form instructions: https://www.irs.gov/pub/irs-pdf/iw4p.pdf

- IRS Publication 15-T: https://www.irs.gov/publications/p15t

IRS Assistance and Guidance

- Phone: 1-800-829-1040

- Email: [email protected]

- Online chat: https://www.irs.gov/help/contact-your-local-irs-office

Additional Information and Support Online

- National Payroll Reporting Consortium (NPRC): https://www.nprc.org/

- American Payroll Association (APA): https://www.americanpayroll.org/

- Payroll Professionals Alliance (PPA): https://www.payrollprofessionalsalliance.com/

Helpful Answers

What are the eligibility criteria for using the Mi W-4p form?

To use the Mi W-4p form, you must meet the following criteria: be a U.S. citizen or resident alien, have only one job, and not claim dependents who are also claimed by another taxpayer.

Where can I find additional resources and support related to the Mi W-4p form?

The IRS website provides a range of resources, including the official Mi W-4p form, instructions, and FAQs. You can also contact the IRS directly for assistance and guidance.

What are the alternatives to using the Mi W-4p form?

Alternative methods for managing tax withholdings include using the traditional W-4 form, adjusting your withholding allowances, or making estimated tax payments. Each method has its own advantages and disadvantages, so it’s important to choose the option that best suits your individual circumstances.