Free Maryland Tax Forms 2024 Download: A Comprehensive Guide

Navigating the complexities of tax season can be a daunting task, especially when it comes to ensuring you have the right forms. If you’re a Maryland resident, accessing free Maryland tax forms for 2024 is crucial for filing your taxes accurately and on time. This comprehensive guide will provide you with all the essential information you need to download, fill out, and submit your Maryland tax forms with ease.

With the 2024 tax filing season approaching, it’s time to gather the necessary documents and prepare your finances. Understanding the types of tax forms available, where to find them, and how to complete them correctly is key to a smooth and stress-free filing process. This guide will walk you through each step, ensuring you have all the tools and knowledge you need to fulfill your tax obligations.

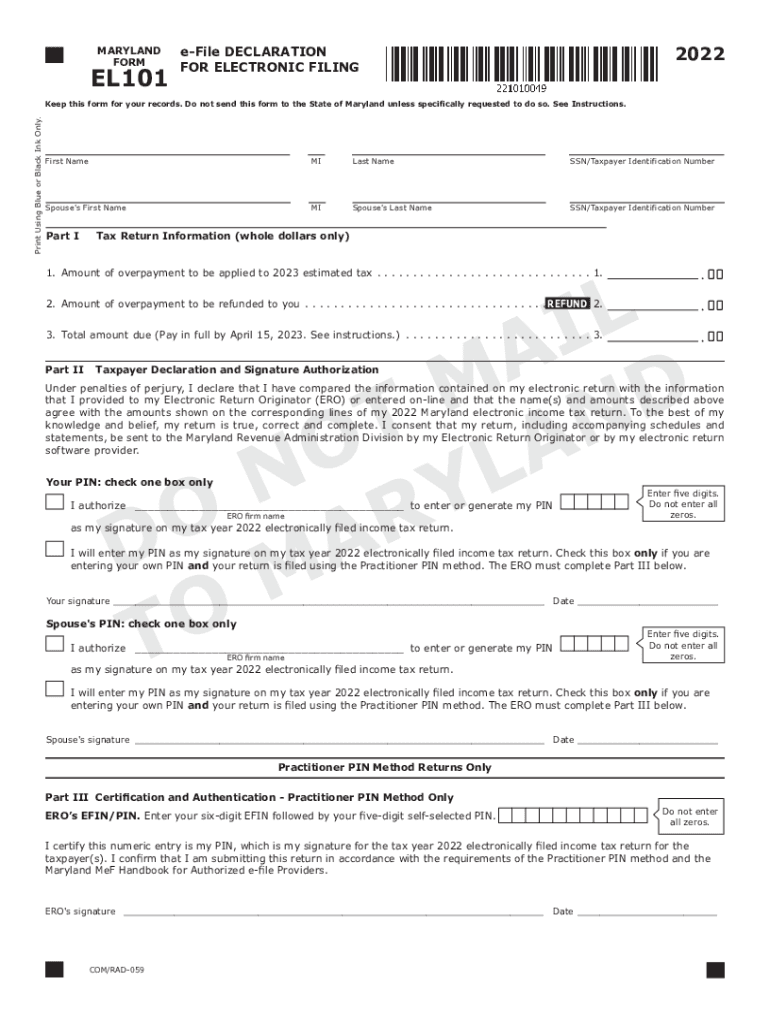

Filling Out Maryland Tax Forms

Banging job on getting your mitts on the Maryland tax forms, mate! To smash this out, let’s run through the basics, innit.

First up, make sure you’ve got all the right clobber. That means gathering up your P45, payslips, and any other bits and bobs you might need. Once you’ve got that sorted, you can start to fill in the forms.

Understanding the Forms

The forms might look a bit daunting at first, but don’t fret. Take your time and read through the instructions carefully. If there’s anything you don’t understand, don’t be afraid to ask for help. There’s plenty of info online or you can give the tax office a bell.

Submitting Maryland Tax Forms

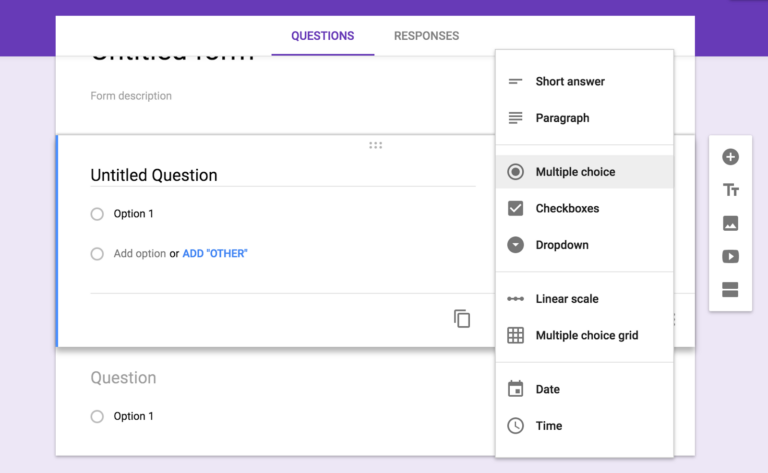

There are multiple ways to submit your Maryland tax forms: online, by mail, or in person.

Filing your Maryland tax forms online is the quickest and easiest method. You can file your forms directly through the Maryland Comptroller’s website. You will need to create an account and provide your personal information and tax documents.

If you prefer to file your Maryland tax forms by mail, you can download the forms from the Maryland Comptroller’s website or request them by phone. Once you have completed your forms, mail them to the address provided on the forms.

You can also file your Maryland tax forms in person at one of the Comptroller’s offices. You will need to bring your completed forms and any necessary supporting documentation.

Filing Deadlines

The deadline for filing your Maryland tax forms is April 15th. If you file your forms late, you may be subject to penalties and interest charges.

Resources for Maryland Tax Forms

The Maryland Comptroller’s Office and other organizations provide various resources to assist individuals with Maryland tax forms. These resources include online assistance, telephone support, and in-person assistance at local offices.

Contact Information

- Maryland Comptroller’s Office: (410) 260-7900 or 1-800-MD-TAXES

- Website: https://www.comp.maryland.gov/

Online Forums and Discussion Boards

Online forums and discussion boards provide a platform for taxpayers to connect with others and seek assistance with Maryland tax forms. These forums often have moderators or experts who can answer questions and provide guidance.

FAQs

Where can I download free Maryland tax forms?

You can download free Maryland tax forms from the Maryland Comptroller’s Office website at https://www.comp.maryland.gov/taxes/individual/forms.aspx.

What is the deadline for filing Maryland tax returns?

The deadline for filing Maryland tax returns is April 15, 2025.

What are the penalties for filing Maryland tax returns late?

The penalties for filing Maryland tax returns late include a late filing penalty of 5% per month, up to a maximum of 25%, and a late payment penalty of 1% per month, up to a maximum of 10%.