Free Ma Tax Forms 2024 Download: A Comprehensive Guide

Navigating the complexities of tax season can be daunting, but it doesn’t have to be. The Massachusetts Department of Revenue provides free tax forms to assist taxpayers in accurately filing their returns. This guide will provide a comprehensive overview of the available forms, offer step-by-step instructions for downloading and completing them, and Artikel the process for filing Massachusetts tax returns using these forms.

Whether you’re a seasoned tax filer or tackling your returns for the first time, this guide will empower you with the knowledge and resources necessary to navigate the tax season with confidence.

Free Massachusetts Tax Forms 2024 Overview

The Massachusetts Department of Revenue (DOR) is responsible for administering and collecting taxes in the state of Massachusetts. The DOR provides free tax forms to help taxpayers file their taxes accurately and on time. These forms are available for download on the DOR website or by mail.

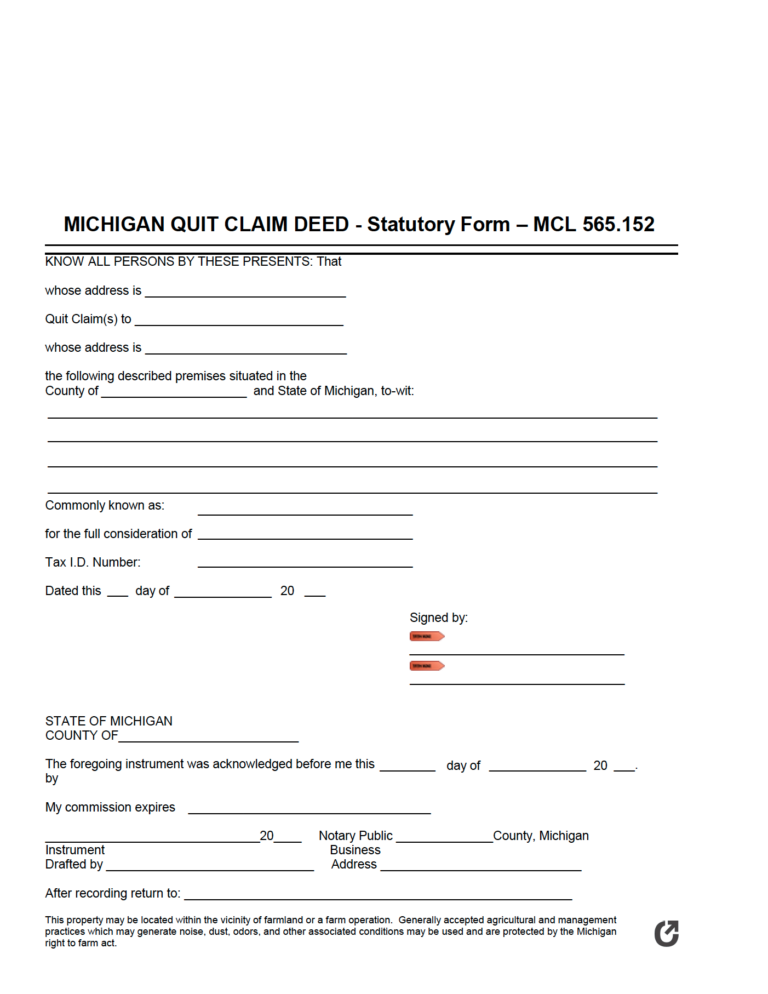

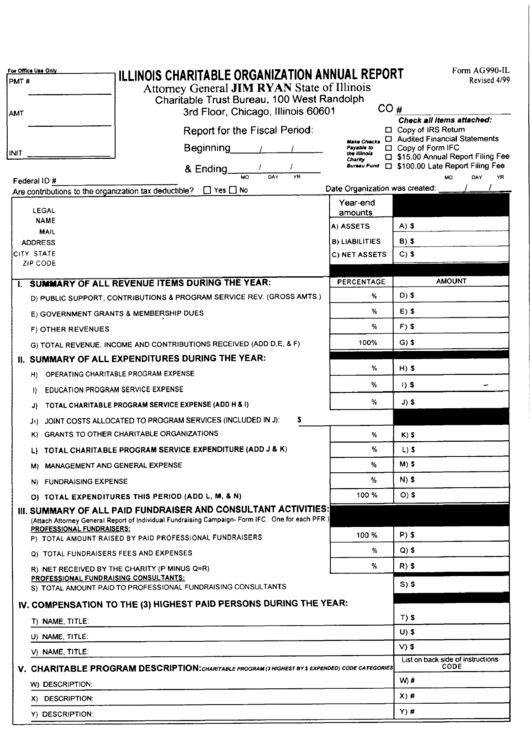

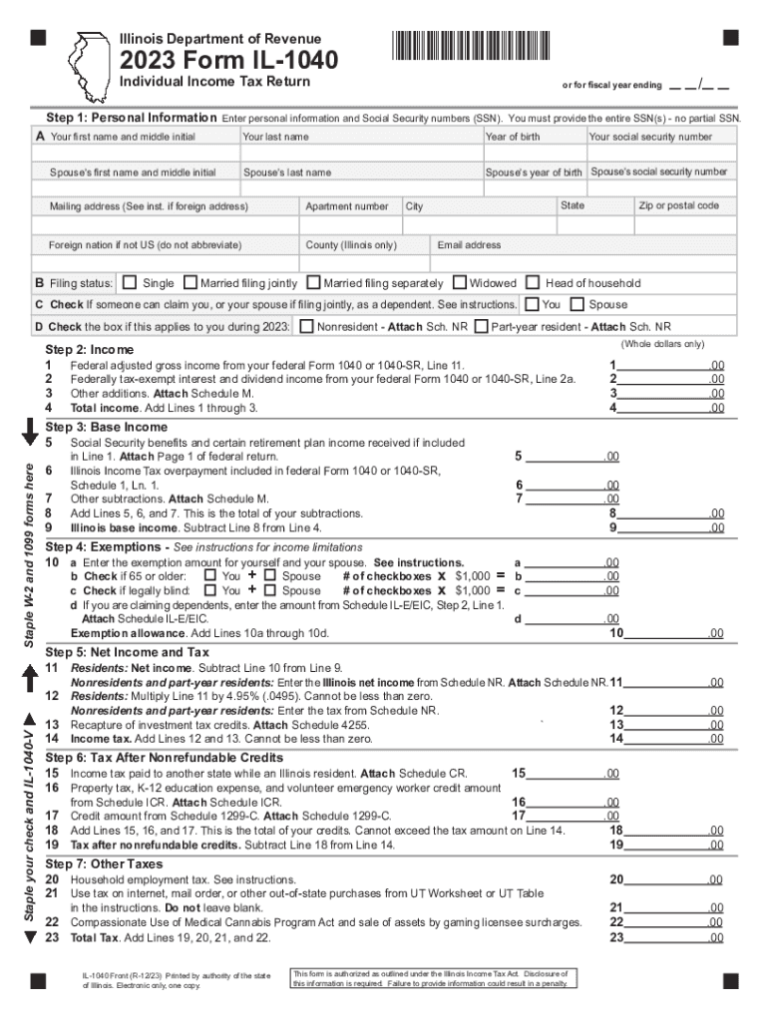

The free Massachusetts tax forms for 2024 include individual income tax forms, corporate income tax forms, and sales tax forms. The individual income tax forms are used to report income earned from wages, salaries, investments, and other sources. The corporate income tax forms are used to report income earned by businesses. The sales tax forms are used to report sales of goods and services.

Downloading Free Massachusetts Tax Forms 2024

Intro paragraph

It’s that time of year again, folks! Tax season is upon us, and if you’re a Massachusetts resident, you’ll need to get your hands on the latest tax forms. Luckily, the Massachusetts Department of Revenue makes it easy to download these forms for free. Here’s a quick guide on how to do it:

Explanatory paragraph

To download free Massachusetts tax forms, you’ll need to visit the Department of Revenue’s website. Once you’re there, hover over the “Forms” tab and select “Individual Income Tax Forms.” On the next page, you’ll see a list of all the available forms. Find the forms you need and click on the “Download” link.

Navigating the Website

The Department of Revenue’s website is easy to navigate. The “Forms” tab is located at the top of the page, and the “Individual Income Tax Forms” link is the first option in the drop-down menu. Once you’re on the forms page, you can use the search bar to find specific forms or browse the categories.

Locating Specific Forms

If you know the specific form you need, you can use the search bar to find it quickly. Simply enter the form number or name into the search bar and click “Search.” The website will return a list of all the forms that match your search criteria.

Additional Resources

If you need help downloading or filling out your tax forms, the Department of Revenue offers a variety of resources. You can call the department’s customer service line at (617) 887-6367 or visit the department’s website for more information.

Using and Completing Free Massachusetts Tax Forms 2024

Bruv, it’s vital to use the right tax forms and fill ’em out right. If you don’t, you could end up paying more tax than you should or even getting into trouble with the taxman.

Here’s a quick guide to help you fill out your Massachusetts tax forms like a pro:

Personal Info

- Make sure your name, address, and Social Security number are correct.

- If you’re filing jointly, include your spouse’s info too.

Income

- List all your income, including wages, salaries, tips, and investments.

- Use the correct forms for different types of income, like W-2s and 1099s.

Deductions and Credits

- Take advantage of deductions and credits to reduce your taxable income.

- Common deductions include mortgage interest, charitable donations, and state income taxes.

- Credits can directly reduce your tax bill, like the Earned Income Tax Credit.

Common Mistakes to Avoid

- Don’t leave any fields blank.

- Use the correct forms for your specific situation.

- Double-check your calculations before submitting your return.

- Don’t file late. If you can’t make the deadline, file for an extension.

Filing Massachusetts Tax Returns Using Free Tax Forms

Filing Massachusetts tax returns using free tax forms is a straightforward process that can be completed online or by mail. The Massachusetts Department of Revenue (DOR) provides a variety of free tax forms and resources to help taxpayers file their returns accurately and on time.

The deadline for filing Massachusetts tax returns is April 15th. Taxpayers can file their returns online, by mail, or through a tax professional. The DOR recommends filing online for the fastest and most convenient option.

To file your Massachusetts tax return online, you will need to create an account with the DOR. Once you have created an account, you can access the online tax filing system and complete your return. The online system will guide you through the filing process and help you to calculate your tax liability.

If you prefer to file your Massachusetts tax return by mail, you can download the necessary forms from the DOR website. The forms are also available at local libraries and post offices. Once you have completed your return, you can mail it to the DOR at the address provided on the form.

The DOR offers a variety of resources to help taxpayers file their returns. These resources include online tutorials, webinars, and live chat support. Taxpayers can also contact the DOR by phone or email if they have any questions.

Questions and Answers

Q: Where can I download the free Massachusetts tax forms?

A: You can download the free Massachusetts tax forms from the Department of Revenue’s website at https://www.mass.gov/dor/forms.

Q: What types of tax forms are available?

A: The Department of Revenue offers a wide range of tax forms, including individual income tax forms, corporate income tax forms, and sales tax forms.

Q: How do I complete the tax forms?

A: Each tax form includes specific instructions on how to complete it. Additionally, the Department of Revenue provides guidance and resources to assist taxpayers in filling out the forms accurately.

Q: What is the deadline for filing Massachusetts tax returns?

A: The deadline for filing Massachusetts tax returns is April 15th. However, if you file for an extension, you have until October 15th to file your return.