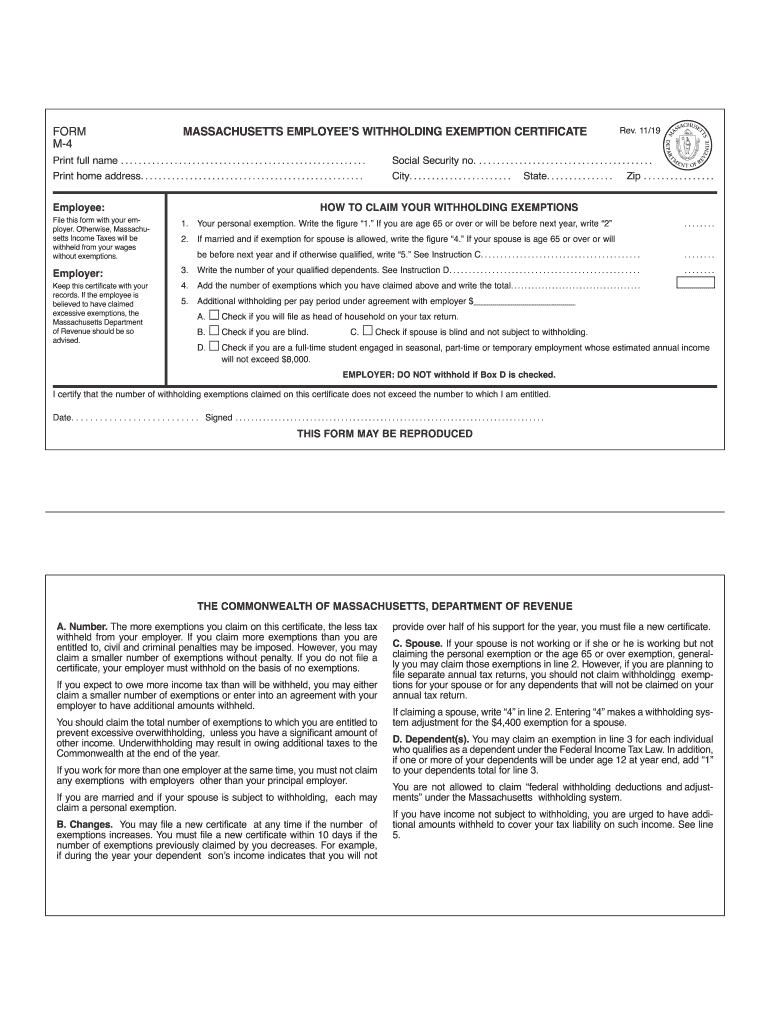

Free M4 Tax Form Download: A Comprehensive Guide

Navigating the complexities of tax filing can be daunting, but understanding and accessing the right forms is crucial. Among the essential tax documents is Form M4, a vital component for individuals seeking to accurately report their income and expenses. This comprehensive guide will provide a step-by-step overview of Form M4, including its purpose, eligibility criteria, and how to download it effortlessly online.

Whether you’re a seasoned taxpayer or filing Form M4 for the first time, this guide will empower you with the knowledge and resources to complete the process confidently. We’ll delve into the specific requirements, filing deadlines, and potential tax implications, ensuring you fulfill your tax obligations accurately and efficiently.

Form Description and Accessibility

Yo, Form M4 is the free tax return form that’s available to young people in the UK. It’s designed for those who are 16-20 years old and have a simple tax situation.

To be eligible for Form M4, you need to meet the following criteria:

- You must be between 16 and 20 years old.

- You must be a UK resident.

- You must have a simple tax situation, such as:

- You only have one job.

- You don’t have any other sources of income, such as investments or property.

- You don’t have any complex tax deductions or credits.

How to Access and Download Form M4

You can download Form M4 online from the GOV.UK website. Here’s how to do it:

- Go to the GOV.UK website.

- Search for “Form M4”.

- Click on the link to the form.

- Scroll down to the bottom of the page and click on the “Download” button.

- Save the form to your computer.

Filing s and Deadlines

Filing Form M4 is essential for reporting your income and expenses. Here’s what you need to know about the s and deadlines.

When filing Form M4, you’ll need to include the following information:

- Your personal details (name, address, contact information)

- Your income from all sources

- Your expenses and deductions

- Your calculations of your taxable income and tax liability

The deadline for filing Form M4 is April 5th. If you file late, you may have to pay penalties and interest.

Common Errors to Avoid

Here are some common errors to avoid when filing Form M4:

- Not including all of your income

- Not deducting all of your allowable expenses

- Making mistakes in your calculations

- Filing late

Available Resources and Support

Completing Form M4 doesn’t have to be a hassle, bruv. Check out these sick resources to get you sorted:

Online Tutorials and Webinars

- Tax Assist Direct: Free online tutorials that break down Form M4 step-by-step.

- HMRC: Watch webinars to get the lowdown on Form M4 and other tax stuff.

Tax Professionals

If you’re feeling a bit overwhelmed, don’t sweat it. Tax pros can help you navigate Form M4 like a boss:

- Chartered Institute of Taxation: Find a qualified tax advisor near you.

- Association of Taxation Technicians: Get expert guidance from ATT members.

Contact Info

Need to reach out for help? Here are some numbers to keep handy:

- HMRC Helpline: 0300 200 3300

- TaxAid: 0345 120 3779

Tax Implications and Calculations

Submitting Form M4 has tax consequences that can impact your overall tax burden. It’s essential to comprehend these implications and the calculations involved to ensure accurate tax filing.

Form M4 plays a role in determining your tax liability by considering your income, deductions, and credits. Completing it involves several calculations, and understanding these calculations is crucial for accurate tax reporting.

Tax Implications

- Filing Form M4 can alter your tax liability by adjusting your taxable income. Taxable income is the amount of income subject to taxation, and Form M4 calculations can result in a higher or lower taxable income, affecting your overall tax liability.

- Depending on your circumstances, Form M4 may lead to a tax refund or a tax bill. If you overpaid taxes during the year, you may be eligible for a refund, while if you underpaid, you may need to pay additional taxes.

Calculation Breakdown

- Form M4 calculations involve various steps, including:

- Calculating your gross income by summing up all sources of income, such as wages, salaries, investments, and business income.

- Subtracting allowable deductions from your gross income to arrive at your taxable income. Deductions reduce your taxable income, thereby potentially lowering your tax liability.

- Applying applicable tax rates to your taxable income to determine your tax liability. Tax rates vary based on income levels and other factors.

- Factoring in tax credits, which are direct reductions to your tax liability. Credits can further lower your tax burden or result in a refund.

Deductions and Credits

- Form M4 allows for various deductions that can reduce your taxable income, including:

- Standard deduction: A fixed amount that reduces your taxable income without itemizing deductions.

- Itemized deductions: Specific expenses that can be deducted from your income, such as mortgage interest, charitable contributions, and medical expenses.

- Form M4 also considers tax credits that can directly reduce your tax liability, such as:

- Personal exemption credit: A credit for each taxpayer and dependent claimed on your tax return.

- Child tax credit: A credit for qualifying children under the age of 17.

- Earned income tax credit: A credit for low- to moderate-income working individuals and families.

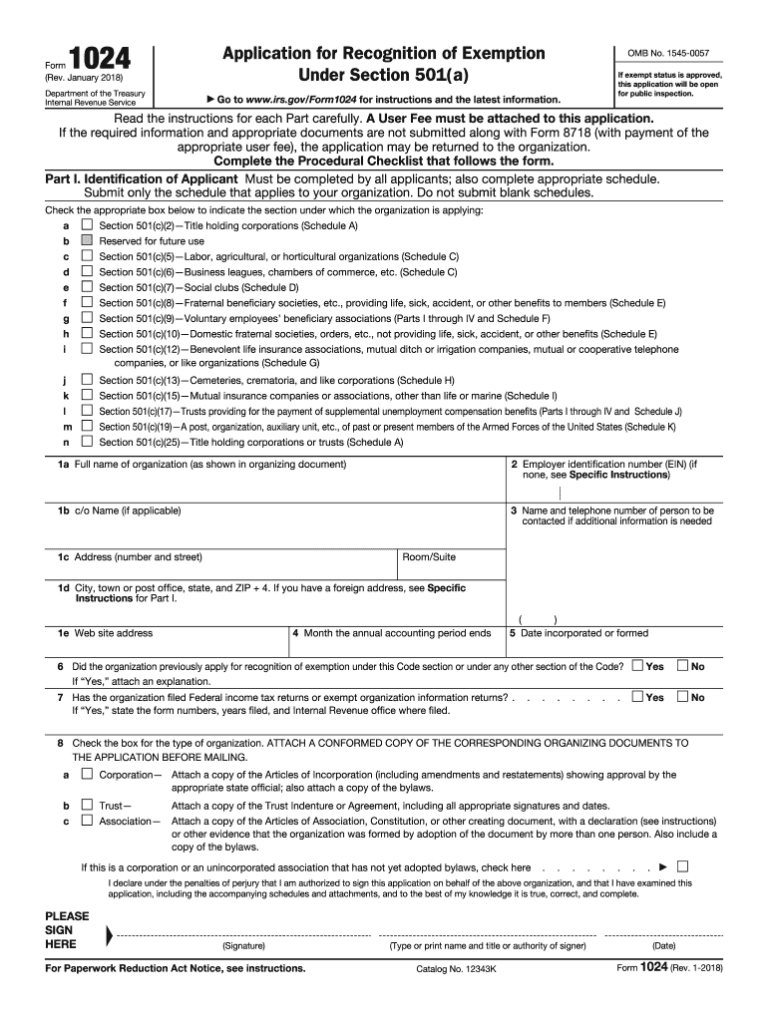

Comparison with Other Forms

Form M4 is part of a series of tax forms designed for different types of income and tax situations. It’s worth comparing it to other related forms to understand its specific purpose and requirements.

Let’s compare Form M4 to Form M1 and Form M2, which are also used for reporting income and deductions.

Form M1 vs. Form M4

- Purpose: Form M1 is used to report employment income, while Form M4 is used to report income from self-employment or business activities.

- Eligibility: Form M1 is for individuals with employment income, while Form M4 is for self-employed individuals or businesses.

- Filing Requirements: Both Form M1 and Form M4 must be filed annually by the tax filing deadline.

Form M2 vs. Form M4

- Purpose: Form M2 is used to report income from property rentals, while Form M4 is used to report income from self-employment or business activities.

- Eligibility: Form M2 is for individuals with income from property rentals, while Form M4 is for self-employed individuals or businesses.

- Filing Requirements: Both Form M2 and Form M4 must be filed annually by the tax filing deadline.

Summary Table

| Form | Purpose | Eligibility | Filing Requirements |

|---|---|---|---|

| M1 | Employment income | Individuals with employment income | Annually by tax filing deadline |

| M2 | Property rental income | Individuals with income from property rentals | Annually by tax filing deadline |

| M4 | Self-employment or business income | Self-employed individuals or businesses | Annually by tax filing deadline |

FAQ Corner

What is the purpose of Form M4?

Form M4 is a tax form used to report income and expenses for self-employed individuals and businesses.

Who is eligible to file Form M4?

Individuals who earn income from self-employment or business activities are eligible to file Form M4.

Where can I download Form M4 online?

Form M4 can be downloaded from the official government website or through tax preparation software.

What is the deadline for filing Form M4?

The deadline for filing Form M4 is typically the same as the deadline for filing your personal income tax return.

What are some common errors to avoid when filing Form M4?

Common errors to avoid include miscalculating income or expenses, failing to report all sources of income, and missing the filing deadline.