Free HO3 Policy Form Download: A Comprehensive Guide

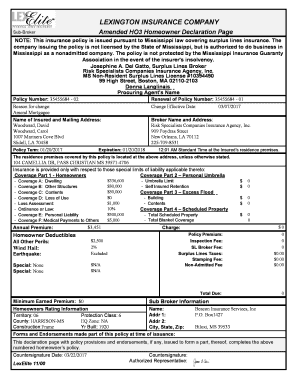

Homeowners insurance is a crucial investment that protects your home and belongings from unforeseen events. Understanding your HO3 policy form is essential to ensure you have the right coverage for your needs. In this guide, we’ll delve into the world of free HO3 policy forms, exploring their benefits, limitations, and how to choose the right one for you.

HO3 policies are the most common type of homeowners insurance, providing comprehensive coverage for your dwelling, other structures, personal property, and liability. Free HO3 policy forms offer an accessible and convenient way to obtain the necessary information about your coverage, allowing you to make informed decisions about your insurance needs.

Introduction to Free Homeowner’s (HO3) Policy Forms

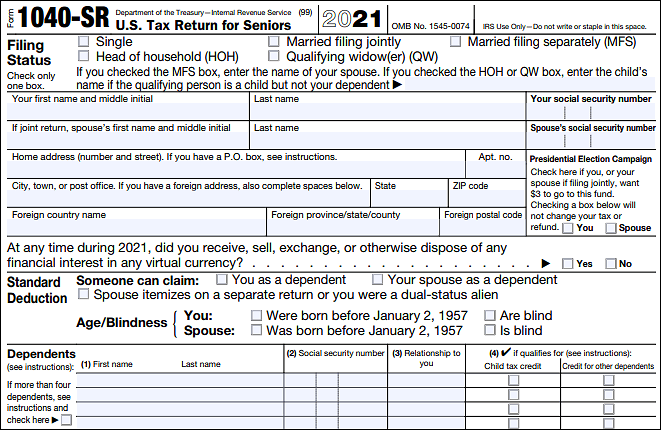

A homeowner’s insurance policy, also known as an HO3 policy, protects your home and belongings from damage or loss. It is important to have an HO3 policy in place to protect your financial investment in your home. There are many different sources for obtaining free HO3 policy forms, including insurance companies, banks, and online resources.

Benefits of Obtaining a Free HO3 Policy Form

There are many benefits to obtaining a free HO3 policy form. First, it allows you to compare different policies and rates from different insurance companies. This can help you find the best policy for your needs at the best price. Second, a free HO3 policy form can help you understand the coverage that is available to you and the limits of that coverage. This can help you make informed decisions about your insurance needs.

Sources for Obtaining Free HO3 Policy Forms

There are many different sources for obtaining free HO3 policy forms. One of the best places to start is your insurance company. Many insurance companies offer free HO3 policy forms on their websites or through their agents. You can also find free HO3 policy forms at banks and other financial institutions. Finally, there are a number of online resources that offer free HO3 policy forms.

Benefits of Using a Free HO3 Policy Form

Free HO3 policy forms offer a range of advantages that can make the process of obtaining homeowner’s insurance much more convenient and efficient.

One of the primary benefits of using a free HO3 policy form is the time and effort it can save. By utilizing a pre-drafted form, individuals can avoid the hassle of having to create their own policy from scratch. This can be especially beneficial for those who are unfamiliar with insurance policies or who simply do not have the time to dedicate to the task.

Convenience and Accessibility

Free HO3 policy forms are also highly convenient and accessible. These forms can be easily found online, making them available to anyone with an internet connection. Additionally, many insurance companies provide free HO3 policy forms on their websites, making it even easier for individuals to obtain the coverage they need.

Limitations of Free HO3 Policy Forms

Free HO3 policy forms are a convenient and cost-effective way to protect your home and belongings, but it’s important to be aware of their limitations.

One potential limitation is that free HO3 policy forms may not provide as much coverage as paid policy forms. For example, free HO3 policy forms may not cover certain types of losses, such as damage caused by earthquakes or floods. Additionally, free HO3 policy forms may have lower coverage limits than paid policy forms.

Another potential limitation of free HO3 policy forms is that they may not be as customizable as paid policy forms. This means that you may not be able to tailor the policy to your specific needs.

Finally, it’s important to carefully review the policy form before making a decision. This will help you understand the coverage provided by the policy and any limitations or exclusions.

Tips for Choosing the Right Free HO3 Policy Form

When selecting a free HO3 policy form, it’s crucial to consider your specific needs and circumstances. Here are some tips to help you make an informed decision:

First, take the time to compare coverage options and premiums offered by different insurance providers. This will give you a clear understanding of what each policy covers and how much it will cost.

Endorsements and Riders

Endorsements and riders are additional coverage options that can be added to your HO3 policy to customize your coverage. For example, you may want to add an endorsement for earthquake coverage if you live in an earthquake-prone area.

Helpful Answers

What is a HO3 policy form?

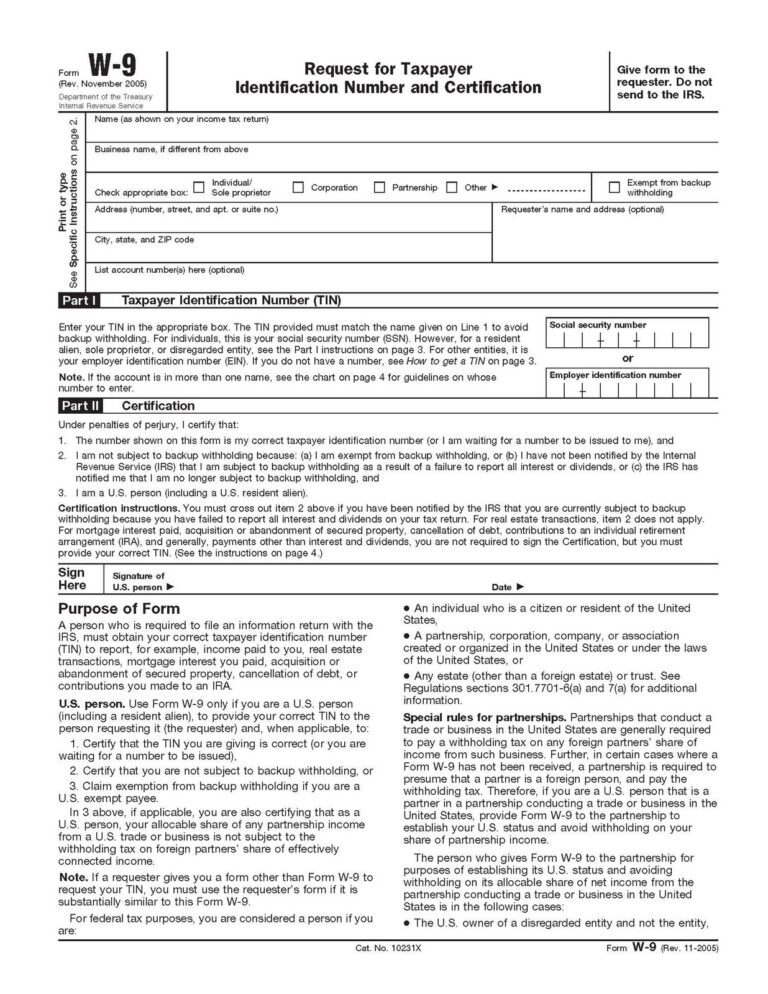

A HO3 policy form Artikels the coverage and terms of your homeowners insurance policy. It includes details about the covered perils, limits of coverage, deductibles, and exclusions.

Why should I use a free HO3 policy form?

Free HO3 policy forms provide an easy and accessible way to understand your coverage options. They allow you to compare different policies and make informed decisions without committing to a specific insurer.

What are the limitations of free HO3 policy forms?

Free HO3 policy forms may not include all the endorsements or riders that you may need to customize your coverage. Additionally, they may not provide the same level of support and guidance as paid policy forms.

How do I choose the right free HO3 policy form?

Compare coverage options, limits, and deductibles to determine the policy that best meets your needs. Consider endorsements and riders to enhance your coverage. Consult with an insurance professional for personalized advice.