Free HDFC KYC Form Download: A Comprehensive Guide

In today’s digital era, convenience and accessibility are paramount. HDFC Bank, one of India’s leading financial institutions, recognizes this need and offers the option to download its KYC (Know Your Customer) form online. This comprehensive guide will walk you through the benefits, steps, and requirements of downloading and completing the HDFC KYC form, empowering you to manage your financial affairs seamlessly.

HDFC’s KYC form is a crucial document that enables the bank to verify your identity and assess your financial risk profile. By downloading the form online, you can save valuable time and effort compared to visiting a physical branch. Moreover, HDFC employs robust security measures to protect your personal information during the download process, ensuring your data remains confidential.

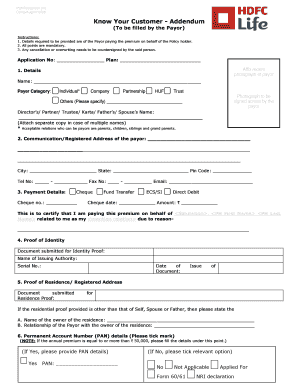

Overview of HDFC KYC Form

Innit, KYC (Know Your Customer) forms are like the backbone of financial institutions, bruv. They’re all about getting to know their customers better, like their name, addy, and all that jazz. It’s a legal requirement, so you can’t skive it.

HDFC’s KYC form is no different, mate. It’s a bit of a faff, but it’s important to fill it out properly. You’ll need to provide basic info like your name, date of birth, and address. You’ll also need to submit some docs, like a copy of your passport or driving license. It’s a bit of a hassle, but it’s worth it in the long run.

HDFC: A Brief History

HDFC (Housing Development Finance Corporation) is a bit of a bigwig in the Indian financial sector, innit. They’ve been around since 1977, and they’re one of the largest mortgage lenders in the country. They’ve also got their fingers in other pies, like banking, insurance, and asset management. So, yeah, they’re a bit of a player.

s for Downloading HDFC KYC Form

Downloading the HDFC KYC form is a simple and straightforward process. Follow these steps to get started:

Visit the official HDFC website: https://www.hdfcbank.com/.

Navigate to the ‘Personal Banking’ section and select ‘KYC Documents’.

Click on the ‘Download KYC Form’ link.

Select the appropriate KYC form based on your requirements (individual, non-individual, etc.).

Click on the ‘Download’ button to save the form to your computer.

Once the download is complete, open the form and fill in the required details.

Common Issues

Here are some common issues that you may encounter while downloading the HDFC KYC form:

- Unable to find the ‘Download KYC Form’ link: Ensure that you are on the official HDFC website and that you have selected the ‘Personal Banking’ section.

- Download fails: Check your internet connection and try again. If the problem persists, contact HDFC customer support.

- Incorrect KYC form downloaded: Make sure that you have selected the correct KYC form based on your requirements.

Filling Out the HDFC KYC Form

Completing the HDFC KYC form accurately is crucial for verifying your identity and ensuring smooth financial transactions. The form consists of several sections and fields, each requiring specific information.

Personal Information

Provide your full name, date of birth, gender, marital status, occupation, and contact details (address, phone number, and email address). Ensure the information matches your official documents.

Identity Proof

Submit a copy of your PAN card, Aadhaar card, passport, or voter ID as proof of identity. Provide the document number and expiry date.

Address Proof

Provide a copy of your utility bill (electricity, water, or gas), bank statement, or rental agreement as proof of address. Ensure the address matches your current residence.

Financial Information

Provide details of your income, sources of income, and bank account information. Accuracy in this section is essential for assessing your financial status.

Declaration

Sign and date the declaration at the end of the form, certifying that the information provided is true and complete. False or incomplete information can result in delays or rejection of your KYC verification.

Submitting the HDFC KYC Form

Submitting the completed KYC form is a crucial step to activate your HDFC account. There are several methods available to submit the form, each with its own advantages and timelines.

Online Submission

The quickest and most convenient way to submit your KYC form is through HDFC’s online portal. Simply log in to your account, navigate to the ‘KYC’ section, and upload a scanned copy of your completed form along with the necessary supporting documents.

In-Person Submission

You can also submit your KYC form in person at any HDFC branch. Visit your nearest branch with the completed form and original supporting documents. The branch staff will verify your identity and accept your submission.

Verification and Timelines

Once you submit your KYC form, it will undergo a verification process to ensure the accuracy and authenticity of the information provided. The verification process typically takes 2-3 business days. If there are any discrepancies or missing documents, you may be contacted for additional information.

Tracking Your Status

You can track the status of your KYC submission online through the HDFC portal. Simply log in to your account and navigate to the ‘KYC’ section. Here, you will find updates on the progress of your submission.

Common Queries

Can I download the HDFC KYC form from any device?

Yes, the HDFC KYC form can be downloaded from any device with an internet connection, including smartphones, tablets, and computers.

Is there a fee for downloading the HDFC KYC form?

No, downloading the HDFC KYC form is completely free of charge.

How long does it take to complete the HDFC KYC form?

The time taken to complete the HDFC KYC form may vary depending on the individual’s circumstances and the availability of required documents. However, it is generally recommended to allocate sufficient time to ensure accurate and comprehensive completion.