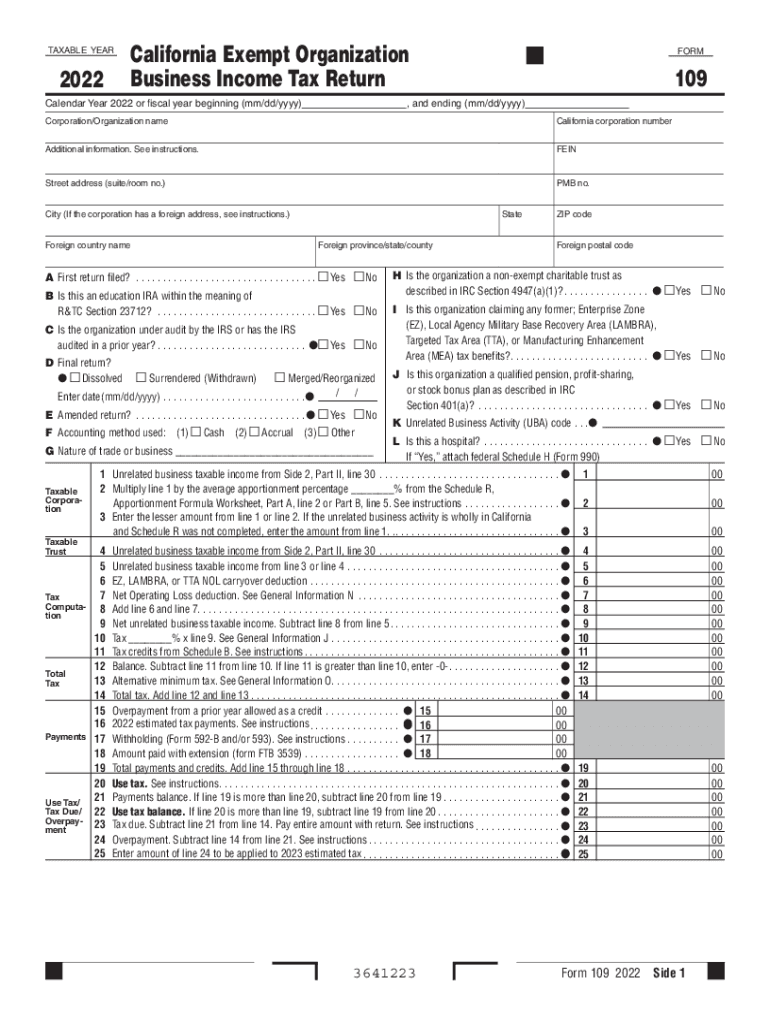

Free Ftb Form 109 Download: A Comprehensive Guide

Navigating the complexities of tax forms can be daunting, but understanding and completing Ftb Form 109 is essential for California taxpayers. This guide provides a comprehensive overview of Ftb Form 109, from downloading and completing the form to understanding its significance and filing options.

Whether you’re a seasoned taxpayer or filing for the first time, this guide will empower you with the knowledge and resources you need to successfully complete Ftb Form 109.

Ftb Form 109 Download Options

You can get the Ftb Form 109 from the official website of the Franchise Tax Board (FTB) of California. The FTB website provides a free, downloadable PDF version of the form.

In addition to the official website, there are other sources from which you can obtain the Ftb Form 109. However, it is important to be cautious when downloading from unofficial sources, as there is a risk that the form may be outdated or altered.

Official Website

- Go to the official website of the Franchise Tax Board (FTB) of California.

- Click on the “Forms” tab.

- Scroll down to the “Individual Income Tax” section.

- Click on the link for “Form 109 – California Income Tax Return for Fiduciaries.”

- The PDF version of the form will open in a new window.

- You can then save the form to your computer or print it out.

Alternative Sources

If you are unable to download the Ftb Form 109 from the official website, there are a number of alternative sources from which you can obtain the form.

- You can order a copy of the form by calling the FTB at (800) 852-5711.

- You can also visit a local FTB office to pick up a copy of the form.

- There are a number of websites that offer free downloads of the Ftb Form 109. However, it is important to be cautious when downloading from unofficial sources, as there is a risk that the form may be outdated or altered.

Risks of Downloading from Unofficial Sources

There are a number of risks associated with downloading the Ftb Form 109 from unofficial sources.

- The form may be outdated.

- The form may have been altered.

- The form may contain malware.

It is important to only download the Ftb Form 109 from official sources to avoid these risks.

Completing Ftb Form 109

Ftb Form 109, California Schedule CA (540), is used to report California source income. It’s a crucial document for taxpayers who have earned income in California and are required to file state taxes. Accurately completing Ftb Form 109 ensures that you fulfill your tax obligations and avoid any potential issues with the California Franchise Tax Board (FTB).

To assist you in completing Ftb Form 109 effectively, we’ve compiled a comprehensive guide that will take you through each section of the form, providing clear instructions and helpful examples.

Section 1: Personal Information

Begin by filling out your personal information, including your name, address, and Social Security number. Ensure that the information you provide matches your federal tax return to avoid any discrepancies.

Section 2: Income

In this section, you’ll report your California source income. This includes wages, salaries, tips, and other forms of compensation earned in California. Carefully review your pay stubs and other income statements to ensure that you accurately report all of your California income.

Section 3: Deductions

Ftb Form 109 allows you to claim certain deductions from your California income. These deductions can reduce your taxable income and potentially lower your tax liability. Common deductions include the standard deduction, itemized deductions, and business expenses.

Section 4: Tax Calculation

Based on your income and deductions, you’ll calculate your California income tax liability in this section. The form provides clear instructions and tax tables to assist you in determining the amount of tax you owe.

Section 5: Credits

Certain tax credits can further reduce your tax liability. Ftb Form 109 includes a section where you can claim eligible tax credits, such as the California Earned Income Tax Credit and the Child and Dependent Care Credit.

Common Errors and Pitfalls to Avoid

To ensure accuracy and avoid potential issues with the FTB, be mindful of the following common errors and pitfalls:

– Inaccurate personal information: Double-check that your name, address, and Social Security number are correct.

– Incomplete income reporting: Thoroughly review your income sources to ensure that you report all of your California source income.

– Missing deductions: Explore all eligible deductions to maximize your tax savings.

– Incorrect tax calculation: Carefully follow the instructions and use the provided tax tables to accurately calculate your tax liability.

– Unclaimed tax credits: Review the available tax credits to determine if you qualify for any that can reduce your tax bill.

Ftb Form 109 Frequently Asked Questions

This section provides answers to common questions about Ftb Form 109, helping you navigate the form and its requirements with ease.

If you have any further questions, please don’t hesitate to contact the relevant authorities or seek professional guidance.

General Questions

- What is Ftb Form 109?

Ftb Form 109 is a tax form used by taxpayers in California to report income from various sources, such as wages, self-employment, and investments. - Who needs to file Ftb Form 109?

Generally, you need to file Ftb Form 109 if you’re a California resident and your gross income exceeds certain thresholds set by the California Franchise Tax Board (FTB). - When is Ftb Form 109 due?

Ftb Form 109 is typically due on April 15th of the year following the tax year. However, if you file for an extension, you may have until October 15th to file. - Where can I get Ftb Form 109?

You can download Ftb Form 109 from the FTB website or obtain a physical copy from a local FTB office.

Completing Ftb Form 109

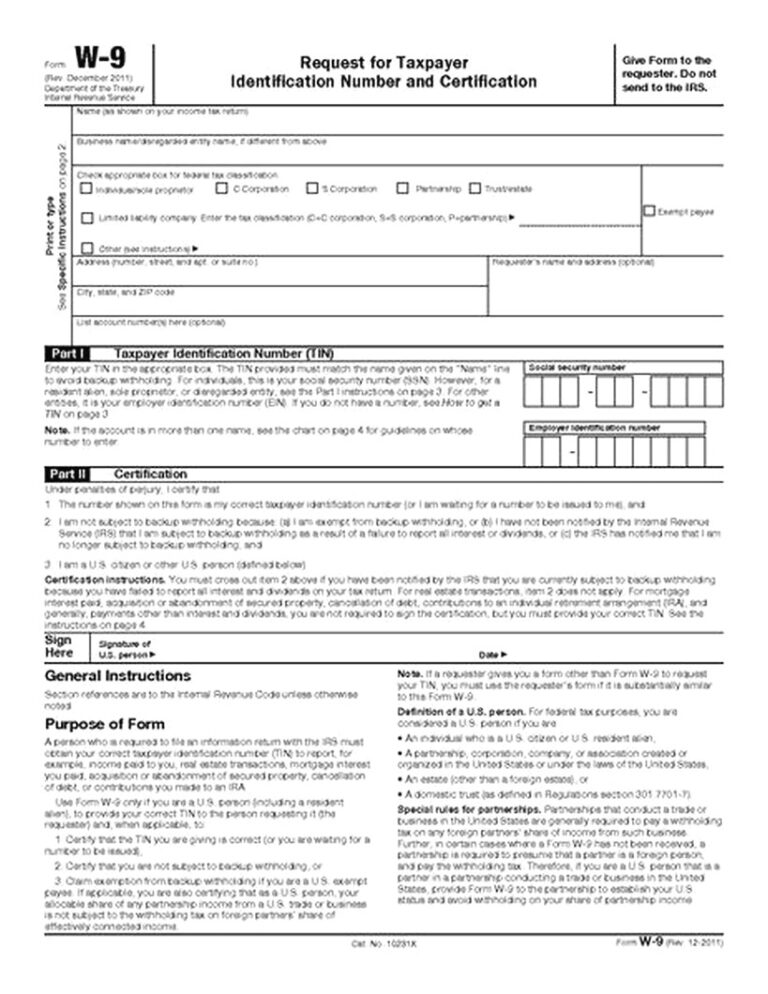

- What information do I need to complete Ftb Form 109?

You’ll need to gather your personal information, income details from all sources, deductions, and any applicable credits. - Where can I find instructions for completing Ftb Form 109?

Detailed instructions are available on the FTB website or within the Ftb Form 109 booklet. - Can I file Ftb Form 109 electronically?

Yes, you can file Ftb Form 109 electronically using the FTB’s e-file system or through a tax software program. - What are some common mistakes to avoid when completing Ftb Form 109?

Some common mistakes include mathematical errors, incorrect social security numbers, and missing or incomplete information.

Filing Ftb Form 109

- Where do I mail Ftb Form 109?

The mailing address for Ftb Form 109 varies depending on your county of residence. You can find the correct address on the FTB website or in the Ftb Form 109 booklet. - What are the penalties for filing Ftb Form 109 late?

Filing Ftb Form 109 late may result in penalties and interest charges. - What if I need to amend Ftb Form 109?

If you need to make changes to your Ftb Form 109 after filing, you can file an amended return using Ftb Form 540X. - Can I get help with completing or filing Ftb Form 109?

Yes, you can contact the FTB for assistance or seek guidance from a tax professional.

Q&A

What is the official website for downloading Ftb Form 109?

The official website for downloading Ftb Form 109 is the Franchise Tax Board (FTB) website: https://www.ftb.ca.gov/forms/.

Can I download Ftb Form 109 from unofficial sources?

While it is possible to find Ftb Form 109 on unofficial sources, it is not recommended. Unofficial sources may provide outdated or inaccurate versions of the form, which could lead to errors in your tax filing.

What are the common errors to avoid when completing Ftb Form 109?

Common errors to avoid when completing Ftb Form 109 include:

– Incorrectly calculating your income or deductions.

– Entering incorrect Social Security numbers or other personal information.

– Failing to sign and date the form.

What are the different methods for filing Ftb Form 109?

You can file Ftb Form 109 by mail, online, or through a tax professional. Filing online is the fastest and most convenient method.

What are the deadlines for filing Ftb Form 109?

The deadline for filing Ftb Form 109 is April 15th. If you file after the deadline, you may be subject to penalties and interest charges.