Free Form W3 2024 Download: A Comprehensive Guide

Navigating the complexities of tax forms can be a daunting task, but understanding Form W3 is crucial for ensuring accurate withholding allowances and avoiding tax penalties. In this comprehensive guide, we delve into the intricacies of Form W3 2024, providing a clear and concise overview of its purpose, key features, and the essential steps for its completion and submission.

Whether you’re a seasoned taxpayer or filing Form W3 for the first time, this guide will empower you with the knowledge and confidence to handle this important document with ease. By understanding the nuances of Form W3, you can ensure compliance, optimize your tax deductions, and avoid potential tax-related issues.

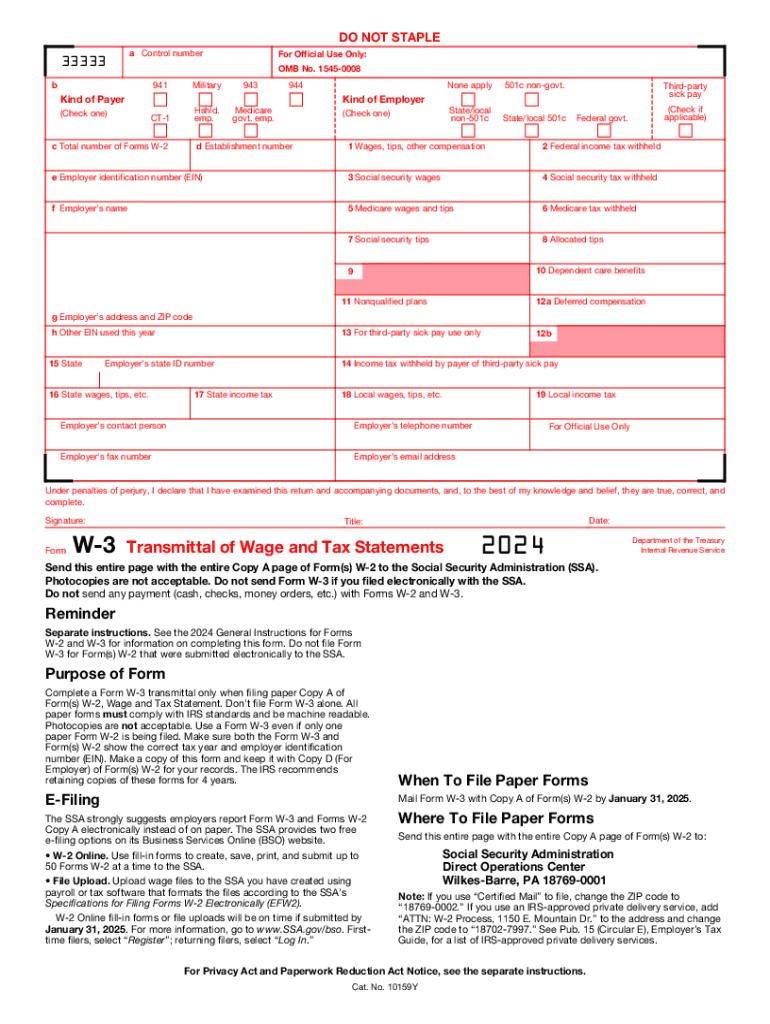

Free Form W3 2024 Overview

Form W3 is a crucial document used by employers in the United Kingdom to provide employees with a detailed breakdown of their earnings and deductions for the tax year. It serves as a comprehensive record of an employee’s income and tax liability, and it plays a vital role in ensuring compliance with tax regulations.

The 2024 version of Form W3 introduces several key updates and enhancements. One significant change is the inclusion of a new section dedicated to reporting non-cash benefits. This section aims to provide greater transparency and accuracy in reporting employee compensation, ensuring that all forms of remuneration are accounted for. Additionally, the 2024 Form W3 incorporates updated tax rates and allowances, reflecting changes in the UK tax system. These updates ensure that the form remains compliant with the latest tax regulations and provides employees with an accurate representation of their tax liability.

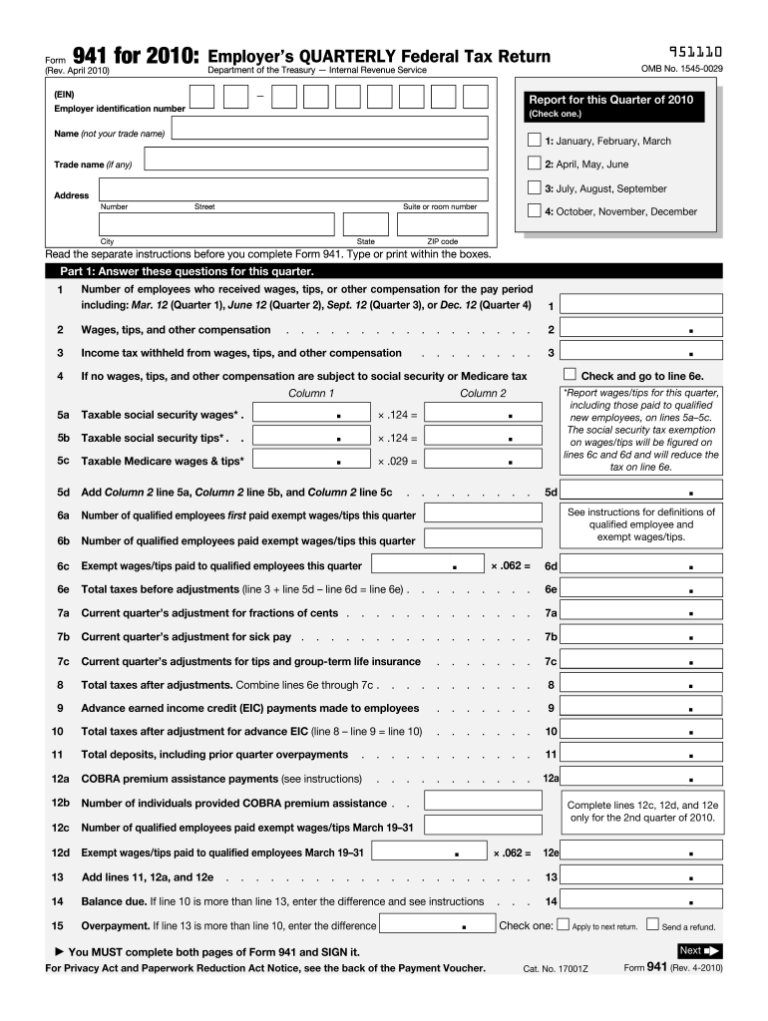

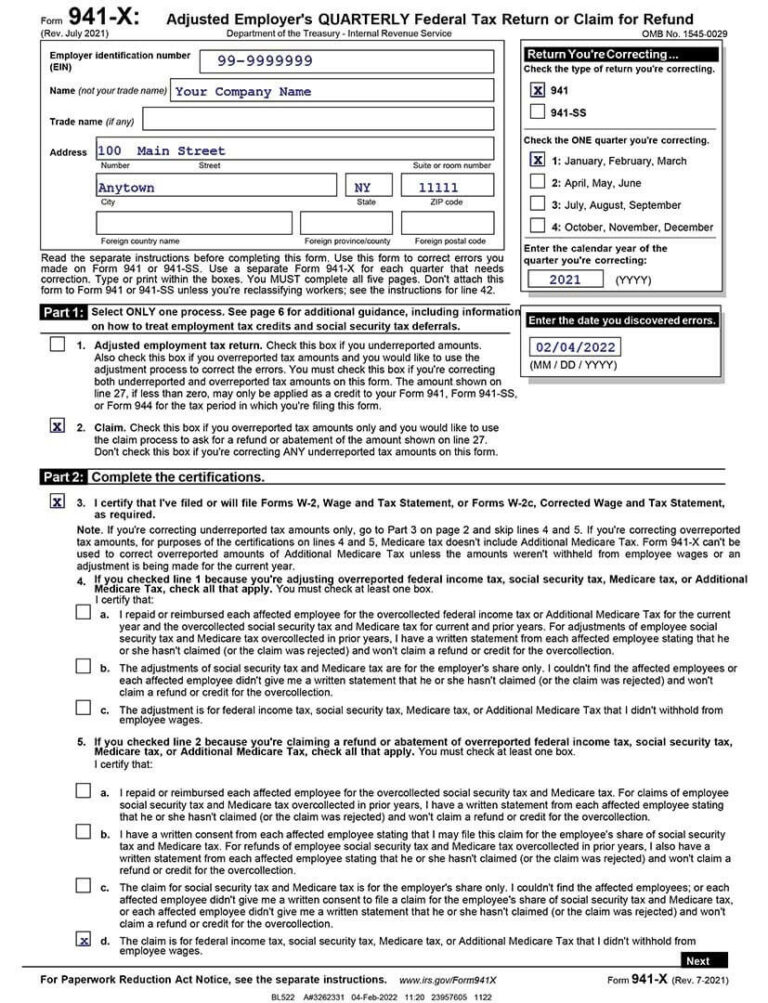

Filling Out Form W3

Filling out Form W3 is essential for determining your withholding allowances and ensuring accurate tax withholding from your paychecks. Follow these steps to complete the form correctly:

Personal Information

- Enter your full name, address, and Social Security number (SSN).

Eligibility for Allowances

Determine if you qualify for any withholding allowances based on your personal circumstances. Common eligibility criteria include:

- Married filing jointly or single with dependents

- Head of household with dependents

- Dependent of another taxpayer

Calculating Withholding Allowances

Calculate your withholding allowances using the following steps:

- Determine the number of personal allowances you are eligible for based on your circumstances.

- If you have dependents, add one additional allowance for each dependent.

- Subtract any allowances you claimed on a previous Form W4 (if applicable).

Additional Information

- If you have multiple jobs, you may need to adjust your allowances to avoid over-withholding.

- You can use the IRS Withholding Calculator to estimate your withholding allowances.

- Review your Form W3 annually and make any necessary adjustments based on changes in your circumstances.

Common Mistakes to Avoid

- Claiming more allowances than you are eligible for

- Not claiming enough allowances, resulting in over-withholding

- Incorrectly entering your personal information

Submission and Processing

Submitting your Form W3 2024 is crucial to ensure your tax withholding is accurate. You have a few options for submitting your form:

Online Submission

The quickest and most convenient way to submit your Form W3 2024 is through the HMRC’s online portal. This method allows you to complete and submit your form electronically, saving you time and hassle.

Postal Mail

If you prefer to submit your Form W3 2024 by post, you can download the form from the HMRC website and send it to the address provided. Ensure you use the correct postage to avoid delays in processing.

Processing Time

Once you submit your Form W3 2024, it typically takes around 10 working days for the HMRC to process it. However, during peak periods, processing times may be longer.

Tips for Accurate and Timely Processing

To ensure your Form W3 2024 is processed accurately and timely, follow these tips:

- Provide complete and accurate information on the form.

- Double-check your details before submitting.

- Submit your form as early as possible to avoid any delays.

- Keep a copy of your submitted form for your records.

FAQs and Resources

Still need help? Check out these frequently asked questions and resources.

If you can’t find what you’re looking for, reach out to HMRC or visit their website for further assistance.

FAQs

| Question | Answer |

|---|---|

| What is Form W3? | Form W3 is used to claim back tax that has been deducted from your wages or pension. |

| Who needs to fill out Form W3? | You need to fill out Form W3 if you think you have overpaid tax. This could be because you have:

|

| How do I fill out Form W3? | You can fill out Form W3 online or by post. If you fill out the form online, you can use HMRC’s online tax calculator to help you. |

| What is the deadline for submitting Form W3? | The deadline for submitting Form W3 is 31st January after the end of the tax year. |

| What happens after I submit Form W3? | HMRC will process your claim and send you a refund if you are due one. |

Resources

FAQ

What is the purpose of Form W3?

Form W3 is used by employees to provide their employers with information about their withholding allowances. This information is used to calculate the amount of federal income tax that should be withheld from the employee’s paycheck.

What are the key features of Form W3 2024?

Form W3 2024 has several key features, including a new section for employees to report their expected income for the year, updated withholding tables, and a revised worksheet for calculating withholding allowances.

How do I download Form W3 2024?

You can download Form W3 2024 from the IRS website or from your payroll provider.

How do I fill out Form W3 2024?

To fill out Form W3 2024, you will need to provide your personal information, your withholding allowances, and your expected income for the year.

What are some common mistakes to avoid when filling out Form W3 2024?

Some common mistakes to avoid when filling out Form W3 2024 include claiming too many withholding allowances, not claiming enough withholding allowances, and making errors in your personal information.