Free Form Schedule 8812 Download: A Comprehensive Guide

Filing taxes can be a daunting task, but understanding and completing Schedule 8812 can help you navigate the process smoothly. This comprehensive guide will provide you with all the essential information you need to download, understand, complete, and file Schedule 8812, ensuring a seamless tax filing experience.

Schedule 8812 is a crucial form used to report additional information related to your tax return, including income, expenses, and other relevant details. By providing clear instructions and addressing commonly asked questions, this guide aims to empower you with the knowledge and confidence to tackle Schedule 8812 with ease.

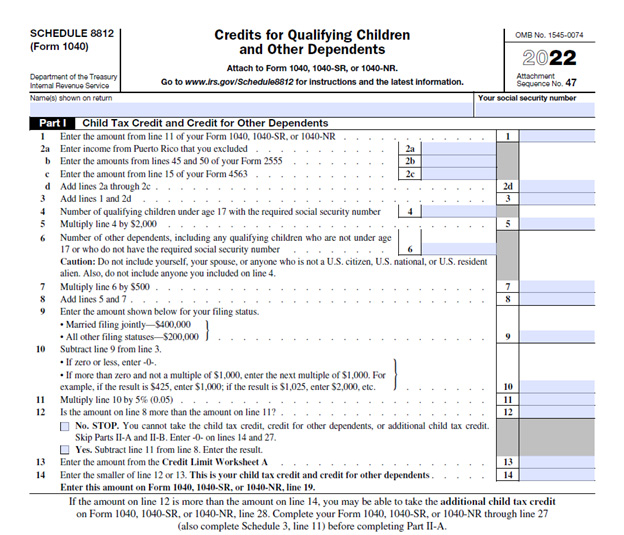

Schedule 8812 Overview

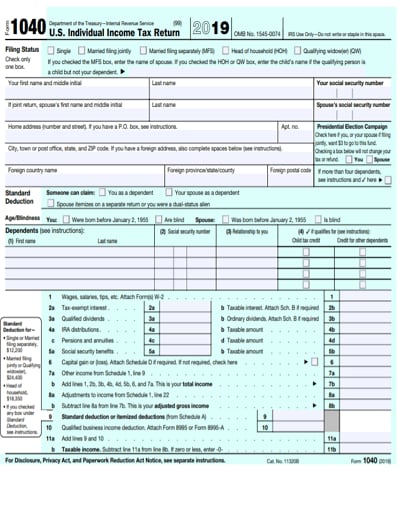

Schedule 8812 is a tax form used to report certain types of income and expenses that are not included on your regular tax return. This can include income from self-employment, rental properties, or other sources. It’s important to file Schedule 8812 if you have any of these types of income, as it can help you reduce your tax liability.

The form is divided into several sections, including:

- Part I: Income

- Part II: Expenses

- Part III: Net Income or Loss

Part I includes fields for reporting your income from various sources, such as self-employment, rental properties, and other income. Part II includes fields for reporting your expenses, such as advertising, car and truck expenses, and other expenses. Part III includes fields for calculating your net income or loss.

Downloading the Form

Downloading the official Schedule 8812 form is a breeze! Head over to the IRS website, type “Schedule 8812” into the search bar, and click the first result. You’ll be taken to a page where you can download the form in PDF format. Alternatively, you can get your hands on a physical copy by visiting your local IRS office.

Understanding the s

Yo, it’s mad important to read and understand the s that come with the form, bruv. These s are like the rulebook for filling it in, so you need to know what they’re saying. Don’t be a melt and skip over them, or you’ll end up with a form that’s more of a dog’s dinner than a proper application.

The s will usually tell you what info you need to provide, where to put it, and how to fill it in. They might also give you some tips on what to do if you’re not sure about something. So, take your time and have a good read through them before you start filling in the form. It’ll save you loads of hassle in the long run.

Navigating the s

Most s are pretty straightforward to navigate. They’ll usually have a table of contents at the beginning that tells you where to find the info you need. You can also use the index at the back of the s to look up specific topics. If you’re still struggling to find what you’re looking for, don’t be afraid to ask for help from a mate or a teacher.

Additional Resources

Check out these helpful links and resources to make filling out Form 8812 a breeze, bruv.

Need some extra help, mate? Don’t hesitate to reach out to the tax wizards at the IRS or a qualified tax pro. They’re always down to lend a hand.

IRS Publications

- Publication 537: Installment Sales

- Publication 525: Taxable and Nontaxable Income

Online Tools

- IRS Installment Sale Calculator: Crunch the numbers and see how much you’ll owe, innit?

- IRS Tax Withholding Estimator: Figure out how much tax you’ll need to pay upfront, no sweat.

IRS Contact Information

Give the IRS a buzz at 1-800-829-1040 or hit them up online at IRS.gov.

Tax Professionals

Find a qualified tax pro near you who can help you navigate the ins and outs of Form 8812, no worries.

Helpful Answers

Can I download Schedule 8812 from sources other than the IRS website?

Yes, there are several reputable websites that offer free downloads of Schedule 8812. However, it is always recommended to obtain the official form directly from the IRS website to ensure authenticity and accuracy.

Is it necessary to file Schedule 8812 even if I don’t have any additional income or expenses to report?

No, you only need to file Schedule 8812 if you have additional information to report that cannot be included on the main tax return form. If all necessary information can be reported on the main form, filing Schedule 8812 is not required.

What are some common mistakes to avoid when completing Schedule 8812?

Common mistakes include miscalculating income or expenses, entering incorrect information, and failing to attach necessary supporting documentation. Carefully reviewing the instructions, double-checking your calculations, and organizing your records can help minimize errors.