Free Form 941b 2024 Download: A Comprehensive Guide

Navigating the complexities of tax forms can be a daunting task, but understanding and completing Form 941b is crucial for businesses and individuals alike. This guide provides a comprehensive overview of Form 941b for the 2024 tax year, ensuring you have the necessary information to download, complete, and file the form accurately and efficiently.

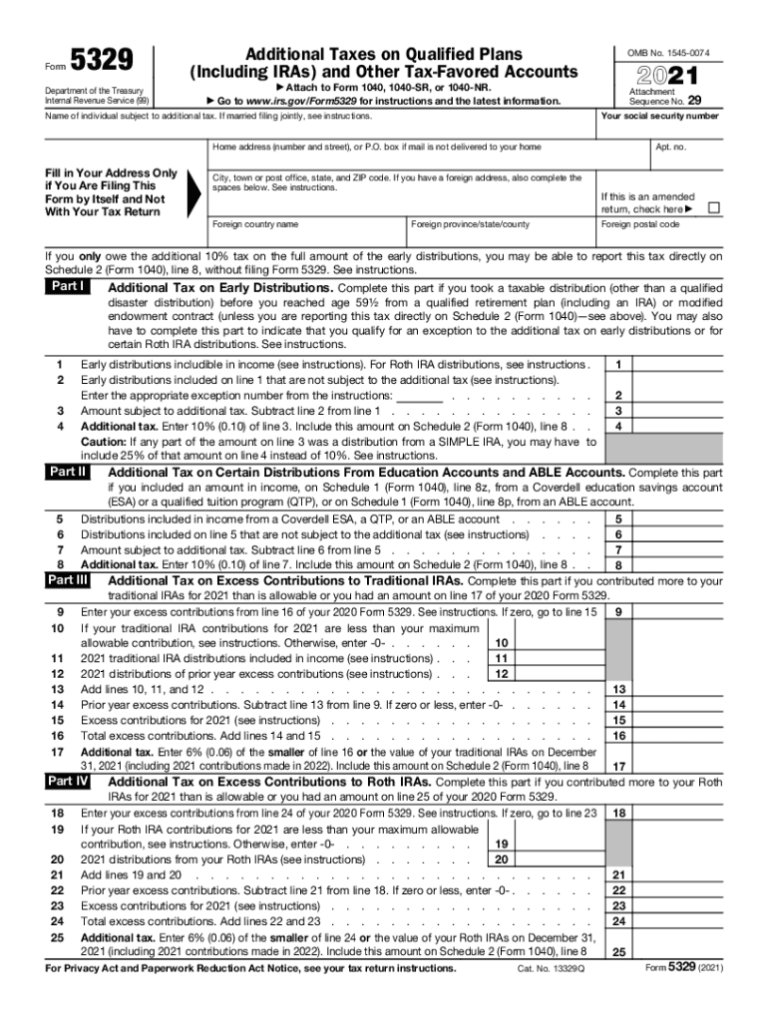

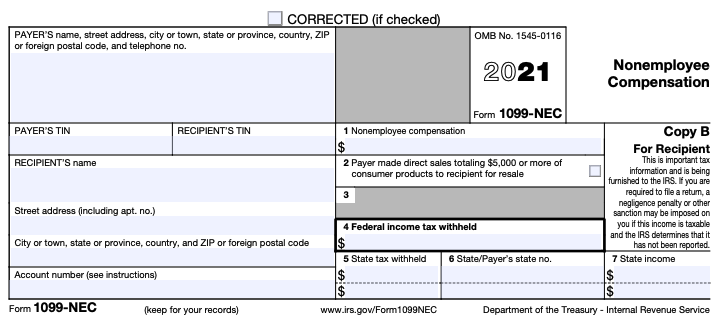

Form 941b is an essential document for reporting federal income tax withheld from wages, Social Security tax, and Medicare tax. Staying informed about any changes or updates to the form is vital, and this guide will highlight any notable revisions for the 2024 tax year. Additionally, we will explore various methods for downloading and filing the form, ensuring a seamless and timely submission process.

Free Form 941b 2024 Form Overview

Yo, blud! Listen up, the Free Form 941b 2024 is a banger for your quarterly employment tax return. It’s like the boss of forms, giving the taxman all the deets on your employees’ wages, tips, and other bits. This form is crucial, so get it right, bruv.

Now, this 2024 tax year is a bit special. The tax rates have had a glow-up, and there might be some new rules in the mix. So, make sure you check the latest guidelines to avoid any mishaps.

Key Sections of Form 941b

The 941b is a beast of a form, but don’t fret. Let’s break it down:

- Part 1: Employer Info – This is your crib, where you spill the beans about your business.

- Part 2: Taxable Wages and Tips – Here’s where you dish out the dough your employees earned.

- Part 3: Tax Calculations – This is where the magic happens, with all the calculations to figure out how much tax you owe.

- Part 4: Tax Payments – Time to pony up the cash. Show the taxman how you’ve been paying your dues.

- Part 5: Additional Information – Any extra bits you need to chuck in, like employee counts or adjustments.

Downloading Form 941b 2024

Fam, listen up! Getting your hands on Form 941b for the 2024 tax year is a breeze. Just follow these sick steps:

IRS Website

– Hit up the IRS website (www.irs.gov).

– Search for “Form 941b.”

– Click the link for the 2024 version.

– Download the form as a PDF or print it straight away.

Alternative Sources

– If the IRS website’s acting up, try these other spots:

– TaxSlayer: www.taxslayer.com/forms/irs-form-941b

– TaxAct: www.taxact.com/forms/irs-form-941b

– H&R Block: www.hrblock.com/tax-center/irs-forms-instructions/form-941b

Technical Requirements

– You’ll need a PDF reader like Adobe Acrobat Reader to open the form.

– Make sure your internet connection is stable for a smooth download.

Filling Out Form 941b 2024

Completing Form 941b for the 2024 tax year is a breeze when you have the right guide. This comprehensive guide will walk you through each section and line item, providing clear explanations and tips to help you breeze through the process. Buckle up, grab your pen, and let’s get this sorted.

Section A: Employer Information

Start by filling in your business’s details, including your name, address, and Employer Identification Number (EIN). Double-check everything is accurate to avoid any hiccups.

Section B: Tax Liability

Here’s where you calculate your tax liability. Follow the instructions carefully and fill in the amounts for Social Security tax, Medicare tax, and withheld income tax. Remember to use the correct tax rates for 2024.

Section C: Adjustments

Time for adjustments! If you made any corrections or adjustments to your payroll, enter them here. This could include things like prior-year adjustments or reclassifications.

Section D: Deposits

Record all the deposits you made throughout the quarter in this section. Make sure to include the dates and amounts, and double-check that they match your records.

Section E: Signature

Once you’re satisfied that everything is correct, it’s time to sign and date the form. This is your official declaration that the information you’ve provided is accurate and true.

Tips for Accurate Completion

- Use the 2024 tax rates and forms.

- Double-check all calculations before entering them.

- Keep a copy of your completed form for your records.

- File Form 941b on time to avoid penalties.

Resources and Support

Innit, need a bit of a hand with Form 941b? Don’t sweat it, fam. We’ve got your back. Here’s a sick list of resources to help you out:

If you’re stuck or have any questions, you can always hit up the IRS at 1-800-829-1040. They’re like the OG tax experts, so they’ll sort you out.

Online Forums and Discussion Groups

Feeling a bit lost? Join the tax gang online. There are loads of forums and discussion groups where you can chat with other taxpayers, share tips, and get support. Check out:

- Reddit’s r/tax subreddit: Where the tax nerds hang out.

- TaxBuzz: A lively forum with tax pros and fellow taxpayers.

Questions and Answers

What is the purpose of Form 941b?

Form 941b is used to report federal income tax withheld from wages, Social Security tax, and Medicare tax.

Where can I download Form 941b for the 2024 tax year?

Form 941b for the 2024 tax year can be downloaded from the IRS website or through alternative sources such as tax software providers.

What are the key changes to Form 941b for the 2024 tax year?

Any notable changes or updates to Form 941b for the 2024 tax year will be discussed in the guide.

What is the deadline for filing Form 941b?

The deadline for filing Form 941b varies depending on the filing method. The guide will provide detailed information on the deadlines and penalties associated with late filing.

Where can I get help completing Form 941b?

The guide will provide a list of resources available to assist taxpayers with completing Form 941b, including contact information for the IRS and other relevant organizations.