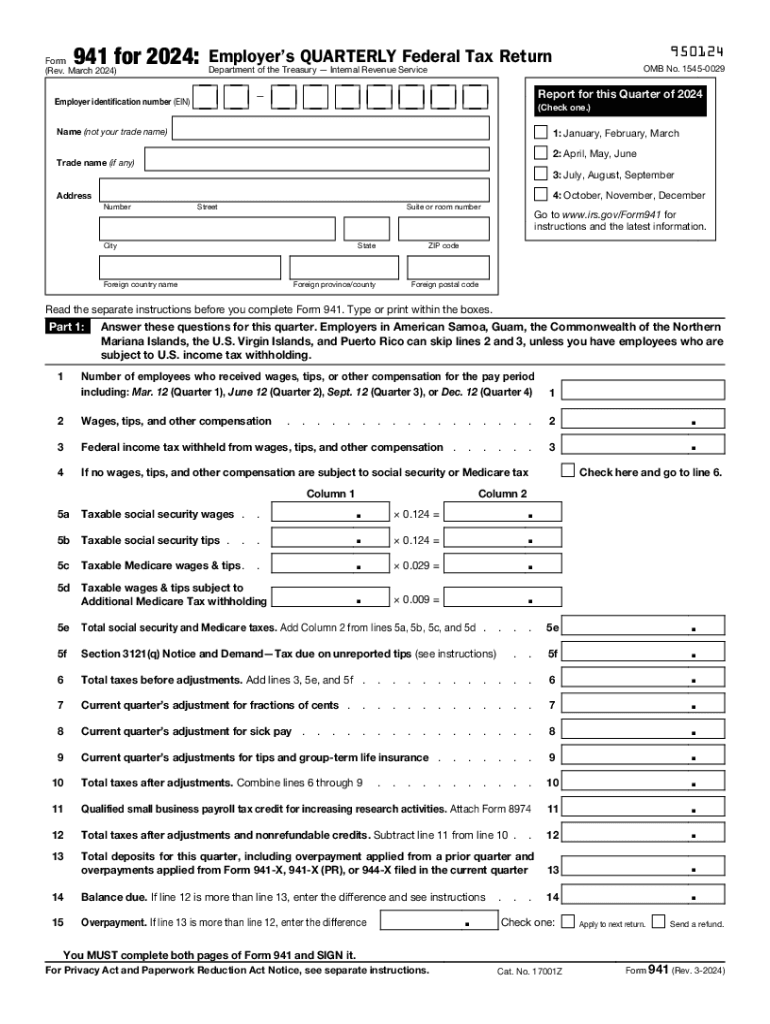

Free Form 941 Year 2024 Download: A Comprehensive Guide

The Free Form 941 is an IRS tax form used by businesses to report their quarterly federal income tax and social security tax liability. The form is available for download on the IRS website and can be used by businesses of all sizes. This guide will provide an overview of the Free Form 941, discuss the benefits of using the form, and provide step-by-step instructions on how to download and use the form.

The Free Form 941 is a convenient and easy-to-use form that can help businesses save time and money on their tax preparation. The form is available in both English and Spanish and can be downloaded for free from the IRS website.

Free Form 941: An Overview

Free Form 941 is an online portal that allows businesses to file their quarterly employment tax returns. It is a secure and convenient way to file taxes, and it can save businesses time and money.

Free Form 941 is available to businesses of all sizes. It is particularly beneficial for businesses that have complex tax situations or that file multiple returns. Free Form 941 can also help businesses to avoid penalties for late or inaccurate filings.

Some examples of businesses that can benefit from using Free Form 941 include:

- Businesses with employees in multiple states

- Businesses that have employees who are paid on a commission basis

- Businesses that have employees who are self-employed

Changes to Free Form 941 for 2024

Yo, listen up businesses! There’s some fresh changes coming to Free Form 941 for 2024. Get ready to adapt your game plan.

These tweaks are designed to streamline your reporting process and keep your tax filings on fleek. Here’s the lowdown:

Updated Filing Format

Starting in 2024, Free Form 941 will sport a new filing format. It’s gonna be more flexible and user-friendly, making it a breeze to report your quarterly payroll info.

Electronic Filing Mandate

Attention, businesses! Filing Free Form 941 electronically will become the norm from 2024 onwards. It’s a slick move that’ll save you time and effort, so get your tech game on point.

Simplified Form Instructions

The crew at the IRS has been working hard to simplify the Free Form 941 instructions. Expect clearer language and step-by-step guidance, making it easier than ever to fill out the form.

Impact on Businesses

These changes are all about making your tax life easier, fam. Here’s how they’ll impact you:

- Reduced Paperwork: No more wrestling with paper forms. Electronic filing is the future, saving you time and hassle.

- Increased Accuracy: Electronic filing minimizes errors and ensures your data is transmitted securely.

- Improved Efficiency: Streamlined filing and simplified instructions will free up your time for more important business.

How to Prepare

Get ready for the Free Form 941 changes by following these tips:

- Check Your Software: Make sure your accounting software is up to date to support the new filing format.

- Get Electronic Filing Ready: Sign up for an IRS-approved electronic filing provider and get your e-signature sorted.

- Review the Instructions: Take some time to read the updated instructions to avoid any confusion.

How to Download Free Form 941 for 2024

Blud, need to get your mitts on the Free Form 941 for 2024? We got you fam. This banger’s a breeze to download, innit? Here’s the lowdown:

Step 1: Cruise to the Official Crib

Hit up the official IRS website: https://www.irs.gov/forms-pubs/about-form-941. It’s like the HQ for all things tax-related, yeah?

Step 2: Find Your Flavour

Scroll down until you spot “2024 Forms.” It’s like a treasure chest filled with tax goodies. Click on “Form 941” and you’re golden.

Step 3: Save the Banger

Now, you’re on the Form 941 page. Look for the “Download” button. It’s your ticket to tax bliss. Click on that and save the PDF to your crib.

Step 4: Chill and Print

Once the download’s done, open the PDF and print it out. Boom! You’re sorted, innit?

Troubleshooting Tips:

- “I can’t find the download button, bruv!” – Check again, fam. It should be right there, staring you in the face.

- “The download’s taking ages, man!” – Patience is a virtue, blud. Give it some time. Your internet might be a bit slow, yeah?

- “The PDF won’t open, what gives?” – Make sure you’ve got a PDF reader installed on your device. If not, grab one for free online.

Using Free Form 941: A Step-by-Step Guide

Free Form 941 is an electronic filing system for employers to report their quarterly federal taxes. It offers a flexible and user-friendly way to submit tax returns, allowing employers to tailor the form to their specific needs. Here’s a step-by-step guide to using Free Form 941:

Step 1: Accessing Free Form 941

– Visit the IRS website (www.irs.gov) and navigate to the “Forms & Pubs” section.

– Under “Forms,” search for “Form 941” and select “Free Form 941.”

– Click on the “Access Free Form 941” button.

Step 2: Creating a New Return

– Select “Create a New Return” from the Free Form 941 homepage.

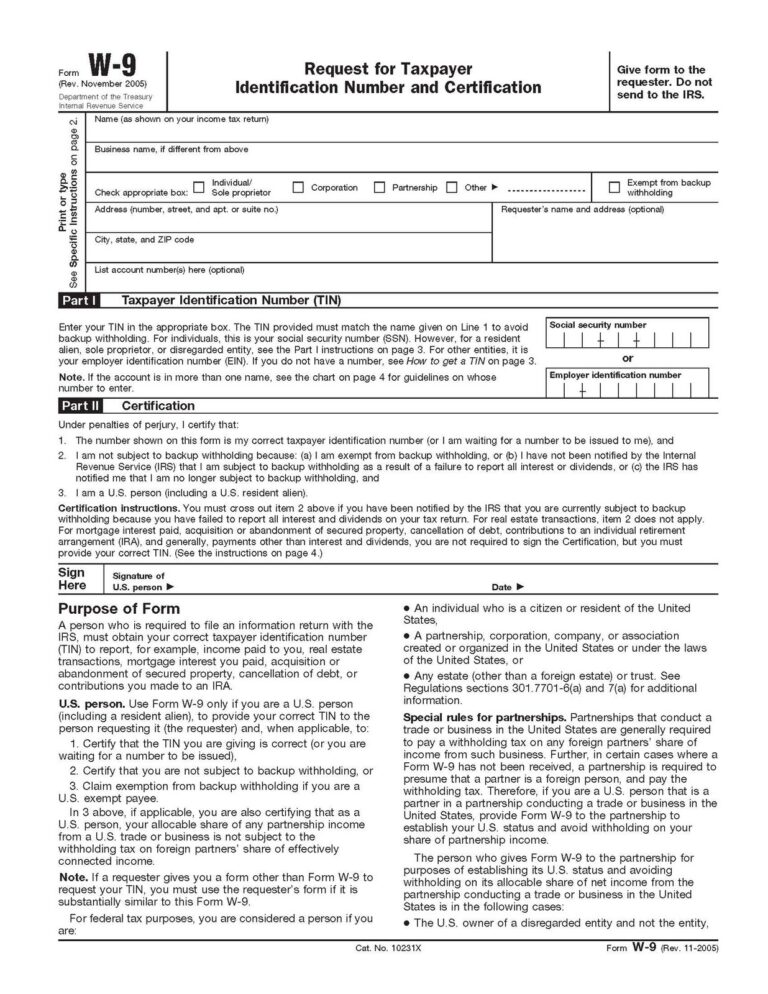

– Enter the required information, such as your Employer Identification Number (EIN), tax period, and tax year.

– Click “Continue” to proceed.

Step 3: Entering Employer Information

– Verify or update your employer information, including your business name, address, and contact details.

– Ensure the information matches your IRS records.

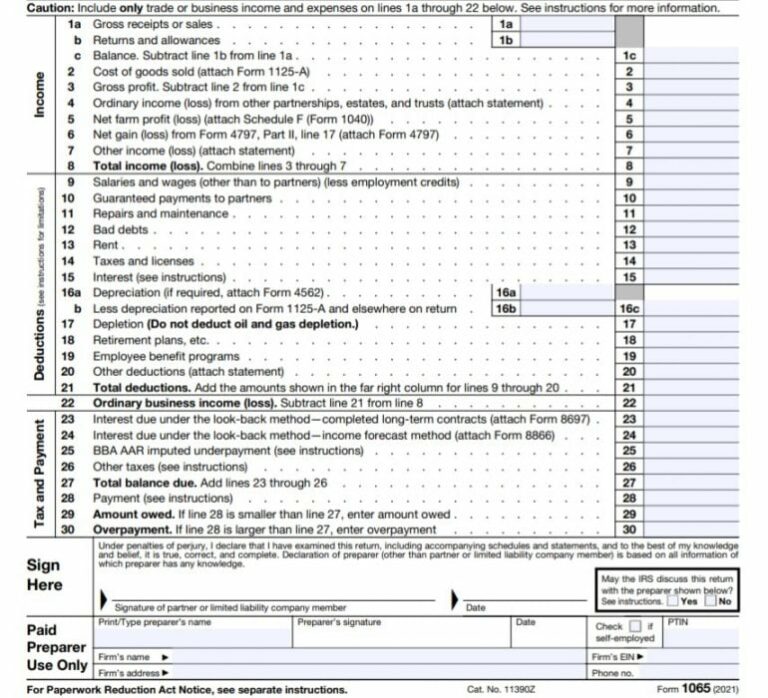

Step 4: Entering Tax Information

– Navigate to the “Taxes” tab.

– Enter the tax amounts for each tax type, such as federal income tax, Social Security tax, and Medicare tax.

– Use the “Add” button to create new tax lines as needed.

Step 5: Entering Employee Information

– Navigate to the “Employees” tab.

– Enter the information for each employee, including their name, Social Security number, and wages.

– Use the “Add” button to add multiple employees.

Step 6: Reviewing and Submitting the Return

– Carefully review the return to ensure all information is accurate and complete.

– Click the “Validate” button to check for any errors or inconsistencies.

– If no errors are found, click the “Submit” button to file your return electronically.

Step 7: Printing and Retaining a Copy

– After submitting the return, you can print a copy for your records.

– It’s recommended to retain a copy of the return for at least three years.

Common Errors and Troubleshooting for Free Form 941

Even though Free Form 941 is designed to be user-friendly, some common errors can occur when using it. These errors can be frustrating, but they can usually be resolved quickly by following a few simple troubleshooting steps.

Here are some of the most common errors that users may encounter when using Free Form 941:

Error: “Invalid SSN or EIN”

This error occurs when you enter an invalid Social Security Number (SSN) or Employer Identification Number (EIN). To resolve this error, make sure that you have entered the correct SSN or EIN. You can also try re-entering the SSN or EIN to see if that resolves the issue.

Error: “Missing required information”

This error occurs when you have not entered all of the required information on the Free Form 941. To resolve this error, make sure that you have completed all of the required fields on the form.

Error: “Incorrect calculation”

This error occurs when you have made an error in calculating your taxes. To resolve this error, carefully review your calculations and make sure that you have made no mistakes.

Error: “Unable to file”

This error occurs when you are unable to file your Free Form 941. This can be due to a variety of reasons, such as a problem with the IRS website or a problem with your internet connection. To resolve this error, try filing your Free Form 941 again later. If you are still unable to file your Free Form 941, you can contact the IRS for assistance.

In addition to the errors listed above, there are a number of other errors that can occur when using Free Form 941. If you encounter an error that is not listed above, you can refer to the IRS website for more information.

The IRS also provides a number of resources to help you troubleshoot errors when using Free Form 941. These resources include:

- The IRS website

- The IRS helpline

- The IRS Publication 3941, “Instructions for Form 941, Employer’s Quarterly Federal Tax Return”

Frequently Asked Questions

What is the Free Form 941?

The Free Form 941 is an IRS tax form used by businesses to report their quarterly federal income tax and social security tax liability.

Who can use the Free Form 941?

The Free Form 941 can be used by businesses of all sizes.

How do I download the Free Form 941?

The Free Form 941 can be downloaded from the IRS website.

How do I use the Free Form 941?

The Free Form 941 is a fillable PDF form that can be completed using a computer or by hand.

Where do I mail the Free Form 941?

The Free Form 941 should be mailed to the IRS address that is listed on the form.