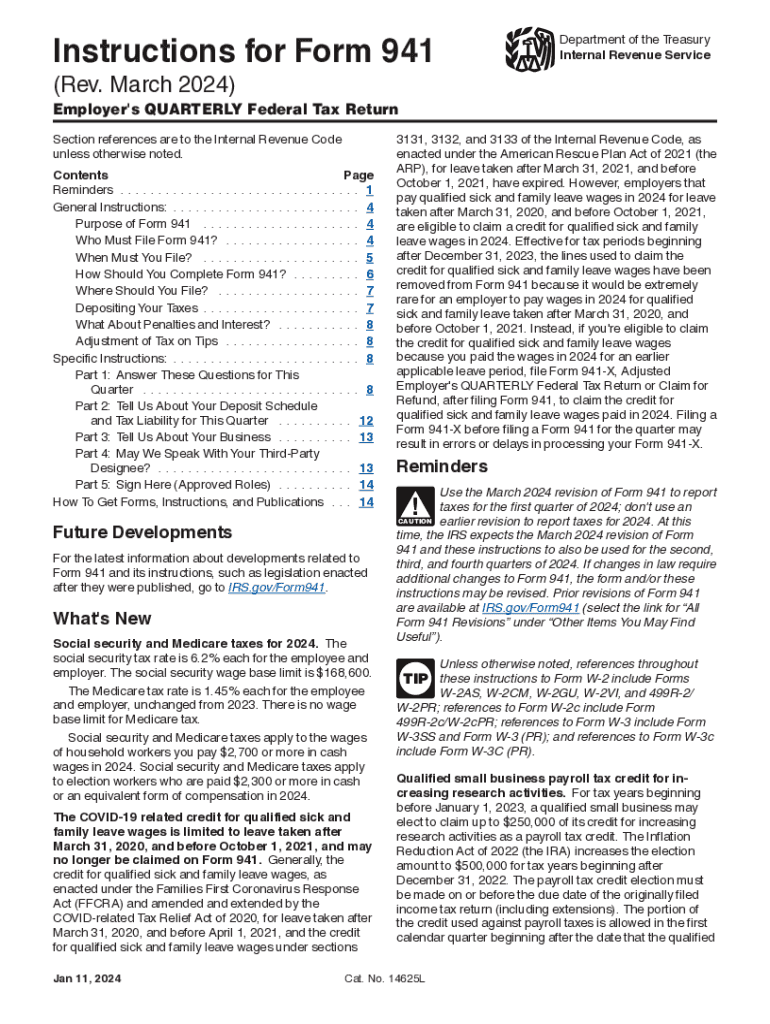

Free Form 941 Instructions 2024 Download: A Comprehensive Guide

Navigating the complexities of tax filing can be daunting, especially when it comes to forms like Form 941. As a business owner, understanding the nuances of this form is crucial for ensuring compliance and avoiding penalties. This guide will provide a comprehensive overview of Form 941, offering clear instructions for downloading, understanding, and completing it accurately.

The Internal Revenue Service (IRS) requires certain businesses to file Form 941, which reports quarterly federal income tax withheld from employees, as well as Social Security and Medicare taxes. Understanding the purpose, significance, and filing requirements of Form 941 is essential for businesses to fulfill their tax obligations effectively.

Frequently Asked Questions

In this section, we’ll tackle some of the most common questions and concerns regarding Form 941. We’ll keep our answers clear and concise, so you can get the information you need without any fuss.

What is Form 941?

Form 941 is a quarterly tax return used by employers to report their federal income tax, Social Security tax, and Medicare tax liabilities. It’s due on the 15th day of the month following the end of each quarter.

Who needs to file Form 941?

Any employer who pays wages to employees is required to file Form 941. This includes businesses, nonprofits, and government agencies.

How do I get a copy of Form 941?

You can download a copy of Form 941 from the IRS website or order it by calling 1-800-TAX-FORM (1-800-829-3676).

Where do I mail Form 941?

The mailing address for Form 941 varies depending on your location. You can find the correct address on the IRS website or on the form itself.

What are the penalties for filing Form 941 late?

The IRS can impose penalties for filing Form 941 late. The penalty is 5% of the unpaid taxes for each month or part of a month that the return is late, up to a maximum of 25%.

Can I file Form 941 electronically?

Yes, you can file Form 941 electronically using the IRS’s e-file system. This is the preferred method of filing, as it is more accurate and efficient than paper filing.

Common Queries

What is the purpose of Form 941?

Form 941 is used to report federal income tax withheld from employees, as well as Social Security and Medicare taxes, to the Internal Revenue Service (IRS).

Who is required to file Form 941?

Businesses that pay wages to employees and are subject to federal income tax withholding, Social Security tax, and Medicare tax are required to file Form 941.

When is Form 941 due?

Form 941 is due quarterly, on the last day of the month following the end of each quarter (April 30, July 31, October 31, and January 31).

Where can I download the Free Form 941 Instructions?

The Free Form 941 Instructions can be downloaded from the IRS website at https://www.irs.gov/forms-pubs/about-form-941.