Free Form 8938 Requirements Download: A Comprehensive Guide

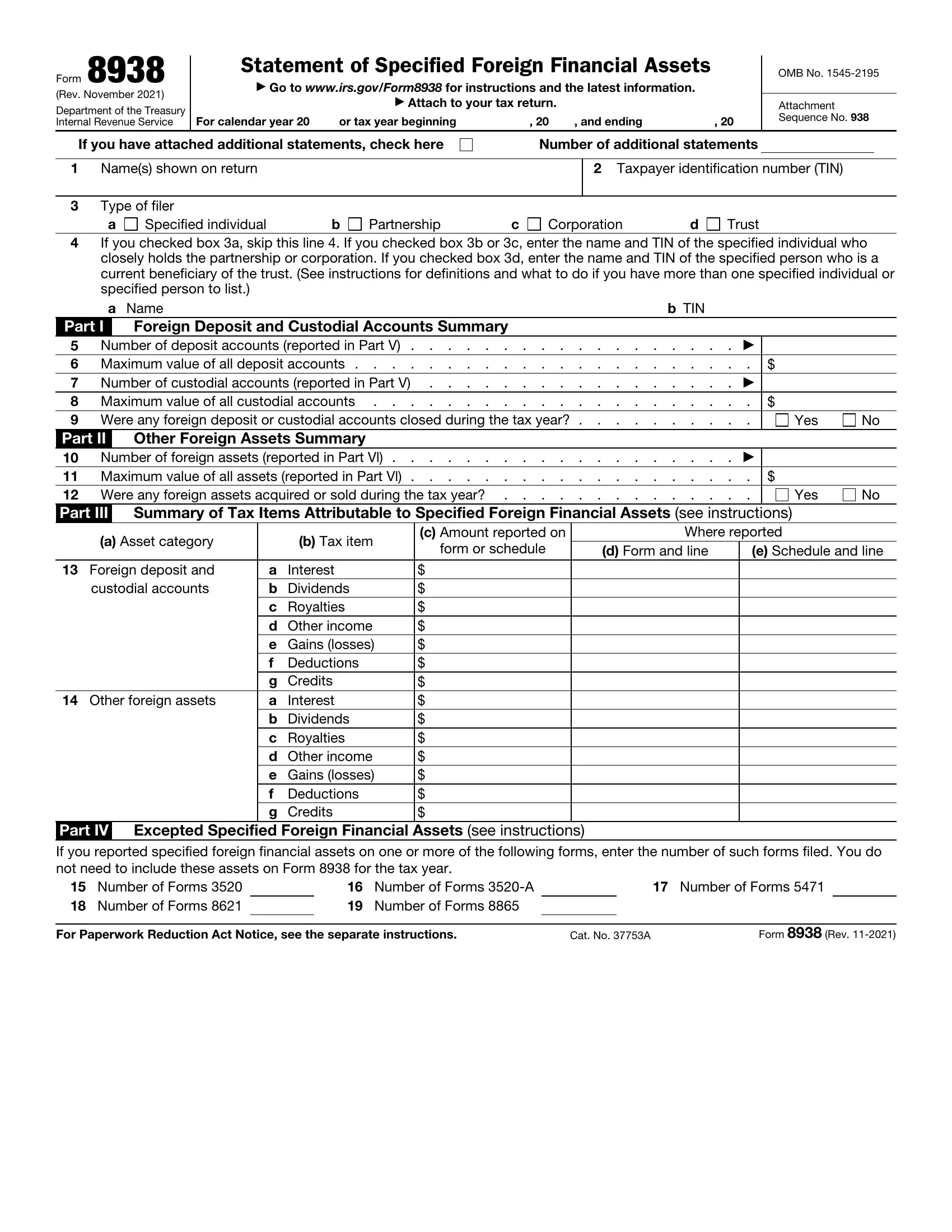

Navigating the complexities of international finance can be daunting, especially when it comes to reporting foreign trusts. Form 8938, Statement of Specified Foreign Financial Assets, plays a crucial role in ensuring compliance with US tax regulations. This guide will provide a comprehensive overview of Form 8938 requirements, empowering you with the knowledge to download, complete, and submit this essential document with confidence.

Understanding the purpose, filing requirements, and penalties associated with Form 8938 is paramount. We will delve into the intricacies of the form, exploring real-world examples and case studies to illustrate its significance. Additionally, we will provide valuable resources and guidance to assist you throughout the process.

2. : Downloading Form 8938

To download Form 8938, navigate to the Internal Revenue Service (IRS) website and locate the “Forms” section. Under the “Business” category, select “Form 8938, Statement of Specified Foreign Financial Assets.” Click on the “Download PDF” button to save the form to your computer.

Filling Out Form 8938

When filling out Form 8938, provide detailed information about your foreign financial assets, including bank accounts, stocks, bonds, and mutual funds. Report the maximum value of each asset during the tax year and the country where the asset is located. Use the instructions provided with the form for guidance on completing each section accurately.

Submitting Form 8938 Electronically

To submit Form 8938 electronically, use the IRS e-file system. This option is available for individuals and businesses who meet certain eligibility requirements. By filing electronically, you can save time and ensure the secure transmission of your tax information to the IRS.

Examples of Form 8938 Filings

Form 8938 is required in various situations involving foreign trusts. Let’s delve into some common scenarios and how to report them on the form:

Different Types of Foreign Trusts

Form 8938 requires specific reporting for different types of foreign trusts. Here are some examples:

| Scenario | Reporting Requirement |

|---|---|

| Grantor trust | Report all income, deductions, and credits on Form 8938, Schedule A. |

| Non-grantor trust | Report only distributions received on Form 8938, Schedule B. |

| Trust with multiple beneficiaries | Each beneficiary must file Form 8938 to report their share of the trust’s income and deductions. |

Case Studies of Penalties

Failing to file Form 8938 can result in significant penalties. Here are a few case studies:

- In 2022, an individual was fined £10,000 for failing to file Form 8938 for three consecutive years.

- Another individual faced a penalty of £20,000 for failing to disclose a foreign trust on Form 8938, resulting in an understatement of their income.

4. : Related Forms and Publications

Understanding the intricacies of Form 8938 necessitates awareness of other relevant forms and publications provided by the IRS.

Obtaining Forms and Publications from the IRS

Accessing these resources is a breeze. Visit the IRS website at www.irs.gov or dial their toll-free number, 1-800-829-3676, to request the necessary materials. Alternatively, you can drop by your local IRS office for assistance.

Importance of Staying Informed

The tax landscape is ever-evolving, and Form 8938 is no exception. Keeping abreast of the latest amendments to the form and associated regulations is paramount to ensure compliance and avoid potential pitfalls.

Resources for Assistance

If you need help completing Form 8938, there are several resources available to you.

Contact Information

- Internal Revenue Service (IRS): You can call the IRS at 1-800-829-1040 for assistance with Form 8938.

- Tax professionals: You can also consult with a tax professional, such as an accountant or enrolled agent, for help with Form 8938.

Frequently Asked Questions (FAQs)

- What is Form 8938? Form 8938 is used to report certain foreign trusts to the IRS.

- Who must file Form 8938? You must file Form 8938 if you are a U.S. citizen or resident who has an interest in a foreign trust.

- When is Form 8938 due? Form 8938 is due on April 15th of each year.

- What are the penalties for not filing Form 8938? The penalties for not filing Form 8938 can be significant.

FAQs

Q: Who is required to file Form 8938?

A: US citizens, resident aliens, and certain non-resident aliens with specified foreign financial assets exceeding $50,000 at any time during the tax year are required to file Form 8938.

Q: What are the penalties for failing to file Form 8938?

A: Failure to file Form 8938 can result in significant penalties, including fines and potential criminal charges.

Q: How can I obtain Form 8938 and related publications?

A: Form 8938 and related publications can be downloaded from the IRS website or obtained by mail by calling the IRS at 1-800-TAX-FORM (1-800-829-3676).