Free Form 8938 Penalty Download: A Comprehensive Guide

Navigating the complexities of tax reporting can be a daunting task, especially when it comes to understanding and managing penalties. Form 8938 plays a crucial role in this process, and ensuring its accurate completion and timely submission is essential to avoid costly consequences.

This comprehensive guide will delve into the intricacies of Form 8938, providing a detailed overview of its purpose, penalties associated with it, and step-by-step instructions on how to download, fill out, and submit the form. We will also address commonly asked questions to empower you with the knowledge you need to handle Form 8938 with confidence.

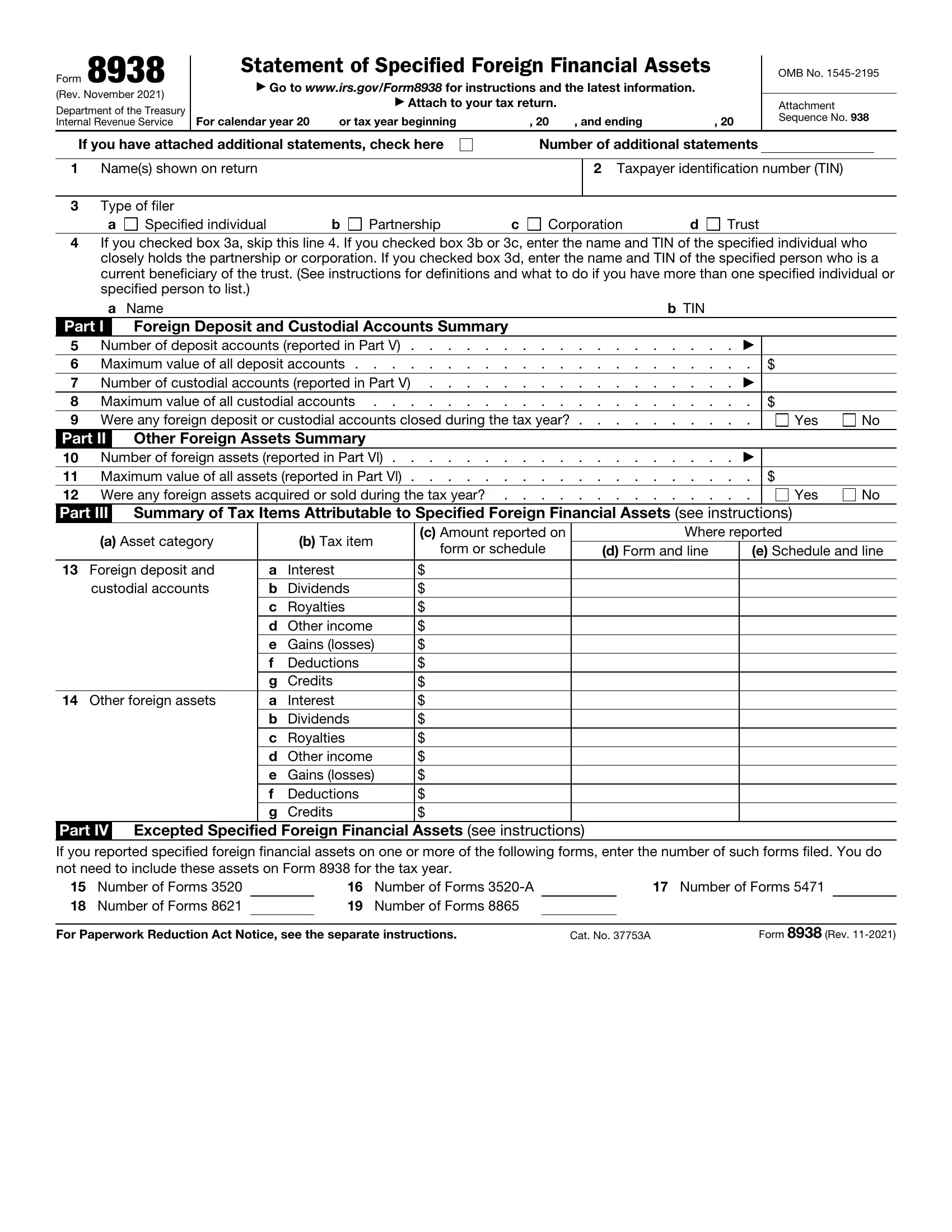

Form 8938 Overview

Form 8938, known as “Statement of Specified Foreign Financial Assets”, is a tax form filed with the IRS to report certain foreign financial assets held by US citizens or residents. The purpose of this form is to ensure compliance with US tax laws by disclosing foreign assets that may be subject to taxation. It helps the IRS identify potential tax liabilities and enforce reporting requirements.

The form comprises several sections, each covering specific aspects of foreign financial assets. These sections include:

Part I: Taxpayer Information

This section captures basic information about the taxpayer, including name, address, and Social Security number.

Part II: Foreign Financial Assets

This section requires the taxpayer to provide details about their foreign financial assets, such as bank accounts, investment accounts, and other financial instruments held outside the US. It includes fields for reporting the account numbers, balances, and the countries where the assets are located.

Part III: Foreign Trusts

If the taxpayer has any ownership interest in foreign trusts, they must disclose them in this section. Information such as the trust name, country of establishment, and the taxpayer’s beneficial interest is required.

Part IV: Foreign Corporations

This section is for reporting ownership interests in foreign corporations. It includes fields for the corporation’s name, country of incorporation, and the taxpayer’s ownership percentage.

Part V: Penalties

This section calculates any potential penalties for failure to timely file Form 8938 or for underreporting foreign financial assets. It also provides instructions on how to make penalty payments.

By completing Form 8938 accurately and on time, taxpayers can demonstrate compliance with US tax laws and avoid potential penalties. It’s important to consult with a tax professional if you have complex foreign financial assets or need guidance on completing the form.

Understanding Penalties

Penalties for not filing Form 8938 on time or for not reporting correctly can be harsh. If you’re late filing, you could be fined up to £10,000. And if you don’t report correctly, you could be fined up to £30,000.

It’s important to be aware of these penalties so that you can avoid them. If you’re not sure how to file Form 8938, you should seek professional advice.

Additional Resources

If you need further assistance or have questions about the Free Form 8938 Penalty, here are some useful resources:

FAQs and Support Documents

- IRS FAQs on Form 8938: https://www.irs.gov/forms-pubs/about-form-8938

- IRS Support Document on Form 8938: https://www.irs.gov/pub/irs-pdf/i8938.pdf

Contact Information

If you have any questions or need assistance, you can contact the IRS at:

- Phone: 1-800-829-1040

- Website: https://www.irs.gov/

Summary Table

Here’s a summary table of the key information covered in this article:

| Topic | Summary |

|---|---|

| Form 8938 | Used to report and pay the failure-to-file penalty. |

| Penalty Amount | Varies depending on the type of tax return and the number of days late. |

| Due Date | Same as the due date of the tax return. |

| Penalties | Can be substantial, so it’s important to file your tax returns on time. |

FAQ Corner

What are the consequences of failing to file Form 8938 on time?

Late filing of Form 8938 can result in penalties of up to $50 per month, with a maximum penalty of $25,000.

Can I download Form 8938 from the IRS website?

Yes, Form 8938 can be downloaded from the IRS website at www.irs.gov.

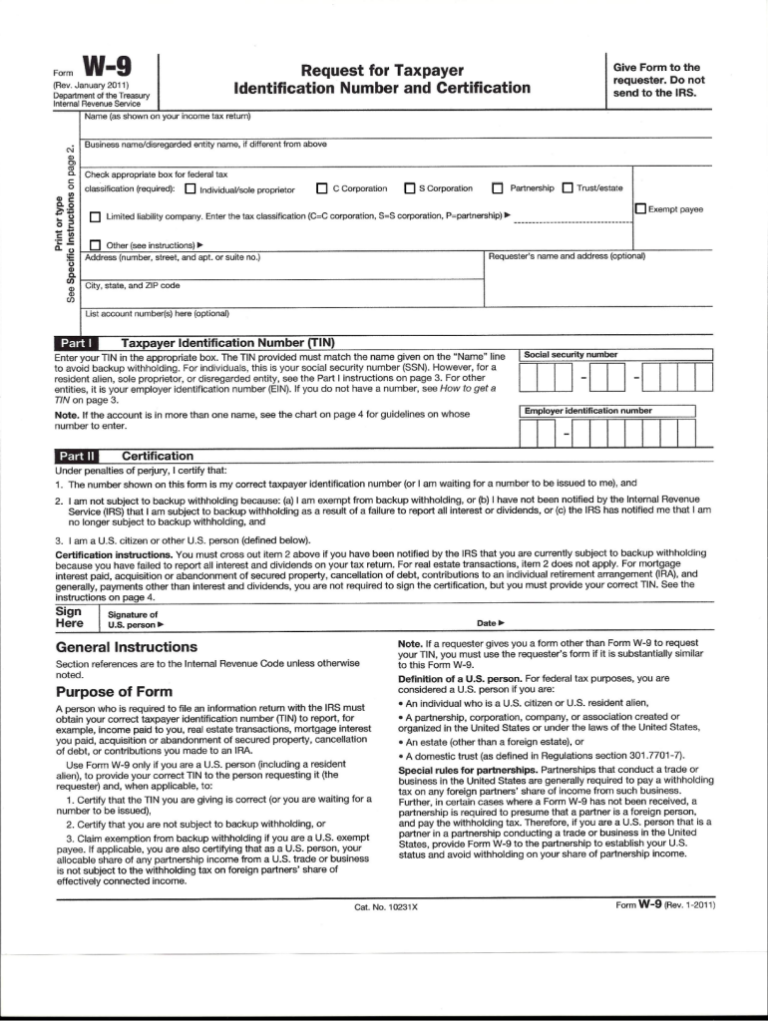

What information do I need to gather before filling out Form 8938?

You will need to gather information such as your Social Security number, employer identification number, and details of the foreign trust or foreign estate.

Where can I find additional resources and support for Form 8938?

The IRS website provides a wealth of resources, including FAQs, support documents, and contact information for assistance.