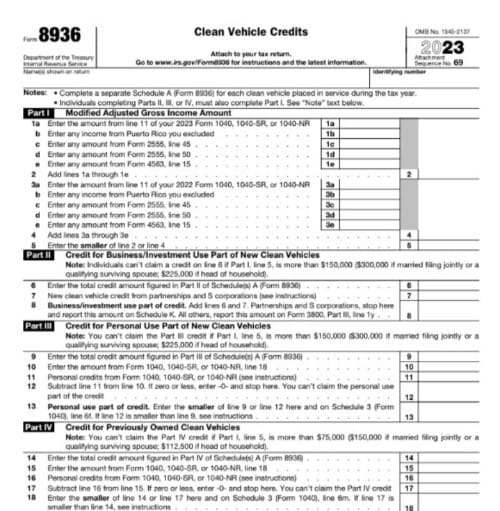

Free Form 8936 Example Download: A Comprehensive Guide

Navigating the complexities of tax forms can be daunting, but understanding and utilizing Form 8936 is essential for certain tax-related situations. This comprehensive guide provides a detailed overview of Form 8936, offering step-by-step instructions for downloading, completing, and submitting the form, ensuring a seamless and accurate tax filing process.

This guide covers everything you need to know about Form 8936, including its purpose, who needs to file it, and how to obtain, fill out, and submit the form. We’ll also explore alternative forms and methods that may be applicable in specific circumstances, providing you with a well-rounded understanding of your tax filing options.

Free Form 8936 Overview

Form 8936, known as the “Statement of Foreign Financial Assets”, is a document required by the US Internal Revenue Service (IRS) from taxpayers who have foreign financial assets exceeding specific thresholds. It’s primarily used to report foreign bank accounts, stocks, bonds, mutual funds, and other investments held outside the US.

Individuals and entities with an aggregate value of foreign financial assets exceeding $50,000 at any time during the tax year must file Form 8936. This includes US citizens, residents, and non-resident aliens with a US tax filing obligation.

Purpose and Usage

The primary purpose of Form 8936 is to help the IRS enforce tax compliance by ensuring that taxpayers accurately report their worldwide income, including income from foreign sources. By disclosing foreign financial assets, taxpayers help the IRS identify potential tax evasion and avoidance schemes.

Who Needs to File

Individuals and entities required to file Form 8936 include:

- US citizens, regardless of where they reside

- US residents, including green card holders

- Non-resident aliens with a US tax filing obligation

Entities such as trusts, estates, partnerships, and corporations may also need to file Form 8936 if they have foreign financial assets.

When to File

Form 8936 is due on the same date as your federal income tax return, which is generally April 15th. However, taxpayers may request an extension to file Form 8936 by filing Form 4868, Application for Automatic Extension of Time to File US Individual Income Tax Return.

Submitting Form 8936

There are a few different ways to submit Form 8936:

– Mail: You can mail the completed form to the IRS at the address provided on the form.

– Fax: You can fax the completed form to the IRS at the number provided on the form.

– Online: You can submit the completed form online through the IRS website.

It is important to submit Form 8936 timely. The due date for Form 8936 is April 15th of the year following the year in which the loss occurred. If you file your Form 8936 late, you may have to pay penalties and interest.

Mailing Form 8936

To mail Form 8936, you will need to:

1. Complete the form in its entirety.

2. Sign and date the form.

3. Include all required attachments.

4. Mail the form to the IRS at the address provided on the form.

Faxing Form 8936

To fax Form 8936, you will need to:

1. Complete the form in its entirety.

2. Sign and date the form.

3. Include all required attachments.

4. Fax the form to the IRS at the number provided on the form.

Submitting Form 8936 Online

To submit Form 8936 online, you will need to:

1. Go to the IRS website.

2. Click on the “Forms” tab.

3. Select Form 8936 from the list of forms.

4. Follow the instructions on the screen to complete and submit the form.

Alternatives to Form 8936

There may be situations where using Form 8936 is not the most suitable option. In such cases, alternative forms or methods can be explored. Here’s a comparative analysis of some alternatives to Form 8936:

Alternative Forms

– Form 8937: This form is used to report certain types of tax credits and deductions that cannot be reported on Form 8936. For example, the child tax credit, the earned income tax credit, and the American opportunity tax credit.

– Form 1040-ES: This form is used to make estimated tax payments if you expect to owe more than $1,000 in taxes for the year. Estimated tax payments are due on April 15, June 15, September 15, and January 15 of the following year.

– Form 1040-V: This form is used to file a simplified tax return if your income is below a certain threshold. Form 1040-V is not available to everyone, so you should check the IRS website to see if you qualify.

Comparison of Alternatives

The following table compares the advantages and disadvantages of each alternative to Form 8936:

| Form | Advantages | Disadvantages |

|—|—|—|

| Form 8937 | – Used to report certain types of tax credits and deductions that cannot be reported on Form 8936 | – More complex than Form 8936 |

| Form 1040-ES | – Used to make estimated tax payments | – Must be filed quarterly |

| Form 1040-V | – Simplified tax return | – Not available to everyone |

FAQs

Can I download Form 8936 online?

Yes, Form 8936 is available for download from the official IRS website and various other reputable sources.

What is the purpose of Form 8936?

Form 8936 is used to report qualified adoption expenses for the adoption of a child with special needs.

Who needs to file Form 8936?

Individuals who have incurred qualified adoption expenses for the adoption of a child with special needs are required to file Form 8936.

What are the deadlines for filing Form 8936?

Form 8936 must be filed with your federal income tax return by the tax filing deadline, typically April 15th.

Where can I get help filling out Form 8936?

You can consult with a tax professional, such as a certified public accountant (CPA) or enrolled agent (EA), for assistance with completing Form 8936.