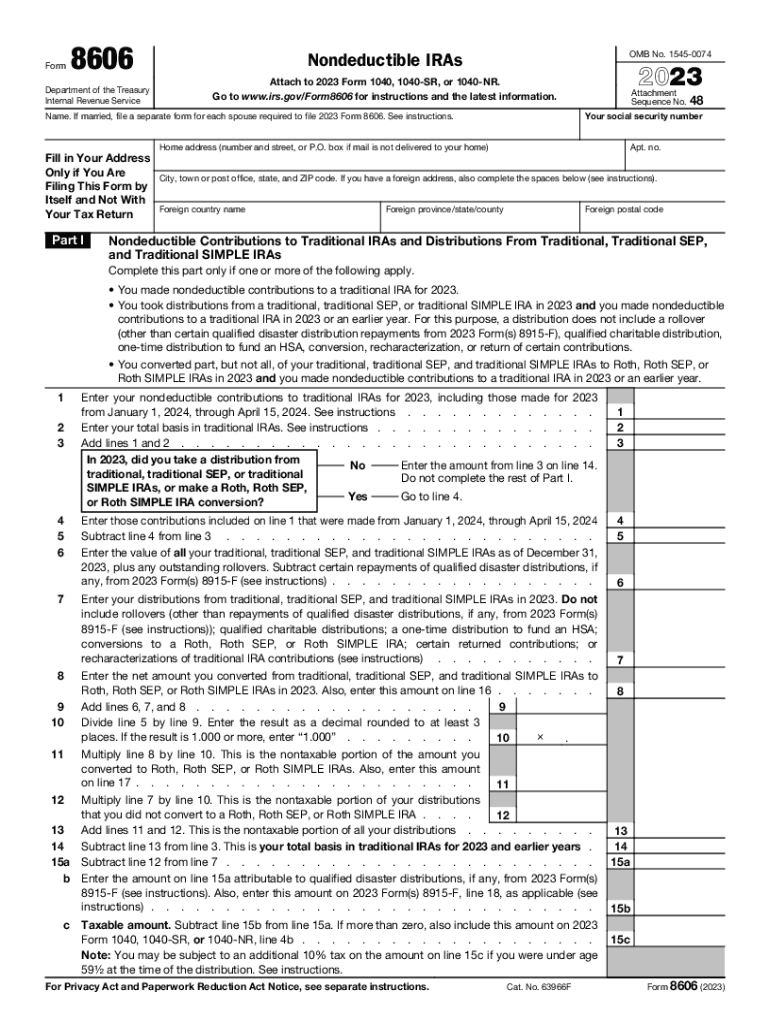

Free Form 8606 Instruction Download: A Comprehensive Guide

Navigating the intricacies of tax reporting can be a daunting task, but understanding and utilizing Form 8606 is a crucial step in ensuring accurate and timely tax filings. This form, officially titled “Nondeductible IRAs,” plays a pivotal role in reporting contributions to traditional and Roth IRAs, as well as other relevant information. To empower taxpayers with the knowledge they need, this guide provides a comprehensive overview of Form 8606, including detailed instructions for downloading, completing, and submitting the form.

With a focus on clarity and accessibility, this guide delves into the purpose, structure, and significance of Form 8606. By exploring the intricacies of this form, taxpayers can gain a deeper understanding of their tax obligations and make informed decisions regarding their retirement savings.

Free Form 8606 Overview

Form 8606 is a vital document for Brits looking to apply for a National Insurance number. It serves as a gateway for individuals who need to work, pay taxes, and access various government services in the UK. The form has been around for decades, playing a crucial role in streamlining the application process for National Insurance numbers.

Form 8606 comprises several sections, each catering to specific information about the applicant. It includes personal details, contact information, reasons for applying, and supporting documentation. Completing the form accurately and submitting it along with the required documents is essential for a successful application.

Purpose of Form 8606

The primary purpose of Form 8606 is to gather essential information from individuals who require a National Insurance number. This number is a unique identifier used by the UK government to track individuals’ contributions to the National Insurance system. It’s crucial for accessing various government benefits, including healthcare, pensions, and unemployment benefits.

Sections of Form 8606

Form 8606 consists of several sections, each collecting specific information about the applicant. These sections include:

- Personal Details: This section collects basic information such as name, address, date of birth, and contact details.

- Reasons for Applying: Here, applicants must indicate the reason for applying for a National Insurance number, such as starting a new job, self-employment, or claiming benefits.

- Supporting Documentation: Applicants must provide copies of supporting documents, such as passports, birth certificates, and proof of address, to verify their identity and eligibility.

Downloading s

Alright, let’s get down to the nitty-gritty. Downloading Form 8606 is a doddle, so follow these steps and you’ll be sorted.

First off, head to the official Inland Revenue website. It’s like the holy grail for tax forms, so you can’t miss it.

Finding the Form

Once you’re there, type “Form 8606” into the search bar. It’ll show you a list of all the different versions of the form, so pick the one that’s right for you.

Downloading the Form

Now, click on the “Download” button. You might need to save it to your computer or open it in a new tab, depending on your browser.

And there you have it! Form 8606, ready for you to fill in and get your tax sorted.

Form Completion and Submission

Filling in Form 8606 is a doddle, but it’s important to be on the ball and get it spot on. Here’s the lowdown on how to fill it out like a pro and submit it without any hiccups.

Filling it Out

First off, make sure you’ve got all the right info to hand. You’ll need your personal details, income, and expenses. Once you’ve got that sorted, follow these top tips:

* Be accurate – Don’t guesstimate or make stuff up. Double-check everything before you hit submit.

* Be thorough – Fill in every section that applies to you. If it doesn’t, write “N/A” or leave it blank.

* Be clear – Write legibly and use black ink. If you’re typing it up, use a standard font like Arial or Times New Roman.

Submitting it

There are two ways to submit your form:

* Online – This is the easiest and quickest way. Just go to the HMRC website and follow the instructions. You’ll need to create an account if you don’t have one already.

* By post – You can also send your form by post. Just print it out, fill it in, and send it to the address on the form.

Whichever method you choose, make sure you submit your form by the deadline. If you miss the deadline, you may have to pay a penalty.

Common Issues and Troubleshooting

Innit, using Form 8606 can be a bit of a bludger, but don’t you worry your pretty little head. This section will guide you through the common issues you might face and how to sort them out like a pro. We’ll also fill you in on any limitations or restrictions you need to know about.

Incorrect or Incomplete Information

If you’re getting error messages or your form isn’t being accepted, it’s likely because you’ve put in the wrong info or missed out some bits. Double-check everything carefully, making sure you’ve filled in all the required fields and that the info you’ve given is bang on.

Technical Glitches

Sometimes, the website or your internet connection can play up, causing you to lose your progress or get stuck. If this happens, don’t panic. Just refresh the page or try again later. If the problem keeps happening, give the tech support team a bell and they’ll sort it out for you.

Limitations and Restrictions

There are a few things you need to keep in mind when using Form 8606:

- You can only submit the form once, so make sure you’ve got everything sorted before you hit that submit button.

- The form is only valid for a certain amount of time, so don’t leave it hanging around for too long before you submit it.

- You can’t save your progress and come back to it later, so make sure you’ve got all the info you need before you start filling it in.

Additional Resources and Support

In case you need further assistance or information about Form 8606, several resources are available.

If you encounter any difficulties completing or submitting the form, don’t hesitate to reach out to the relevant authorities or support channels.

Contact Details

- HM Revenue and Customs (HMRC): 0300 200 3300

- HMRC Online Enquiry Service: https://www.gov.uk/contact-hmrc

Online Resources

- HMRC Form 8606 Guide: https://www.gov.uk/government/publications/form-8606-certificate-of-charitable-status-for-gift-aid

- Charity Commission Website: https://www.gov.uk/government/organisations/charity-commission

- Online Forum for Charities: https://www.charityforum.org.uk/

FAQs

What is the purpose of Form 8606?

Form 8606 serves as a reporting mechanism for nondeductible contributions made to traditional and Roth IRAs. It ensures that these contributions are properly accounted for and reported to the Internal Revenue Service (IRS).

Where can I download Form 8606?

The official Form 8606 can be conveniently downloaded from the IRS website at www.irs.gov.

Are there any specific requirements for completing Form 8606?

Yes, completing Form 8606 requires accurate information, including your Social Security number, IRA account numbers, and contribution amounts. Refer to the IRS instructions for detailed guidance.

What are the common issues associated with Form 8606?

Common issues may include incorrect entries, missing information, or confusion regarding the types of IRA contributions to report. Carefully review the form and seek professional assistance if needed.

Where can I find additional support for Form 8606?

The IRS website provides comprehensive resources, including instructions, FAQs, and contact information for assistance. Additionally, tax professionals can offer personalized guidance tailored to your specific situation.