Free Form 801 Oregon: Download, Fill Out, and Submit with Ease

Navigating legal processes can be daunting, but it doesn’t have to be. Understanding the purpose and significance of legal forms like Form 801 in Oregon is crucial for ensuring a smooth and compliant experience. In this comprehensive guide, we will delve into the intricacies of Form 801, providing a step-by-step approach to downloading, filling out, and submitting it.

Whether you’re an individual navigating legal matters or a professional seeking to enhance your knowledge, this guide will equip you with the essential information you need. By understanding the legal implications and nuances of Form 801, you can confidently navigate the legal landscape in Oregon.

Free Form 801 Oregon

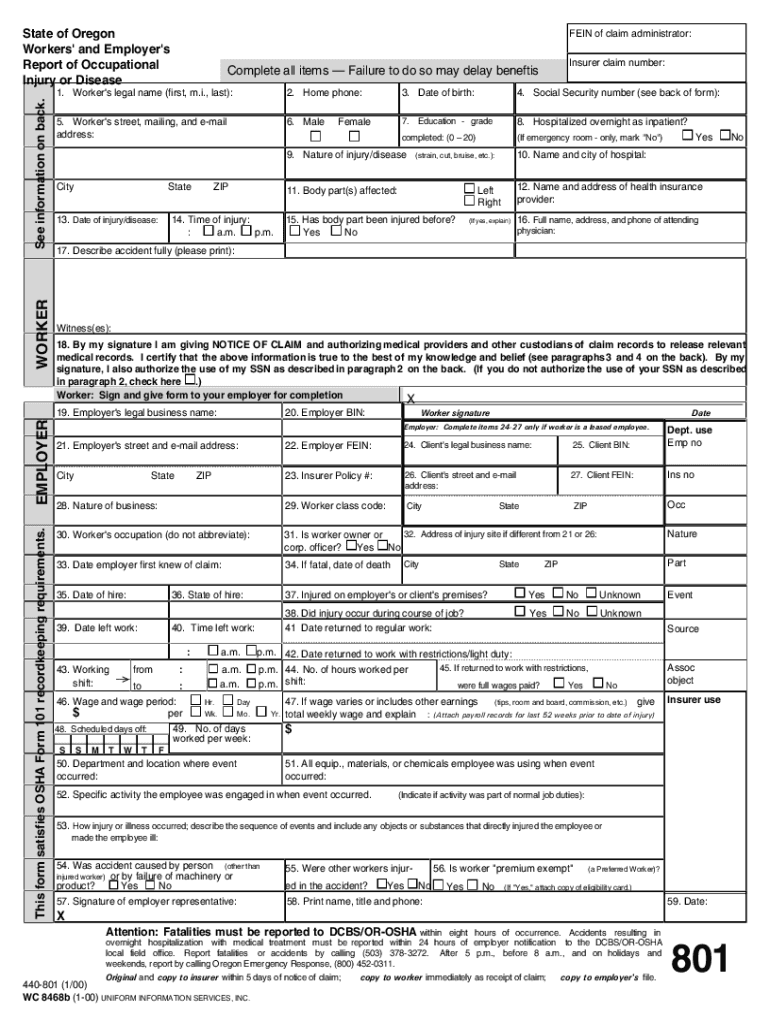

Form 801 in Oregon is a legal document that allows individuals to establish a new business entity, such as a corporation, limited liability company (LLC), or partnership. It is a comprehensive form that requires detailed information about the business, its owners, and its operations.

The form is divided into several sections, each of which covers a specific aspect of the business. The first section, “Business Information,” requires the name, address, and registered agent of the business. The second section, “Owners and Officers,” requires the names, addresses, and titles of the business’s owners and officers. The third section, “Business Purpose,” requires a description of the business’s purpose and activities. The fourth section, “Registered Agent,” requires the name and address of the business’s registered agent. The fifth section, “Signatures,” requires the signatures of the business’s owners and officers.

Filing Form 801 in Oregon is a legal requirement for all businesses that wish to operate in the state. The form must be filed with the Oregon Secretary of State’s office. Once the form is filed, the business will be registered with the state and will be able to conduct business legally.

Downloading Form 801

Downloading Form 801 is a straightforward process. You can obtain the form directly from the official website or through alternative sources.

The form is compatible with various operating systems and devices, including Windows, macOS, iOS, and Android. You can download the form in PDF or fillable format, depending on your preference.

Direct Download Link

- Official website: Oregon Department of Revenue

Alternative Sources

In case you cannot access the official website, you can also obtain Form 801 from the following sources:

- Legal document websites: FindLaw, Nolo

- Tax preparation software: TurboTax, H&R Block

- Local tax offices

Filling Out Form 801

Get your hands on the Oregon Free Form 801? Bangin’! Now, let’s dive into how to fill it out like a pro. Remember, this form is your chance to spill the beans on your financial sitch, so make sure you’re on the level and accurate.

Step-by-Step Guide

- Personal Details: Kick things off by giving them the lowdown on who you are. Name, address, and all that jazz.

- Income: Time to show ’em the dough! List all your income sources, including wages, self-employment, and any other moolah you’re raking in.

- Deductions: This is where you get to flex your deduction game. Mortgage interest, property taxes, and charitable donations – anything that can help you reduce your taxable income.

- Credits: Credits are like little tax breaks that can knock down your tax bill. Check out the list and see if you qualify for any.

- Sign and Date: Once you’re done filling out the form, don’t forget to put your John Hancock on it and slap on the date. This makes it official, innit?

There you have it, bruv! Filling out Form 801 doesn’t have to be a headache. Just follow these steps, and you’ll be sorted.

Tips for Avoiding Errors

- Be Accurate: Make sure all the info you’re giving is on point. Don’t try to pull a fast one, or you might end up in hot water.

- Double-Check: Once you’re done, give it a once-over to make sure you haven’t missed anything or made any boo-boos.

- Seek Help: If you’re feeling a bit overwhelmed, don’t be afraid to reach out for help. A tax pro can guide you through the process and make sure you’re doing it right.

Remember, filling out Form 801 is your chance to show the taxman what you’re made of. So, get it right, and you’ll be laughing all the way to the bank!

Examples and Case Studies

Form 801 has been widely used in Oregon for various purposes, including:

Let’s explore some real-world examples and case studies to demonstrate its effectiveness and impact:

Example 1

Case: A property owner in Portland used Form 801 to request a property tax exemption for their home, claiming they were over 65 years old and met the income eligibility requirements.

Outcome: The county assessor reviewed the form and supporting documentation, verified the applicant’s eligibility, and granted the property tax exemption, resulting in significant savings for the homeowner.

Example 2

Case: A non-profit organization in Eugene used Form 801 to apply for a sales tax exemption on equipment and supplies purchased for their charitable activities.

Outcome: The Oregon Department of Revenue processed the form and determined that the organization qualified for the exemption, allowing them to save money on essential purchases and further their mission.

Example 3

Case: A small business in Bend used Form 801 to request a refund of excess unemployment insurance taxes paid during the COVID-19 pandemic.

Outcome: The Oregon Employment Department reviewed the form and supporting documents, confirmed the business’s eligibility, and issued a refund, providing much-needed financial relief.

Frequently Asked Questions

Below is a compilation of frequently asked questions (FAQs) about Form 801, along with concise and informative answers.

- Who needs to fill out Form 801?

- Individuals who are claiming a deduction for qualified tuition and related expenses.

- What expenses are eligible for the deduction?

- Qualified expenses include tuition, fees, and certain other expenses related to higher education.

- What is the maximum amount of the deduction?

- The maximum deduction amount varies depending on the taxpayer’s filing status and income.

- How do I claim the deduction?

- Complete Form 801 and attach it to your tax return.

- Where can I get help filling out Form 801?

- You can find instructions and resources on the IRS website or seek professional assistance from a tax preparer.

FAQ

What is the purpose of Form 801 in Oregon?

Form 801 is a legal document used in Oregon to initiate various legal proceedings, including civil actions, small claims, and landlord-tenant disputes.

Where can I download Form 801?

You can download Form 801 directly from the Oregon Judicial Department website or obtain it from the courthouse.

How do I fill out Form 801?

Follow the step-by-step instructions provided in this guide, ensuring accurate and complete information.

What are the legal implications of filing Form 801?

Filing Form 801 initiates a legal process, and it’s essential to understand the potential consequences and legal implications.

When should I seek professional assistance?

If you have complex legal matters or require guidance, it’s advisable to consult with an attorney.