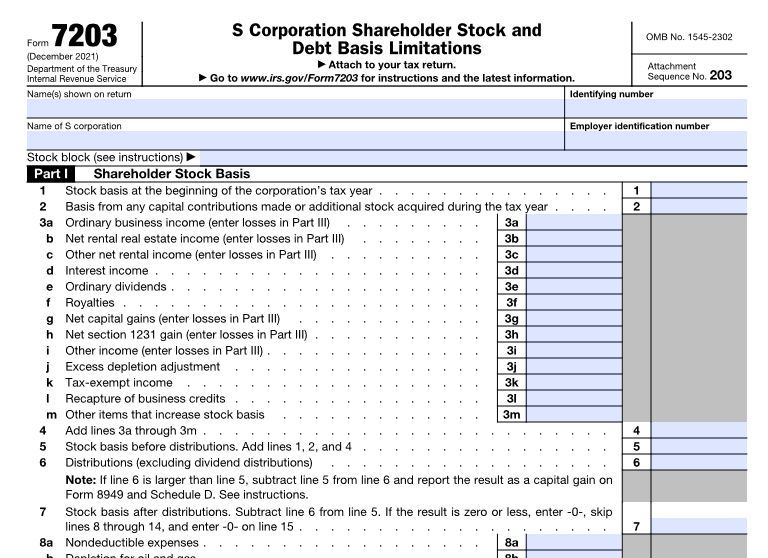

Free Form 7203 Irs Download: A Comprehensive Guide

Navigating the complexities of tax filing can be a daunting task, especially when it comes to specialized forms like the IRS Form 7203. This comprehensive guide will provide you with a thorough understanding of Form 7203, its significance, and the step-by-step process of completing and submitting it accurately. Whether you’re an individual taxpayer or a tax professional, this guide will empower you with the knowledge and resources you need to handle Form 7203 with confidence.

This guide will delve into the purpose, eligibility criteria, and detailed instructions for filling out Form 7203. We will explore the potential penalties and consequences of incorrect or incomplete filing, emphasizing the importance of accuracy and timely submission. Additionally, we will discuss the supporting documents required, providing guidance on gathering and organizing them effectively.

Form 7203 in Context

Blud, Form 7203 is a bit of a don when it comes to your tax filing game. It’s like the captain of the tax forms, innit? It’s the main man when it comes to reporting your quarterly federal excise taxes. Think of it as the big boss that keeps track of all the taxes you’ve been paying on things like fuel, alcohol, and tobacco.

How Form 7203 Rolls with Other Tax Forms

Form 7203 ain’t no solo act, fam. It’s got a crew of other tax forms that it works with to get the job done. One of its main mates is Form 720, the Quarterly Federal Excise Tax Return. Form 720 is like the big picture, giving the IRS the lowdown on all your excise taxes for the quarter. Form 7203, on the other hand, is the nitty-gritty, breaking down those taxes into specific categories like fuel, alcohol, and tobacco.

How Form 7203 Gets Used in Tax Calculations

Form 7203 is like the brains behind your tax calculations. It’s the form that the IRS uses to figure out how much tax you owe. The info from Form 7203 gets plugged into your tax return, and the IRS uses it to calculate your tax liability. It’s like the secret sauce that makes sure you’re paying the right amount of tax, innit?

Example: Fuel Taxes and Form 7203

Let’s say you’re a geezer who drives a gas-guzzler. When you fill up your tank, you’re paying federal excise tax on that fuel. That tax gets reported on Form 7203. The IRS uses that info to calculate how much tax you owe, and it gets added to your tax bill. So, Form 7203 is like the snitch that tells the IRS how much fuel tax you’ve been paying, and the IRS uses that info to make sure you’re paying your fair share.

Historical Perspectives

Form 7203 has a long history, dating back to the early days of income tax. It was originally created as a way for taxpayers to report their foreign bank account balances. Over the years, the form has undergone several significant changes, both in terms of its content and its purpose.

One of the most significant changes to Form 7203 came in 2010, when the Foreign Account Tax Compliance Act (FATCA) was passed. FATCA requires foreign banks to report the account balances of US citizens and residents to the IRS. As a result of FATCA, Form 7203 was expanded to include information about foreign trusts and other foreign financial assets.

In recent years, there have been several other changes to Form 7203, including:

- The addition of a new Schedule B, which requires taxpayers to report information about their foreign trusts.

- The elimination of the requirement to file Form 7203 if the taxpayer’s foreign account balances are below a certain threshold.

- The introduction of a new online filing system for Form 7203.

These changes have made Form 7203 more complex and burdensome for taxpayers. However, they are also necessary to ensure that the IRS has the information it needs to enforce the tax laws.

Future Outlook

The future of Form 7203 is uncertain. However, it is likely that the form will continue to be used by the IRS to collect information about foreign financial assets. It is also possible that the form will be further expanded to include information about other types of foreign assets, such as real estate and investments.

Helpful Answers

Q: What is the purpose of IRS Form 7203?

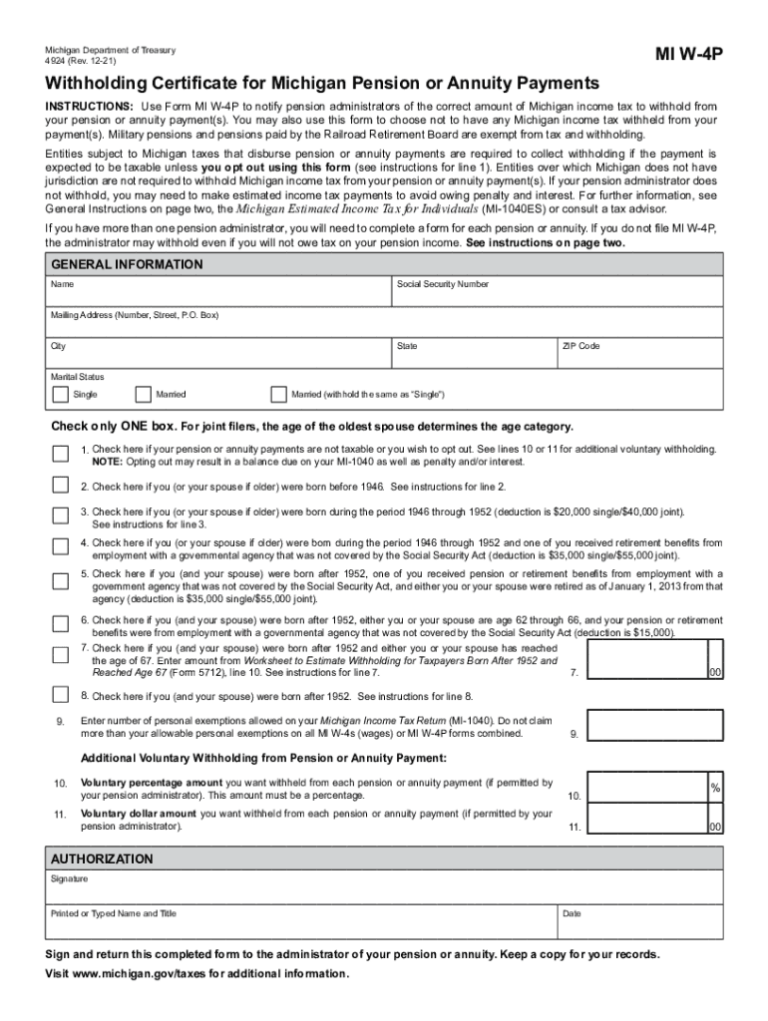

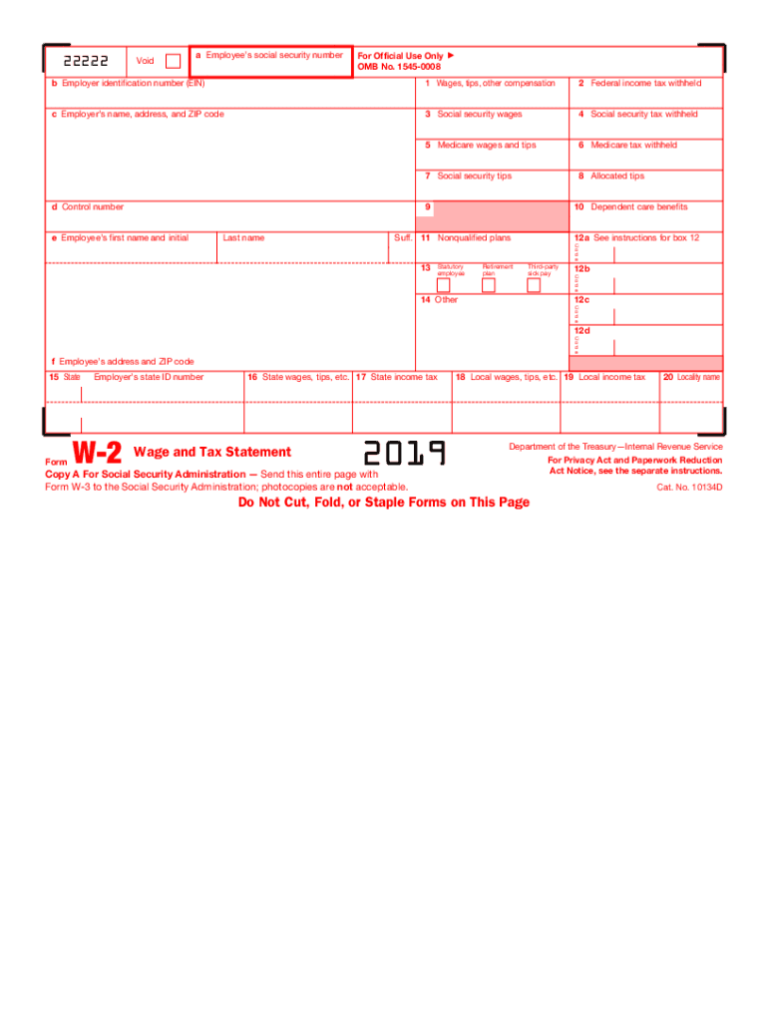

A: Form 7203 is used to report certain types of exempt income, such as income from a qualified retirement plan, IRA, or annuity contract. It is also used to report certain types of non-taxable income, such as gifts, inheritances, and certain types of scholarships and fellowships.

Q: Who is required to file Form 7203?

A: Individuals who receive certain types of exempt or non-taxable income are required to file Form 7203. This includes individuals who receive income from a qualified retirement plan, IRA, or annuity contract, as well as individuals who receive gifts, inheritances, or certain types of scholarships and fellowships.

Q: What are the penalties for incorrect or incomplete filing of Form 7203?

A: The penalties for incorrect or incomplete filing of Form 7203 can vary depending on the nature of the error or omission. In general, the IRS may impose penalties for late filing, failure to file, or incorrect reporting of income.

Q: Where can I get assistance with completing Form 7203?

A: The IRS provides a variety of resources and assistance options to help taxpayers complete Form 7203. Taxpayers can access online resources, call the IRS helpline, or visit an IRS office for assistance.