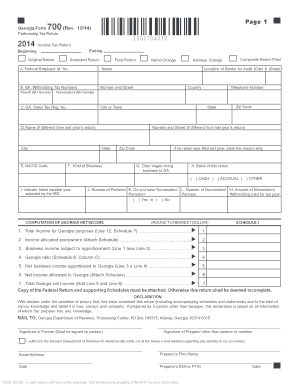

Free Form 700 Instructions Download: A Comprehensive Guide

Navigating the complexities of Form 700 can be a daunting task, but it’s essential for ensuring compliance and avoiding costly penalties. This comprehensive guide will provide you with all the necessary information on how to download Form 700 instructions, ensuring you have the tools you need to complete this important document accurately and efficiently.

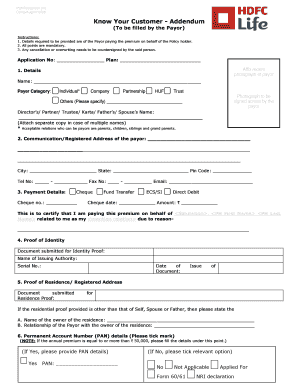

Understanding the purpose and significance of Form 700 is crucial. Whether you’re an individual or an entity, we’ll explore the scenarios where filing Form 700 becomes a legal obligation. We’ll also delve into the structure and content of the form, making it easier for you to navigate its sections and subsections.

Yo, bruv, listen up! Form 700 is like the VIP pass to the world of politics. It’s the form that tells the government who’s bankrolling your political campaign. It’s super important to file it, or you might get into some serious trouble.

Filing Form 700 is like putting your money where your mouth is. It shows that you’re serious about playing by the rules and being transparent about where your campaign funds are coming from. It also helps keep the whole political system on the straight and narrow, making sure that no one’s trying to pull any funny business behind the scenes.

Who Needs to File Form 700?

Not everyone needs to file Form 700. It’s only for the big players: candidates running for federal office, political committees, and other organizations that are trying to influence elections.

- Candidates running for President, Vice President, or Congress

- Political action committees (PACs)

- Super PACs

- Other organizations that spend more than $250 on election-related activities

Filling out Form 700 correctly is super important. It’s like a ticket to getting your taxes sorted, so don’t mess it up. If you don’t follow the instructions carefully, you could end up with a load of hassle.

Consequences of Not Following the Instructions

Not sticking to the rules can lead to major problems. The taxman might reject your form, which means you’ll have to do it all over again. Or worse, you could get fined or even prosecuted. So, it’s not worth taking any risks.

Common Errors

Here are some of the most common mistakes people make when filling out Form 700:

– Putting down the wrong info or leaving things blank.

– Not signing the form.

– Sending it in late.

– Using the wrong tax code.

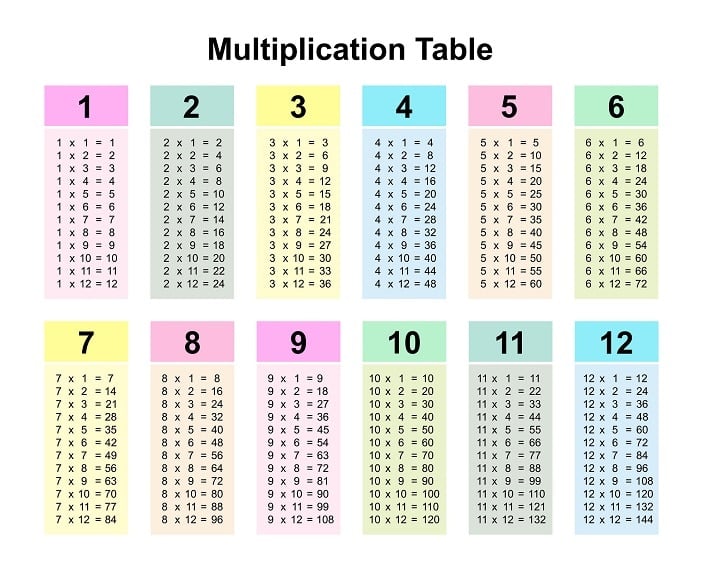

– Making maths errors.

So, make sure you double-check everything before you send it off. It’s not rocket science, but it’s important to get it right.

If you need more help understanding Form 700, there are a few resources available.

The IRS website has a helpful guide to Form 700 that can be found here: https://www.irs.gov/forms-pubs/about-form-700.

You can also find publications from the IRS that provide more detailed information about Form 700. These publications can be found on the IRS website or by calling the IRS at 1-800-829-1040.

If you have any questions about Form 700, you can contact the IRS at 1-800-829-1040.

Common Queries

What is the purpose of Form 700?

Form 700 is used to report certain financial transactions and is required by the Bank Secrecy Act.

Who is required to file Form 700?

Individuals or entities engaged in specific financial transactions, such as cash transactions over $10,000, are required to file Form 700.

Where can I download Form 700 instructions?

You can download Form 700 instructions from the Financial Crimes Enforcement Network (FinCEN) website.

What are the consequences of not filing Form 700?

Failure to file Form 700 can result in civil and criminal penalties.

Where can I get help with Form 700?

You can contact FinCEN or consult with a qualified tax professional for assistance with Form 700.