Free Form 540 Nr Download: A Comprehensive Guide for Non-Residents

Filing taxes as a non-resident can be a daunting task, but it doesn’t have to be. The Free Form 540 NR is specifically designed to help non-residents navigate the complexities of the US tax system. In this guide, we will provide a comprehensive overview of Form 540 NR, including its purpose, filing requirements, structure, income reporting, tax credits and deductions, payment options, common errors, and troubleshooting tips.

Whether you’re a student, a business traveler, or an investor, understanding Form 540 NR is essential for ensuring accurate and timely tax filing. By providing clear and concise information, we aim to empower non-residents with the knowledge they need to confidently navigate the US tax landscape.

Free Form 540 NR Overview

The Free Form 540 NR tax form, officially known as the Nonresident Income Tax Return, is a document used by nonresident aliens to report their income and pay taxes to the Internal Revenue Service (IRS). It is specifically designed for individuals who are not permanent residents or citizens of the United States but have earned income from US sources during the tax year.

Purpose of Form 540 NR

The primary purpose of Form 540 NR is to calculate and pay income taxes on income earned in the US by nonresident aliens. It allows individuals to report their income from various sources, including wages, salaries, tips, investments, and self-employment. By filing Form 540 NR, nonresident aliens can comply with their tax obligations and avoid potential penalties.

History and Changes

The Free Form 540 NR has undergone several revisions over the years to reflect changes in tax laws and regulations. In 2018, the form was updated to align with the Tax Cuts and Jobs Act, which introduced significant changes to the US tax code. These changes impacted nonresident aliens, and the updated Form 540 NR reflected these adjustments.

Who Should File Form 540 NR

Individuals who are required to file Form 540 NR include:

- Nonresident aliens who have earned income from US sources during the tax year.

- Individuals who have been physically present in the US for more than 183 days during the tax year.

- Nonresident aliens who are engaged in a trade or business in the US.

- Individuals who are required to file a return even if they do not owe any taxes.

Filing s and Deadlines

Filing Form 540 NR is mandatory for non-resident aliens required to file US income tax returns. The specific filing s and deadlines for Form 540 NR are Artikeld below:

Filing s

- Form 540 NR must be filed by non-resident aliens who meet the following criteria:

- Earned income from US sources

- Required to file a US income tax return

Deadlines

Form 540 NR must be filed by the following deadlines:

- April 15th: For taxpayers using the calendar year

- June 15th: For taxpayers using a fiscal year

Penalties for Late Filing

Late filing of Form 540 NR may result in penalties and interest charges. The penalty for late filing is 5% of the unpaid tax for each month the return is late, up to a maximum of 25% of the unpaid tax.

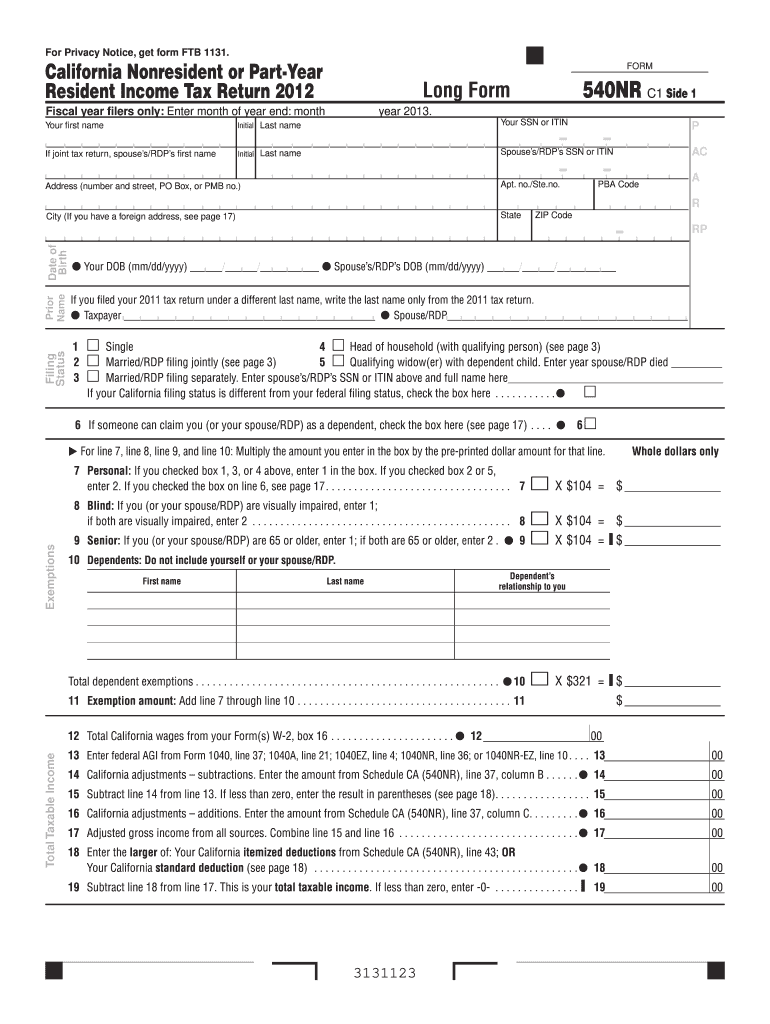

Form Structure and Sections

The Form 540 NR comprises various sections and schedules designed to gather specific information related to the taxpayer’s income and financial status. Each section serves a distinct purpose in providing a comprehensive view of the taxpayer’s financial situation for the tax year.

The form is structured into the following sections:

Part I: Personal Information

- This section collects basic personal information about the taxpayer, including name, address, social security number, and filing status.

- It also includes information about dependents and any applicable exemptions or deductions.

Part II: Income

- This section covers various sources of income, including wages, salaries, tips, dividends, interest, and other forms of income.

- It also includes adjustments to income, such as alimony received or paid, and contributions to retirement accounts.

Part III: Deductions

- This section allows taxpayers to itemize or claim the standard deduction.

- Itemized deductions include expenses such as mortgage interest, charitable contributions, and state and local taxes.

- The standard deduction is a fixed amount that varies depending on the taxpayer’s filing status.

Part IV: Taxable Income

- This section calculates the taxpayer’s taxable income by subtracting deductions from total income.

- Taxable income is the amount of income subject to taxation.

Part V: Tax

- This section determines the taxpayer’s tax liability based on their taxable income and applicable tax rates.

- It includes calculations for federal income tax, self-employment tax, and other applicable taxes.

Part VI: Payments

- This section records any payments made towards the taxpayer’s tax liability, such as withholding from wages or estimated tax payments.

- It also includes information about any applicable tax credits or refunds.

Schedules

- In addition to the main sections, Form 540 NR includes several schedules that provide additional details on specific aspects of the taxpayer’s financial situation.

- These schedules include:

- Schedule A: Itemized Deductions

- Schedule B: Interest and Dividends

- Schedule C: Profit or Loss from Business

- Schedule D: Capital Gains and Losses

- Schedule E: Supplemental Income and Loss

- Schedule F: Farm Income and Expenses

Income Reporting and Calculations

Filing Form 540 NR involves reporting various types of income and accurately calculating taxable income and deductions. Let’s dive into the specifics.

For non-residents, taxable income refers to the portion of your worldwide income that’s subject to U.S. taxation. It’s calculated by subtracting allowable deductions from your gross income.

Types of Income to Report

As a non-resident, you must report all income sourced from the United States, including:

- Wages, salaries, tips, and other compensation from employment

- Business income (if you have a U.S. business)

- Capital gains from the sale of U.S. assets

- Rental income from U.S. properties

- Interest and dividends from U.S. sources

- Pensions and annuities from U.S. sources

Methods for Calculating Taxable Income and Deductions

Calculating taxable income involves subtracting allowable deductions from gross income. Deductions are expenses that reduce your taxable income.

For non-residents, common deductions include:

- Standard deduction

- Itemized deductions, such as mortgage interest, charitable contributions, and state income taxes

- Business expenses, if you have a U.S. business

- Certain foreign income exclusions and deductions

Examples

To illustrate, if you earn $50,000 from a U.S. employer and have $10,000 in eligible deductions, your taxable income would be $40,000.

Tax Credits and Deductions

Non-resident taxpayers filing Form 540 NR are eligible for certain tax credits and deductions that can reduce their tax liability. These benefits are designed to provide relief to non-residents who may have limited income or expenses connected to the United States.

Tax Credits

Tax credits directly reduce the amount of tax owed, dollar for dollar. Non-resident taxpayers may qualify for the following tax credits:

– Foreign Tax Credit: Allows a credit for foreign income taxes paid or accrued on foreign-sourced income.

– Child Tax Credit: Provides a credit for each qualifying child under the age of 17.

Deductions

Deductions reduce the amount of taxable income, which can result in lower tax liability. Non-resident taxpayers may be able to deduct the following expenses:

– Standard Deduction: A fixed amount that reduces taxable income without itemizing deductions.

– Itemized Deductions: Allow taxpayers to deduct certain expenses in detail, such as charitable contributions, mortgage interest, and state and local taxes.

The availability and eligibility criteria for these tax credits and deductions vary depending on factors such as residency status, income level, and filing status. Taxpayers should consult the IRS website or a tax professional for specific guidance on their eligibility and how to claim these benefits.

Payment and Refund Options

Filing Form 540 NR involves settling your tax dues or claiming a refund if applicable. Here’s a rundown of the payment and refund options available.

Payment Options

You can pay your tax dues through various methods:

- Online Payment: Use the California Franchise Tax Board’s (FTB) website to pay online using a credit or debit card.

- Electronic Funds Withdrawal (EFW): Authorize the FTB to withdraw funds directly from your bank account.

- Mail-in Payment: Send a check or money order along with Form 540 NR to the FTB’s mailing address.

- In-Person Payment: Visit a FTB office to make a payment in person.

Refund Options

If you’re eligible for a refund, you can receive it through the following methods:

- Direct Deposit: Provide your bank account details on Form 540 NR to have the refund deposited directly.

- Paper Check: The FTB will mail you a paper check to the address provided on the form.

Electronic Payment and Refund Options

Electronic payment and refund options offer convenience and faster processing times:

- FTB Online Services: Create an account on the FTB website to access online payment and refund options.

- Electronic Services for Tax Professionals (ESTP): Tax professionals can use ESTP to file and pay taxes electronically on behalf of their clients.

Common Errors and Troubleshooting

Non-residents often encounter errors when filing Form 540 NR. Understanding these errors and knowing how to avoid them can help ensure a smooth and accurate filing process.

Error: Incorrectly Reporting Income

- Non-residents may unintentionally report worldwide income on Form 540 NR, which is incorrect. Only U.S.-sourced income should be reported.

- Incorrectly converting foreign currency amounts to U.S. dollars can lead to errors in income reporting.

Error: Missing or Incorrect Tax Forms

- Non-residents may fail to attach required tax forms, such as Form 8802 or Form 8833, which can delay processing.

- Incorrectly completing these forms can also lead to errors in tax calculations.

Error: Incorrectly Claiming Tax Credits or Deductions

- Non-residents may mistakenly claim tax credits or deductions that they are not eligible for, such as the Earned Income Tax Credit.

- Incorrectly calculating the amount of allowable deductions can also result in errors.

Error: Filing Late or Incomplete

- Filing Form 540 NR late can result in penalties and interest charges.

- Submitting an incomplete or inaccurate return can delay processing and potentially lead to additional errors.

Tips for Avoiding Errors

- Carefully review the instructions provided with Form 540 NR.

- Seek professional assistance from a tax preparer or accountant if needed.

- Gather all necessary tax documents and forms before starting the filing process.

- Double-check all calculations and ensure that all information is accurate.

- File on time to avoid penalties and interest charges.

FAQs

What is the purpose of Form 540 NR?

Form 540 NR is a tax return form used by non-resident aliens to report their US income and claim any applicable tax benefits.

Who is required to file Form 540 NR?

Non-resident aliens who have US income, including income from wages, self-employment, investments, or real estate, are required to file Form 540 NR.

What is the filing deadline for Form 540 NR?

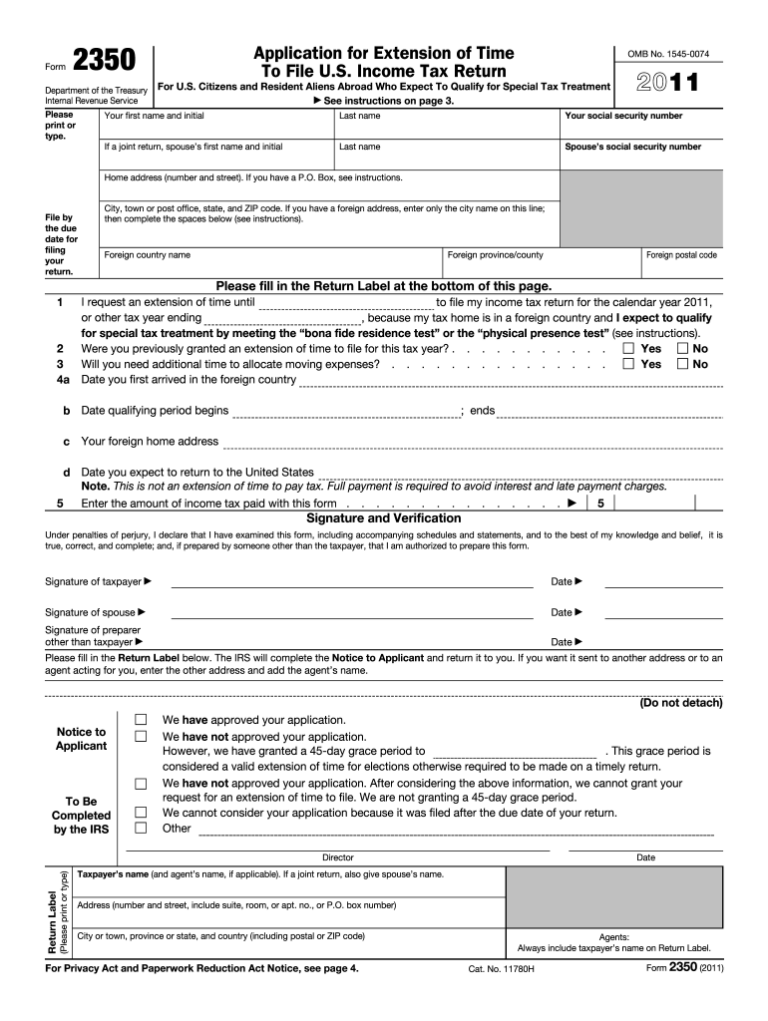

The filing deadline for Form 540 NR is April 15th. However, non-resident aliens may be eligible for an extension by filing Form 4868.

What are the common errors to avoid when filing Form 540 NR?

Common errors include incorrect reporting of income, deductions, and credits, as well as missing or incomplete documentation. It’s important to carefully review the instructions and seek professional guidance if needed.