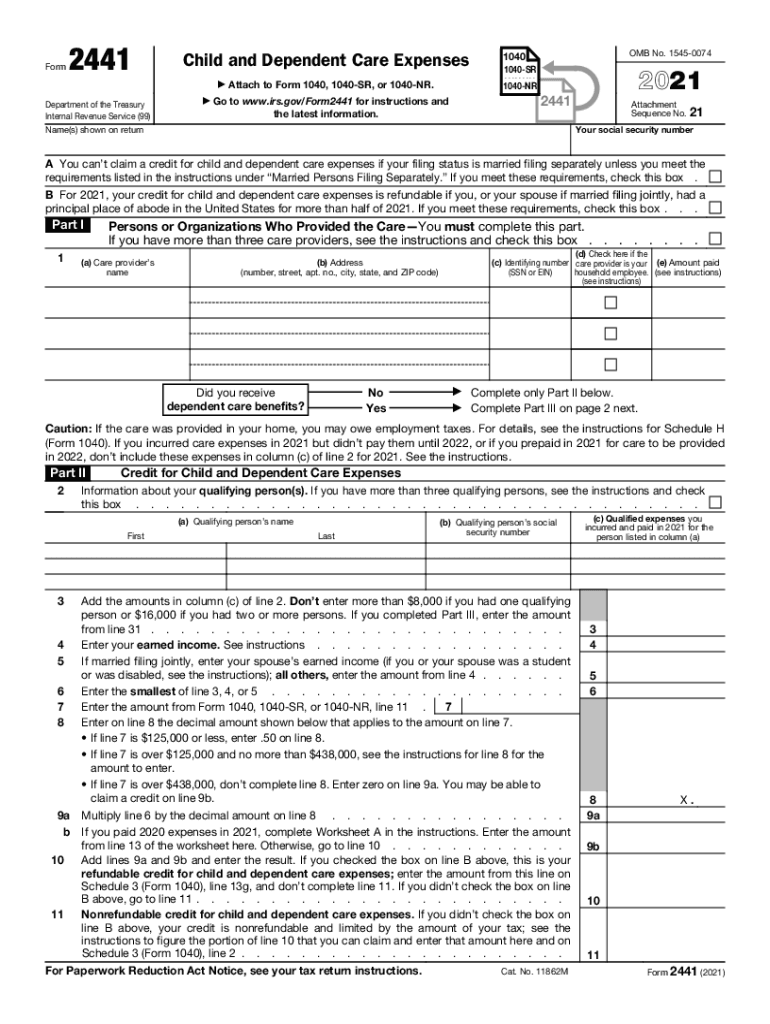

Free Form 2441 For 2024 Download: A Comprehensive Guide

The tax filing season can be a daunting time for many, but it doesn’t have to be. With the right resources and guidance, you can navigate the complexities of tax filing and ensure that you meet your obligations while maximizing your benefits. One essential form in the tax filing process is Form 2441, which plays a crucial role in claiming the child tax credit. In this comprehensive guide, we will delve into the intricacies of Form 2441, providing you with all the information you need to complete and submit it accurately and efficiently.

Form 2441 is an important document that allows you to claim the child tax credit, a valuable benefit that can significantly reduce your tax liability. Understanding the purpose, eligibility criteria, and filing requirements of Form 2441 is essential to ensure that you receive the maximum benefits to which you are entitled. This guide will provide you with a clear and concise overview of everything you need to know about Form 2441, empowering you to navigate the tax filing process with confidence.

General Overview

Form 2441 is a crucial document for UK taxpayers. It’s a self-assessment tax return that helps individuals calculate and pay their Income Tax and National Insurance contributions. This form is vital for ensuring compliance with the UK tax system.

History and Evolution

Form 2441 has undergone several revisions over the years to reflect changes in tax laws and regulations. The latest version, introduced in 2022, includes updates to simplify the form and make it more user-friendly.

Target Audience

Form 2441 is primarily intended for individuals who are self-employed or have other sources of income that fall outside the scope of PAYE (Pay As You Earn). This includes freelancers, contractors, and those with rental income.

Filing Requirements and s

Submitting Form 2441 is a crucial step for individuals seeking to claim tax relief on their pension contributions. Understanding the eligibility criteria and following the step-by-step s ensures a smooth and successful application process.

Eligibility Criteria

- You’re a UK resident.

- You’re paying into a registered pension scheme.

- You haven’t taken any taxable withdrawals from your pension.

- You’re not receiving any other tax relief on your pension contributions.

s

Follow these s to complete and submit Form 2441:

- Download the Form 2441 from HMRC’s website.

- Fill out the form with your personal and pension details.

- Attach any necessary supporting documents, such as payslips or pension statements.

- Send the completed form to HMRC by post or online.

Gathering Necessary Documentation

To support your claim, you may need to provide the following documents:

- Payslips showing your pension contributions.

- Pension statements showing your pension balance and contributions.

- Proof of your UK residency, such as a utility bill or bank statement.

Additional Resources and Support

The process of filing Form 2441 can be a bit tricky, but there are many resources available to help you. Here are some of the most useful ones:

The IRS website has a dedicated page for Form 2441, where you can find instructions, publications, and other helpful information. You can also use the IRS’s online tool to calculate your credit.

Online Tools

- IRS Form 2441: https://www.irs.gov/forms-pubs/about-form-2441

- IRS Form 2441 Instructions: https://www.irs.gov/pub/irs-pdf/i2441.pdf

- IRS Publication 501, Exemptions, Standard Deduction, and Filing Information: https://www.irs.gov/pub/irs-pdf/p501.pdf

- IRS Interactive Tax Assistant: https://www.irs.gov/help/ita

Publications

- IRS Publication 972, Child Tax Credit and Credit for Other Dependents: https://www.irs.gov/pub/irs-pdf/p972.pdf

- IRS Publication 596, Earned Income Credit (EIC): https://www.irs.gov/pub/irs-pdf/p596.pdf

Contact Information

- IRS Customer Service: 1-800-829-1040

- IRS Taxpayer Advocate: 1-877-777-4778

- IRS website: https://www.irs.gov

Tax Preparation Software and Services

There are a number of tax preparation software and services that can help you complete Form 2441. These services can range in price from free to several hundred dollars. Some of the most popular tax preparation software and services include:

- TurboTax

- H&R Block

- TaxAct

- Jackson Hewitt

- Liberty Tax Service

Q&A

What is the purpose of Form 2441?

Form 2441 is used to claim the child tax credit, a valuable benefit that can reduce your tax liability.

Who is eligible to file Form 2441?

To be eligible to file Form 2441, you must meet certain criteria, such as having a qualifying child and meeting income requirements.

What are the filing requirements for Form 2441?

To file Form 2441, you must gather the necessary documentation, complete the form accurately, and submit it to the IRS by the tax filing deadline.

What are the tax implications of filing Form 2441?

Filing Form 2441 can result in a reduction of your tax liability due to the child tax credit.

Where can I find additional resources and support for Form 2441?

There are numerous resources available to assist you with Form 2441, including online tools, publications, and contact information for the IRS.