Free Form 15400 Irs Download: A Comprehensive Guide

Navigating the complexities of tax filing can be a daunting task, but understanding and utilizing Form 15400 from the Internal Revenue Service (IRS) can significantly simplify the process. This free form serves as a crucial tool for individuals and businesses to report various types of income and expenses, ensuring accurate tax calculations and timely filings.

In this comprehensive guide, we will delve into the purpose, significance, and eligibility criteria of Form 15400. We will provide step-by-step instructions on how to download, fill out, and file the form seamlessly. Additionally, we will address commonly asked questions to empower you with the knowledge necessary for a successful Form 15400 submission.

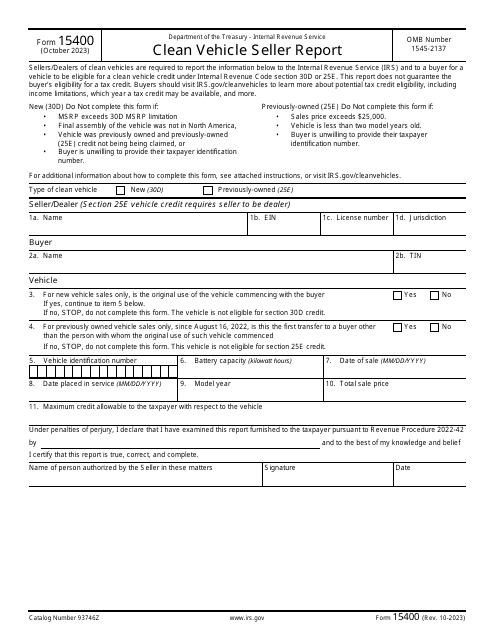

Free Form 15400 Irs

The Free Form 15400 Irs is a document that allows taxpayers to report any changes or corrections to their tax return after it has been filed. It can be used to report changes to income, deductions, credits, or other items that affect the taxpayer’s tax liability.

The Free Form 15400 Irs is not a substitute for filing an amended tax return. However, it can be used to make small changes or corrections to a tax return that has already been filed.

Sections and Fields Included in Form 15400

The Free Form 15400 Irs includes the following sections and fields:

- Part I: Taxpayer Information – This section includes the taxpayer’s name, address, and Social Security number.

- Part II: Changes to Income – This section includes any changes to the taxpayer’s income that have occurred since the original tax return was filed.

- Part III: Changes to Deductions – This section includes any changes to the taxpayer’s deductions that have occurred since the original tax return was filed.

- Part IV: Changes to Credits – This section includes any changes to the taxpayer’s credits that have occurred since the original tax return was filed.

- Part V: Other Changes – This section includes any other changes to the taxpayer’s tax return that have occurred since the original tax return was filed.

Eligibility Criteria for Filing Form 15400

The Free Form 15400 Irs can be filed by any taxpayer who needs to make changes or corrections to their tax return after it has been filed. However, the IRS recommends that taxpayers only use the Free Form 15400 Irs to make small changes or corrections. If the taxpayer needs to make significant changes to their tax return, they should file an amended tax return.

Downloading Form 15400

Downloading Form 15400 from the IRS website is a quick and easy process. Here’s a step-by-step guide to help you get started:

Accessing the IRS Website

- Visit the official IRS website at https://www.irs.gov/.

- In the search bar, type “Form 15400” and press enter.

- Click on the link for “Form 15400: Return for the 2023 Tax Year”.

Downloading the Form

- On the Form 15400 page, click on the “Download PDF” button.

- Select the file format you prefer (e.g., PDF, RTF, or DOCX).

- Click on the “Save” or “Download” button to save the form to your computer.

Alternative Methods

If you are unable to download Form 15400 online, you can request a physical copy by mail or visit an IRS office. To request a copy by mail, call the IRS at 1-800-TAX-FORM (1-800-829-3676) or write to the IRS at the following address:

Internal Revenue Service

P.O. Box 25866

Richmond, VA 23289

Filling Out Form 15400

Filling out Form 15400 accurately is crucial to ensure your claim for a refund or credit is processed smoothly and efficiently. Here’s a comprehensive guide to help you complete the form correctly and avoid common pitfalls.

Personal Information

Begin by providing your personal details, including your full name, address, and Social Security number. Double-check the accuracy of this information, as it’s essential for processing your claim.

Tax Information

In this section, you’ll need to enter details about your income and deductions. Use your tax return or other official documents to ensure accuracy. If you’re unsure about any specific deductions or credits, consult a tax professional for guidance.

Filing Status

Indicate your filing status, whether you’re filing individually, jointly, or as head of household. This status affects your tax liability and the amount of refund or credit you’re entitled to.

Refund or Credit Information

Provide your bank account information if you want the refund or credit to be directly deposited. Ensure the account number and routing number are correct to avoid delays or errors.

Signature and Date

Finalize the form by signing and dating it. Your signature authorizes the IRS to process your claim and make the necessary adjustments to your tax account.

Common Errors to Avoid

- Inaccurate personal information

- Incorrect tax calculations

- Missing or incomplete deductions

- Wrong filing status

- Errors in bank account information

Filing Form 15400

Filing Form 15400 is a crucial step in reporting your tax-exempt status to the IRS. You can choose from various methods to file this form, each with its advantages and timelines.

Electronic Filing

Electronic filing is the quickest and most convenient way to submit Form 15400. You can use the IRS e-file system or a tax software program that supports electronic filing. To e-file, you’ll need a valid email address and an electronic signature. Once submitted, you’ll receive an acknowledgment from the IRS confirming receipt of your filing.

Mail-in Filing

If you prefer the traditional method, you can mail Form 15400 to the IRS. Print and complete the form, ensuring all sections are filled out accurately. Mail the completed form to the address provided in the instructions. Keep a copy of the mailed form for your records.

In-person Filing

In-person filing is less common but still an option. Visit your local IRS office and inquire about filing Form 15400. You may need to schedule an appointment or drop off the completed form during specific office hours.

Deadlines and Consequences

The deadline for filing Form 15400 varies depending on your organization’s fiscal year. Late filing may result in penalties and interest charges. It’s advisable to file on time to avoid any potential consequences.

FAQs

What is the purpose of Form 15400?

Form 15400 is used to report income and expenses from sources not typically captured on regular tax forms, such as self-employment, rental properties, and investments.

How do I download Form 15400?

You can download Form 15400 directly from the IRS website or by visiting an IRS office.

What are the eligibility criteria for filing Form 15400?

You are eligible to file Form 15400 if you have income or expenses that cannot be reported on other tax forms.

Can I file Form 15400 electronically?

Yes, you can file Form 15400 electronically using tax software or through the IRS website.

What are the deadlines for filing Form 15400?

The deadline for filing Form 15400 is the same as the deadline for filing your regular tax return.