Free Form 134a Pdf Download: A Comprehensive Guide

Navigating the complexities of legal documentation can be daunting, but understanding and accessing essential forms like the Form 134a is crucial. This document plays a vital role in various legal proceedings, and obtaining it in a convenient and reliable manner is paramount. This guide will provide a comprehensive overview of Form 134a, its significance, and the most accessible methods for downloading it in PDF format.

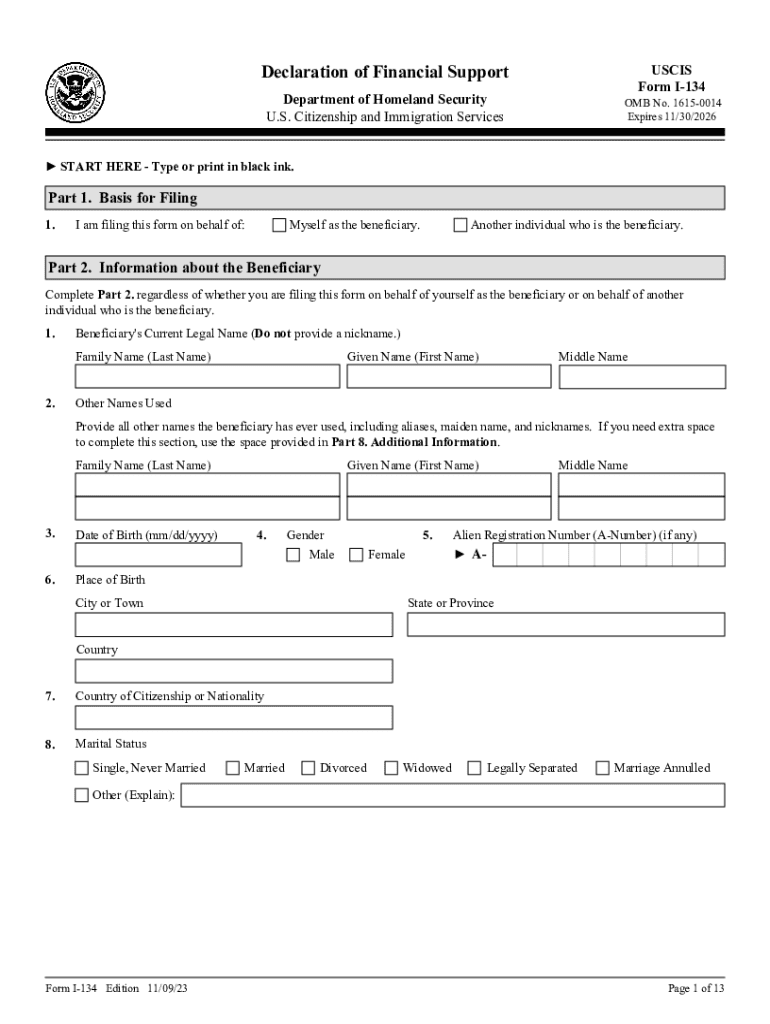

Form 134a serves as a legal declaration, often utilized in legal proceedings to establish facts or provide evidence. It is commonly employed in matters related to family law, property disputes, and estate planning. Understanding the purpose and content of this form is essential for individuals involved in such legal processes.

Definition and Overview

Form 134a is a self-assessment tax return used by UK residents to declare their income and calculate their tax liability. It’s primarily intended for individuals with simple tax affairs, such as those with employment income, pensions, or savings interest.

The purpose of Form 134a is to simplify the tax filing process for these individuals, allowing them to complete their tax return quickly and easily. It provides a clear and straightforward guide to calculating taxable income and determining the amount of tax owed.

Purpose

- Simplifies tax filing for individuals with straightforward tax affairs.

- Provides a clear and easy-to-understand guide to calculating taxable income and tax liability.

Significance

- Helps individuals meet their tax obligations accurately and on time.

- Reduces the burden of tax filing for those with simple tax affairs.

Accessibility and Availability

Getting your hands on a Form 134a is a piece of cake. There are a bunch of ways to do it.

You can download it straight from the GOV.UK website. It’s available as a PDF, so you can fill it in on your computer or print it out and fill it in by hand.

Reliable Sources for Downloading the Form in PDF Format

- GOV.UK: https://www.gov.uk/government/publications/form-134a-certificate-of-registration-or-re-registration-of-a-vessel

- Maritime and Coastguard Agency: https://www.gov.uk/government/organisations/maritime-and-coastguard-agency

Alternative Formats

If you can’t get hold of a PDF, you can also order a paper copy from the Maritime and Coastguard Agency. Just give them a call or drop them an email.

Key Sections and Content

Form 134a is divided into various sections, each serving a specific purpose. Understanding these sections and their content is crucial for accurate completion.

The form comprises four primary sections:

Personal Details

This section captures your personal information, including your name, address, contact details, and National Insurance number. Ensure the accuracy of this information as it forms the basis for communication and identification.

Employment Details

This section requires details of your current employment, such as your employer’s name, address, and the dates of your employment. It also includes information about your job title, pay, and working hours.

Income and Deductions

This section details your income and any deductions made from your pay, such as tax, National Insurance, and pension contributions. Understanding these deductions is important for calculating your net pay.

Declaration

The final section requires your signature and date to confirm the accuracy of the information provided. This declaration serves as a legal statement and should be completed with care.

Submission and Processing

Sending in Form 134a is a breeze, with multiple options to suit your vibe. You can either drop it off at your local tax office, or post it to the address provided on the form. If you’re feeling tech-savvy, you can even submit it online through the HMRC website.

Once you’ve sent in your form, the HMRC will get to work processing it. They’ll let you know if they need any more info from you, and you can track the progress of your submission online using your reference number.

Online Submission

Submitting Form 134a online is a doddle. Just head over to the HMRC website and follow the instructions. You’ll need to create an account if you don’t have one already, and then you can upload your form and submit it.

Postal Submission

If you prefer to send your form by post, you can find the address on the form itself. Make sure you include your reference number on the envelope so the HMRC can match it up with your online submission.

Tracking Your Submission

You can track the progress of your Form 134a submission online using the HMRC website. Just enter your reference number and you’ll be able to see the status of your form.

FAQ

Where can I find a reliable source to download Form 134a in PDF format?

Numerous reputable websites and legal document repositories provide free access to Form 134a in PDF format. Some trustworthy sources include the official government website, legal aid organizations, and reputable law firms.

Is it possible to obtain Form 134a in alternative formats?

Yes, in addition to PDF format, Form 134a may be available in other formats such as Microsoft Word or text files. These alternative formats can be particularly useful for individuals who prefer to edit or modify the document before printing or submitting it.

What are some common challenges that users may encounter when filling out Form 134a?

Common challenges include understanding the legal terminology used in the form, ensuring accuracy and completeness of the information provided, and potential errors or issues during the submission process. It is advisable to carefully review the form, consult legal resources, and seek professional guidance if needed.

Are there any resources or support channels available to assist with filling out Form 134a?

Yes, various resources and support channels are available to assist individuals with filling out Form 134a. These include online legal aid platforms, government helplines, and community legal centers. Seeking professional advice from an attorney is also recommended for complex or sensitive legal matters.