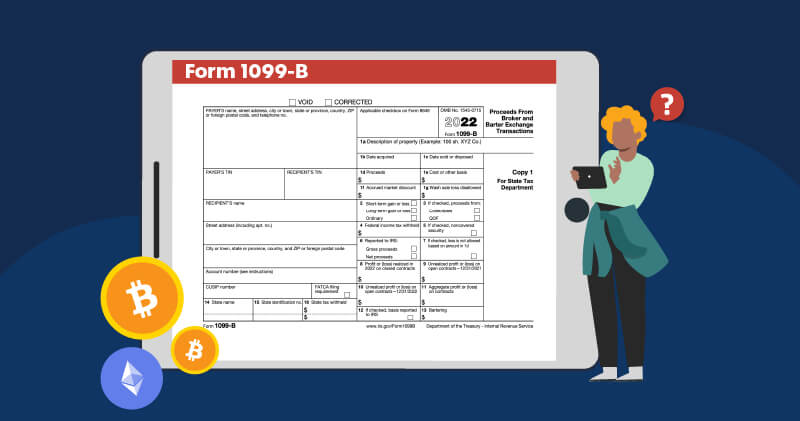

Free Form 1099-b Instructions 2024 Download: A Comprehensive Guide

Navigating the complexities of tax reporting can be a daunting task, especially when it comes to understanding and completing the Free Form 1099-b. This essential document plays a crucial role in reporting brokerage transactions, and staying abreast of its latest updates is paramount for accurate tax filing.

In this comprehensive guide, we will delve into the intricacies of the Free Form 1099-b Instructions 2024 Download, providing a step-by-step approach to ensure seamless completion. From understanding the purpose and significance of the form to troubleshooting common errors, we will equip you with the knowledge and resources necessary for successful tax reporting.

Downloading and Understanding the s

If you’re a British youth looking to get a grip on your 1099-b s, you’re in the right place. In this guide, we’ll break down how to download them from the IRS website and give you the lowdown on what’s inside.

Downloading the s

First off, head over to the IRS website. Once you’re there, click on the “Forms” tab and then select “1099-b” from the dropdown menu. On the next page, you’ll see a link to download the s. Click on that and save the file to your computer.

Understanding the s

Now that you’ve got the s downloaded, let’s take a closer look at what they’re all about. The s are divided into three main sections:

- Part I: Sale or Exchange of a Principal Residence

- Part II: Other Dispositions of Real Property

- Part III: Gain or Loss from the Sale or Exchange of a Principal Residence

Each section contains different information about the sale or exchange of your property. For example, Part I includes details about the sale price, the date of sale, and the address of the property. Part II provides information about any other real property you disposed of during the year, such as a rental property or a vacation home. And Part III calculates your gain or loss from the sale or exchange of your principal residence.

In addition to the three main sections, the s also include a number of other important information, such as:

- Your name and address

- The name and address of the buyer or seller

- The date of the transaction

- The amount of the proceeds from the sale

- The amount of any expenses related to the sale

- The amount of any gain or loss from the sale

If you’re not sure what any of the information on the s means, don’t worry. The IRS provides a number of resources to help you understand them. You can find these resources on the IRS website or by calling the IRS at 1-800-829-1040.

Completing the 1099-b Form

Innit, filling out a 1099-b form can be a bit of a drag, but it’s crucial for getting your tax right, bruv. So, let’s break it down, shall we?

This form is for reporting brokerage transactions, like when you sell stocks, bonds, or other investments. It’s like a receipt that shows how much money you made and what taxes you owe. Here’s a table to help you fill it out:

| Field | What to Put |

|---|---|

| Box 1a | Total sales proceeds. This is how much money you got from selling your investments. |

| Box 1b | Net short-term capital gains. This is how much profit you made from selling investments you held for a year or less. |

| Box 1c | Net long-term capital gains. This is how much profit you made from selling investments you held for more than a year. |

| Box 1d | Federal income tax withheld. This is how much tax the brokerage withheld from your sales proceeds. |

| Box 2 | Unrealized gain (loss). This is how much your investments have gone up (or down) in value since you bought them. |

| Box 3 | Cost or other basis. This is how much you paid for your investments when you bought them. |

| Box 4 | Wash sale loss disallowed. This is how much of a loss you can’t deduct because you bought similar investments within 30 days of selling them. |

| Box 5 | Acquisition date. This is the date you bought the investments. |

| Box 6 | Disposition date. This is the date you sold the investments. |

| Box 7 | CUSIP. This is a unique identifier for the investments you sold. |

| Box 8 | Description. This is a brief description of the investments you sold. |

Now, let’s chat about the types of transactions you need to report on this form. It includes:

- Selling stocks, bonds, or other securities

- Exercising or selling options

- Selling real estate that you used for business

It’s important to note that reporting brokerage transactions on the 1099-b form has tax implications. The gains or losses from these transactions are taxed as capital gains or losses. Short-term capital gains are taxed at your ordinary income tax rate, while long-term capital gains are taxed at a lower rate. Losses can be used to offset gains, and any net loss can be deducted from your taxable income.

Common Errors and Troubleshooting

When filling out a 1099-b form, you need to be accurate and avoid common errors. Here are some tips for troubleshooting errors related to data entry, calculations, and reporting:

Mistakes in data entry

- Make sure all the information you enter on the form is correct, including your name, address, and Social Security number.

- Double-check the amounts you enter, especially if you are entering large numbers.

- Use the correct tax year.

Errors in calculations

- Make sure you are using the correct tax rates.

- Double-check your math, especially if you are making any calculations by hand.

- Use a tax software program to help you with the calculations.

Errors in reporting

- Make sure you are filing the form with the correct tax agency.

- File your form on time.

- Keep a copy of your filed form for your records.

Consequences of filing an incorrect 1099-b form

- You may be subject to penalties and interest if you file an incorrect 1099-b form.

- The IRS may delay your refund if there are errors on your form.

- You may have to file an amended return if you discover an error on your form after you have already filed it.

Resources and Support

:max_bytes(150000):strip_icc()/1099B2022-95af0a55817a4b8ea69f159a8c8451c1.jpg?w=700)

Blud, need a hand with your 1099-b? Check out these sick resources:

- IRS Publications: Grab a copy of Publication 525 for the lowdown on 1099-bs.

- Online Tools: Use the IRS’s interactive tax assistant to get answers to your burning questions.

- Tax Professionals: If you’re feeling lost, reach out to a tax pro for some expert advice.

Contact Information

Need to chat with someone? Here’s how to get in touch:

- IRS: Give them a buzz at 1-800-829-1040.

- Taxpayer Advocate Service: If you’re having issues with the IRS, they’re here to help.

Stay Informed

Keep up with the latest tax news and changes:

- IRS Website: Bookmark it for updates and announcements.

- Tax Publications: Subscribe to the IRS’s publications to stay in the know.

- Tax Professionals: Attend webinars or workshops to learn from the experts.

Answers to Common Questions

What is the purpose of Form 1099-b?

Form 1099-b is used to report proceeds from broker and barter exchange transactions.

When is Form 1099-b due?

Form 1099-b is due to the recipient by January 31st and to the IRS by February 28th (March 31st if filing electronically).

What information is required on Form 1099-b?

Form 1099-b requires information such as the recipient’s name, address, and taxpayer identification number, as well as details about the transactions, including the gross proceeds, cost or other basis, and any adjustments.

What are the penalties for not filing Form 1099-b?

Failure to file Form 1099-b can result in penalties of $50 per form, up to a maximum of $250,000 per year.

Where can I get help with completing Form 1099-b?

You can get help with completing Form 1099-b from the IRS website, a tax professional, or a software program.