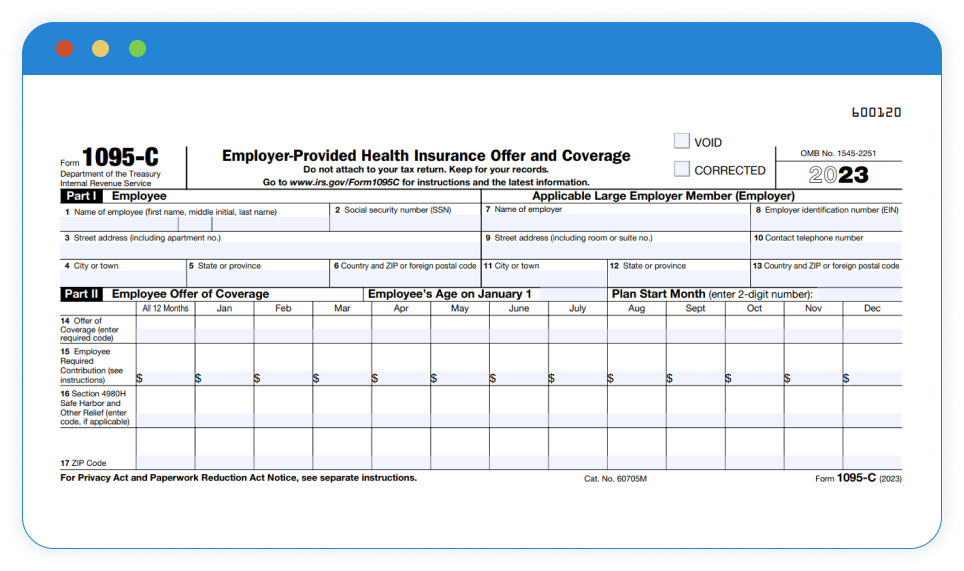

Free Form 1095-c 2024 Download: A Comprehensive Guide

Navigating the healthcare reporting landscape can be daunting, but understanding the Free Form 1095-c 2024 is crucial for individuals and employers alike. This form plays a pivotal role in reporting health insurance coverage, and its accurate completion ensures compliance with the Affordable Care Act (ACA) regulations.

In this comprehensive guide, we will delve into the intricacies of the Free Form 1095-c 2024, providing clear instructions on downloading, completing, and filing this important document. We will also address common errors and troubleshooting tips to ensure a seamless reporting process.

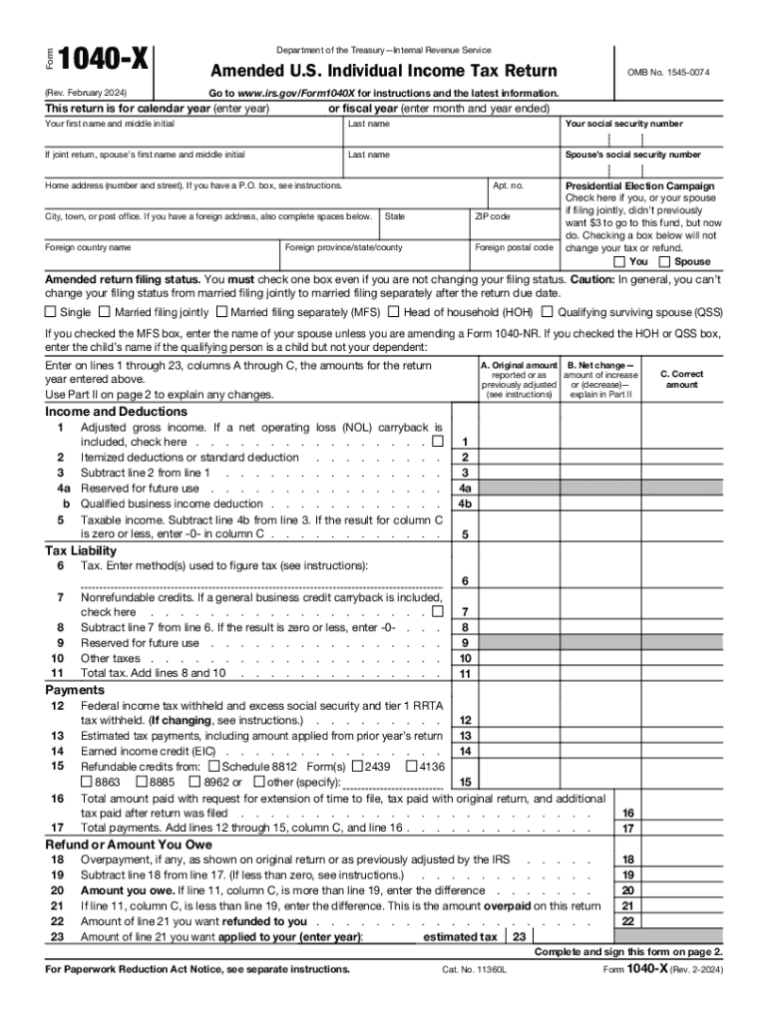

Common Errors and Troubleshooting

Completing the Free Form 1095-c 2024 requires accuracy to ensure that the information provided is correct and complete. Common errors can occur during the completion process, leading to potential issues with the form’s acceptance or processing.

To avoid these errors, it’s essential to understand the potential pitfalls and have troubleshooting tips at hand. Filing an incorrect or incomplete form can result in delays in processing, requests for additional information, or even penalties. Therefore, it’s crucial to address any errors promptly and accurately.

Identifying Common Errors

Some common errors that may occur when completing the Free Form 1095-c 2024 include:

- Incorrect or missing personal information, such as name, address, or Social Security number

- Errors in reporting health insurance coverage dates

- Inaccurate or incomplete information about dependents

- Incorrect calculations of premium amounts or tax credits

- Missing or incorrect signatures

Troubleshooting Tips

To troubleshoot these errors, consider the following tips:

- Double-check all personal information to ensure accuracy and completeness.

- Carefully review health insurance coverage dates and make sure they are reported correctly.

- Gather all necessary information about dependents, including their names, dates of birth, and Social Security numbers.

- Use the instructions provided with the form to calculate premium amounts and tax credits accurately.

- Ensure that all required signatures are obtained before submitting the form.

Consequences of Incorrect or Incomplete Filing

Filing an incorrect or incomplete Free Form 1095-c 2024 can have several consequences, including:

- Delays in processing your tax return

- Requests for additional information or documentation

- Penalties for filing an incorrect or incomplete form

Resources and Support

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png?w=700)

Seeking assistance with completing the Free Form 1095-c 2024? Here’s a bunch of helpful resources and support:

IRS Publications and Online Tools

- IRS Publication 974: Employer’s Guide to Health Insurance

- IRS Publication 1015: Affordable Care Act Questions and Answers

- IRS Online Tool: Employer Mandate Calculator

Contact Information for Support

Need to speak to someone directly? Here are some contact details:

- IRS Helpline: 1-800-829-1040

- IRS Website: www.irs.gov

- National Association of Health Underwriters (NAHU): www.nahu.org

Training and Webinars

Want to brush up on your knowledge or get expert guidance? Check out these resources:

- IRS Webinars on Healthcare Reporting

- NAHU Webinars on Employer Mandate Compliance

- Society for Human Resource Management (SHRM) Webinars on Healthcare Reform

FAQ Section

What is the purpose of the Free Form 1095-c form?

The Free Form 1095-c form is used to report health insurance coverage provided by employers to their employees. It is a key component of the ACA’s individual mandate, which requires most Americans to have health insurance.

Who is eligible to file the Free Form 1095-c form?

Employers with 50 or more full-time equivalent employees are required to file the Free Form 1095-c form for each employee who was offered health insurance coverage during the year.

What information is required on the Free Form 1095-c form?

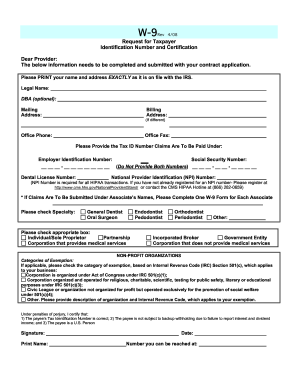

The Free Form 1095-c form requires information such as the employee’s name, address, Social Security number, and dates of health insurance coverage. It also requires information about the employer, such as the employer’s name, address, and Employer Identification Number (EIN).

What are the deadlines for filing the Free Form 1095-c form?

The Free Form 1095-c form must be filed by February 28th (March 31st if filing electronically) for paper filers and by April 1st for electronic filers.

What are the consequences of filing an incorrect or incomplete Free Form 1095-c form?

Filing an incorrect or incomplete Free Form 1095-c form can result in penalties from the IRS. The penalties can range from $250 to $3,000 per form.