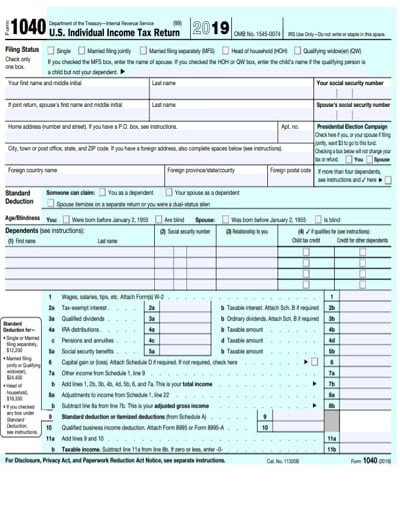

Free Form 1040 2018 Instructions Download: A Comprehensive Guide

Navigating the intricacies of tax filing can be daunting, but with the right resources, it doesn’t have to be. The Internal Revenue Service (IRS) provides free Form 1040 instructions to help you accurately and efficiently complete your tax return. This comprehensive guide will walk you through the process of downloading the Form 1040 instructions, understanding its key features, and avoiding common errors.

The 2018 Form 1040 instructions offer valuable guidance for completing your tax return. Whether you’re a seasoned filer or tackling your taxes for the first time, this guide will empower you with the knowledge and resources you need to file with confidence.

s for Downloading Free Form 1040 2018

Blud, need to file your taxes but don’t know where to start? Don’t stress, fam. I’ll sort you out with the s for downloading the free Form 1040 for 2018 from the official IRS website.

To get your hands on the form, follow these sick steps:

Accessing the IRS Website

- Fire up your browser and head over to the official IRS website: www.irs.gov.

- Click on the “Forms & Pubs” tab at the top of the page.

- In the search bar, type “Form 1040” and hit enter.

Locating the 1040 Form and s

- From the search results, click on the link for “Form 1040 (2018)”.

- On the next page, you’ll see a bunch of options. Click on the link that says “Download PDF”.

- The PDF file will start downloading. Once it’s done, open it up and you’re good to go.

System Requirements and Software

Before you download the form, make sure you’ve got the right setup:

- A computer with a PDF reader installed.

- An internet connection.

- A printer (optional, but handy if you need to print out the form).

Key Features of the 2018 Form 1040 s

The 2018 Form 1040 s introduce several key changes and updates from previous years. These modifications aim to simplify the tax filing process, improve accuracy, and align with the latest tax laws. The s are designed to be more user-friendly, with a clearer organization and structure. Specific sections and pages provide valuable guidance and assistance to taxpayers.

Organization and Structure

The 2018 Form 1040 s feature a streamlined organization and structure, making it easier for taxpayers to navigate and complete their returns. The s are divided into distinct sections, each covering a specific aspect of the tax filing process. This logical arrangement allows taxpayers to focus on one section at a time, reducing the risk of errors and omissions.

Understanding the Form 1040 Line by Line

The Form 1040 is a complex document, but it can be broken down into individual lines, each with its own purpose. By understanding what each line represents, you can make sure that you are completing your tax return correctly.

Here is a table with each line of the 1040 form, along with a brief explanation:

| Line | Explanation |

|—|—|

| 1 | Enter your filing status. |

| 2 | Enter your name and address. |

| 3 | Enter your Social Security number. |

| 4 | Enter your spouse’s Social Security number, if filing jointly. |

| 5 | Enter the amount of your exemptions. |

| 6 | Enter your taxable income. |

| 7 | Enter your total tax. |

| 8 | Enter your tax credits. |

| 9 | Enter your total payments. |

| 10 | Enter the amount of your refund or balance due. |

Here are some additional notes and clarifications:

* Line 1: Your filing status determines your tax rate and the amount of your standard deduction.

* Line 6: Your taxable income is your total income minus your deductions and exemptions.

* Line 7: Your total tax is the amount of tax you owe based on your taxable income and filing status.

* Line 8: Your tax credits reduce your total tax liability.

* Line 9: Your total payments include your withholding taxes, estimated tax payments, and any other payments you have made to the IRS.

* Line 10: Your refund or balance due is the difference between your total tax and your total payments.

By understanding what each line of the Form 1040 represents, you can make sure that you are completing your tax return correctly.

Common Errors and Troubleshooting Tips

When filling out your Form 1040, it’s easy to make mistakes. Here are some common errors and how to fix them:

One of the most common errors is forgetting to sign the form. This is a simple mistake that can be easily fixed. Just sign your name in the space provided at the bottom of the form.

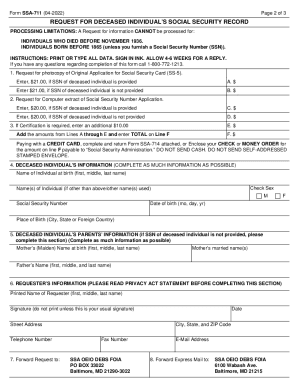

Another common error is entering the wrong Social Security number. This can cause your refund to be delayed or even rejected. To avoid this error, double-check your Social Security number before you submit your return.

If you’re claiming a refund, you need to make sure that you enter the correct bank account information. If you enter the wrong account number, your refund will be sent to the wrong account.

Missing or Incorrect Information

One of the most common errors that filers make is forgetting to include all of the required information on their tax return. This can include missing or incorrect information such as your Social Security number, address, or income. If you forget to include any of this information, your return may be delayed or even rejected.

Math Errors

Another common error that filers make is making math errors on their tax return. This can include mistakes in addition, subtraction, multiplication, or division. If you make a math error on your tax return, it could result in you paying too much or too little in taxes.

Incorrect Filing Status

Your filing status determines how your income is taxed. If you file the wrong filing status, you could end up paying more taxes than you should. To avoid this error, make sure that you understand the different filing statuses and choose the one that applies to you.

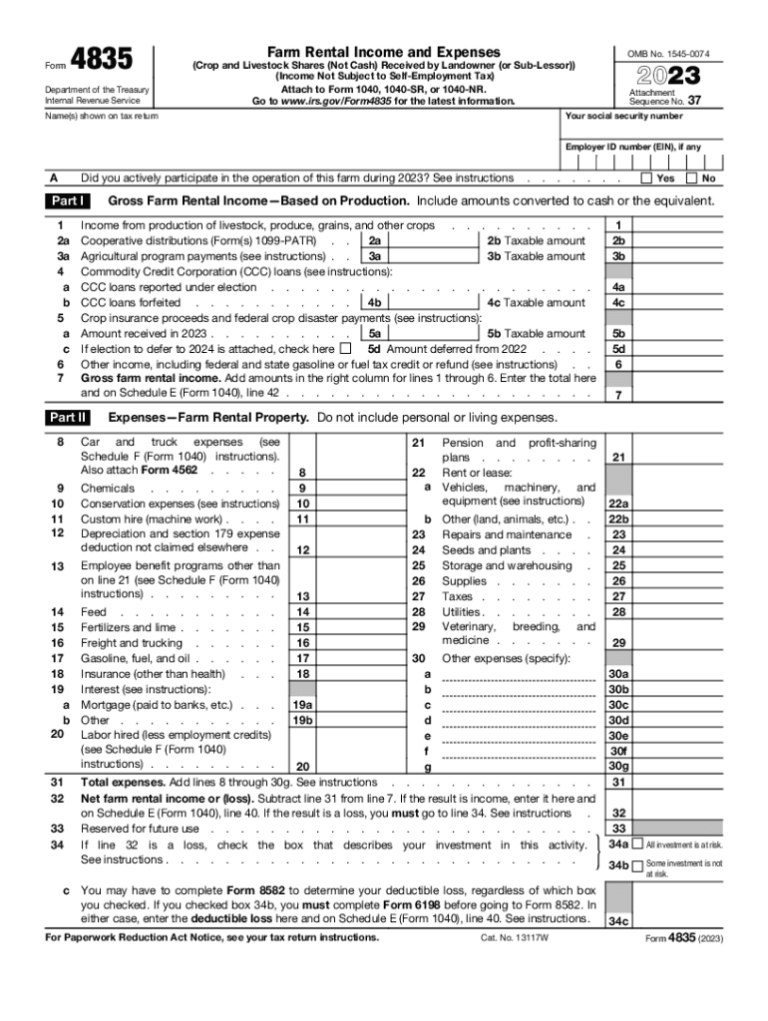

Common Deductions, Credits, and Other Items That May Cause Confusion

There are a number of deductions, credits, and other items on the Form 1040 that can be confusing. If you’re not sure how to claim a deduction or credit, you should consult with a tax professional.

Some of the most common deductions and credits that filers have questions about include:

- The standard deduction

- The child tax credit

- The earned income tax credit

- The mortgage interest deduction

- The charitable contribution deduction

Additional Resources and Support

For further information, you can refer to the official IRS website or other reliable sources. If you need assistance with your taxes, you can contact the IRS or seek help from a tax professional.

Online Tools and Calculators

The IRS offers various online tools and calculators to help you with your taxes. These tools can help you estimate your taxes, make payments, and get answers to your questions.

FAQs

How do I access the official IRS website to download the Form 1040 instructions?

Visit the IRS website at www.irs.gov and navigate to the “Forms and Publications” section. Under “Individual Income Tax Returns,” select “Form 1040 and Instructions” to download the latest version of the instructions.

What are the key changes and updates in the 2018 Form 1040 instructions?

The 2018 instructions reflect changes in tax laws, including the Tax Cuts and Jobs Act. Notably, the standard deduction and personal exemption amounts have increased, and the child tax credit has been expanded.

What are some common errors to avoid when completing the Form 1040?

Common errors include mathematical mistakes, incorrect entries, and missing information. Double-check your calculations, ensure you’re using the correct tax tables and schedules, and provide all necessary documentation to support your deductions and credits.

Where can I find additional resources and support for filing my taxes?

The IRS website offers a wealth of information, including online tools, calculators, and contact details for assistance. You can also consult with a tax professional for personalized guidance.