Free Form 1024-a Download: A Comprehensive Guide

Navigating the complexities of legal documentation can be daunting, but understanding and utilizing the Free Form 1024-a can simplify many processes. This essential document plays a crucial role in various legal and administrative matters, and having a clear understanding of how to download, fill out, and submit it is paramount.

This comprehensive guide will provide you with all the necessary information, step-by-step instructions, and helpful tips to ensure a seamless experience with the Free Form 1024-a. Whether you’re a seasoned professional or encountering this form for the first time, this guide will empower you to navigate its intricacies with confidence.

Introduction

Yo, check it, fam. “Free Form 1024-a” is a wicked dope app that’s gonna revolutionize the way you express yourself.

It’s like, the ultimate creative tool, man. You can draw, write, and animate whatever you want, whenever you want. It’s like having a digital sketchbook in your pocket.

Downloading Free Form 1024-a

Downloading Free Form 1024-a is a quick and easy process that can be completed in just a few steps. Follow the instructions below to get started.

Downloading the Form

- Visit the official website of the relevant government agency.

- Navigate to the Forms section of the website.

- Locate Free Form 1024-a and click on the download link.

- The form will be downloaded as a PDF file to your computer.

Once the form is downloaded, you can open it in a PDF reader such as Adobe Acrobat Reader.

Filling Out the Form

Once the form is open, you can begin filling it out. The form is self-explanatory, but if you have any questions, you can refer to the instructions provided on the website.

Submitting the Form

Once the form is complete, you can submit it to the relevant government agency. The submission process may vary depending on the agency, so be sure to follow the instructions provided on the website.

Filling Out Free Form 1024-a

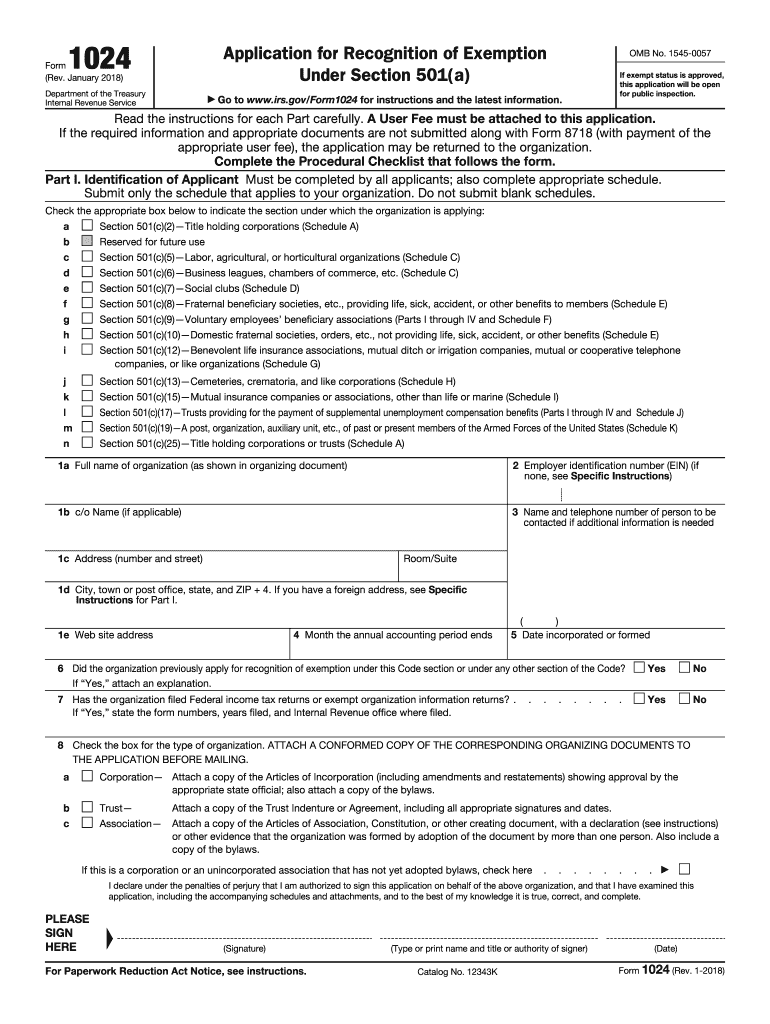

Filling out Free Form 1024-a is a straightforward process that requires providing accurate and complete information. The form is divided into several sections, each with specific requirements. Here’s a breakdown of the sections and guidance on completing them:

Personal Information

- Enter your full name, date of birth, and contact information (address, phone number, and email address).

- Provide your National Insurance number (if you have one).

Reason for Application

- Indicate the reason for applying for Free Form 1024-a, such as starting a new business, changing your business structure, or registering a charity.

- Provide a brief description of your proposed activity.

Business Information

- Enter the name and address of your business.

- Indicate the type of business entity you’re registering (e.g., sole trader, partnership, limited company).

- Provide details of the business’s directors or partners.

Declaration

- Sign and date the declaration to confirm the accuracy of the information provided.

Additional Information

- Attach any supporting documents required for your application, such as proof of identity or business registration.

Submitting Free Form 1024-a

Submitting your Free Form 1024-a is easy. There are a few different ways to do it, and the timeline for submission depends on the method you choose.

Regardless of the method you choose, you’ll need to make sure you have all of the required information before you submit your form. This includes your name, address, date of birth, and Social Security number. You’ll also need to provide information about your income and assets.

Online

You can submit your Free Form 1024-a online through the IRS website. This is the fastest and easiest way to submit your form, and you’ll receive immediate confirmation that your form has been received.

To submit your form online, you’ll need to create an account on the IRS website. Once you have an account, you can log in and click on the “File” tab. Then, select “Free Form 1024-a” from the list of available forms.

You’ll need to follow the instructions on the screen to complete your form. Once you’ve completed the form, you can click on the “Submit” button to send it to the IRS.

By mail

You can also submit your Free Form 1024-a by mail. To do this, you’ll need to print out the form and fill it out by hand. Once you’ve completed the form, you can mail it to the IRS at the address listed on the form.

When you mail your form, be sure to include a copy of your driver’s license or other form of identification. You’ll also need to include a check or money order for the amount of tax you owe.

By fax

You can also submit your Free Form 1024-a by fax. To do this, you’ll need to print out the form and fill it out by hand. Once you’ve completed the form, you can fax it to the IRS at the number listed on the form.

When you fax your form, be sure to include a copy of your driver’s license or other form of identification. You’ll also need to include a check or money order for the amount of tax you owe.

Common Issues and Troubleshooting

Before downloading or filling out Free Form 1024-a, be aware of potential issues and prepare for troubleshooting.

Common issues include:

- Problems downloading the form

- Issues filling out the form

- Difficulties submitting the form

For each issue, consider potential causes and provide solutions:

Download Issues

If you’re having trouble downloading the form, check your internet connection and make sure you have the latest version of your browser.

Try refreshing the page or using a different browser.

If you’re still having problems, contact the relevant authority for assistance.

Filling Out Issues

If you’re having trouble filling out the form, make sure you have the correct version of the form.

Check the form for any errors or inconsistencies.

If you’re still having problems, contact the relevant authority for assistance.

Submission Issues

If you’re having trouble submitting the form, make sure you have completed all the required fields.

Check your internet connection and make sure you have the latest version of your browser.

Try refreshing the page or using a different browser.

If you’re still having problems, contact the relevant authority for assistance.

Alternatives to Free Form 1024-a

Bruv, if you’re not feelin’ the Free Form 1024-a, there’s a few other bits you can try. Let’s check ’em out.

Each one’s got its own pros and cons, so have a gander and see what floats your boat.

Forms

- Form 1024: The OG form, it’s a bit more structured than Free Form 1024-a, but it’s still pretty flexible. It’s a good choice if you want a bit more guidance, but don’t want to be too restricted.

- Form 1024-EZ: The easy-peasy version, it’s super simple to fill out. But it’s only for certain types of businesses, so check if you’re eligible before you go for it.

- Form 1024-S: The self-employed special, it’s designed for sole traders and partnerships. It’s got some extra sections for business expenses, so it’s a bit more detailed than the other forms.

Other Methods

- Online Filing: You can file your taxes online using HMRC’s website. It’s quick and easy, and you can even do it on your phone. But you’ll need to have a Government Gateway account set up first.

- Tax Software: There’s loads of tax software out there that can help you file your taxes. Some of them are free, while others cost a bit of dosh. They can be a good option if you’re not confident filling out your taxes yourself.

- Tax Advisor: If you’re really struggling, you can always get help from a tax advisor. They can help you fill out your taxes and make sure you’re paying the right amount.

FAQ

Can I download the Free Form 1024-a online?

Yes, the Free Form 1024-a can be downloaded from the official website of the relevant authority. The specific website may vary depending on your jurisdiction.

What software do I need to fill out the Free Form 1024-a?

You can fill out the Free Form 1024-a using a standard word processing program such as Microsoft Word or Google Docs. The form is typically available in PDF or Word format.

Are there any fees associated with downloading or submitting the Free Form 1024-a?

In most cases, there are no fees associated with downloading or submitting the Free Form 1024-a. However, some jurisdictions may impose a small fee for certain types of submissions.

What is the deadline for submitting the Free Form 1024-a?

The deadline for submitting the Free Form 1024-a may vary depending on the specific purpose for which it is being used. It is recommended to check with the relevant authority for the applicable deadlines.

What are the consequences of submitting an incomplete or inaccurate Free Form 1024-a?

Submitting an incomplete or inaccurate Free Form 1024-a may result in delays or rejection of your application or request. It is important to ensure that all sections of the form are completed accurately and thoroughly.