Free Fillable 1096 Form Download: Your Guide to Hassle-Free Filing

Navigating the world of tax forms can be daunting, especially when it comes to complex ones like Form 1096. But with the advent of free fillable 1096 forms, filing has become a breeze. This guide will provide you with a comprehensive overview of free fillable 1096 forms, their benefits, and how to use them effectively, ensuring a seamless and stress-free filing experience.

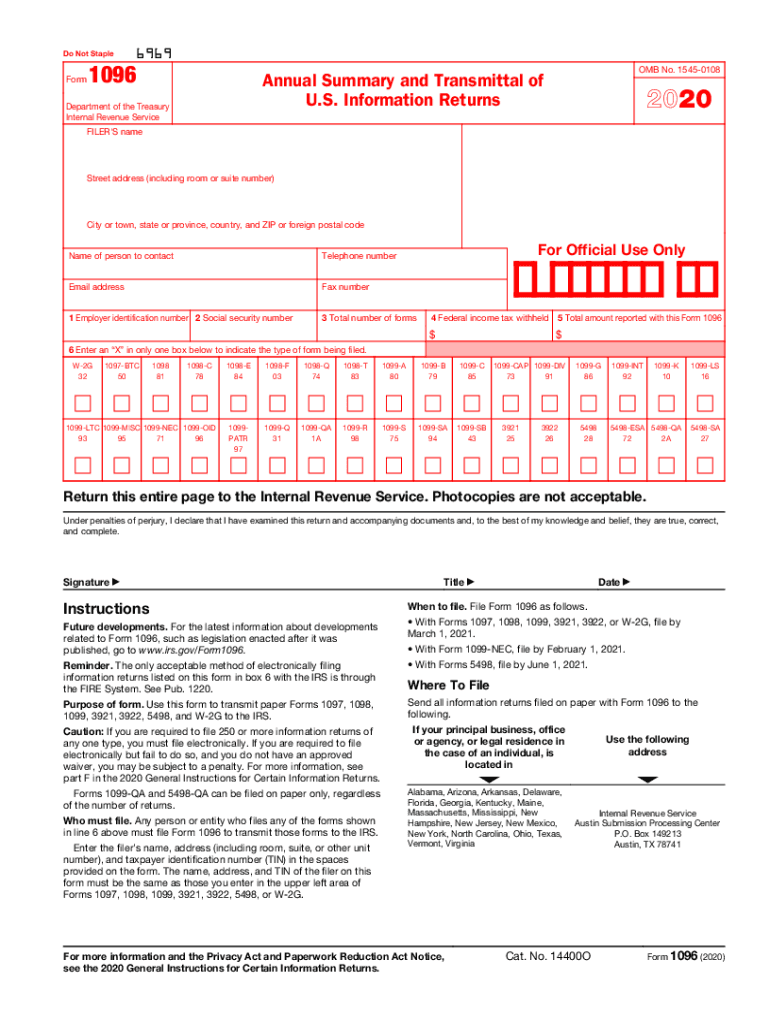

Form 1096, also known as the Annual Summary and Transmittal of U.S. Information Returns, plays a crucial role in reporting various types of income and payments made to individuals and entities. It’s essential for businesses and individuals alike to understand the requirements and benefits of using a free fillable 1096 form to ensure accurate and timely filing.

Considerations for Choosing a Free Fillable 1096 Form

Choosing the right free fillable 1096 form is crucial for a seamless and hassle-free filing experience. Several factors need to be considered to ensure you select a form that meets your specific requirements.

Compatibility

Make sure the form is compatible with your software and operating system. If you’re using a specific tax preparation software, check if it supports the form you’re downloading. Similarly, ensure the form is compatible with your computer’s operating system to avoid any technical glitches during the filing process.

Security and Privacy

The security and privacy of your personal and financial information should be a top priority. Choose a form that employs robust security measures to protect your data from unauthorized access or misuse. Look for forms that use encryption and other security protocols to safeguard your sensitive information.

Step-by-Step Guide to Using a Free Fillable 1096 Form

This guide will help you download, install, and complete a free fillable 1096 form accurately.

Downloading and Installing the Form

1. Go to the official IRS website or a reputable tax software provider.

2. Search for “Free Fillable 1096 Form.”

3. Download the form in a format compatible with your computer or software.

4. Install the form by following the instructions provided.

Filling Out the Form

Section A: Information About the Transmitter

* Fill in your name, address, and employer identification number (EIN).

* Indicate the calendar year for which you’re reporting.

Section B: Information About the Recipient

* Provide the recipient’s name, address, and Social Security number (SSN) or individual taxpayer identification number (ITIN).

Section C: Insurance Information

* Enter the health insurance policy number and coverage dates.

* Indicate the type of insurance provided (e.g., employer-sponsored, individual market).

Section D: Employer Information

* Complete this section only if you’re reporting for an employer-sponsored plan.

* Provide the employer’s name, address, and EIN.

Section E: Summary of Coverage

* Enter the number of months of health insurance coverage for the recipient.

* Indicate if the recipient was offered affordable coverage.

Section F: Additional Information

* Complete this section if there are any additional details or changes to report.

* For example, if the recipient was uninsured for part of the year.

Section G: Certification

* Sign and date the form to certify that the information is accurate.

Submitting the Form

* Once the form is complete, save it and submit it electronically or by mail to the IRS.

Common Mistakes to Avoid When Using a Free Fillable 1096 Form

Completing a free fillable 1096 form can be a straightforward process, but it’s important to be aware of some common mistakes that can occur. These mistakes can lead to delays in processing, penalties, or even legal issues.

To avoid these mistakes, it’s essential to understand the form’s requirements and follow the instructions carefully. Here are some of the most common mistakes to watch out for:

Incorrect or Incomplete Information

- Providing incorrect or incomplete information, such as incorrect addresses, missing tax identification numbers, or inaccurate amounts, can lead to delays in processing and potential penalties.

- It’s crucial to double-check all the information on the form to ensure its accuracy and completeness before submitting it.

Filing Late

- Filing your 1096 form late can result in penalties and interest charges.

- Make sure to file your form by the deadline to avoid any unnecessary fees.

Using an Outdated Form

- Using an outdated form can lead to errors and potential rejection of your filing.

- Always download the most up-to-date version of the 1096 form from the IRS website.

Not Keeping a Copy of Your Form

- It’s important to keep a copy of your filed 1096 form for your records.

- This copy can serve as proof of filing and can be helpful in case of any inquiries or audits.

Incorrect Signature

- The 1096 form must be signed by an authorized individual.

- Make sure the person signing the form has the proper authority to do so.

Advanced Tips for Using a Free Fillable 1096 Form

Yo, listen up! If you’re tryna smash that 1096 form like a pro, check out these next-level tips. These gems will help you automate the hustle, save time, and make your life a breeze.

Using Macros and Formulas

Macros and formulas are like magic spells for your form. They can automate calculations, fill in data, and make your life so much easier. Here’s how to work that magic:

- Macros: These bad boys can record a series of actions and then replay them whenever you need ’em. Perfect for repetitive tasks like calculating totals or formatting numbers.

- Formulas: Formulas are like super-smart equations that can perform calculations based on other data in the form. This means you can automate calculations without having to do ’em manually.

Troubleshooting Common Issues with Free Fillable 1096 Forms

It’s a bit of a drag when your free fillable 1096 form acts up, innit? Let’s sort it out like a pro with these troubleshooting tips.

If you’re struggling with technical issues while using a free fillable 1096 form, don’t fret. Here’s a step-by-step guide to help you sort it out.

Technical Issues and Solutions

- Form Not Loading: Make sure you’ve got a stable internet connection. If it’s still not loading, try using a different browser or clearing your cache.

- Unable to Save Form: Check if you have permission to save the file in the location you’re trying to. Also, ensure the file isn’t corrupted or locked.

- Incorrect Calculations: Double-check the data you’ve entered, especially for numbers. Make sure you’re using the correct formulas and that there are no typos.

- Compatibility Issues: If you’re having trouble opening or editing the form in your software, try downloading the latest version or using a different program.

Seeking Support

If you’re still stuck, don’t hesitate to reach out for help. Here are some resources you can tap into:

- IRS Website: The IRS website has a wealth of information and resources on 1096 forms, including troubleshooting tips.

- Software Provider: If you’re using software to fill out the form, contact their support team for assistance.

- Tax Professional: If all else fails, consider consulting a tax professional who can guide you through the process.

FAQ Section

What is the purpose of Form 1096?

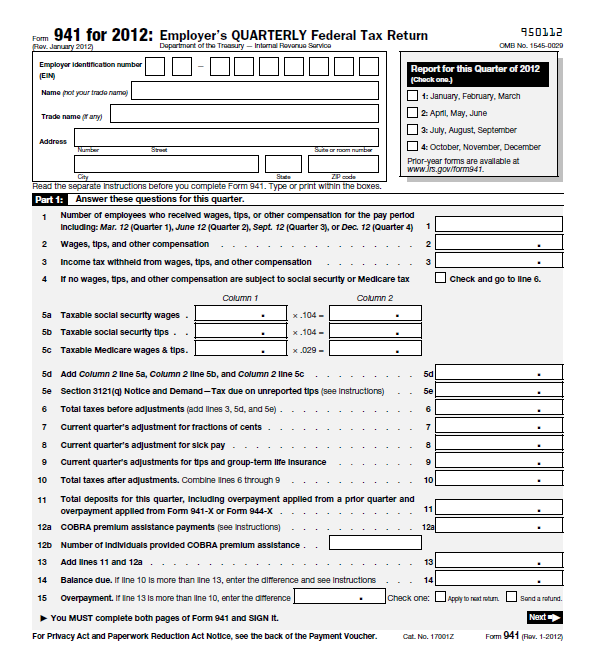

Form 1096 serves as a summary and transmittal document for various information returns, including Forms 1099-MISC, 1099-NEC, and 1099-R. It provides a consolidated overview of payments made to individuals and entities during the tax year.

Who is required to file Form 1096?

Any business or individual who makes certain types of payments, such as nonemployee compensation, prizes, or awards, exceeding specific thresholds is required to file Form 1096.

What are the benefits of using a free fillable 1096 form?

Free fillable 1096 forms offer numerous advantages, including convenience, time-saving, cost-effectiveness, and accessibility. They eliminate the need for manual calculations and reduce the risk of errors, ensuring accurate and timely filing.

What key features should I look for in a free fillable 1096 form?

When choosing a free fillable 1096 form, consider its user-friendliness, ease of navigation, accurate calculations, and error-checking capabilities. A well-designed form will guide you through the filing process seamlessly.

What are some common mistakes to avoid when using a free fillable 1096 form?

Common mistakes to avoid include incorrect or incomplete information, missing or invalid taxpayer identification numbers, and mathematical errors. Careful attention to detail and double-checking your entries will help prevent these issues.