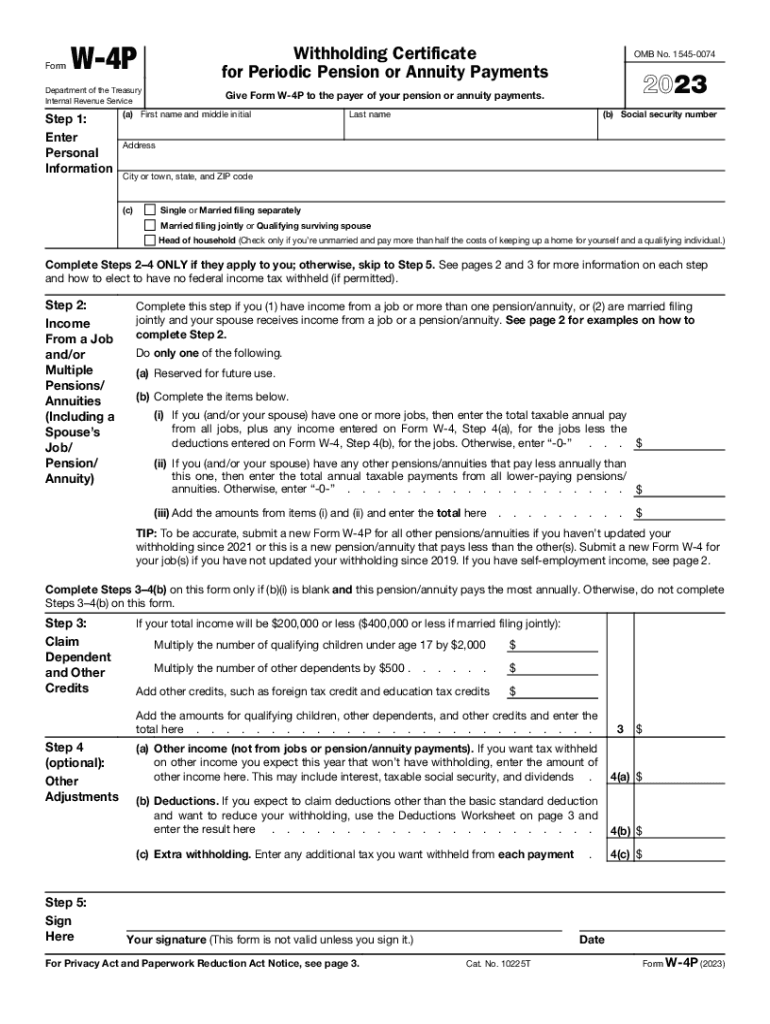

Free Federal W4p Form Download: Your Guide to Withholding Allowances

Navigating the complexities of federal income tax withholding can be a daunting task, but the W4p form is here to help. This guide will provide you with a comprehensive overview of the W4p form, its benefits, and how to use it effectively to manage your tax withholdings.

The W4p form, also known as the Withholding Certificate for Pension or Annuity Payments, is an essential document for individuals receiving pension or annuity payments. It allows you to specify your withholding allowances, which determine how much federal income tax is withheld from your payments.

Understanding the W4p Form

The W4p form is an important document that helps you calculate the amount of federal income tax that will be withheld from your paychecks. It’s important to fill out the form accurately to avoid overpaying or underpaying your taxes. Understanding the different sections of the form will help you complete it correctly.

Personal Information

The first section of the W4p form asks for your personal information, including your name, address, and Social Security number. It’s important to make sure that this information is accurate and up-to-date.

Exemptions

The next section of the form asks you to claim exemptions. Exemptions reduce the amount of income tax that is withheld from your paychecks. You can claim an exemption for yourself, your spouse, and any dependents you have. The number of exemptions you claim will affect the amount of tax that is withheld from your paychecks.

Additional Income

If you have additional income, such as from self-employment or investments, you need to include that information on the W4p form. This will help ensure that the correct amount of tax is withheld from your paychecks.

Common Mistakes to Avoid

There are a few common mistakes that people make when filling out the W4p form. These mistakes can lead to overpaying or underpaying your taxes. Here are a few things to avoid:

- Claiming too many exemptions. If you claim too many exemptions, you may not have enough tax withheld from your paychecks. This can lead to a large tax bill at the end of the year.

- Not claiming enough exemptions. If you don’t claim enough exemptions, too much tax may be withheld from your paychecks. This can lead to a refund at the end of the year, but it also means that you’re giving the government an interest-free loan.

- Making mistakes on your personal information. If you make mistakes on your personal information, the IRS may not be able to process your form correctly. This can lead to delays in getting your refund or having too much or too little tax withheld from your paychecks.

Using the W4p Form Effectively

Innit, the W4p form is your go-to tool for keeping your tax withholdings in check. It’s like the secret sauce that helps you manage how much moolah Uncle Sam takes out of your paycheck each time.

Now, let’s chat about withholding allowances. These little fellas are like magic numbers that tell the taxman how many dependents you’ve got. Each allowance you claim means a chunk of your paycheck that won’t be taxed. So, if you’ve got a big family, you’ll want to claim more allowances to avoid overpaying.

Tips for Optimizing Withholding

- Check your withholding regularly: Life’s a rollercoaster, and so is your tax situation. Make sure you’re not underpaying or overpaying by checking your withholding every year or whenever your circumstances change.

- Use the W4p worksheet: The W4p form comes with a handy worksheet that helps you figure out how many allowances to claim. It’s like having a tax wizard in your pocket.

- Don’t overclaim: Claiming too many allowances can lead to a nasty tax bill later on. Be honest and claim the number of allowances you’re entitled to.

Additional Resources and Support

If you need further assistance with the W4p form, there are several resources available to help you. Online calculators and tutorials can provide step-by-step guidance and calculations. Professional tax assistance services can offer personalized advice and ensure your form is filled out correctly.

Online Calculators and Tutorials

- The IRS website offers an interactive W4p calculator that can help you determine your withholding.

- Paycheck City provides a comprehensive W4p calculator and tutorial.

- NerdWallet offers a user-friendly W4p calculator with clear instructions.

Professional Tax Assistance Services

If you have complex financial situations or need personalized advice, consider seeking professional tax assistance. Certified Public Accountants (CPAs) and Enrolled Agents (EAs) can provide expert guidance and ensure your W4p form is optimized for your specific circumstances.

FAQ Corner

Where can I download the free Federal W4p form?

You can download the free Federal W4p form from the IRS website: https://www.irs.gov/forms-pubs/about-form-w4p

What is the purpose of the W4p form?

The W4p form is used to certify your withholding allowances for pension or annuity payments. It helps the payer determine how much federal income tax to withhold from your payments.

How do I fill out the W4p form?

The W4p form is relatively straightforward to fill out. You will need to provide your personal information, such as your name, address, and Social Security number. You will also need to indicate your withholding allowances. The IRS provides detailed instructions on how to complete the form on their website.