Free FAA Form 8500 Download: A Comprehensive Guide to Financial Planning

Navigating the complexities of personal finance can be daunting, but the Federal Aviation Administration (FAA) Form 8500 offers a valuable tool to simplify the process. This comprehensive form provides a structured framework for tracking income, expenses, and assets, making it an indispensable resource for financial planning and decision-making.

In this guide, we will delve into the significance of Form 8500, explore the benefits of free downloads, identify reputable sources for obtaining the form, and provide step-by-step guidance on filling it out. Additionally, we will discuss how Form 8500 can be effectively utilized for financial planning and budgeting.

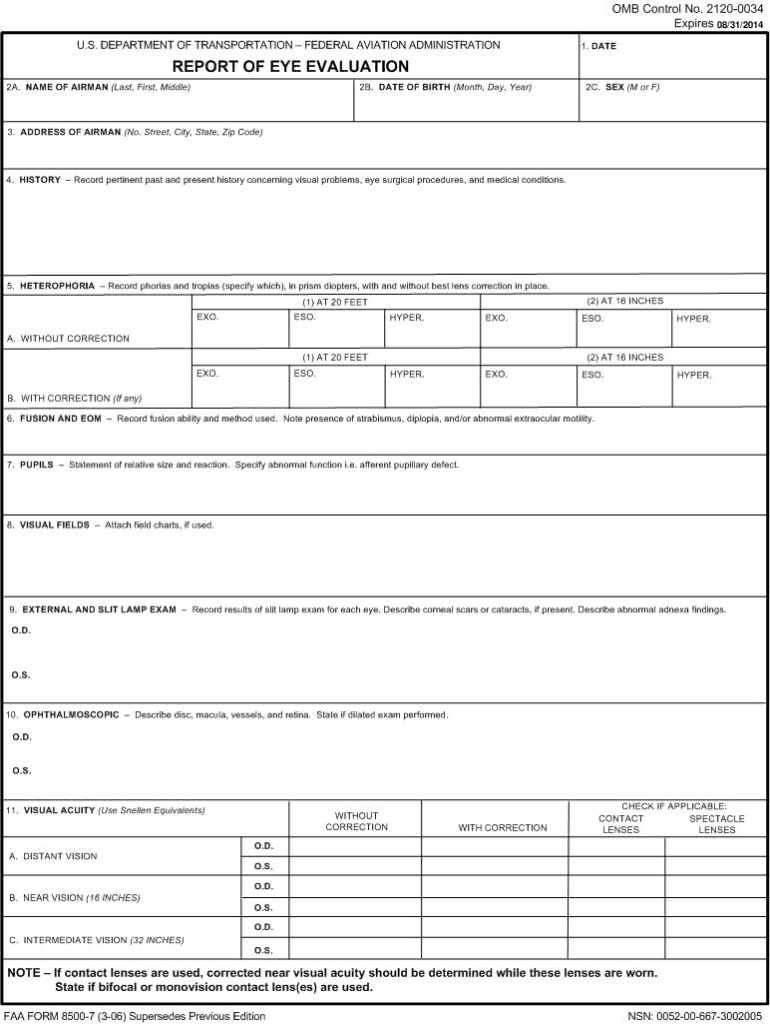

Definition of Form 8500

Form 8500, also known as the “Credit Application and Report Authorisation”, is a crucial document used by individuals seeking to apply for credit, typically in the form of a loan or credit card.

This form serves as a comprehensive source of information for lenders, providing them with a detailed snapshot of an applicant’s financial situation and credit history. It allows lenders to assess the applicant’s ability to repay the loan and make informed decisions regarding the approval and terms of the credit.

Information Captured in Form 8500

Form 8500 collects a wide range of personal and financial information, including:

- Personal details (name, address, contact information)

- Employment and income information

- Asset and liability details (e.g., savings, investments, debts)

- Credit history (e.g., previous loans, credit cards, and payment records)

- Authorisation for credit checks

Filling Out Form 8500

Filling out Form 8500 is a straightforward process that can be completed in a few simple steps. By following these steps and providing accurate information, you can ensure that your form is processed efficiently.

To begin, gather all the necessary information and documents. This may include your Social Security number, employer identification number, and financial statements. Once you have gathered all the required information, you can start filling out the form.

Step 1: Personal Information

- Provide your full name, address, and contact information.

- Indicate your filing status.

- Enter your Social Security number.

Step 2: Income

- Report all your income from various sources, including wages, salaries, dividends, and interest.

- Use Schedule C or Schedule SE to report self-employment income.

- Include any other taxable income, such as prizes or gambling winnings.

Step 3: Adjustments to Income

- Deduct eligible expenses, such as student loan interest or contributions to a traditional IRA.

- Use Schedule A to itemize deductions.

Step 4: Taxable Income

- Subtract your adjustments from your total income to calculate your taxable income.

- This amount will be used to determine your tax liability.

Step 5: Tax Calculation

- Use the tax table or software to calculate your tax liability based on your taxable income and filing status.

- Subtract any applicable tax credits or deductions.

Step 6: Payments and Refunds

- Enter any estimated tax payments or withholdings.

- Calculate the amount of tax you owe or the refund you are due.

Once you have completed all the sections, review your form carefully for any errors or omissions. Sign and date the form, and attach any necessary schedules or documents. Mail the completed form to the IRS using the provided address.

Using Form 8500 for Financial Planning

Fam, Form 8500 is your go-to tool for keeping tabs on your bread and dough. It’s like a financial roadmap that helps you plan your cheddar and smash your money goals.

With Form 8500, you can:

- Track your income: From your regular 9-to-5 to any side hustles you’re working, jot it all down.

- Monitor your expenses: Every penny you spend, from rent to that new pair of trainers, needs to be accounted for.

- Keep an eye on your assets: Your savings, investments, and any other bits you own that have value.

By keeping track of this info, you can create a budget that works for you and start setting some serious financial goals. Whether it’s saving for a new ride or planning for your future, Form 8500 has got your back.

Budgeting with Form 8500

A budget is like a plan for your money. It tells you how much you’ve got coming in, how much is going out, and where you want the rest to go. Form 8500 helps you do this by:

- Showing you where your money’s going: Once you know where your cash is disappearing, you can start making changes to save more.

- Helping you set spending limits: Set limits for different categories, like food or entertainment, so you don’t overspend.

- Tracking your progress: See how you’re doing against your budget each month and make adjustments as needed.

Setting Financial Goals

Whether you’re saving for a house or just want to get your finances in order, Form 8500 can help you set and achieve your financial goals. Here’s how:

- Identify your goals: Figure out what you’re saving for and how much you need.

- Create a plan: Break down your goal into smaller, more manageable steps.

- Track your progress: Use Form 8500 to track how much you’ve saved and how close you are to reaching your goal.

Other Considerations

Once you have completed Form 8500, review it carefully to ensure all information is accurate and complete. Keep a copy for your records, and submit the original to the relevant tax authority.

Consider the following additional tips and resources to enhance your experience using Form 8500:

Related Resources

- Consult the official tax authority website for detailed guidance and up-to-date information on Form 8500.

- Seek professional advice from a tax advisor or accountant if you have complex financial situations or require specialized guidance.

- Utilize online tax preparation software or services to streamline the process and ensure accuracy.

Further Reading

- Explore the tax authority’s website for additional resources, such as FAQs, webinars, and educational materials.

- Refer to reputable tax publications or online forums for insights and updates on tax-related matters.

- Stay informed about changes in tax laws and regulations by subscribing to tax-related newsletters or attending industry events.

Q&A

What is the purpose of FAA Form 8500?

FAA Form 8500 is designed to provide a comprehensive snapshot of an individual’s financial status, including income, expenses, and assets.

Why is it important to have free access to Form 8500?

Free access to Form 8500 eliminates financial barriers and ensures that everyone has the opportunity to effectively manage their finances.

Where can I find reputable sources to download Form 8500?

Reputable sources for downloading Form 8500 include the FAA website, financial planning websites, and online document repositories.

How do I fill out Form 8500?

Filling out Form 8500 involves carefully completing each section, including personal information, income sources, expenses, assets, and liabilities.

How can I use Form 8500 for financial planning?

Form 8500 can be used to track income and expenses, create budgets, set financial goals, and make informed financial decisions.