Effortlessly File Your Taxes with Free Efile Form 941 Download

Welcome to the world of seamless tax filing! With the advent of Free Efile Form 941 Download, the daunting task of tax preparation has become a breeze. This innovative service empowers businesses of all sizes to navigate the complexities of tax filing with ease, saving them valuable time and resources.

In this comprehensive guide, we will delve into the intricacies of Free Efile Form 941 Download, exploring its benefits, features, and the step-by-step process of using this service. By the end of this journey, you will be equipped with the knowledge and confidence to embrace the future of tax filing and streamline your business operations.

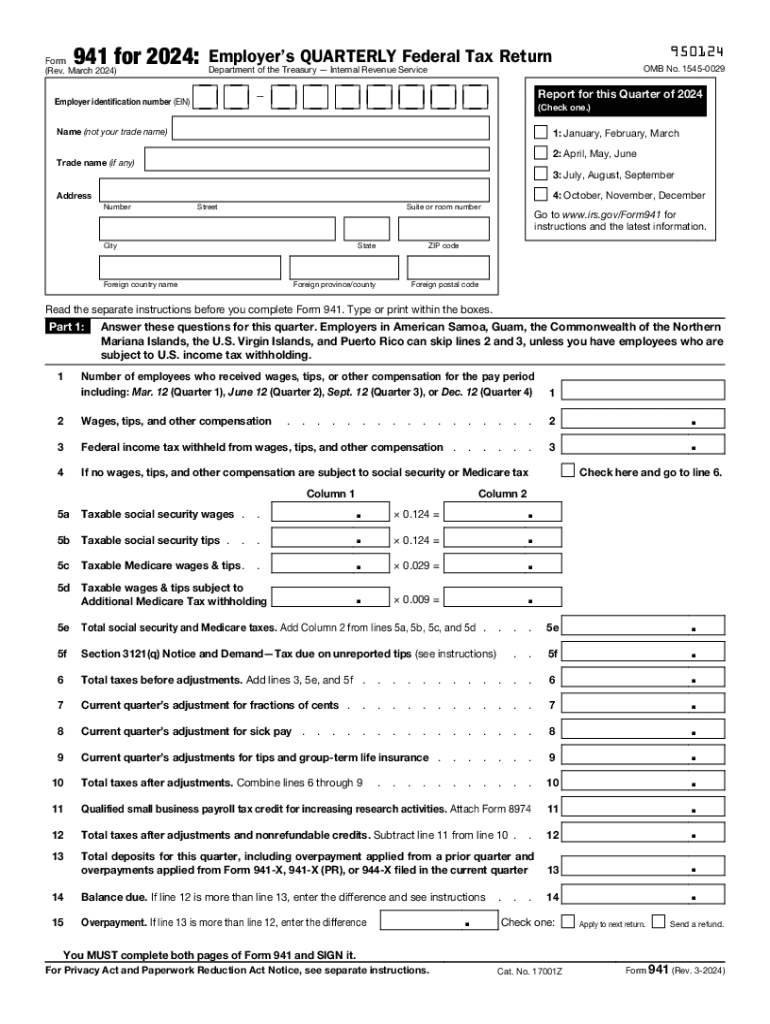

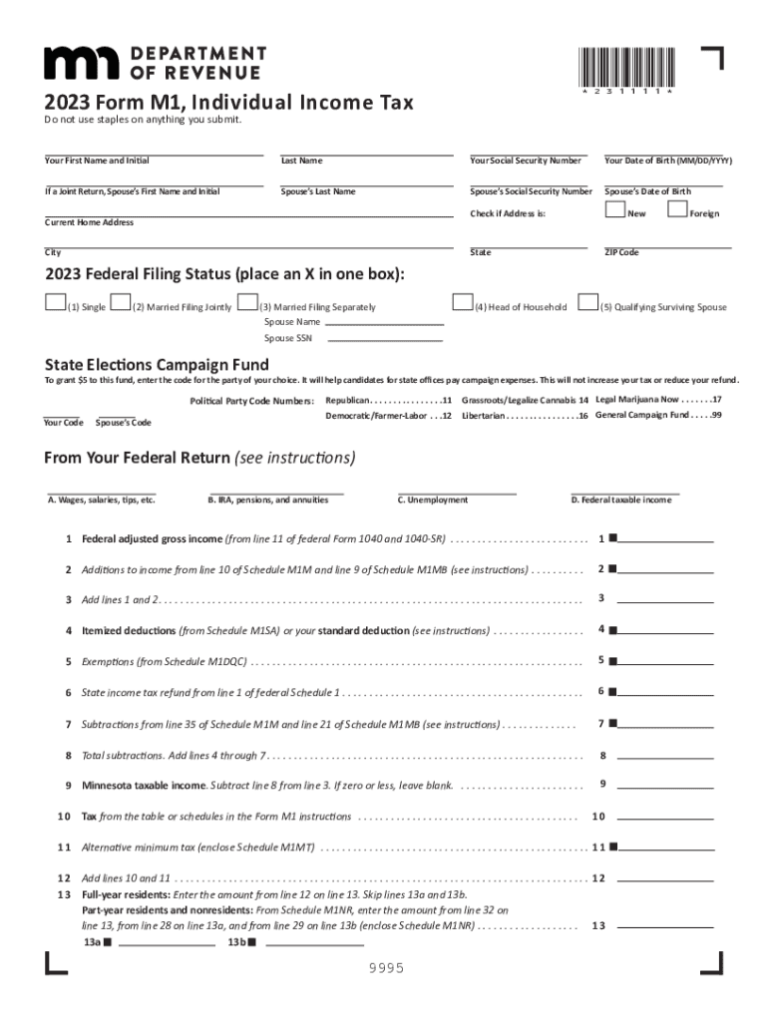

Definition of Free Efile Form 941 Download

Free Efile Form 941 Download is a nifty tool that allows you to file your quarterly federal income tax return (Form 941) electronically for free. It’s like having a personal tax wizard at your fingertips, without the hefty price tag.

Filing your taxes electronically has a bunch of perks. It’s way quicker and easier than filling out paper forms, and it’s more secure too. Plus, you can avoid any potential postal delays or lost paperwork. So, if you’re looking to streamline your tax filing process, Free Efile Form 941 Download is the way to go.

Benefits of Using Free Efile Form 941 Download

- It’s free! No hidden fees or subscriptions to worry about.

- It’s easy to use. The interface is user-friendly, so you don’t need to be a tax whizz to figure it out.

- It’s secure. Your data is encrypted and protected, so you can rest assured that your information is safe.

- It’s fast. E-filing takes minutes, compared to days or weeks for paper filing.

- It’s convenient. You can file your taxes from anywhere with an internet connection, at any time of day or night.

Benefits of Using Free Efile Form 941 Download

Free Efile Form 941 Download simplifies tax filing, saves time, and reduces errors. It’s the easy way to file your quarterly employment tax returns.

How it simplifies tax filing

With Free Efile Form 941 Download, you can file your taxes online in just a few minutes. No need to worry about complicated forms or calculations. The software does it all for you.

How it saves time

Filing your taxes online is much faster than filing by mail. You can save hours of time by using Free Efile Form 941 Download.

How it reduces errors

The software checks for errors as you enter your information. This helps to ensure that your return is accurate and complete.

Examples of how businesses have benefited from using this service

Many businesses have benefited from using Free Efile Form 941 Download. Here are a few examples:

- A small business owner saved over $100 on tax preparation fees by using Free Efile Form 941 Download.

- A large corporation saved over $1,000 on tax preparation fees by using Free Efile Form 941 Download.

- A non-profit organization saved over $500 on tax preparation fees by using Free Efile Form 941 Download.

s for Downloading and Using Free Efile Form 941

Blagging Free Efile Form 941 is a doddle. Just follow these cheeky steps:

- Boot up your brolly: Head over to the IRS website and search for “Free Efile Form 941”.

- Fill in the blanks: You’ll need to give the IRS some basic info, like your business name and address.

- Hit the button: Once you’re done, click the “Download” button to save the form to your computer.

- Open it up: Use a PDF reader like Adobe Acrobat to open the form.

- Fill it in, bruv: Fill out the form electronically or print it out and fill it in by hand.

- Send it back: Once you’re done, you can either e-file the form or mail it to the IRS.

Common Challenges

Q: I can’t find the Free Efile Form 941 on the IRS website.

A: Make sure you’re searching for the correct form number. It’s Form 941, not Form 1040.

Q: I’m having trouble filling out the form.

A: The IRS website has a helpful guide that can walk you through the process step-by-step.

Q: I don’t have a PDF reader.

A: You can download Adobe Acrobat Reader for free from the Adobe website.

Q: I’m not sure how to e-file the form.

A: The IRS website has a section dedicated to e-filing. You can find instructions and a list of approved e-file providers there.

Features of Free Efile Form 941 Download

Free Efile Form 941 Download is equipped with a range of features designed to simplify tax filing and enhance the user experience. These features include user-friendly interfaces, automated calculations, and secure data handling, making it an ideal choice for businesses looking to streamline their tax filing process.

The intuitive interface guides users through the filing process seamlessly, with clear instructions and easy-to-navigate menus. Automated calculations ensure accuracy and reduce the risk of errors, saving businesses time and effort. Additionally, the platform employs robust security measures to protect sensitive data, giving users peace of mind.

Simplified User Interface

- Straightforward navigation and clear instructions make filing a breeze.

- Easy-to-understand menus and options streamline the process.

- Businesses can save time and avoid frustrations associated with complex interfaces.

Automated Calculations

- Accurate calculations eliminate the risk of manual errors.

- Businesses can be confident in the accuracy of their tax filings.

- Time saved on calculations allows businesses to focus on other important tasks.

Secure Data Handling

- Robust security measures protect sensitive data.

- Businesses can trust that their information is safeguarded.

- Peace of mind knowing that data is protected from unauthorized access.

Comparison with Other Tax Filing Options

Filing your taxes can be a daunting task, but it doesn’t have to be. There are a number of different tax filing options available, each with its own pros and cons. In this section, we’ll compare Free Efile Form 941 Download with other popular tax filing options to help you make an informed decision about which option is right for you.

One of the most important factors to consider when choosing a tax filing option is the cost. Free Efile Form 941 Download is a free service, which can save you a significant amount of money compared to other options. However, there are some other free tax filing options available, so it’s important to compare them all to find the best one for you.

Paid Tax Filing Software

Paid tax filing software is a popular option for people who want to file their taxes accurately and efficiently. These programs typically offer a variety of features, such as guided interviews, error checking, and automatic calculations. However, paid tax filing software can be expensive, and some programs may not be worth the cost. Pros of using paid tax filing software include:

- Accuracy: Paid tax filing software is designed to help you file your taxes accurately, which can save you time and money in the long run.

- Efficiency: Paid tax filing software can help you file your taxes quickly and easily, freeing up your time for other things.

- Features: Paid tax filing software typically offers a variety of features, such as guided interviews, error checking, and automatic calculations, which can make filing your taxes easier.

Cons of using paid tax filing software include:

- Cost: Paid tax filing software can be expensive, and some programs may not be worth the cost.

- Complexity: Paid tax filing software can be complex to use, especially for people who are not familiar with taxes.

- Security: Paid tax filing software can be a target for hackers, so it’s important to choose a program that has a good security record.

Tips for Effective Use of Free Efile Form 941 Download

Banging tips for getting the most out of your Free Efile Form 941 Download, innit? Dodge the dodginess and make tax time a breeze, bruv.

Get Your Documents Sorted

- Round up all your tax info like a boss – W-2s, 1099s, the whole shebang.

- Keep your records safe and sound. Don’t be a mug and lose ’em.

Double-Check Your Info

- Give your details a once-over. Make sure they’re spick and span, no dodgy business.

- Check your calculations twice, maybe even thrice. Don’t let any sneaky mistakes slip through the cracks.

Don’t Leave It Till the Last Minute

- Don’t be a lazy sod. Get your taxes done early doors, before the deadline looms.

- It’ll save you a world of stress and potential penalties, mate.

Use the Help Features

- The Free Efile Form 941 Download comes with built-in help. Don’t be shy, use it.

- It’ll guide you through the tricky bits and keep you on the straight and narrow.

Save Your Return

- Once you’ve filled out your form, don’t forget to save it, yeah?

- Keep a copy for your records, just in case.

FAQ Section

Is Free Efile Form 941 Download compatible with all operating systems?

Yes, Free Efile Form 941 Download is compatible with all major operating systems, including Windows, macOS, and Linux.

Can I use Free Efile Form 941 Download to file taxes for multiple businesses?

Yes, Free Efile Form 941 Download allows you to manage and file taxes for multiple businesses under a single account.

Is my data secure when using Free Efile Form 941 Download?

Absolutely! Free Efile Form 941 Download employs industry-leading security measures to protect your sensitive data, ensuring its confidentiality and integrity.

Can I receive support if I encounter any issues while using Free Efile Form 941 Download?

Yes, Free Efile Form 941 Download provides comprehensive support through email, phone, and live chat, ensuring that you receive timely assistance whenever needed.